Global Electric Mobility Market - Key Trends & Drivers Summarized

Electric mobility is rapidly transforming the transportation landscape, offering a sustainable alternative to traditional internal combustion engine vehicles. Electric vehicles (EVs), including cars, buses, bikes, and scooters, utilize electric powertrains to reduce carbon emissions and dependence on fossil fuels. Advances in battery technology, particularly lithium-ion batteries, have significantly enhanced the range, efficiency, and affordability of EVs. Governments worldwide are promoting electric mobility through incentives, subsidies, and stringent emission regulations, encouraging both consumers and manufacturers to transition to cleaner modes of transportation. This shift is also supported by the development of extensive charging infrastructure, making EVs more convenient and accessible for everyday use.Recent trends in electric mobility highlight a surge in EV adoption and innovation. The automotive industry is witnessing a flurry of new EV models, ranging from compact city cars to luxury sedans and SUVs, catering to diverse consumer preferences. Additionally, advancements in battery technology, such as solid-state batteries and ultra-fast charging systems, are addressing key challenges related to range anxiety and charging time. The integration of smart technologies, including autonomous driving capabilities and connected car features, is further enhancing the appeal of electric vehicles. Moreover, there is a growing focus on the lifecycle sustainability of EVs, with increased efforts in recycling and reusing batteries to minimize environmental impact.

The growth in the electric mobility market is driven by several factors. One of the primary drivers is the escalating environmental concerns and the global push for reducing greenhouse gas emissions, prompting regulatory bodies to enforce stricter emission standards. Technological advancements, particularly in battery performance and charging infrastructure, are making electric vehicles more practical and appealing to consumers. Additionally, the declining cost of batteries and the increasing availability of various EV models are making electric mobility more economically viable for a broader audience. Consumer behavior is also shifting, with greater awareness and preference for sustainable and eco-friendly transportation options. Furthermore, significant investments from automotive manufacturers and tech companies in R&D and production facilities are accelerating the market expansion. These factors collectively underscore the dynamic growth and future potential of the electric mobility market.

Report Scope

The report analyzes the Electric Mobility market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Electric Cars, Electric Bikes, Electric Commercial Vehicles).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Electric Cars segment, which is expected to reach US$2.2 Trillion by 2030 with a CAGR of 21.1%. The Electric Bikes segment is also set to grow at 23.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $255.6 Billion in 2024, and China, forecasted to grow at an impressive 20.4% CAGR to reach $452.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric Mobility Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric Mobility Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric Mobility Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accell Group NV, BMW AG, BYD Co. Ltd., Ford Motor Company, General Motors Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 594 companies featured in this Electric Mobility market report include:

- Accell Group NV

- BMW AG

- BYD Co. Ltd.

- Ford Motor Company

- General Motors Company

- Gogoro

- Honda Motor Co., Ltd.

- KTM AG

- Mahindra Electric Mobility Limited

- Nissan Motor Corporation, Ltd.

- Terra Motors Corporation

- Tesla Inc.

- Vmoto Limited

- Volkswagen AG

- Zero Motorcycles Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accell Group NV

- BMW AG

- BYD Co. Ltd.

- Ford Motor Company

- General Motors Company

- Gogoro

- Honda Motor Co., Ltd.

- KTM AG

- Mahindra Electric Mobility Limited

- Nissan Motor Corporation, Ltd.

- Terra Motors Corporation

- Tesla Inc.

- Vmoto Limited

- Volkswagen AG

- Zero Motorcycles Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 681 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

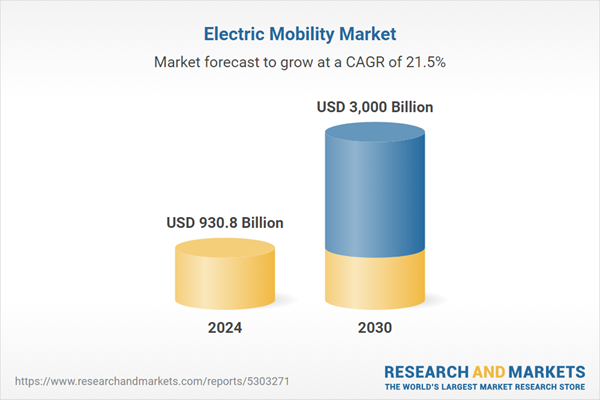

| Estimated Market Value ( USD | $ 930.8 Billion |

| Forecasted Market Value ( USD | $ 3000 Billion |

| Compound Annual Growth Rate | 21.5% |

| Regions Covered | Global |