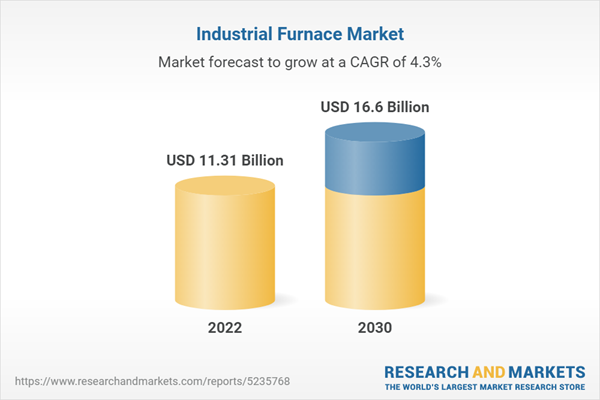

The report on the global industrial furnace market provides qualitative and quantitative analysis for the period from 2021-2030. The revenue generated by the industrial furance market was around USD 11.31 billion in 2022 and is expected to reach over USD 16.60 billion in 2030 and is expected to grow with a CAGR of 4.28% over the forecast period 2023-2030. The study on industrial furnace market covers the analysis of the leading geographies such as North America, Europe, Asia Pacific, and RoW for the period of 2021-2030.

An industrial furnace refers to equipment that is used to provide heat for a certain process or reaction. Industrial furnaces are indispensable devices for metal casting and other processes in the iron and steel industry. They are also used in glassmaking and chemical manufacturing. Therefore, with the increasing demand for processed material in several industries including chemical and glassmaking industries, the demand for industrial furnaces is rising. Moreover, due to the increasing demand for advanced lightweight automotive vehicles and growing environmental concerns, automakers are actively pursuing strategies to improve fuel efficiency and lower emissions. This has led to the prominent use of magnesium and aluminum alloys as crucial materials for manufacturing more lightweight and efficient vehicles in the automotive sector. Consequently, there is a rising need for industrial furnaces, which are utilized to heat these alloys for casting them into the desired components. Thus, the industrial furnace market is experiencing a surge in demand, primarily due to the automotive industry's growing inclination toward lightweight vehicles as it continues to expand.

The gas or fuel-operated segment in the industrial furnace market commands the largest market share, primarily due to its several advantages. Gas furnaces burn gas to produce heat for a variety of industrial processes. Gas furnaces can contain air, oxidized gas, inert gas, reducing, salt bath, or vacuum atmospheres. Natural gas is the main type of gas used for gas furnaces. Moreover, for environmental protection, gas-fired furnaces use Oscillating Combustion Technology (OCT) to reduce Nitrous Oxide (NOx), a waste product from burning natural gas. Additionally, they excel in providing higher heat efficiency, as gas can quickly warm the air, and they maintain reliability even in freezing temperatures. Additionally, the cost-effectiveness of gas, which is generally lower than electricity, results in significant energy savings. The initial investment for a gas furnace is also comparatively lower, making it a popular choice across various industries.

The Europe region is poised to hold the largest market share in the global industrial furnace market due to several key factors. In alignment with its sustainability goals, Europe is witnessing a growing consumer preference for fuel-efficient vehicles to mitigate emissions. Consequently, there is a notable surge in the adoption of lightweight electric vehicles across the continent. For instance, the International Energy Agency (IEA) reported a more than 15% increase in electric car sales in Europe in 2022 compared to 2021, reaching 2.7 million units. Capitalizing on this consumer shift, European automotive manufacturers are prioritizing the production of lightweight vehicles. This escalating demand presents a valuable opportunity for companies in the automotive lightweight materials sector to expand their output using industrial furnaces. Furthermore, Europe is home to prominent players in the automotive lightweight materials industry, including BASF SE and Covestro AG, among others. Additionally, the European chemicals industry supports the EU Green Deal and has the ambition to go climate-neutral by 2050. Therefore, chemical industries in Europe also rely heavily on industrial furnaces for producing processed materials in a sustainable way. Moreover, the presence of numerous well-established furnace manufacturers and a focus on research and development contribute to Europe's dominance in the global industrial furnace market.

1. Key Opinion Leaders

2. Internal and External subject matter experts

3. Professionals and participants from the industry

2. Product/brand/marketing managers

3. CXO level executives

4. Regional/zonal/ country managers

5. Vice President level executives.

2. Government/institutional publications

3. Trade and associations journals

4. Databases such as WTO, OECD, World Bank, and among others.

5. Websites and publications by research agencies

2. Complete coverage of all the segments in the industrial furnace market to analyze the trends, developments in the global market and forecast of market size up to 2030.

3. Comprehensive analysis of the companies operating in the global industrial furnace market. The company profile includes analysis of product portfolio, revenue, SWOT analysis and latest developments of the company.

4. Growth Matrix presents an analysis of the product segments and geographies that market players should focus to invest, consolidate, expand and/or diversify.

An industrial furnace refers to equipment that is used to provide heat for a certain process or reaction. Industrial furnaces are indispensable devices for metal casting and other processes in the iron and steel industry. They are also used in glassmaking and chemical manufacturing. Therefore, with the increasing demand for processed material in several industries including chemical and glassmaking industries, the demand for industrial furnaces is rising. Moreover, due to the increasing demand for advanced lightweight automotive vehicles and growing environmental concerns, automakers are actively pursuing strategies to improve fuel efficiency and lower emissions. This has led to the prominent use of magnesium and aluminum alloys as crucial materials for manufacturing more lightweight and efficient vehicles in the automotive sector. Consequently, there is a rising need for industrial furnaces, which are utilized to heat these alloys for casting them into the desired components. Thus, the industrial furnace market is experiencing a surge in demand, primarily due to the automotive industry's growing inclination toward lightweight vehicles as it continues to expand.

The gas or fuel-operated segment in the industrial furnace market commands the largest market share, primarily due to its several advantages. Gas furnaces burn gas to produce heat for a variety of industrial processes. Gas furnaces can contain air, oxidized gas, inert gas, reducing, salt bath, or vacuum atmospheres. Natural gas is the main type of gas used for gas furnaces. Moreover, for environmental protection, gas-fired furnaces use Oscillating Combustion Technology (OCT) to reduce Nitrous Oxide (NOx), a waste product from burning natural gas. Additionally, they excel in providing higher heat efficiency, as gas can quickly warm the air, and they maintain reliability even in freezing temperatures. Additionally, the cost-effectiveness of gas, which is generally lower than electricity, results in significant energy savings. The initial investment for a gas furnace is also comparatively lower, making it a popular choice across various industries.

The Europe region is poised to hold the largest market share in the global industrial furnace market due to several key factors. In alignment with its sustainability goals, Europe is witnessing a growing consumer preference for fuel-efficient vehicles to mitigate emissions. Consequently, there is a notable surge in the adoption of lightweight electric vehicles across the continent. For instance, the International Energy Agency (IEA) reported a more than 15% increase in electric car sales in Europe in 2022 compared to 2021, reaching 2.7 million units. Capitalizing on this consumer shift, European automotive manufacturers are prioritizing the production of lightweight vehicles. This escalating demand presents a valuable opportunity for companies in the automotive lightweight materials sector to expand their output using industrial furnaces. Furthermore, Europe is home to prominent players in the automotive lightweight materials industry, including BASF SE and Covestro AG, among others. Additionally, the European chemicals industry supports the EU Green Deal and has the ambition to go climate-neutral by 2050. Therefore, chemical industries in Europe also rely heavily on industrial furnaces for producing processed materials in a sustainable way. Moreover, the presence of numerous well-established furnace manufacturers and a focus on research and development contribute to Europe's dominance in the global industrial furnace market.

Report Findings

1) Drivers

- Increasing demand for processed materials in various industries is a major driver of the market for industrial furnaces.

- The industrial furnace market is witnessing heightened demand driven by the automotive industry's increasing preference for lightweight vehicles.

2) Restraints

- High initial capital investment hampers the demand of the industrial furnace market.

3) Opportunities

- The adoption of Industry 4.0 and Internet of Things technologies thrive as an opportunity for manufacturers of industrial furnaces.

Research Methodology

A) Primary Research

The primary research involves extensive interviews and analysis of the opinions provided by the primary respondents. The primary research starts with identifying and approaching the primary respondents, the primary respondents are approached include1. Key Opinion Leaders

2. Internal and External subject matter experts

3. Professionals and participants from the industry

The primary research respondents typically include

1. Executives working with leading companies in the market under review2. Product/brand/marketing managers

3. CXO level executives

4. Regional/zonal/ country managers

5. Vice President level executives.

B) Secondary Research

Secondary research involves extensive exploring through the secondary sources of information available in both the public domain and paid sources. Each research study is based on over 500 hours of secondary research accompanied by primary research. The information obtained through the secondary sources is validated through the crosscheck on various data sources.The secondary sources of the data typically include

1. Company reports and publications2. Government/institutional publications

3. Trade and associations journals

4. Databases such as WTO, OECD, World Bank, and among others.

5. Websites and publications by research agencies

Segment Covered

The global industrial furnace market is segmented on the basis of furnace type, and end user.The Global Industrial Furnace Market by Furnace Type

- Gas or Fuel Operated

- Electrically Operated

The Global Industrial Furnace Market by End User

- Metals & Mining

- Transportation

- Oil & Gas

- Chemicals

- Others

Company Profiles

The companies covered in the report include- ANDRITZ

- Carbolite Gero Ltd.

- International Thermal Systems

- Ipsen

- Grupo NUTEC

- Thermal Product Solutions

- Epcon Industrial Systems, LP

- Gasbarre Products, Inc.

- ABBOTT FURNACE COMPANY

- AICHELIN Holding GmbH

What does this Report Deliver?

1. Comprehensive analysis of the global as well as regional markets of the industrial furnace market.2. Complete coverage of all the segments in the industrial furnace market to analyze the trends, developments in the global market and forecast of market size up to 2030.

3. Comprehensive analysis of the companies operating in the global industrial furnace market. The company profile includes analysis of product portfolio, revenue, SWOT analysis and latest developments of the company.

4. Growth Matrix presents an analysis of the product segments and geographies that market players should focus to invest, consolidate, expand and/or diversify.

This product will be delivered within 1-3 business days.

Table of Contents

Chapter 1. Preface

Chapter 2. Executive Summary

Chapter 3. Global Industrial Furnace Market Overview

Chapter 5. Company Profiles and Competitive Landscape

Chapter 6. Global Industrial Furnace Market by Furnace Type

Chapter 7. Global Industrial Furnace Market by End User

Chapter 8. Global Industrial Furnace Market by Region 2023-2030

Companies Mentioned

- ANDRITZ

- Carbolite Gero Ltd.

- International Thermal Systems

- Ipsen

- Grupo NUTEC

- Thermal Product Solutions

- Epcon Industrial Systems, LP

- Gasbarre Products, Inc.

- ABBOTT FURNACE COMPANY

- AICHELIN Holding GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | April 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 11.31 Billion |

| Forecasted Market Value ( USD | $ 16.6 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |