Global Tile and Stone Adhesives Market - Key Trends and Drivers Summarized

How Are Tile and Stone Adhesives Enhancing Modern Construction?

Tile and stone adhesives are specialized bonding materials designed to ensure a secure and durable attachment of tiles and stones on various surfaces, including floors, walls, and facades. These adhesives offer superior bonding strength, flexibility, and resistance to moisture, heat, and chemicals, making them essential in residential, commercial, and industrial construction projects. Available in different types such as cementitious, epoxy, and polyurethane-based formulations, tile and stone adhesives are tailored to meet specific application requirements, including ceramic tiles, porcelain, marble, and natural stone. As modern construction emphasizes aesthetics, durability, and faster installation times, tile and stone adhesives have become indispensable in achieving long-lasting finishes.What Are the Key Segments in the Tile and Stone Adhesives Market?

Major product types include cementitious adhesives, epoxy adhesives, and polyurethane adhesives. Cementitious adhesives hold a significant share due to their affordability, ease of application, and strong bonding properties, making them suitable for a wide range of tiles and stone surfaces. Epoxy adhesives are preferred for areas requiring high chemical resistance, such as industrial kitchens and chemical laboratories, while polyurethane adhesives are used for flexible bonding in areas prone to vibrations and movement. Applications of tile and stone adhesives cover residential buildings, commercial complexes, and industrial facilities. Residential buildings represent the largest segment, driven by increasing renovation activities and new housing projects globally. In commercial complexes, tile and stone adhesives are used for high-traffic areas like shopping malls, offices, and hospitals, where durability and aesthetic appeal are critical. In industrial settings, these adhesives are applied in workshops, factories, and chemical processing plants to ensure strong, resistant, and long-lasting bonds on various surfaces.How Are Tile and Stone Adhesives Applied Across Construction Projects?

In residential construction, tile and stone adhesives are used extensively for bathroom and kitchen tiles, living room floors, and exterior facades, providing durable bonds that resist moisture and temperature changes. In commercial complexes, these adhesives are applied to flooring, wall claddings, and decorative stone installations, offering a blend of aesthetic appeal and functional durability. In industrial facilities, adhesives are crucial for floor tiles, wall coverings, and machine base structures, where chemical resistance and heavy load-bearing capacities are essential. The use of specialized adhesives also speeds up installation processes, allowing faster project completion and reduced labor costs.What Factors Are Driving the Growth in the Tile and Stone Adhesives Market?

The growth in the Tile and Stone Adhesives market is driven by several factors, including increasing construction activities, rising renovation projects, and growing consumer demand for aesthetic interiors. Innovations like improved bonding technologies, fast-curing adhesives, and eco-friendly formulations have expanded the scope of tile and stone adhesive applications. The focus on enhancing installation speed, improving resistance to wear and tear, and reducing maintenance costs has further fueled demand, as these adhesives provide reliable solutions for diverse construction needs. Additionally, urbanization, increased investment in infrastructure, and evolving architectural trends have contributed to market growth, encouraging broader adoption in both residential and commercial sectors.Report Scope

The report analyzes the Tile and Stone Adhesives market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Chemistry (Cementitious, Epoxy, Other Chemistries); Type of Construction (New Construction, Repairs & Renovation); Application (Residential, Commercial, Institutional).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cementitious Chemistry segment, which is expected to reach US$4.4 Billion by 2030 with a CAGR of a 11.1%. The Epoxy Chemistry segment is also set to grow at 9.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 14.5% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Tile and Stone Adhesives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Tile and Stone Adhesives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Tile and Stone Adhesives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, Akemi, Ardex, Ashland, Bostik and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Tile and Stone Adhesives market report include:

- 3M

- Akemi

- Ardex

- Ashland

- Bostik

- DuPont

- Fosroc

- H.B. Fuller

- Henkel

- Huntsman

- Illinois Tool Works

- Jiangsu NIGAO Science and Technology

- Laticrete International

- Mapei

- Pidilite Industries

- Royal Adhesive

- Saint-Gobain Weber

- Sika

- Terraco

- Uniseal

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- Akemi

- Ardex

- Ashland

- Bostik

- DuPont

- Fosroc

- H.B. Fuller

- Henkel

- Huntsman

- Illinois Tool Works

- Jiangsu NIGAO Science and Technology

- Laticrete International

- Mapei

- Pidilite Industries

- Royal Adhesive

- Saint-Gobain Weber

- Sika

- Terraco

- Uniseal

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 363 |

| Published | February 2026 |

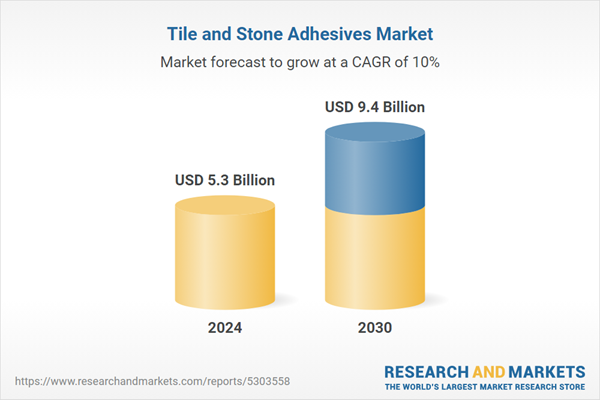

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.3 Billion |

| Forecasted Market Value ( USD | $ 9.4 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |