Global Optical Films Market - Key Trends & Drivers Summarized

What Has Propelled the Rapid Expansion of Optical Films in Display Technologies?

Optical films have become essential components in modern display technologies, driving enhanced image quality, energy efficiency, and durability in consumer electronics such as smartphones, tablets, laptops, and televisions. With the rapid evolution of display technology, the demand for high-performance screens with vivid color reproduction, high contrast, and optimal brightness has surged, and optical films play a crucial role in meeting these requirements. The primary function of optical films in displays is to manipulate light, which improves clarity and reduces glare in various lighting conditions. Films like polarizers, reflective films, and anti-reflective films work together to enhance the visual experience, making displays clearer and more readable. As consumer electronics have become indispensable in daily life, manufacturers of optical films have innovated continuously to keep up with the high expectations for screen quality, ensuring sharper images, true-to-life colors, and improved viewing angles in all lighting environments.The demand for larger, high-resolution screens has further boosted the market for optical films. With the rise of 4K and 8K displays in televisions and monitors, the role of optical films in enhancing resolution, contrast, and light transmission has expanded significantly. These advanced screens require specialized films to maintain clarity and brightness across wider dimensions without compromising color fidelity. Additionally, foldable displays in devices like smartphones have created new requirements for flexible optical films that can bend without losing optical properties. This has led to innovations in flexible and durable film materials, ensuring that even foldable and curved displays provide consistent image quality. As screen technology advances, optical films continue to be indispensable in delivering the enhanced visual experience that consumers expect from modern devices.

The increased adoption of OLED and micro-LED technologies has also intensified the demand for optical films that can optimize the performance of these cutting-edge displays. OLED screens, known for their vibrant colors and deep blacks, rely on optical films to manage light distribution and reduce reflections, thus enhancing brightness and contrast. Similarly, micro-LED displays, which offer even higher brightness levels and energy efficiency, use specialized optical films to maintain color uniformity and prevent glare. Both OLED and micro-LED technologies are gaining popularity in premium devices, driving the optical films market as manufacturers invest in solutions that complement the unique requirements of these advanced screens. As a result, optical films have solidified their role as foundational elements in the next generation of display technology, catering to both high-definition and energy-efficient display demands.

How Are Optical Films Transforming the Solar Energy Sector?

Optical films are increasingly recognized for their transformative role in the solar energy sector, where they are used to enhance the efficiency and durability of solar panels. As the global shift towards renewable energy accelerates, solar panel manufacturers are continually seeking ways to improve energy capture and durability, making optical films an invaluable component. Anti-reflective films, for instance, are applied to the surface of solar panels to reduce light reflection, allowing more sunlight to be absorbed. This simple enhancement can significantly increase the energy efficiency of panels by ensuring that a maximum amount of sunlight is converted into usable energy. Reflective and light-diffusing films are also used within solar modules to redirect sunlight toward active photovoltaic cells, maximizing the amount of energy harvested even under diffuse lighting conditions. By using optical films, solar panel efficiency can be optimized, which is crucial for meeting global renewable energy targets.Beyond energy efficiency, optical films contribute to the longevity of solar panels by protecting them from environmental elements. UV-blocking films are frequently used in solar modules to prevent degradation caused by prolonged exposure to sunlight, which can reduce the lifespan of panels over time. Optical films with anti-soiling properties are also being developed to keep solar panels cleaner for longer, minimizing dust accumulation that can obstruct sunlight and reduce efficiency. In regions with harsh environmental conditions, such as deserts or coastal areas, these protective films are essential in preserving the functionality of solar installations. By enhancing durability, optical films help reduce maintenance costs and ensure that solar panels continue to perform optimally over extended periods, making them a vital asset in the solar energy sector.

As the adoption of solar energy expands worldwide, the demand for optical films in this industry is expected to grow substantially. With new government incentives and an increasing number of companies committing to sustainable energy practices, the solar market is set to become one of the largest consumers of advanced optical films. Innovations in film materials, such as nanostructured coatings, are opening up new possibilities for even more efficient and resilient solar panels. These advancements underscore the critical role that optical films play in achieving a sustainable energy future, enabling solar panels to operate at peak efficiency and meet the rising global demand for renewable energy sources.

What Role Do Optical Films Play in the Automotive and Architectural Sectors?

In the automotive and architectural sectors, optical films are increasingly valued for their ability to control light, enhance aesthetics, and improve energy efficiency. In automotive applications, optical films are used in both interior and exterior applications, from dashboard displays and infotainment screens to head-up displays that project critical information onto the windshield. These films improve readability and reduce glare, creating a safer and more comfortable driving experience by ensuring that digital displays remain clear in various lighting conditions. Additionally, optical films are used in automotive windows to reduce glare and heat, providing UV protection and keeping interiors cooler. With the rise of electric vehicles (EVs) and autonomous driving technologies, automotive manufacturers are investing in high-performance optical films to optimize in-car displays and enhance driver comfort, supporting the increasing demand for advanced vehicle interiors that combine technology with user-friendly interfaces.In the architectural sector, optical films are primarily used in windows and glass facades to manage light transmission, improve insulation, and enhance energy efficiency in buildings. By applying solar control films to windows, architects can reduce heat gain within a building, thereby lowering the need for air conditioning and contributing to significant energy savings. Reflective and tinted films also offer privacy and reduce glare, enhancing occupant comfort without obstructing natural light. Moreover, advancements in smart window technologies have incorporated optical films that adjust their tint in response to changing light conditions, optimizing both energy efficiency and user comfort. These intelligent films allow for dynamic light control in residential, commercial, and industrial buildings, further solidifying the role of optical films in energy-efficient building design.

As both the automotive and architectural sectors prioritize sustainability, the use of optical films to reduce energy consumption and enhance the longevity of materials is becoming a standard practice. In automotive manufacturing, the transition to electric and hybrid vehicles has sparked a demand for lightweight, energy-saving materials, and optical films are helping achieve these goals by reducing heat buildup and improving the efficiency of in-car displays. Similarly, the green building movement has spurred growth in architectural applications for optical films, as sustainable building certifications increasingly recognize the benefits of solar control and energy-efficient window films. As regulations on energy efficiency become more stringent worldwide, the adoption of optical films in these sectors is expected to increase, driven by their proven ability to contribute to sustainability objectives while enhancing user comfort and design flexibility.

What Is Fueling the Growth in the Optical Films Market?

The growth in the optical films market is driven by several factors, including rising demand for high-performance displays, advancements in renewable energy applications, and increasing adoption in automotive and architectural design. The consumer electronics industry, particularly for devices like smartphones, laptops, and televisions, remains a major driver for optical films, as manufacturers prioritize high-resolution screens with enhanced visual quality. Innovations in display technology, such as OLED and micro-LED, have created a need for advanced optical films that optimize light transmission, contrast, and color accuracy. Additionally, the trend toward larger and foldable screens has boosted demand for optical films that are flexible, durable, and capable of maintaining optical properties under various conditions. As consumer demand for high-definition and energy-efficient displays grows, the optical films market continues to expand, driven by manufacturers' efforts to deliver the latest in display technology.The adoption of renewable energy solutions, especially solar power, is another significant growth driver for optical films. Solar energy installations are rapidly increasing worldwide, fueled by government incentives, corporate sustainability goals, and technological advancements that have made solar panels more efficient and affordable. Optical films play a crucial role in enhancing the performance of solar panels by reducing reflection, protecting against UV degradation, and improving durability in harsh environments. The global push for cleaner energy sources has led to increased investment in solar power infrastructure, consequently boosting demand for optical films tailored for solar applications. As renewable energy becomes more integral to global energy strategies, the role of optical films in this sector is expected to grow significantly, creating opportunities for new film materials and technologies that enhance the efficiency and lifespan of solar panels.

Lastly, the expansion of smart and sustainable design initiatives in automotive and architectural sectors is driving demand for optical films that improve energy efficiency and comfort. In automotive design, optical films are increasingly used in displays, windows, and infotainment systems, particularly as EVs and autonomous vehicles require advanced display technology and user-friendly interfaces. Similarly, in architecture, the trend toward green building and energy-efficient designs has led to greater adoption of solar control and insulating films in windows and glass facades. These films reduce energy costs and support sustainable building certifications, aligning with the growing emphasis on environmental responsibility in construction. With regulations favoring energy-efficient designs and rising consumer demand for sustainable solutions, optical films have established themselves as indispensable in the automotive and architectural industries, reinforcing the growth trajectory of the optical films market.

Report Scope

The report analyzes the Optical Films market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Polarizing Film, Backlight Unit Film, Other Films); Application (Smartphones & Tablets Application, Desktop Monitors & Laptops Application, Signage / Large Format Display Application, Television Application, Automotive Display Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polarizing Film segment, which is expected to reach US$24 Billion by 2030 with a CAGR of 9.1%. The Backlight Unit Film segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.7 Billion in 2024, and China, forecasted to grow at an impressive 10% CAGR to reach $9.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Optical Films Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Optical Films Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Optical Films Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, 3M India Ltd., AGC, Inc., ALPHA Optical Co., Ltd., Alpine Research Optics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 72 companies featured in this Optical Films market report include:

- 3M Company

- 3M India Ltd.

- AGC, Inc.

- ALPHA Optical Co., Ltd.

- Alpine Research Optics

- American Polarizers, Inc.

- Angstrom Engineering, Inc.

- Ares Materials

- BenQ Materials Corporation

- Boyd Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- 3M India Ltd.

- AGC, Inc.

- ALPHA Optical Co., Ltd.

- Alpine Research Optics

- American Polarizers, Inc.

- Angstrom Engineering, Inc.

- Ares Materials

- BenQ Materials Corporation

- Boyd Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

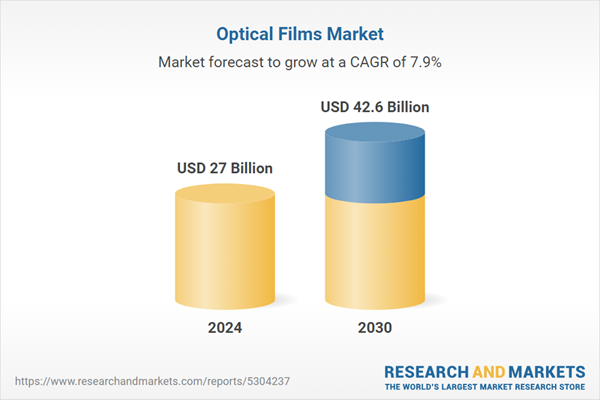

| Estimated Market Value ( USD | $ 27 Billion |

| Forecasted Market Value ( USD | $ 42.6 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |