Global Functional Food Ingredients Market - Key Trends & Drivers Summarized

Functional food ingredients are bioactive compounds added to foods and beverages to provide health benefits beyond basic nutrition. These ingredients include probiotics, prebiotics, vitamins, minerals, antioxidants, and omega-3 fatty acids, among others. They are designed to improve health outcomes such as enhancing digestive health, boosting immune function, reducing inflammation, and supporting cardiovascular health. Functional foods, often marketed as health-enhancing or disease-preventing products, are gaining significant popularity among consumers who are increasingly focused on wellness and preventive healthcare. Examples of functional food products include fortified cereals, dairy products enriched with probiotics, and beverages infused with vitamins and minerals.Technological advancements and ongoing research in food science have significantly expanded the range and efficacy of functional food ingredients. The development of more stable and bioavailable forms of nutrients ensures that these ingredients retain their health benefits throughout the food processing and storage stages. For instance, microencapsulation techniques protect sensitive compounds like probiotics and omega-3 fatty acids from environmental degradation, ensuring their effectiveness when consumed. Furthermore, advancements in genetic engineering and biotechnology are enabling the production of novel functional ingredients with enhanced health benefits. Personalized nutrition, driven by a deeper understanding of the human genome and individual dietary needs, is also influencing the formulation of functional foods, tailoring them to meet specific health goals based on individual genetic profiles.

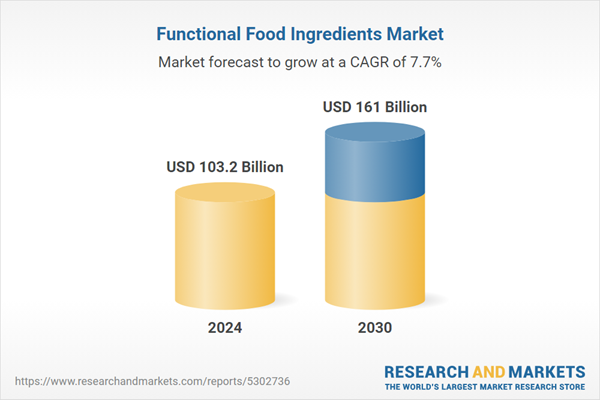

The growth in the functional food ingredients market is driven by several factors. The increasing consumer awareness about health and wellness, coupled with a rising interest in preventive healthcare, is significantly boosting the demand for functional foods. Technological advancements in ingredient formulation and delivery are enhancing the efficacy and appeal of these products. The high levels of innovation in the functional food ingredients space is expected to bring more understanding of the purpose of these products in terms of application and re-position them and eventually make changes as per their shifts from one target application segment to another. Additionally, the aging global population, which is more prone to chronic diseases, is fueling the demand for foods that can help manage or prevent health conditions. The growing prevalence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular issues is also driving consumers towards healthier food options. Moreover, regulatory support and the endorsement of health claims by authoritative bodies are providing a conducive environment for the market's expansion. These factors, alongside ongoing innovation in food technology and personalized nutrition, highlight the dynamic and rapidly evolving nature of the functional food ingredients market.

Report Scope

The report analyzes the Functional Food Ingredients market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Natural, Synthetic); Application (Beverages, Dairy Products, Infant Food, Bakery & Confectionery, Other Applications); Type (Probiotics, Proteins & Amino Acids, Phytochemical & Plant Extracts, Prebiotics, Fibers & Specialty Carbohydrates, Omega-3 Fatty Acids, Other Types).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Ingredients segment, which is expected to reach US$100 Billion by 2030 with a CAGR of 8.1%. The Synthetic Ingredients segment is also set to grow at 7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $31.5 Billion in 2024, and China, forecasted to grow at an impressive 10.5% CAGR to reach $21.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Functional Food Ingredients Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Functional Food Ingredients Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Functional Food Ingredients Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Cargill, Inc., Archer Daniels Midland Company, Ashland Global Holdings, Inc., Associated British Foods PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 73 companies featured in this Functional Food Ingredients market report include:

- BASF SE

- Cargill, Inc.

- Archer Daniels Midland Company

- Ashland Global Holdings, Inc.

- Associated British Foods PLC

- Chr. Hansen Holding A/S

- Corbion NV

- Arla Foods Ingredients Group P/S

- Avebe Group

- Biocatalysts Ltd.

- Bio Actives Japan Corporation

- DMH Ingredients, Inc.

- AmTech Ingredients LLC

- Bioseutica

- ANAGENIX

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Cargill, Inc.

- Archer Daniels Midland Company

- Ashland Global Holdings, Inc.

- Associated British Foods PLC

- Chr. Hansen Holding A/S

- Corbion NV

- Arla Foods Ingredients Group P/S

- Avebe Group

- Biocatalysts Ltd.

- Bio Actives Japan Corporation

- DMH Ingredients, Inc.

- AmTech Ingredients LLC

- Bioseutica

- ANAGENIX

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 421 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 103.2 Billion |

| Forecasted Market Value ( USD | $ 161 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |