Speak directly to the analyst to clarify any post sales queries you may have.

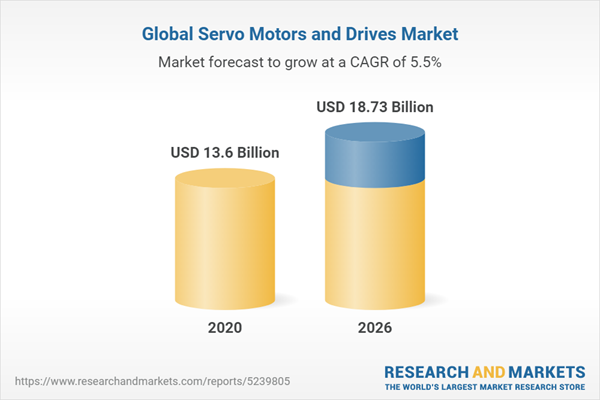

The servo motors and drives market by revenue is expected to grow at a CAGR of over 5% during the period 2021-2026.

The global servo motors and drives market share is expected to grow at a significant rate owing to a large application of robotics in factories, medical facilities, and other related industries. Both servo motors and drives are expected to observe exponential growth during the forecast period. Their penetration is increasing as several industries are opting for automation and innovative applications to transform operations, according to Industry 4.0. Industrial robots are the major applications, which use servo motors and drives, thus the increased use of robotics and automation in industries is expected to drive the market growth.

The following factors are likely to contribute to the growth of the servo motors and drives market during the forecast period:

- Growth in CNC Machine Market

- Industrial Revolution 4.0

- Growth in Robotic Business Field

- Rapid Advances and Growth in Automation

The study considers the present scenario of the servo motors and drives market and its market dynamics for the period 2020-2026. It covers a detailed overview of several market growth enablers, restraints, and trends. The report offers both the demand and supply aspects of the market. It profiles and examines leading companies and other prominent ones operating in the market.

Global Servo Motors and Drives Market Segmentation

The global servo motors and drives market research report includes a detailed segmentation by product type, motor type, sales channel, power output, material, voltage, end-user, geography. Factory automation and the application of robotics in several commercial and industrial segments are expected to drive the demand for servo motors. Japan, China, the US, and Germany are key countries boosting the growth of servo motors. The market is expected to grow due to an increase in automation and precision techniques. A key driver for the growth of AC servo motors is advances in microprocessor technology and the development of permanent magnet for these machines. Growth in smart factories with IoT and AI and other automated systems has been increased, thereby driving the demand for servo motors.

Increased application of servo motors in packaging and medical sectors is expected to drive the growth of linear servo motors. These motors provide high speed, longer strokes, and accuracy. The demand for linear servo motors was slightly high in 2020 as the demand in Europe, North America, and APAC increased. The growing demand for components with integrated servo power, along with high-resolution precision feedback, is expected to be a major contributor to the growth of rotary servo motors during the forecast period. Moreover, rotary devices are anticipated to increase due to their high-power functioning coupled with precise-positioning capabilities.

Above 5kW servo motors and drives are governed by strict energy-efficiency legislation across the globe, especially in developed countries. These machines hold the highest revenue share in the market and are expected to accelerate further at the highest CAGR during the forecast period. Below 5kW motors and drives are expected to grow at a CAGR of over 6%, expecting to register a revenue share of approx. USD 8 billion by 2026. Several government regulations, including the necessity to operate below 5kW with frequency inverters, are expected to hamper the production of below 5kW servo motors.

Packaging, pharmaceuticals, food preparation, bakery machines, and meat processing units are some major end-users of stainless steel servo motors and drives. While steel prices are fluctuating currently, vendors and other suppliers are shifting to other manufacturing materials. However, stainless steel servo motors and drives are expected to have a high share on account of their increased application, long life, and high performance. However, non-stainless steel models manufactured from aluminum, copper, and iron, are gaining traction due to cost efficiency and reliability. The rise in steel prices and disruptions in production has escalated the demand for non-stainless-steel based motors and drives.

Low voltage servo motors and drives are widely used in brushed and brushless DC motors and brushless AC motors. Favorable government policies, aiming to achieve energy efficiency, coupled with significant enhancements in conventional machinery in small to medium businesses, are expected to boost the demand for low-voltage models. Low-voltage machines are expected to account for the highest revenue share of over $11 billion by 2026.

The demand for servo motors and drives from the end-user industry is anticipated to grow due to increased industrial production and the replacement of old and worn out motors with energy-efficient ones. The demand is expected to increase in the coming years due to the expansion and investment by private and public players in oil & gas, chemical, mining, and other industries in the Middle East, North America, and APAC. However, the end-user industry demand for servo motors and drives has been adversely affected in 2020 on account of the COVID-19 outbreak. The impact level varies in intensity and scale as the industry is characterized by a high degree of end-user variability. Vendor margins were affected in Q2 and Q3 2020, and vendors will continue to experience margin pressures as the payment terms are expected to be realigned.

Increased consumer’s trust and reduced expense in direct sales channels and high opportunities for deeper market penetration and a better understanding of the local demand via indirect sales hold significant promise for direct as well as indirect distribution sales channels for the global servo motors market. Direct sales are traditional distribution channels for several industries to sell products directly to large end-customers. However, indirect sales channels involve selling products to a partner, who, in turn, sells to end customers. While some vendors utilize the direct and indirect channel parallel, others have entirely switched to an indirect sales channel to improve business.

Product Type

- Servo Motor

- AC

- DC

- Servo Drive

- AC

- DC

- Linear

- Rotary

- Direct Sales

- Direct to OEMs

- Direct to End-users

- Direct to System Integrators

- Indirect Sales

- Distributor to OEMs

- Distributor to End-users

- Distributor to System Integrators

- Above 5kW

- Below 5kW

- Stainless Steel

- Non-stainless Steel

- Low

- Medium

- High

- Machine Tools

- Packaging

- Electronics & Semiconductor

- Robotics

- Automotive

- Metal Processing

- Warehousing

- Oil & Gas

- Paper Industry

- Aerospace & Defence

- Food & Beverages

- Textiles

- Printing

- Pharmaceutical

- Woodworking

- Power Generation

- Others

INSIGHTS BY GEOGRAPHY

APAC accounts for the highest servo motors and drives market share and is expected to further grow at a significant rate by 2026. The major factors driving the demand for servo motors and drives in the region are rapidly increasing factory automation and the use of robotics in the region. With the presence of some developed countries, the demand from several applications industry end-users is expected to grow during the forecast period. The APAC market is expected to reach USD 7.60 billion by 2026, growing at a CAGR of 5.67%. It is expected to grow due to increased production and the development of factory automation. Packaging, robotics, machine tools, electronics & semiconductor, and metal processing industries are the leading five industries, which are expected to dominate the demand for servo motors and drives during the forecast period.

By Geography

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- APAC

- China

- Japan

- South Korea

- India

- Australia

- Latin America

- Brazil

- Mexico

- Chile

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- Turkey

- Rest of Middle East

INSIGHTS BY VENDORS

Emerson, Siemens, Rockwell Automation, ABB, Mitsubishi Electric, Delt, Fuji Electric are the major players in the market. They have a strong presence in both high-end and low-end servo motor and drives segments. Also, most vendors are vertically integrated and provide end-to-end solutions to their customers. Vendors in the market are expanding their presence through partnerships, investments, and mergers and acquisitions. Several vendors are focusing on innovation in production technologies to provide a variety of products along with efficiency in the global servo motor and drive market.

Prominent Vendors

- Emerson

- Siemens

- Rockwell Automation

- ABB

- Mitsubishi Electric

- Delta

- Fuji Electric

- Yaskawa

- Sanyo Denki

- Parker Hannifin

- Allied Motion

- Nidec

Other Prominent Vendors

- Ametek

- ARC Systems

- Bonfiglioli

- Oriental Motor

- Schneider Electric

- Callan Technology

- Panasonic Industry Europe

- Sew-Eurodrive

- FANUC

- Bosch Rexroth

- Kollmorgen

- HNC Electric

- Moog

- Tamagawa Seiki

- GSK CNC Equipment

- Infranor

- KEB Automation

- Beckhoff

- TECO Electro Devices

KEY QUESTIONS ANSWERED

1. What is the future outlook and growth projections of the servo motors and drives market?

2. What are the major upcoming trends in the servo motors and drives market?

3. What opportunities exist for major players and new entrants in the servo motors and drives market?

4. Which regions are likely to observe the highest revenue during the forecast period?

5. Which end-users are projected to contribute maximum revenue to the market?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.2 Base Year

4.3 Scope Of The Study

5 Report Assumptions & Caveats

5.1 Key Caveats

5.1 Currency Conversion

5.2 Market Derivation

6 Market at a Glance

7 Introduction

7.1 Overview

7.2 Market Potential

7.3 Raw Material Insights

7.4 Pricing And Profit Margin Analysis

7.5 FAQ

7.6 Impact Of COVID-19

8 Market Opportunities & Trends

8.1 Industrial Revolution 4.0

8.2 Growth In CNC Machine Market

9 Market Growth Enablers

9.1 Growth In Robotics Industry

9.2 Advancements In Automation Industry

9.3 Demand From Medical Applications

10 Market Restraints

10.1 Maintenance Of Servo Motors

10.2 High Cost Of Servo Motors/Systems

10.3 Impact Of COVID-19 On Steel Price

11 Market Landscape

11.1 Market Overview

11.2 Market Size & Forecast

11.3 Five Forces Analysis

12 Product

12.1 Market Snapshot & Growth Engine

12.2 Market Overview

13 Servo Motor

13.1 Market Size & Forecast

13.2 Market by Geography

13.3 AC Servo Motor

13.4 DC Servo Motor

14 Servo Drive

14.1 Market Size & Forecast

14.2 Market by Geography

14.3 AC Servo Drive

14.4 DC Servo Drive

15 Servo Motor Type

15.1 Market Snapshot & Growth Engine

15.2 Market Overview

15.3 Linear

15.4 Rotary

16 Material

16.1 Market Snapshot & Growth Engine

16.2 Market Overview

16.3 Stainless Steel

16.4 Non-Stainless Steel

17 Voltage

17.1 Market Snapshot & Growth Engine

17.2 Market Overview

17.3 Low Voltage

17.4 Medium Voltage

17.5 High Voltage

18 Rated Power

18.1 Market Snapshot & Growth Engine

18.2 Market Overview

18.3 Rated Power Above 5kW

18.4 Rated Power Below 5kW

19 Sales Channel

19.1 Market Snapshot & Growth Engine

19.2 Market Overview

19.3 Direct Sales Channel

19.4 Indirect Sales Channel

19.5 Direct To OEM

19.6 Direct To END-USER

19.7 Direct To System Integrator

19.8 Distributor TO OEM

19.9 Distributor To END-USER

19.10 Distributor To System Integrator

20 End-User

20.1 Market Snapshot & Growth Engine

20.2 Market Overview

20.3 Machine Tool

20.4 Packaging

20.5 Electronics & Semiconductors

20.6 Robotics

20.7 Automotive

20.8 Metal Processing

20.9 Warehouse

20.10 Oil & Gas

20.11 Paper Industry

20.12 Aerospace & Defense

20.13 Food & Beverage

20.14 Textiles

20.15 Printing

20.16 Pharmaceutical

20.17 Woodwork

20.18 Power Generation

20.19 Others

21 Geography

21.1 Market Snapshot & Growth Engine

21.2 Geographic Overview

22 APAC

22.1 Market Overview

22.2 Market Size & Forecast

22.3 Sales Channel

22.4 Product

22.5 Servo Motor

22.6 Servo Drive

22.7 Voltage

22.8 End-User

22.9 Key Countries

22.1 China: Market Size & Forecast

22.11 Japan: Market Size & Forecast

22.12 India: Market Size & Forecast

22.13 South Korea: Market Size & Forecast

22.14 Australia: Market Size & Forecast

23 Europe

23.1 Market Overview

23.2 Market Size & Forecast

23.3 Sales Channel

23.4 Product

23.5 Servo Motor

23.6 Servo Drive

23.7 Voltage

23.8 End-User

23.9 Key Countries

23.10 Germany: Market Size & Forecast

23.11 France: Market Size & Forecast

23.12 Italy: Market Size & Forecast

23.13 Spain: Market Size & Forecast

23.14 UK: Market Size & Forecast

24 North America

24.1 Market Overview

24.2 Market Size & Forecast

24.3 Sales Channel

24.4 Product

24.5 Servo Motor

24.6 Servo Drive

24.7 Voltage

24.8 End-User

24.9 Key Countries

24.1 US: Market Size & Forecast

24.11 Canada: Market Size & Forecast

25 Latin America

25.1 Market Overview

25.2 Market Size & Forecast

25.3 Sales Channel

25.4 Product

25.5 Servo Motor

25.6 Servo Drive

25.7 Voltage

25.8 End-User

25.9 Key Countries

25.10 Mexico: Market Size & Forecast

25.11 Brazil: Market Size & Forecast

25.12 Chile: Market Size & Forecast

25.13 Rest of Latin America: Market Size & Forecast

26 Middle East & Africa

26.1 Market Overview

26.2 Market Size & Forecast

26.3 Sales Channel

26.4 Product

26.5 Servo Motor

26.6 Servo Drive

26.7 Voltage

26.8 End-User

26.9 Key Countries

26.1 Saudi Arabia: Market Size & Forecast

26.11 Turkey: Market Size & Forecast

26.12 Rest Of Middle East & Africa: Market Size & Forecast

27 Competitive Landscape

27.1 Competition Overview

28 Key Company Profiles

28.1 Emerson

28.2 SIEMENS

28.3 Rockwell Automation

28.4 ABB

28.5 Mitsubishi Electric

28.6 Delta

28.7 Fuji Electric

28.8 Yaskawa

28.9 Sanyo Denki

28.10 Parker Hannifin

28.11 Allied Motion

28.12 Nidec

29 Other Prominent Vendors

29.1 Ametek

29.2 ARC Systems

29.3 Bonfiglioli

29.4 Oriental Motor

29.5 Schneider Electric

29.6 Callan Technology

29.7 Panasonic Industry Europe

29.8 SEW-Eurodrive

29.9 Fanuc

29.10 Bosch Rexroth

29.11 Kollmorgen

29.12 HNC Electric

29.13 Moog

29.14 Tamagawa Seiki

29.15 GSK CNC Equipment

29.16 Infranor

29.17 KEB Automation

29.18 Beckhoff

29.19 Teco Electro Devices

30 Report Summary

30.1 Key Takeaways

30.2 Strategic Recommendations

31 Quantitative Summary

31.1 Market By Geography

31.2 APAC

31.3 Europe

31.4 North America

31.5 Latin America

31.6 Middle East & Africa

31.7 Market By Product

31.8 Market By Voltage

31.9 Market By Material

31.1 Market By Servo Motor Type

31.11 Market By Power Capacity

31.12 Market By Servo Motor

31.13 Market By Servo Drive

31.14 Market By Sales Channel

31.15 Market By End-User

32 Appendix

32.1 Abbreviations

List Of Exhibits

Exhibit 1 Segmentation of Global Servo Motors & Drives Market

Exhibit 2 Market Size Calculation Approach 2020

Exhibit 3 Major Applications of Servo Motors & Drives

Exhibit 4 Blueprint of Servo System

Exhibit 5 Market Share & Classification of Servo Motors & Drives 2020

Exhibit 6 Key Highlights

Exhibit 7 Strategic Vendor insights

Exhibit 8 Impact of Industrial Revolution 4.0

Exhibit 9 Key Applications in Industry 4.0

Exhibit 10 Industry 4.0 Snapshot

Exhibit 11 Impact of Growth in CNC Machine Market

Exhibit 12 Advantages and Disadvantages of Servo Motors in CNC Machines

Exhibit 13 Features of Servo Motors in CNC Machines

Exhibit 14 Impact of Growth in Robotics Industry

Exhibit 15 Impact of Advancements in Automation Industry

Exhibit 16 Impact of Demand from Medical Applications

Exhibit 17 Impact of Maintenance of Servo Motors

Exhibit 18 Major Concerns over Servo Motors & Drives Maintenance

Exhibit 19 Impact of High Cost of Servo Motors/Systems

Exhibit 20 Impact of COVID-19 on Steel Price

Exhibit 21 Steel Market Trend by Geography in 2020

Exhibit 22 Incremental Growth by Key Geographies ($ billion)

Exhibit 23 Servo Motors & Drives Market Trends

Exhibit 24 Global Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 25 Five Forces Analysis 2020

Exhibit 26 Incremental Growth by Product 2020 & 2026

Exhibit 27 Servo Motors & Drives Market Revenue by Products in 2020 ($ billion)

Exhibit 28 Revenue Share and CAGR of Servo Motors Market by Geography

Exhibit 29 Revenue Share and CAGR of Servo Drives Market by Geography

Exhibit 30 Demand Highlights

Exhibit 31 Global Servo Motors Market 2020-2026 ($ billion)

Exhibit 32 Global AC Servo Motors Market 2020-2026 ($ billion)

Exhibit 33 Global DC Servo Motors Market 2020-2026 ($ billion)

Exhibit 34 Global Servo Drives Market 2020-2026 ($ billion)

Exhibit 35 Global AC Servo Drives Market 2020-2026 ($ billion)

Exhibit 36 Global DC Servo Drives Market 2020-2026 ($ billion)

Exhibit 37 Incremental Growth by Servo Motor Type 2020 & 2026

Exhibit 38 Revenue Share of Rotary and Linear Servo Motors 2020 & 2026 (%)

Exhibit 39 Global Linear Servo Motors Market 2020-2026 ($ billion)

Exhibit 40 Market Dynamics

Exhibit 41 Global Rotary Servo Motors Market 2020-2026 ($ billion)

Exhibit 42 Incremental Growth by Material 2020 & 2026

Exhibit 43 Incremental Growth by Material Type 2020-2026 ($ billion)

Exhibit 44 Key Insights

Exhibit 45 Geographical Representation of Stainless Steel Production in 2019 (%)

Exhibit 46 Global Stainless Steel Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 47 Global Non-Stainless-Steel Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 48 Incremental Growth by Voltage 2020 & 2026

Exhibit 49 Growth Momentum and Market Share by Voltage Type 2020-2026

Exhibit 50 Low Voltage Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 51 Medium Voltage Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 52 High Voltage Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 53 Incremental Growth by Rated Power 2020 & 2026

Exhibit 54 Global Servo Motors & Drives Market Dynamics by Rated Power (%)

Exhibit 55 Global Servo Motors & Drives Market by Rated Power above 5kW 2020-2026 ($ billion)

Exhibit 56 Global Servo Motors & Drives Market by Rated Power Below 5kW 2020-2026 ($ billion)

Exhibit 57 Incremental Growth by Sales Channel 2020 & 2026

Exhibit 58 Global Servo Motors & Drives Market by Sales Channel Type: Overview

Exhibit 59 Growth Momentum and Market Share 2020-2026 (Revenue)

Exhibit 60 Growth Momentum and Market Share by Direct Channels 2020-2026

Exhibit 61 Growth Momentum and Market Share by Indirect Channels 2020-2026

Exhibit 62 Market by Direct to OEM Sales Channel 2020-2026 ($ billion)

Exhibit 63 Market by Direct to End-user Sales Channel 2020-2026 ($ billion)

Exhibit 64 Market by Direct to System Integrator Sales Channel 2020-2026 ($ billion)

Exhibit 65 Market by Distributor to OEM Sales Channel 2020-2026 ($ billion)

Exhibit 66 Market by Distributor to End-user Sales Channel 2020-2026 ($ billion)

Exhibit 67 Market by Distributor to System Integrator Sales Channel 2020-2026 ($ billion)

Exhibit 68 Incremental Growth by End-user 2020 & 2026

Exhibit 69 Applications of Servo Motors & Drives in Machine Tool Industry

Exhibit 70 Scope and Demand for Servo Motors & Drives in Machine Tool Market

Exhibit 71 Key Insights of CNC Machinery Market Related to Servo Motors & Drives

Exhibit 72 Global Servo Motors & Drives Market by Machine Tool Segment 2020-2026 ($ billion)

Exhibit 73 Applications of Servo Motors & Drives in Packaging Industry

Exhibit 74 Global Packaging Market Outlook 2014-2020 (%)

Exhibit 75 Key Factors Creating Demand for Servo Motors in Packaging Industry

Exhibit 76 Global Servo Motors & Drives Market by Packaging Segment 2020-2026 ($ billion)

Exhibit 77 Market Share by Geography 2020 & 2026

Exhibit 78 Global Servo Motors & Drives Market by Electronics & Semiconductor Segment 2020-2026 ($ billion)

Exhibit 79 Applications of Servo Motors & Drives in Robotics Industry

Exhibit 80 Applications of Robots in Industries

Exhibit 81 Future Scope of Servo Motors in Robotics

Exhibit 82 Global Servo Motors & Drives Market by Robotics Segment 2020-2026 ($ billion)

Exhibit 83 Geographic Outlook of Automotive Sector

Exhibit 84 Global Servo Motors & Drives Market by Automotive Segment 2020-2026 ($ billion)

Exhibit 85 Global Servo Motors & Drives Market by Metal Processing Segment 2020-2026 ($ billion)

Exhibit 86 Applications of Servo Motors & Drives in Warehouse Industry

Exhibit 87 Global Servo Motors & Drives Market by Warehouse Segment 2020-2026 ($ billion)

Exhibit 88 Global Servo Motors & Drives Market by Oil & Gas Segment 2020-2026 ($ billion)

Exhibit 89 Global Servo Motors & Drives Market by Paper Segment 2020-2026 ($ billion)

Exhibit 90 Global Servo Motors & Drives Market by Aerospace & Defense Segment 2020-2026 ($ billion)

Exhibit 91 Motors and drives are designed to help different processes in the food and beverage industry. Some of them include:

Exhibit 92 Future Scope in F&B Industry

Exhibit 93 Global Servo Motors & Drives Market by Food & Beverage Segment 2020-2026 ($ billion)

Exhibit 94 Global Servo Motors & Drives Market by Textiles Segment 2020-2026 ($ billion)

Exhibit 95 Global Servo Motors & Drives Market by Printing Segment 2020-2026 ($ billion)

Exhibit 96 Global Servo Motors & Drives Market by Pharmaceutical Segment 2020-2026 ($ billion)

Exhibit 97 Global Servo Motors & Drives Market by Woodwork Segment 2020-2026 ($ billion)

Exhibit 98 Global Investments in Power Sector by Technology 2019 & 2020 ($ billion)

Exhibit 99 Geographic Outlook of Power Generation Sector 2020

Exhibit 100 Global Servo Motors & Drives Market by Power Generation Segment 2020-2026 ($ billion)

Exhibit 101 Global Servo Motors & Drives Market by Other Industries 2020-2026 ($ billion)

Exhibit 102 Incremental Growth by Geography 2020 & 2026

Exhibit 103 Market Share of Key Regions in 2020 (%)

Exhibit 104 Absolute Growth of Key Countries in APAC

Exhibit 105 Key Industries Revenue Share and Growth Momentum in APAC

Exhibit 106 APAC Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 107 Incremental Growth in APAC 2020 & 2026

Exhibit 108 Supply Chain of Servo Motors Market in China

Exhibit 109 Servo Motors & Drives Market in China 2020-2026 ($ billion)

Exhibit 110 Industrial Servo Motors Market by Downstream Industries

Exhibit 111 Key Insights

Exhibit 112 Japan Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 113 Servo Motors & Drives Market in India 2020-2026 ($ billion)

Exhibit 114 Future Trends in Servo Motors & Drives Market in India

Exhibit 115 Key Highlights

Exhibit 116 Servo Motors & Drives Market in South Korea 2020-2026 ($ billion)

Exhibit 117 Servo Motors & Drives Market in Australia 2020-2026 ($ billion)

Exhibit 118 Absolute Growth of Key Countries in Europe

Exhibit 119 Yearly Shipments of Multipurpose Industrial Robots 2015 & 2019 (thousand units)

Exhibit 120 Revenue Share and Growth Momentum of Key Industries in Europe

Exhibit 121 Europe Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 122 Incremental Growth in Europe 2020 & 2026

Exhibit 123 Robotics & Automation Industry in Germany

Exhibit 124 Germany Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 125 Annual Variation in Industrial Production (%)

Exhibit 126 Servo Motors & Drives Market in France 2020-2026 ($ billion)

Exhibit 127 Key Insights

Exhibit 128 Servo Motors & Drives Market in Italy 2020-2026 ($ billion)

Exhibit 129 Servo Motors & Drives Market in Spain 2020-2026 ($ billion)

Exhibit 130 Key Demand Insights in UK

Exhibit 131 Servo Motors & Drives Market in UK 2020-2026 ($ billion)

Exhibit 132 Absolute Growth of Key Countries in North America

Exhibit 133 Demand for Robotics from North American Industries in 2017

Exhibit 134 Revenue Share and Growth Momentum of Key Industries in North America

Exhibit 135 Servo Motors & Drives Market in North America 2020-2026 ($ billion)

Exhibit 136 Incremental Growth in North America 2020 & 2026

Exhibit 137 Key Highlights of Servo Motors & Drives Market in US 2020

Exhibit 138 Servo Motors & Drives Market in US 2020-2026 ($ billion)

Exhibit 139 Servo Motors & Drives Market in Canada 2020-2026 ($ billion)

Exhibit 140 Absolute Growth of Key Countries in Latin America

Exhibit 141 Revenue Share and Growth Momentum of Key Industries in Latin America

Exhibit 142 Latin America Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 143 Incremental Growth in Latin America 2020 & 2026

Exhibit 144 Key Export Insights

Exhibit 145 Servo Motors & Drives Market in Mexico 2020-2026 ($ million)

Exhibit 146 Servo Motors & Drives Market in Brazil 2020-2026 ($ million)

Exhibit 147 Servo Motors & Drives Market in Chile 2020-2026 ($ million)

Exhibit 148 Servo Motors & Drives Market in Rest of Latin America 2020-2026 ($ million)

Exhibit 149 Absolute Growth of Key Countries in MEA

Exhibit 150 Revenue Share and Growth momentum of Key Industries in MEA

Exhibit 151 MEA Servo Motors & Drives Market 2020-2026 ($ billion)

Exhibit 152 Incremental Growth in MEA 2020 & 2026

Exhibit 153 Servo Motors & Drives Market in Saudi Arabia 2020-2026 ($ million)

Exhibit 154 Servo Motors & Drives Market in Turkey 2020-2026 ($ million)

Exhibit 155 Servo Motors & Drives Market in Rest of MEA 2020-2026 ($ million)

Exhibit 156 Key competitive factors

Exhibit 157 Competitive ScenarioList Of Tables

Table 1 Key Caveats

Table 2 Currency Conversion 2013−2020

Table 3 Difference between DC and AC Servo Motors

Table 4 Global Servo Motors Market by Geography 2020-2026 ($ billion)

Table 5 Difference between Features of AC Servo Motor Types

Table 6 Global AC Servo Motors Market by Geography 2020-2026 ($ billion)

Table 7 Global DC Servo Motors Market by Geography 2020-2026 ($ million)

Table 8 Global Servo Drives Market by Geography 2020-2026 ($ billion)

Table 9 Global AC Servo Drives Market by Geography 2020-2026 ($ billion)

Table 10 Global DC Servo Drives Market by Geography 2020-2026 ($ million)

Table 11 Low Voltage Servo Motors & Drives Market by Geography 2020-2026 ($ billion)

Table 12 Medium Voltage Servo Motors & Drives Market by Geography 2020-2026 ($ billion)

Table 13 High Voltage Servo Motors & Drives Market by Geography 2020-2026 ($ million)

Table 14 Direct to OEM Sales Channel Market by Geography 2020-2026 ($ million)

Table 15 Direct to End-user Sales Channel Market by Geography 2020-2026 ($ million)

Table 16 Direct to System Integrator Sales Channel Market by Geography 2020-2026 ($ million)

Table 17 Distributor to OEM Sales Channel Market by Geography 2020-2026 ($ billion)

Table 18 Distributor to End-user Sales Channel Market by Geography 2020-2026 ($ million)

Table 19 Distributor to System Integrator Sales Channel Market by Geography 2020-2026 (million)

Table 20 Comparison between Servo and Stepper Motors in CNC Machines

Table 21 Machine Tool Industry Market by Geography 2020-2026 ($ million)

Table 22 Packaging Market by Geography 2020-2026 (million)

Table 23 Electronics & Semiconductor Market by Geography 2020-2026 ($ billion)

Table 24 Robotics Market by Geography 2020-2026 ($ million)

Table 25 Automotive Market by Geography 2020-2026 ($ million)

Table 26 Metal Processing Market by Geography 2020-2026 ($ million)

Table 27 Warehouse Market by Geography 2020-2026 ($ million)

Table 28 Oil & Gas Market by Geography 2020-2026 ($ million)

Table 29 Paper Market by Geography 2020-2026 ($ million)

Table 30 Aerospace & Defense Market by Geography 2020-2026 ($ million)

Table 31 Food & Beverage Market by Geography 2020-2026 ($ million)

Table 32 Textiles Market by Geography 2020-2026 ($ million)

Table 33 Printing Market by Geography 2020-2026 ($ million)

Table 34 Pharmaceutical Market by Geography 2020-2026 ($ million)

Table 35 Woodwork Market by Geography 2020-2026 ($ million)

Table 36 Power Generation Market by Geography 2020-2026 ($ million)

Table 37 Other Industries Market by Geography 2020-2026 ($ million)

Table 38 APAC Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 39 APAC Servo Motors & Drives Market by Product 2020-2026 ($ billion)

Table 40 APAC Servo Motor Market 2020-2026 ($ billion)

Table 41 APAC Servo Drive Market 2020-2026 ($ billion)

Table 42 APAC Servo Motors & Drives Market by Voltage 2020-2026 ($ billion)

Table 43 APAC Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 44 Europe Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 45 Europe Servo Motors & Drives Market by Product 2020-2026 ($ billion)

Table 46 Servo Motors Market in Europe 2020-2026 ($ billion)

Table 47 Servo Drives Market in Europe 2020-2026 ($ billion)

Table 48 Europe Servo Motors & Drives Market by Voltage 2020-2026 ($ billion)

Table 49 Europe Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 50 North America Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 51 North America Servo Motors & Drives Market by Product 2020-2026 ($ billion)

Table 52 North America Servo Motors Market 2020-2026 ($ billion)

Table 53 North America Servo Drives Market 2020-2026 ($ billion)

Table 54 North America Servo Motors & Drives Market by Voltage 2020-2026 ($ billion)

Table 55 North America Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 56 Latin America Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 57 Latin America Servo Motors & Drives Market by Product 2020-2026 ($ million)

Table 58 Latin America Servo Motors Market 2020-2026 ($ million)

Table 59 Latin America Servo Drives Market 2020-2026 ($ million)

Table 60 Latin America Servo Motors & Drives Market 2020-2026 ($ million)

Table 61 Latin America Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 62 MEA Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 63 MEA Servo Motors & Drives Market by Product 2020-2026 ($ million)

Table 64 MEA Servo Motors Market 2020-2026 ($ million)

Table 65 MEA Servo Drives Market 2020-2026 ($ million)

Table 66 MEA Servo Motors & Drives Market by Voltage 2020-2026 ($ million)

Table 67 MEA Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 68 Emerson: Major Product Offerings

Table 69 Siemens: Major Product Offerings

Table 70 Rockwell Automation: Major Product Offerings

Table 71 ABB: Major Product Offerings

Table 72 Mitsubishi Electric: Major Product Offerings

Table 73 Delta: Major Product Offerings

Table 74 Fuji Electric: Major Product Offerings

Table 75 Yaskawa: Major Product Offerings

Table 76 Sanyo Denki: Major Product Offerings

Table 77 Parker Hannifin: Major Product Offerings

Table 78 Allied Motion: Major Product Offerings

Table 79 Nidec: Major Product Offerings

Table 80 Ametek: Major Product Offerings

Table 81 ARC Systems: Major Product Offerings

Table 82 Bonfiglioli: Major Product Offerings

Table 83 Oriental Motor: Major Product Offerings

Table 84 Schneider Electric: Major Product Offerings

Table 85 Callan Technology: Major Product Offerings

Table 86 Panasonic Industry Europe: Major Product Offerings

Table 87 Sew-Eurodrive: Major Product Offerings

Table 88 FANUC: Major Product Offerings

Table 89 Bosch Rexroth: Major Product Offerings

Table 90 Kollmorgen: Major Product Offerings

Table 91 HNC Electric: Major Product Offerings

Table 92 Moog: Major Product Offerings

Table 93 Tamagawa Seiki: Major Product Offerings

Table 94 GSK CNC Equipment: Major Product Offerings

Table 95 Infranor: Major Product Offerings

Table 96 KEB Automation: Major Product Offerings

Table 97 Beckhoff: Major Product Offerings

Table 98 TECO Electro Devices Major Product Offerings

Table 99 Global Servo Motors & Drives Market by Geography 2020-2026 ($ billion)

Table 100 Global Servo Motors & Drives Market by Geography 2020-2026 (Revenue %)

Table 101 APAC Servo Motors & Drives Market by Product 2020-2026 ($ billion)

Table 102 APAC Servo Motors & Drives Market by Voltage 2020-2026 ($ billion)

Table 103 APAC Servo Motors Market 2020-2026 ($ billion)

Table 104 APAC Servo Drives Market 2020-2026 ($ billion)

Table 105 APAC Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 106 APAC Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 107 Europe Servo Motors & Drives Market by Product 2020-2026 ($ billion)

Table 108 Europe Servo Motors & Drives Market by Voltage 2020-2026 ($ billion)

Table 109 Europe Servo Motors Market 2020-2026 ($ billion)

Table 110 Europe Servo Drives Market 2020-2026 ($ billion)

Table 111 Europe Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 112 Europe Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 113 North America Servo Motors & Drives Market by Product 2020-2026 ($ billion)

Table 114 North America Servo Motors & Drives Market by Voltage 2020-2026 ($ billion)

Table 115 North America Servo Motors Market 2020-2026 ($ billion)

Table 116 North America Servo Drives Market 2020-2026 ($ billion)

Table 117 North America Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 118 North America Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 119 Latin America Servo Motors & Drives Market by Product 2020-2026 ($ million)

Table 120 Latin America Servo Motors & Drives Market by Voltage 2020-2026 ($ million)

Table 121 Latin America Servo Motors Market 2020-2026 ($ million)

Table 122 Latin America Servo Drives Market 2020-2026 ($ million)

Table 123 Latin America Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 124 Latin America Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 125 MEA Servo Motors & Drives Market by Product 2020-2026 ($ million)

Table 126 MEA Servo Motors & Drives Market by Voltage 2020-2026 ($ million)

Table 127 MEA Servo Motors Market 2020-2026 ($ million)

Table 128 MEA Servo Drives Market 2020-2026 ($ million)

Table 129 MEA Servo Motors & Drives Market by Sales Channel 2020-2026 ($ million)

Table 130 MEA Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 131 Global Servo Motors & Drives Market by Product 2020-2026 ($ billion)

Table 132 Global Servo Motors & Drives Market by Product 2020-2026 (Revenue %)

Table 133 Global Servo Motors & Drives Market by Voltage 2020-2026 ($ billion)

Table 134 Global Servo Motors & Drives Market by Voltage 2020-2026 (Revenue %)

Table 135 Global Servo Motors & Drives Market by Material 2020-2026 ($ billion)

Table 136 Global Servo Motors & Drives Market by Material 2020-2026 (Revenue %)

Table 137 Global Servo Motors & Drives Market by Servo Motor Type 2020-2026 ($ billion)

Table 138 Global Servo Motors & Drives Market by Servo Motor Type 2020-2026 (Revenue %)

Table 139 Global Servo Motors & Drives Market by Power Capacity 2020-2026 ($ billion)

Table 140 Global Servo Motors & Drives Market by Power Capacity 2020-2026 (Revenue %)

Table 141 Global Servo Motors Market 2020-2026 ($ billion)

Table 142 Global Servo Motors Market 2020-2026 (Revenue %)

Table 143 Global Servo Drives Market 2020-2026 ($ billion)

Table 144 Global Servo Drives Market 2020-2026 (Revenue %)

Table 145 Global Servo Motors & Drives Market by Sales Channel 2020-2026 ($ billion)

Table 146 Global Servo Motors & Drives Market by Sales Channel 2020-2026 (Revenue %)

Table 147 Global Servo Motors & Drives Market by End-user 2020-2026 ($ million)

Table 148 Global Servo Motors & Drives Market by End-User 2020-2026 (Revenue %)

Companies Mentioned

- Emerson

- Siemens

- Rockwell Automation

- ABB

- Mitsubishi Electric

- Delta

- Fuji Electric

- Yaskawa

- Sanyo Denki

- Parker Hannifin

- Allied Motion

- Nidec

- Ametek

- ARC Systems

- Bonfiglioli

- Oriental Motor

- Schneider Electric

- Callan Technology

- Panasonic Industry Europe

- Sew-Eurodrive

- FANUC

- Bosch Rexroth

- Kollmorgen

- HNC Electric

- Moog

- Tamagawa Seiki

- GSK CNC Equipment

- Infranor

- KEB Automation

- Beckhoff

- TECO Electro Devices

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| Published | February 2021 |

| Forecast Period | 2020 - 2026 |

| Estimated Market Value ( USD | $ 13.6 Billion |

| Forecasted Market Value ( USD | $ 18.73 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |