Global Field Device Management (FDM) Market - Key Trends & Drivers Summarized

What Is Field Device Management and Why Is It Vital in Industrial Operations?

Field Device Management (FDM) refers to the centralized system for configuring, monitoring, and diagnosing field devices such as sensors, actuators, and flow meters in industrial settings. FDM enables remote access and control over a wide array of field devices, allowing for real-time adjustments, troubleshooting, and performance monitoring, which enhances operational efficiency and asset reliability. By providing a centralized interface for managing field devices, FDM solutions support preventive and predictive maintenance strategies, reducing the need for manual checks and minimizing costly downtime.The demand for Field Device Management (FDM) solutions is rising across industries such as oil and gas, utilities, manufacturing, and chemical processing due to the need for efficient, centralized management of field devices, improved maintenance, and enhanced operational uptime. FDM solutions allow for the remote configuration, monitoring, and diagnostics of field devices, such as sensors, actuators, and flow meters, making it easier to ensure that devices are operating optimally. By providing real-time insights into device performance and health, FDM solutions help prevent unplanned downtime, reduce maintenance costs, and increase operational efficiency.

As industries increasingly adopt Industry 4.0 practices, the role of FDM solutions has expanded to support smart, connected, and data-driven operations. In sectors with complex, high-cost machinery and extensive field networks, such as oil and gas and utilities, FDM enables predictive maintenance and minimizes on-site visits, creating significant cost savings. This trend is particularly strong in regions with large industrial bases, such as North America, Europe, and Asia-Pacific, where companies are focusing on digital transformation to improve asset performance, reliability, and safety. The need for proactive device management, enhanced productivity, and cost efficiency is a major driver of the FDM market.

How Are Technological Advancements Impacting the Development and Implementation of Field Device Management Solutions?

Technological advancements in connectivity, IoT, and data analytics are transforming the capabilities of FDM solutions, making them more versatile and effective. Integration with Industrial Internet of Things (IIoT) platforms enables FDM solutions to collect and process data from a wide array of field devices, providing operators with comprehensive insights into equipment health and enabling predictive maintenance. Cloud-based FDM systems allow for remote device access and management, supporting real-time diagnostics and updates from anywhere, reducing the need for on-site technical interventions.Moreover, AI and machine learning are being incorporated into FDM solutions to analyze device data and identify anomalies before they result in equipment failure. These capabilities allow FDM systems to detect patterns in device performance and anticipate issues, enhancing the accuracy of maintenance schedules and reducing downtime. As industries increasingly adopt connected devices and rely on data-driven decision-making, these advancements in FDM technology are enabling more effective, predictive, and automated management of field assets, making FDM an essential component of modern industrial operations.

What Role Do Efficiency and Sustainability Goals Play in Shaping the Field Device Management Market?

Efficiency and sustainability goals are playing a significant role in the adoption of FDM solutions, as companies aim to optimize asset performance while minimizing resource use and environmental impact. FDM solutions enable centralized monitoring and efficient management of field devices, allowing industries to reduce energy consumption, prevent waste, and optimize maintenance schedules. By supporting predictive maintenance, FDM reduces unnecessary replacements and repairs, aligning with sustainability initiatives that aim to extend equipment lifespan and minimize material waste.Additionally, FDM solutions contribute to environmental compliance by ensuring devices are operating within safety and regulatory parameters, reducing the risk of emissions or other environmental hazards. In sectors like utilities and oil and gas, where regulatory pressures and environmental expectations are high, FDM helps organizations achieve compliance while enhancing operational efficiency. This alignment with sustainability and efficiency goals is a strong driver in the FDM market, as companies increasingly prioritize responsible, resource-efficient practices.

What Factors Are Driving Growth in the Field Device Management Market?

The growth of the Field Device Management market is driven by the increasing adoption of IoT and Industry 4.0 technologies, the need for predictive and proactive maintenance, regulatory compliance requirements, and the push toward sustainable and efficient operations. As industries focus on digital transformation, FDM solutions enable companies to manage their field assets more effectively by providing real-time insights, supporting remote diagnostics, and reducing maintenance costs. This demand is particularly strong in high-maintenance sectors like manufacturing, oil and gas, and utilities, where FDM improves equipment reliability and minimizes downtime.Technological advancements in connectivity and data analytics have made FDM solutions more robust and accessible, allowing for more detailed device diagnostics and predictive maintenance. Additionally, regulatory and sustainability pressures are prompting companies to adopt FDM solutions to maintain compliance, optimize energy use, and reduce waste. Together, these factors - digital transformation, efficiency gains, compliance needs, and sustainability objectives - are driving robust growth in the Field Device Management market, positioning it as a key enabler in modern, data-driven industrial operations.

Report Scope

The report analyzes the Field Device Management market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Software, Hardware); End-Use (Energy & Utilities, Oil & Gas, Metals & Mining, Chemicals & Pharmaceuticals, Food & Beverages, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 6.3%. The Hardware Component segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $512.1 Million in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $632.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Field Device Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Field Device Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Field Device Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB, Azbil Corporation, Emerson Electric Co., Endress+Hauser, Fanuc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Field Device Management market report include:

- ABB

- Azbil Corporation

- Emerson Electric Co.

- Endress+Hauser

- Fanuc

- Festo

- Hach Company

- Hamilton Company

- Honeywell

- Metso Automation

- Mitsubishi Electric

- Omega Engineering

- OMRON

- Phoenix Contact

- Rockwell Automation

- Schneider Electric

- Siemens

- Valmet

- Weidmüller

- Yokogawa

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB

- Azbil Corporation

- Emerson Electric Co.

- Endress+Hauser

- Fanuc

- Festo

- Hach Company

- Hamilton Company

- Honeywell

- Metso Automation

- Mitsubishi Electric

- Omega Engineering

- OMRON

- Phoenix Contact

- Rockwell Automation

- Schneider Electric

- Siemens

- Valmet

- Weidmüller

- Yokogawa

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

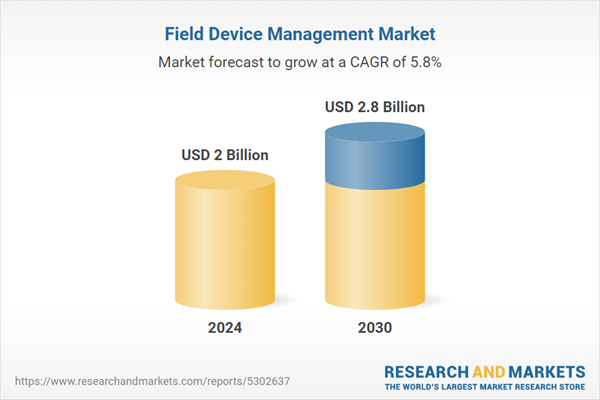

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.8 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |