Global Stretch and Shrink Films Market - Key Trends and Drivers Summarized

How Are Stretch and Shrink Films Supporting Packaging Solutions?

Stretch and shrink films are plastic packaging materials designed to secure, protect, and stabilize products during storage and transportation. Stretch films are used to wrap pallets, providing stability and protection against dust, moisture, and tampering, while shrink films are applied to products before heat treatment, conforming tightly to the shape of the items for added protection. These films are used in industries like food and beverage, pharmaceuticals, consumer goods, and logistics, offering versatile and cost-effective packaging solutions. As global supply chains become more complex, the demand for reliable and durable packaging materials like stretch and shrink films has grown, supporting efficient product handling and distribution.What Are the Key Segments in the Stretch and Shrink Films Market?

Key types include stretch films (hand stretch, machine stretch) and shrink films (polyolefin, PVC, and polyethylene shrink films), with machine stretch films holding the largest market share due to their use in automated packaging lines, improving efficiency and reducing labor costs. Materials cover polyethylene, polypropylene, PVC, and polyolefin, with polyethylene representing a significant segment driven by its high strength, flexibility, and cost-effectiveness. Applications span food and beverage packaging, consumer goods, pharmaceuticals, and logistics, with food and beverage packaging leading the market as it ensures product freshness, safety, and compliance with regulatory standards.How Are Stretch and Shrink Films Integrated Across Packaging Sectors?

In the food and beverage industry, shrink films are used to package items like bottles, cans, and perishable goods, providing tamper-evident and moisture-resistant packaging that ensures product safety and shelf-life extension. In logistics and warehousing, stretch films secure pallet loads, preventing product damage during transportation and storage, reducing waste, and maintaining product integrity. In the pharmaceutical sector, shrink films provide unit-dose packaging and tamper-evidence, supporting compliance with stringent safety regulations. Additionally, consumer goods manufacturers use both stretch and shrink films for bundling products, creating multipacks, and ensuring attractive retail packaging that improves shelf appeal and consumer convenience.What Factors Are Driving the Growth in the Stretch and Shrink Films Market?

The growth in the Stretch and Shrink Films market is driven by several factors, including increasing demand for efficient and cost-effective packaging solutions across industries like food and beverage, pharmaceuticals, and logistics. Advancements in film formulations, such as improved puncture resistance, clarity, and stretchability, have enhanced the performance of stretch and shrink films, supporting broader adoption in packaging applications. The focus on reducing product damage, maintaining product safety, and ensuring compliance with packaging standards has further fueled demand, as manufacturers and logistics providers seek reliable and versatile packaging materials. Additionally, growing e-commerce activities, rising global trade, and increased focus on sustainability have contributed to market growth, encouraging the use of recyclable and eco-friendly stretch and shrink films.Report Scope

The report analyzes the Stretch and Shrink Films market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Hoods, Sleeves & Labels, Wraps); Resin Type (LLDPE, LDPE, PVC, Other Resin Types); Application (Food & Beverage, Industrial Packaging, Consumer Goods, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $4.9 Billion in 2024, and China, forecasted to grow at an impressive 9.9% CAGR to reach $6.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Stretch and Shrink Films Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Stretch and Shrink Films Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

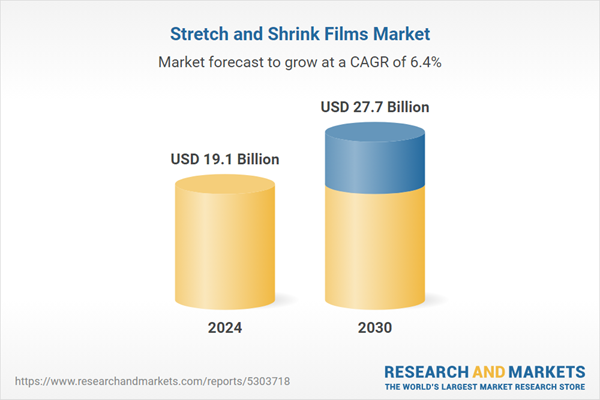

- How is the Global Stretch and Shrink Films Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AEP Industries Inc., Allied Global Plastics Private Limited, Anchor Packaging, Bemis Company Inc., Berry Global Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Stretch and Shrink Films market report include:

- AEP Industries Inc.

- Allied Global Plastics Private Limited

- Anchor Packaging

- Bemis Company Inc.

- Berry Global Inc.

- Bollore Inc.

- Bonset America Corporation

- Coveris Holding Corp.

- E. I. du Pont de Nemours and Co (DuPont)

- ExxonMobil Chemical Company

- FUJI Seal International Inc

- Intertape Polymer Group Inc.

- Sigma Plastics Group

- The Dow Chemical Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AEP Industries Inc.

- Allied Global Plastics Private Limited

- Anchor Packaging

- Bemis Company Inc.

- Berry Global Inc.

- Bollore Inc.

- Bonset America Corporation

- Coveris Holding Corp.

- E. I. du Pont de Nemours and Co (DuPont)

- ExxonMobil Chemical Company

- FUJI Seal International Inc

- Intertape Polymer Group Inc.

- Sigma Plastics Group

- The Dow Chemical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 382 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.1 Billion |

| Forecasted Market Value ( USD | $ 27.7 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |