Global Monolithic Microwave IC (MMIC) Market - Key Trends and Drivers Summarized

How Is Monolithic Microwave IC (MMIC) Revolutionizing Communication Technologies?

Monolithic Microwave Integrated Circuits (MMIC) are semiconductor devices used in high-frequency applications, including radar systems, satellite communications, wireless networks, and aerospace. These integrated circuits are designed to perform functions such as amplification, mixing, and signal processing at microwave frequencies, making them crucial components in modern communication systems. The increasing demand for high-speed, reliable communication networks, particularly with the rollout of 5G technology, is driving the adoption of MMICs across various industries. MMICs are widely used in applications that require compact, high-performance microwave components, including military and defense systems, automotive radar, and telecommunications infrastructure. The advantages of MMICs, such as their small size, high reliability, and ability to operate at high frequencies, make them well-suited for these applications. As the demand for high-frequency communication solutions grows, the MMIC market is expected to expand, with new developments in semiconductor materials and design techniques enhancing the performance of these circuits.What Trends Are Shaping the MMIC Market?

Several trends are shaping the MMIC market, including the rapid expansion of 5G networks, increasing adoption of advanced driver-assistance systems (ADAS), and the growing demand for satellite-based communication services. The deployment of 5G technology requires high-frequency components to support faster data transfer and increased network capacity, leading to higher demand for MMICs in telecommunications. Additionally, the automotive industry is incorporating more radar-based safety features, such as adaptive cruise control and collision avoidance, which rely on MMICs for signal processing. The defense sector continues to be a significant user of MMIC technology, with applications in radar, electronic warfare, and communication systems. As defense budgets increase and militaries modernize their equipment, the demand for high-frequency components, including MMICs, is expected to grow. Technological advancements, such as the development of Gallium Nitride (GaN)-based MMICs, are also driving the market, offering improved power efficiency and performance at higher frequencies.How Do Market Segments Shape the MMIC Industry?

Material types include Gallium Arsenide (GaAs), Silicon Germanium (SiGe), and Gallium Nitride (GaN), with GaN gaining popularity due to its superior performance at high power and frequency levels. Applications for MMICs span telecommunications, automotive, aerospace, defense, and consumer electronics, with telecommunications representing the largest market segment due to the rollout of 5G networks. Frequency ranges for MMICs include low (up to 6 GHz), medium (6-30 GHz), and high (above 30 GHz), with medium and high-frequency ranges seeing significant growth as they cater to advanced communication systems and radar applications. Geographically, North America and Asia-Pacific are the leading markets for MMICs, driven by the presence of major semiconductor manufacturers, advancements in communication technologies, and high defense spending.What Factors Are Driving the Growth in the MMIC Market?

The growth in the MMIC market is driven by several factors, including the expansion of 5G networks, increasing use of radar-based safety systems in automotive, and rising demand for satellite communications. The need for high-frequency components in modern communication systems is boosting the adoption of MMICs. Technological advancements, such as the development of GaN-based MMICs, are enhancing the performance of these circuits, making them more suitable for high-power applications. Additionally, growing defense spending and modernization of military communication systems are further contributing to market growth.Report Scope

The report analyzes the Monolithic Microwave IC (MMIC) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Power Amplifiers, Low Noise Amplifiers, Attenuators, Switches, Phase Shifters, Other Components); Material Type (Gallium Arsenide, Indium Phosphide, Indium Gallium Phosphide, Gallium Nitride, Other Material Types); Application (Consumer / Enterprise Electronics, Wireless Communication Infrastructure, Automotive, Aerospace & Defense, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Power Amplifiers Component segment, which is expected to reach US$9.4 Billion by 2030 with a CAGR of a 9.8%. The Low Noise Amplifiers Component segment is also set to grow at 8.3% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Monolithic Microwave IC (MMIC) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Monolithic Microwave IC (MMIC) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Monolithic Microwave IC (MMIC) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

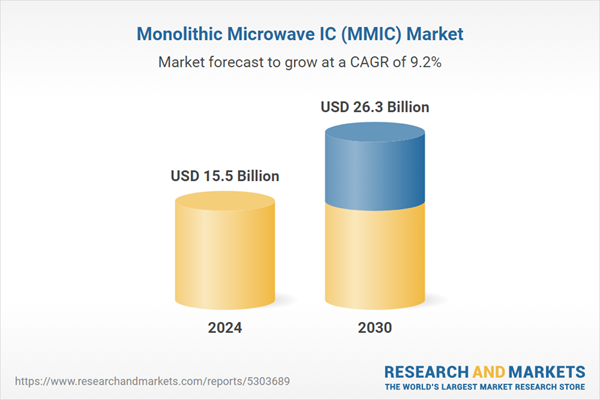

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Analog Devices, Inc., Arralis, Aspen Electronics Ltd., BAE Systems, BeRex and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Monolithic Microwave IC (MMIC) market report include:

- Analog Devices, Inc.

- Arralis

- Aspen Electronics Ltd.

- BAE Systems

- BeRex

- Broadcom

- Custom MMIC

- Infineon Technologies AG

- KYOCERA Corporation

- MACOM

- Maxim Integrated

- MICROREL Electronic Components

- Mini-Circuits

- NXP Semiconductors

- Ommic S.A.

- Qorvo, Inc

- Radiant Group of Companies

- Skyworks Solutions, Inc.

- The SETI League, Inc.

- United Monolithic Semiconductors

- Vectrawave

- WIN Semiconductors

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Analog Devices, Inc.

- Arralis

- Aspen Electronics Ltd.

- BAE Systems

- BeRex

- Broadcom

- Custom MMIC

- Infineon Technologies AG

- KYOCERA Corporation

- MACOM

- Maxim Integrated

- MICROREL Electronic Components

- Mini-Circuits

- NXP Semiconductors

- Ommic S.A.

- Qorvo, Inc

- Radiant Group of Companies

- Skyworks Solutions, Inc.

- The SETI League, Inc.

- United Monolithic Semiconductors

- Vectrawave

- WIN Semiconductors

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 237 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.5 Billion |

| Forecasted Market Value ( USD | $ 26.3 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |