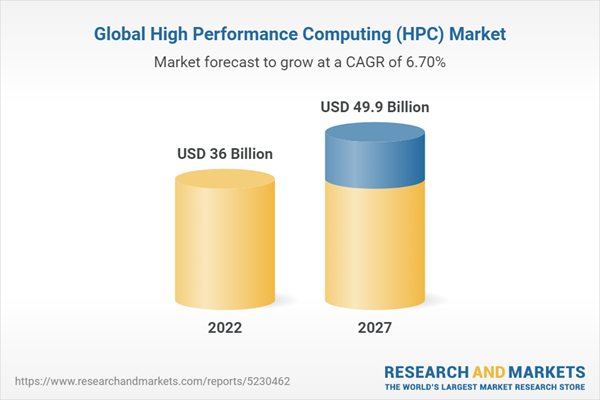

High-performance computing (HPC) market is expected to grow from USD 36.0 Billion in 2022 to USD 49.9 Billion by 2027, at a CAGR of 6.7%. The market growth can be attributed to several factors, such as the heavy investment in data centers in North America, and Europe regions.

Advancements in healthcare systems, healthcare research, and communication technologies have led to the development of better standard practices within the healthcare & life sciences vertical. With rising technological innovations, healthcare institutes face the need to deliver various healthcare services through active collaboration between hospital administrators and doctors while improving the overall efficiency and quality of patient care. Life sciences deal with the use of informatics to understand and unveil previously unknown facts about living beings. HPC is being implemented widely in various applications within the healthcare & life sciences vertical for running multiple simulations, data management and modeling processes, and next-generation sequencing. HPC solutions provide the necessary computational power for these applications and help tackle challenges pertaining to the high computational power requirements of the healthcare & life sciences vertical.

Organizations with an employee base of more than 1,000 people are considered large enterprises. As the adoption of new digital technologies increases, many large enterprises have replaced their traditional data center infrastructure technologies and other management processes with HPC systems and solutions. Large enterprises are usually characterized by high-server densities and high computational power requirements. These organizations require highly reliable infrastructure. HPC solutions can facilitate data center providers with fast processing abilities and deliver quick results, increasing their profitability. Moreover, HPC solutions aid large enterprises in processing numerous applications simultaneously within a short time, enabling a significant reduction in downtime.

The on-premises deployment consists of various dedicated computing nodes that are attached to their parent nodes and further connected to workstations. This deployment type supports specialized hardware, such as InfiniBand and Graphics Processing Unit (GPU). However, the emergence of HPC in the cloud has affected the growth of the on-premises deployment type segment. Yet, organizations are deploying HPC solutions using the on-premises deployment type because of the security and confidentiality factors. Many vendors are making continued investments in the on-premises deployment type, as well as developing new cloud business models for HPC. Major vendors offering on-premise HPC solutions include HPE, IBM, and Dell.

Some of the major players in the silicon photomultiplier market include Advanced Micro Devices (US), Intel (US), HPE (US), IBM (US), Dell (US), Lenovo (China), Fujitsu (Japan), Atos (France), CISCO (US), Nvidia (Japan), NEC Corporation (Japan)and so on.

In this report, the high-performance computing market has been segmented on the basis of Component, Computation Type, Industry, Deployment, Server Price Band, Verticals, and Region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions - North America, Europe, APAC, and RoW. Value chain analysis has been included in the report, along with the key players and their competitive analysis in the high-performance computing ecosystem.

Advancements in healthcare systems, healthcare research, and communication technologies have led to the development of better standard practices within the healthcare & life sciences vertical. With rising technological innovations, healthcare institutes face the need to deliver various healthcare services through active collaboration between hospital administrators and doctors while improving the overall efficiency and quality of patient care. Life sciences deal with the use of informatics to understand and unveil previously unknown facts about living beings. HPC is being implemented widely in various applications within the healthcare & life sciences vertical for running multiple simulations, data management and modeling processes, and next-generation sequencing. HPC solutions provide the necessary computational power for these applications and help tackle challenges pertaining to the high computational power requirements of the healthcare & life sciences vertical.

Large enterprises segment is expected to hold a higher market share during the forecast period

Organizations with an employee base of more than 1,000 people are considered large enterprises. As the adoption of new digital technologies increases, many large enterprises have replaced their traditional data center infrastructure technologies and other management processes with HPC systems and solutions. Large enterprises are usually characterized by high-server densities and high computational power requirements. These organizations require highly reliable infrastructure. HPC solutions can facilitate data center providers with fast processing abilities and deliver quick results, increasing their profitability. Moreover, HPC solutions aid large enterprises in processing numerous applications simultaneously within a short time, enabling a significant reduction in downtime.

On-Premises deployment of HPC to hold the largest market share during the forecast period

The on-premises deployment consists of various dedicated computing nodes that are attached to their parent nodes and further connected to workstations. This deployment type supports specialized hardware, such as InfiniBand and Graphics Processing Unit (GPU). However, the emergence of HPC in the cloud has affected the growth of the on-premises deployment type segment. Yet, organizations are deploying HPC solutions using the on-premises deployment type because of the security and confidentiality factors. Many vendors are making continued investments in the on-premises deployment type, as well as developing new cloud business models for HPC. Major vendors offering on-premise HPC solutions include HPE, IBM, and Dell.

Breakdown of primary participants:

- By Company Type: Tier 1 = 30%, Tier 2 = 50%, and Tier 3 = 20%

- By Designation: C-Level Executives = 10%, Directors = 30%, and Others = 60%

- By Region: North America = 20%, Europe = 20%,APAC = 50%, andRoW = 10%

Some of the major players in the silicon photomultiplier market include Advanced Micro Devices (US), Intel (US), HPE (US), IBM (US), Dell (US), Lenovo (China), Fujitsu (Japan), Atos (France), CISCO (US), Nvidia (Japan), NEC Corporation (Japan)and so on.

Research Coverage:

In this report, the high-performance computing market has been segmented on the basis of Component, Computation Type, Industry, Deployment, Server Price Band, Verticals, and Region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions - North America, Europe, APAC, and RoW. Value chain analysis has been included in the report, along with the key players and their competitive analysis in the high-performance computing ecosystem.

Key Benefits to Buy the Report:

- This report includes statistics for the high-performance computing market-based component, Computation Type, Industry, Deployment, Server Price Band, Verticals, and Region, along with their respective market sizes.

- Value-chain analysis and key industry trends have been provided for the market.

- Major drivers, restraints, opportunities, and challenges for shave have been provided in detail in this report.

- This report would help stakeholders to understand their competitors better and gain more insights to enhance their position in the market. The competitive landscape section includes the competitor ecosystem and the recent development strategies adopted by the key players in the market, such as new product launches, acquisitions, collaborations, agreements, and partnerships.

Table of Contents

1 Introduction

2 Research Methodology

4 Premium Insights

5 Market Overview

6 High Performance Computing Market, by Component

7 HPC Market, by Deployment Type

8 High Performance Computing Market, by Organization Size

9 HPC Market, by Server Price Band

10 High Performance Computing Market, by Application Area

11 HPC Market, by Region

12 Competitive Landscape

13 Company Profiles

14 Appendix

Companies Mentioned

- Advanced Micro Devices

- Adaptive Computing

- Advanced Clustering Technologies

- Advanced Hpc

- Arm Limited

- Aspen System

- Atos

- Cisco

- Dassault Systems

- Datadirect Networks

- Dawning Information Industry Co. Ltd. (Sugon)

- Dell

- Equus Computers

- Excelero

- Fujitsu

- Giga-Byte

- Hewlett Packard Enterprise (Hpe)

- Ibm

- Inspur

- Intel

- Iron Global

- Lenovo

- Microsoft

- Montage Technology

- Nec Corporation

- Netapp

- Nvidia

- Oracle

- Penguin Computing

- Web Services

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 201 |

| Published | May 2022 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 36 Billion |

| Forecasted Market Value ( USD | $ 49.9 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |