Barium carbonate, often represented by the chemical formula BaCO₃, is a white solid compound that is naturally occurring and commonly found in the mineral witherite. It is used in a variety of applications. In the ceramic industry, barium carbonate is utilized to enhance the brightness and smoothness of glazes. It's also a key ingredient in producing special types of glass, including those used for television tubes. Furthermore, it is employed to purify specific chemical solutions by removing sulfates. Another significant application is its role in the manufacturing of bricks, where it counteracts the detrimental effects of natural soluble salts, preventing the formation of salt marks. Handling barium carbonate requires caution since ingestion can be harmful. Its use and disposal are governed by environmental and safety regulations to ensure the well-being of both individuals and the environment.

The escalating demand from the chemical industry is majorly driving the global market. Along with this, continual advancements in the formulation of numerous pharmaceutical products and the development of new materials is providing an impetus to the market. As more complex processes and products emerge, the need for highly purified chemical solutions is escalating. In addition to this, continuous research and development activities in various sectors are positively influencing the market. Any innovative use or efficiency improvements are acting as a growth-inducing factor. As industries diversify and expand their product offerings, they may find new uses for barium carbonate. For instance, while it's already used in ceramics and glass, there might be specialized products within these sectors that come to rely more heavily on barium carbonate as they grow in popularity. Moreover, the presence of a stable and well-established supply chain creates a positive market outlook.

Barium Carbonate Market Trends/Drivers

Expansion of the electronics and television industry

The electronics and television industry is expanding at a rapid pace, and this has significantly driven the demand. It is a crucial component in the production of cathode-ray tubes (CRTs) for televisions and other display devices. These tubes require special types of glass to function efficiently, and it plays a pivotal role in achieving the required properties for this glass. As developing countries continue to industrialize, there is a rise in the demand for electronics, especially in regions where the market penetration for these products is still low. In addition, the emergence of newer technologies might have shifted some of the demand away from CRTs in favor of technologies including LCD, LED, and OLED. Moreover, the expansion and diversification of the electronics industry, coupled with the rise in the number of households purchasing televisions, especially in emerging economies, are fueling the demand.Growing ceramic and glass industries

Barium carbonate is an essential component in the ceramic industry, especially in glazing. Additionally, it enhances the brightness and smoothness of ceramic glazes. With urbanization and increased infrastructure development worldwide, the demand for ceramic products, including tiles and sanitary ware, has skyrocketed. In addition, the glass industry heavily relies on barium carbonate for producing various specialized types of glass. Furthermore, the construction growth in many developing nations is leading to a rise in the demand for glass products. From architectural applications to household decor, the versatility of glass products is undeniable. As these industries grow, the ripple effect on the demand for barium carbonate becomes more pronounced, marking it as a significant market driver.Requirement in brick manufacturing

The brick manufacturing industry is another sector where barium carbonate holds importance. In this industry, the product is used to combat the harmful effects of natural soluble salts. These salts further lead to the formation of efflorescence or salt marks on bricks, compromising their aesthetic appeal and structural integrity. With rapid urbanization and infrastructural developments, the demand for construction materials, including bricks, has accelerated. In confluence with this, quality bricks are a staple in construction, and the need for bricks free from efflorescence is high. As the construction industry grows, especially in growing urban centers, the demand for barium carbonate in brick manufacturing also sees a corresponding growth.Barium Carbonate Industry Segmentation

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels from 2025-2033. The report has categorized the market based on end use.Breakup by End Use

- Glass

- Brick and Clay

- Barium Ferrites

- Photographic Paper Coatings

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes glass, brick and clay, barium ferrites, photographic paper coatings, and others. According to the report, brick and clay accounted for the largest market share.

Market drivers for the brick and clay end use segment in the industry include the sustained growth in the construction and infrastructure sectors. As urbanization continues, there is a growing demand for high-quality bricks, tiles, and sanitary ware. Additionally, the product plays a critical role in this domain by countering the adverse effects of natural soluble salts, preventing the formation of unsightly efflorescence on bricks, and ensuring their structural integrity and aesthetic appeal. Along with this, stringent quality standards and regulations in the construction industry further underscore the need for barium carbonate in brick manufacturing. Moreover, the growing emphasis on sustainable building materials is leading to increased research and development efforts, potentially uncovering novel applications for construction materials. As a result, the brick and clay segment in the industry is poised for continued growth, fueled by the ever-expanding construction sector and its enduring need for high-performance building materials.

Breakup by Region

- China

- Japan

- Latin America

- Middle East and Africa

- Europe

- Others

The market research report has also provided a comprehensive analysis of all the major regional markets, which include China, Japan, Latin America, Middle East and Africa, Europe, and others. According to the report, China accounted for the largest market share.

The barium carbonate industry in China is experiencing robust growth, primarily driven by the region’s growing electronics manufacturing sector, one of the largest in the world, which relies heavily on barium carbonate for the production of cathode-ray tubes (CRTs), a fundamental component in older television and display technologies. As the country continues to advance technologically and urbanize, the demand for electronic devices remains high, influencing the need for barium carbonate. In addition, China's construction industry is expanding rapidly, driven by urbanization and infrastructure development. In addition, the government's commitment to quality and sustainability in construction projects further cements the demand.

Apart from this, China's chemical industry, another significant consumer of barium carbonate, is also experiencing growth as it diversifies and modernizes. The compound's use in purifying chemical solutions makes it indispensable in various industrial processes. Furthermore, the Chinese government's push for environmental regulations and cleaner production processes is resulting in a focus on the use of barium carbonate for sulfate removal in certain industries, thereby contributing to the market growth.

Competitive Landscape

The key players are focusing on efficient and cost-effective production processes to ensure a stable supply of high-quality barium carbonate to their customers. They are investing in modernization and capacity expansion to meet growing demand. Along with this, the accelerating investments in research and development to explore new applications for barium carbonate and improve existing ones are positively influencing the market. In addition, companies must adhere to environmental and safety regulations, especially in the handling and disposal of barium compounds. Compliance is crucial to maintaining their social and environmental responsibilities, which is acting as another growth-inducing factor. Apart from this, manufacturers are implementing sustainable practices, such as recycling or reducing emissions, to minimize their environmental footprint and align with global sustainability goals. Furthermore, key players are diversifying their product portfolio by offering related chemicals or services to cater to a broader range of industries.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Solvay S.A.

- Chemical Products Corporation

- Hubei Jingshan Chutian Barium Salt Corporation Ltd.

- Guizhou Hongxing Development Co. Ltd.

- Sakai Chemical Industry Co. Ltd.

- Hebei Xinji Chemical Group Co. Ltd.

- Shaanxi Ankang Jianghua Group Co. Ltd.

- Zaozhuang City Yongli Chemical Co., Ltd.

Key Questions Answered in This Report

1. What was the size of the global barium carbonate market in 2024?2. What is the expected growth rate of the global barium carbonate market during 2025-2033?

3. What are the key factors driving the global barium carbonate market?

4. What has been the impact of COVID-19 on the global barium carbonate market?

5. What is the breakup of the global barium carbonate market based on the end-use?

6. What are the key regions in the global barium carbonate market?

7. Who are the key players/companies in the global barium carbonate market?

Table of Contents

Companies Mentioned

- Solvay S.A.

- Chemical Products Corporation

- Hubei Jingshan Chutian Barium Salt Corporation Ltd.

- Guizhou Hongxing Development Co. Ltd.

- Sakai Chemical Industry Co. Ltd.

- Hebei Xinji Chemical Group Co. Ltd.

- Shaanxi Ankang Jianghua Group Co. Ltd. and Zaozhuang City Yongli Chemical Co. Ltd.

Table Information

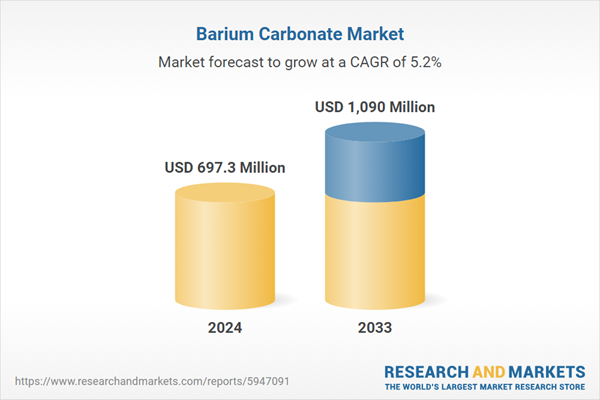

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 697.3 Million |

| Forecasted Market Value ( USD | $ 1090 Million |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |