Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Product Upgradation by Major Players

Product upgradation by major players is a significant driver of the India candy market. As consumer preferences evolve, candy manufacturers are increasingly focusing on enhancing their product offerings to meet growing demand for novelty, quality, and health-conscious alternatives. As a part of this, as September 2024, ITC Candyman launched Candyman Sourzzz, marking its entry into the exciting market of sour candies. Candyman Sourzzz is a tangy jelly that will tantalize the taste buds with its powerful flavor profile. These sour candies are intended to evoke the brand Candyman's spirit of playfulness and mischief. The deal is sure to bring out the wicked side in candy lovers of all ages, particularly the younger generation.Major players are upgrading their candy portfolios by introducing new flavors, shapes, and textures, making the candy experience more exciting for consumers. This includes a wide range of innovative products, such as sugar-free, organic, and functional candies that appeal to the health-conscious segment of the market. Manufacturers are also investing in improving the nutritional profile of their candies, with options that cater to specific dietary requirements such as gluten-free, vegan, and low-calorie products.

Also, product packaging is being upgraded to appeal to consumers seeking convenience, eco-friendly materials, and attractive designs that enhance the overall experience. To further strengthen their market presence, companies are leveraging technological advancements in production, ensuring that their candy products are of higher quality while maintaining cost-effectiveness. The launch of limited-edition or seasonal products is another strategy employed by key players to maintain consumer interest and drive sales. These product upgradations help candy brands stay competitive in a rapidly evolving market, meeting the preferences of a diverse consumer base.

Growing Urbanization

Growing urbanization is a significant driver of the India candy market. As India continues to experience rapid urbanization, more people are moving to cities in search of better job opportunities and improved lifestyles. As a part of this, according to World Bank Group, as of January 2024, India is increasingly urbanizing. By 2036, its towns and cities will house 600 million people, or 40% of the population, up from 31% in 2011, with urban regions generating over 70% of GDP. This demographic shift has led to changes in consumer behaviour, with an increasing demand for convenient, on-the-go snack options, including candy.Urban consumers, particularly working professionals, students, and young adults are increasingly drawn to candies as a quick and affordable indulgence in their busy daily routines. Also, urban areas offer better access to modern retail outlets, supermarkets, hypermarkets, and online platforms, which makes candy products more widely available and accessible to consumers.

The presence of a variety of candy brands and product types, ranging from traditional to premium and health-conscious options, has catered to the evolving tastes of urban consumers. Urbanization also leads to a greater exposure to global food trends, influencing taste preferences and driving demand for international candy flavors and innovations. Also, the rising disposable incomes in cities enable consumers to spend more on indulgent products, including premium or novelty candy varieties. As urbanization continues to rise, the candy market is expected to experience sustained growth, with manufacturers focusing on offering convenient, innovative, and diverse candy options for urban consumers.

Growing Health-Conscious Population

The growing health-conscious population is a significant driver of the India candy market, as more consumers are becoming aware of the impact of sugary and unhealthy snacks on their health. Rising concerns about obesity, diabetes, and other lifestyle diseases are prompting individuals to seek healthier alternatives. As a result, there is an increasing demand for candies that are sugar-free, low-calorie, organic, or made with natural sweeteners. Health-conscious consumers are also looking for products with fewer artificial additives and preservatives, pushing candy manufacturers to innovate with clean-label and functional products.This shift towards healthier candy options is particularly noticeable among the younger generation, urban populations, and those with higher disposable incomes, who are willing to pay a premium for candies that align with their wellness goals. Manufacturers are responding by launching a variety of health-focused candies, such as fruit-based, vegan, gluten-free, and fortified with vitamins or minerals. These innovations are not only appealing to health-conscious individuals but also to those with dietary restrictions or preferences. As the health and wellness trend continues to grow in India, the candy market is expected to see sustained growth, with consumers increasingly turning to healthier, guilt-free indulgences. This trend is pushing brands to strike a balance between taste and nutrition while meeting the rising demand for better-for-you candy options.

Key Market Challenges

Regulatory Complexities

Regulatory complexities are a significant challenge in the India candy market. The Indian food and beverage industry is governed by various regulations set by authorities like the Food Safety and Standards Authority of India (FSSAI), which imposes strict guidelines on the ingredients, production processes, and labeling of confectionery products. These regulations aim to ensure food safety and protect consumer health but can create hurdles for candy manufacturers, especially when it comes to compliance and adhering to the evolving standards. For example, the use of food additives, preservatives, and artificial coloring agents is closely regulated, and companies must ensure their products meet safety standards.Also, with the increasing demand for healthier options, manufacturers must comply with new regulations surrounding sugar content, labeling, and marketing claims, such as "sugar-free" or "organic." Failure to meet these requirements can result in product recalls, fines, or restrictions on sales, leading to potential financial losses and reputational damage. Also, the regulatory landscape in India is continually evolving, and businesses must stay up to date with the latest changes to avoid non-compliance. This can be particularly challenging for smaller manufacturers who may lack the resources to navigate complex regulations. The ongoing need to align products with government standards adds an additional layer of cost and operational complexity for candy producers in India.

Intense Competition Among Major Players

Intense competition among major players is a significant challenge in the India candy market. The confectionery sector is highly fragmented, with numerous local and international brands vying for market share. Large multinational companies, such as Nestlé, Cadbury, and Mars, dominate the market with well-established products and significant brand recognition. These companies often have vast distribution networks, extensive advertising budgets, and strong consumer loyalty, making it difficult for smaller players to compete effectively.At the same time, local manufacturers and regional players are also increasing their presence by offering innovative, cost-effective, and culturally relevant candy options. These smaller brands often leverage regional flavors and traditional ingredients to cater to local preferences, which adds to the competitive pressure on larger players. The growing number of brands and products in the market leads to price wars, which can erode profit margins and create challenges in maintaining product quality. Also, with the increasing demand for healthier and functional candies, companies must continuously innovate to stay relevant in the market. The need for constant product innovation, effective marketing strategies, and efficient distribution channels increases operational costs, making it a challenge for businesses to sustain long-term growth while managing intense competition.

Key Market Trends

Rising Demand for Organic Candy

Rising demand for organic candy is a significant trend in the India candy market, driven by growing health-consciousness among consumers. As more individuals become aware of the adverse effects of artificial ingredients, preservatives, and excessive sugar consumption, there is a shift towards cleaner, healthier alternatives. Organic candy, which is made using natural sweeteners, colors, and flavors, is increasingly preferred by health-conscious consumers who want to indulge without compromising on their dietary choices. This trend is especially popular among urban populations, where awareness of the benefits of organic food products is higher. Younger consumers are seeking healthier indulgences, leading to a rise in demand for sugar-free, gluten-free, and vegan organic candy options. These products appeal to a variety of dietary preferences and restrictions, such as vegan, paleo, and diabetic-friendly options, further expanding their consumer base.Manufacturers are responding by introducing organic versions of popular candy items, including chocolate, gummies, and lollipops, often marketed with claims of “no artificial colors or flavors” and “made with organic ingredients.” As consumer preferences continue to shift towards organic and clean-label products, this trend is expected to shape the future of the candy market, with more brands focusing on product innovation to meet the growing demand for healthier, organic candy options.Increased Consumption of Chocolate Candies Across the Region

Increased consumption of chocolate candies is a prominent trend in the India candy market. As a part of this, as of 2023, the retail sales value of chocolate confectionery items in India was 2.43 billion US dollars. This was an increase over the previous year. The sales value is predicted to exceed USD 4 billion by 2028, expanding at a compound annual growth rate of 10.2 percent. As the Indian population’s disposable income rises and urbanization accelerates, consumers are increasingly indulging in chocolate-based confectioneries, which are perceived as premium, indulgent treats.Chocolate candies have become a staple in the Indian candy market, driven by factors like evolving taste preferences, increasing exposure to international brands, and growing acceptance of chocolate as a mainstream snack rather than an occasional indulgence. Young consumers are fuelling the growth of this segment, with chocolate candies being popular among children and young adults due to their rich flavors and variety.

The rise of innovative chocolate products, such as filled chocolates, premium artisanal chocolates, and healthier chocolate variants like sugar-free or organic options, is further boosting the market. Chocolate candies are also becoming a preferred gifting option during festivals and special occasions, leading to seasonal surges in demand. Also, chocolate brands are leveraging celebrity endorsements and social media marketing to appeal to younger consumers, further driving the consumption of chocolate candies. As consumer preferences shift towards premium indulgence, the chocolate candy segment is expected to maintain its growth trajectory, becoming a dominant category in the Indian candy market.

Increased Focus on Innovative Packaging

Increased focus on innovative packaging is a key trend in the India candy market. As competition intensifies and consumer expectations evolve, manufacturers are prioritizing creative and functional packaging solutions to enhance product appeal and differentiate themselves. Modern consumers, especially in urban areas, are drawn to packaging that is visually appealing, easy to use, and environmentally friendly. Many candy brands are adopting eco-friendly materials, such as recyclable or biodegradable packaging, to meet growing sustainability concerns. Also, innovative packaging is being used to extend shelf life, maintain product freshness, and improve convenience.Resealable packs, smaller portion sizes, and individually wrapped candies are gaining popularity among consumers who value convenience and hygiene. Packaging that provides information on nutritional content, ingredient sourcing, and health benefits is also becoming more common as health-conscious consumers seek transparency. Limited-edition, festive, and seasonal packaging designs are further driving consumer interest and increasing sales during special occasions like festivals and holidays. Overall, packaging innovation is helping candy brands not only to attract attention on the shelves but also to build stronger consumer loyalty and align with emerging trends in sustainability and convenience.

Segmental Insights

Distribution Channel Insights

Supermarket/Hypermarket dominated the India Candy market, due to their wide reach and the convenience they offer consumers. These retail formats provide easy access to a diverse range of candy products, from traditional favorites to premium and health-conscious options. With spacious aisles and well-organized shelves, supermarkets and hypermarkets allow consumers to explore various brands and make informed choices. Also, the presence of attractive promotions, discounts, and bundled offers further enhances the appeal of these retail outlets. The growth of organized retail and increasing disposable incomes among urban consumers continue to bolster the dominance of supermarkets and hypermarkets in the candy market. As a part of this, as of September 2024, the retail market in India was predicted to grow to 1.7 trillion US dollars by 2026, up from 883 billion in 2020.Regional Insights

The North region dominated the India Candy market, driven by high urbanization, rising disposable incomes, and a large consumer base in cities like Delhi, Chandigarh, and Jaipur. Urban centers in the North have seen a surge in demand for both traditional and premium candy products, fuelled by changing consumer preferences, increased health awareness, and a growing appetite for indulgent treats. The presence of modern retail outlets, supermarkets, hypermarkets, and e-commerce platforms in the region further supports candy availability. Also, festivals and celebrations in the North lead to a seasonal increase in candy consumption, further strengthening the region's dominant position in the market.Key Market Players

- ITC Limited

- Nestlé India Limited

- Hershey India Private Limited

- Mondelēz International, Inc

- DS Group

- Mars, Incorporated

- Perfetti Van Melle India Private Limited

- Lotte India

- Dhiman Foods Pvt. Ltd

- Ambic Food Products

Report Scope:

In this report, the India Candy Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Candy Market, By Type:

- Chocolate Candy

- Non-Chocolate Candy

India Candy Market, By Flavor:

- Sweet

- Sour

- Mixed Flavor

India Candy Market, By Sugar Content:

- Sugar-Free

- With-Added Sugar

India Candy Market, By Nature:

- Organic

- Regular

India Candy Market, By Sales Channel:

- Supermarket/Hypermarket

- Convenience Stores

- Specialty Stores

- Online

- Others

India Candy Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Candy Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ITC Limited

- Nestlé India Limited

- Hershey India Private Limited

- Mondelēz International, Inc

- DS Group

- Mars, Incorporated

- Perfetti Van Melle India Private Limited

- Lotte India

- Dhiman Foods Pvt. Ltd

- Ambic Food Products

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | February 2025 |

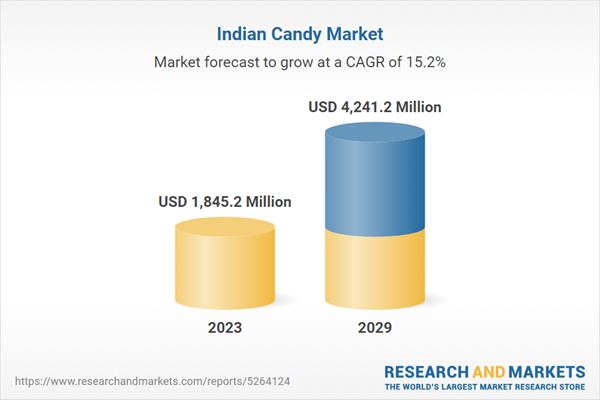

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1845.2 Million |

| Forecasted Market Value ( USD | $ 4241.2 Million |

| Compound Annual Growth Rate | 15.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |