Key Highlights

- Cleaning products such as liquids, powders, and sprays, along with the cleaning equipment, help to remove microbial contamination from a surface and maintain the surface clean and hygienic. The COVID-19 pandemic increased public awareness of maintaining clean and hygienic environments, especially in homes, workplaces, and public spaces. As a result, there has been a surge in demand for cleaning equipment such as vacuum cleaners, steam cleaners, and high-pressure cleaners.

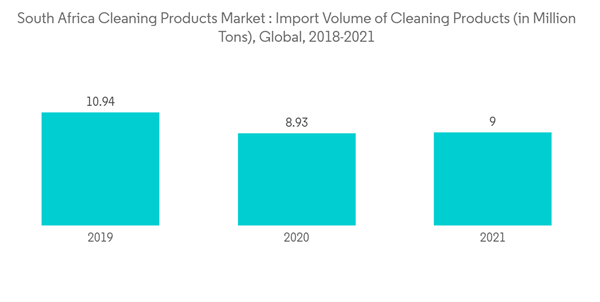

- As per Volza's South Africa import data, vacuum cleaner import shipments in South Africa stood at 658 in 2022. Moreover, South Africa imports most of its vacuum cleaners from Vietnam, Germany, and Belgium. Thereby, high import rates indicate a growing market and consumer interest in cleaning products, which can drive competition and innovation among manufacturers, leading to further growth in the market.

- The cleaning products market will continue to grow over the long term due to various factors such as increasing urbanization, improved living standards, and the availability of new and innovative cleaning products. In addition, the demand from commercial users, such as businesses and institutions, could also contribute to the market's growth. It is worth noting that market trends and consumer preferences can change rapidly, and various external factors, such as economic conditions and government regulations, can also impact the market.

- Product preference varies from person to person and is influenced by demographic and consumer behavior. Consumers are often attracted to innovative products. As a result, they are unable to remain loyal to a single brand. This factor is considered challenging for small and medium-sized manufacturers in the country, which anticipates restraining the market growth.

South Africa Cleaning Products Market Trends

Growing Penetration of Cleaning Products in Households

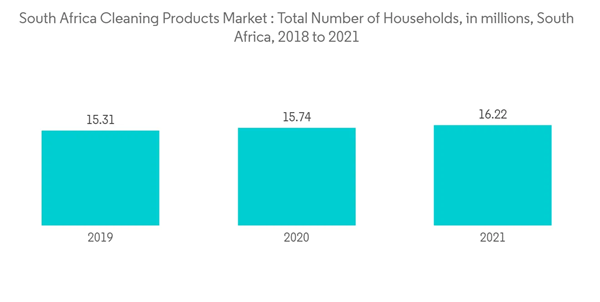

- The growing number of households and disposable income in South Africa has resulted in an increased consumer purchasing power for home care and home hygiene products, which has subsequently driven the sales of household cleaning products in the country.

- The adoption of cleaning equipment, such as steam cleaners and vacuum cleaners, and eco-friendly chemicals in residential settings is primarily driven by the need to achieve a hygienic and chemical-free cleaning of floors, walls, and kitchens. The market for cleaning equipment is gaining traction as deep cleaning and sanitization of home carpets are growing. Kitchens and carpets are the largest application end users in the residential segment, primarily for cleaning equipment.

- Additionally, the growing demand for cleaning products, such as powders and gels, and high economies of scale have enabled the market to witness the proliferation of private label brands at retail shelves through various promotional offers and discounts.

- For instance, Pick n Pay, one of the largest supermarket chain stores in South Africa, offers a range of cleaning products under its private label, PnP brand, that are certified as vegan, cruelty-free, and not tested on animals. This trend towards eco-friendly and animal-friendly cleaning products is likely to continue as consumers become more aware of the impact of their choices on the environment and animal welfare.

- Overall, the market for household cleaning products in South Africa is expected to continue its growth trajectory, driven by the increasing disposable income of households, adoption of cleaning equipment, and growing demand for eco-friendly and animal-friendly cleaning products.

Growing Demand for Cleaning Products in Healthcare Centre

- Cleaning products play a critical role in maintaining cleanliness and hygiene in healthcare environments. Healthcare facilities such as hospitals, clinics, and nursing homes are highly susceptible to microbial contamination due to the constant presence of patients, healthcare professionals, and visitors. Cleaning products such as disinfectants, detergents, and sanitizers are used to clean and disinfect surfaces, medical equipment, instruments, and other items in the healthcare setting.

- The use of cleaning machines, such as steam cleaners, has become increasingly popular in healthcare facilities because they can effectively eliminate germs and bacteria from surfaces and equipment. Steam cleaners use high-temperature steam to kill bacteria and other microorganisms, making them an efficient and eco-friendly cleaning solution. For instance, healthcare centers use steam cleaners (expect to reduce 99% of germs) to minimize the spread of infection and make surfaces and equipment safe to use.

- On the other hand, cleaning products such as enzymatic detergents are also used extensively in hospitals and other outpatient clinics. As a result, manufacturers are focussing on offering cleaning products exclusively for health care centers. For Instance, SaniChem, a cleaning product manufacturer in South Africa, offers a line of high-quality enzymatic detergents and hospital-grade surface disinfectants specially designed for hospitals, group medical practices, emergency medical services, veterinary clinics, and laboratories.

South Africa Cleaning Products Industry Overview

The market is highly competitive with the presence of regional and global level players such as Alfred Kärcher SE & Co. KG. Nilfisk Group, Dyson James Ltd, Tevo Pty Ltd, and Verimark Holdings Ltd, among others. The high prevalence of virus/germs acquired infections has increased home and public hygiene awareness.Companies in the South African cleaning products market strategically add innovative sanitating machines to increase their market value and give a competitive edge. On the other hand, companies also provide customized cleaning equipment as per the client's requirements and their business need, such as CEMSA offering customized equipment solution to offer services as per their hygiene standards, which eventually boost the company sales growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfred Karcher SE & Co. KG

- Miele & Cie. KG

- Nilfisk Group

- Nu-World Holdings Ltd

- Dyson James Ltd

- Robert Bosch GmbH

- Tevo (Pty) Ltd

- Chemstrat

- BWGL Group (Pty) Ltd.

- Cleaning Equipment Manufacturing SA Pty Ltd