The impact of COVID-19 on the pharmaceutical analytical market was significant owing to the increase in demand for developing new drug candidates and vaccines to control the spread of the coronavirus disease. Since, analytical testing is required at all phases of drug development to monitor accuracy, efficiency, and safety. Due to the uncontrolled and sudden increase in covid-19 cases, the development of biosimilars, combination molecules, and other innovative vaccines and medicines has grown, which has resulted in an increased demand for significant bioanalytical testing such as electrophoresis, electrochemical and titrimetric assays, and immunoassays.

In addition, the increasing number of clinical trials, focus on analytical testing of biologics and biosimilars and increased trend of outsourcing laboratory testing services are actively affecting the growth of the studied market.

According to the FDA drug recall statistics, approximately 1,279 drugs are recalled every year globally, and 94% of FDA drug recalls have been in the United States, followed by 4% of FDA drug recalls in Canada in 2021. From 2012 to 2021, the FDA issued 12,028 drug recalls in the United States. This emerges the need to test the products and ensure public safety before they are marketed. Medicines are intended for a better outcome in humans and animals as the poor quality of medicines would affect the health of the patients and the funding systems. Therefore, analytical testing holds an important role in ensuring the safety and efficacy of the drugs.

An increase in R&D activities, collaborations, and strategic partnerships is expected to drive market growth. For instance, in November 2021, Alcami Corporation, Inc. signed a master laboratory services agreement with Novavax. With this agreement, Novavax secured full-time equivalent (FTE) resources to provide analytical testing support for its recombinant nanoparticle protein-based COVID-19 vaccine candidate with Matrix-M adjuvant. Such developments are estimated to propel market growth.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period. However, the complex regulatory framework for maintaining laboratories and challenges in the development of proper analytical techniques are likely to impede market growth.

Pharmaceutical Analytical Testing Market Trends

Stability Testing Segment is Expected to Exhibit a Significant Market Growth Over the Forecast Period

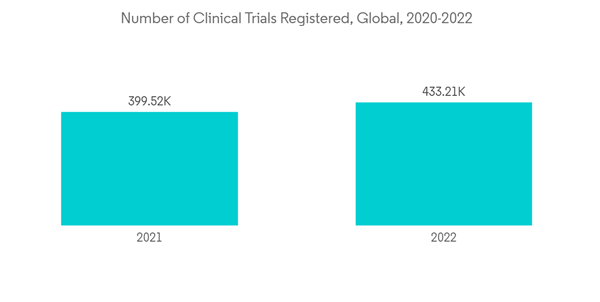

Stability testing is done to evaluate the capability of the drug to retain its properties throughout its shelf-life. The stability studies of pharmaceutical products or drugs are one of the most important parameters for the development of new drugs and new formulations. The stability testing is done based on five parameters: chemical, physical, microbiological, therapeutic, and toxicity. The degradation with respect to any of these parameters can lead to health hazards.The prediction of shelf-life is vital for the pharmaceutical product development of all the dosage forms. It is also utilized to determine the storage conditions and suggest label instructions. The stability testing of pharmaceutical products ensures the maintenance of product quality, safety, and efficacy throughout the shelf life which are considered a prerequisite for the acceptance and approval of any pharmaceutical products. And these studies are required to follow the guidelines of the world health Organization. According to Clinicaltrial.gov 2022 update, 433,207 studies have been registered till the current year, out of which 53% are registered outside the United States and 31% are registered in the United States. Hence, these factors are expected to drive the segment growth.

The strategic initiatives taken by the key players such as product launches, approvals, partnerships is also fueling the segment growth. For instance, in July 2021, LGM Pharma launched its analytical testing and stability services to pharmaceutical developers and manufacturers, including compounding pharmacies. Such developments are estimated to boost the segment growth during the forecast period.

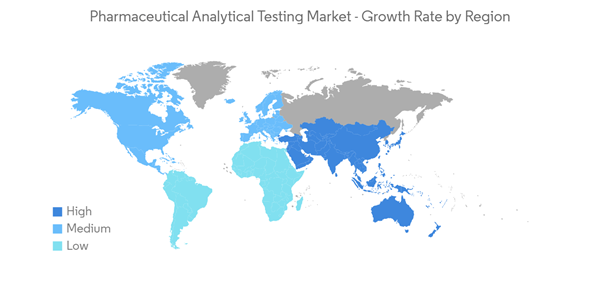

North America Holds a Significant Share in the Market and Expected to do Same During The Forecast Period

North America is expected to be a dominant region in the Pharmaceutical Analytical Testing market owing to the increasing number of R&D activities and investments.Approximately 53 novel drugs were approved in 2020 and 50 were approved in 2021 as per the data provided by the Center for Drug Evaluation and Research (CDER), Food and Drug Administration (FDA). Among the total drugs approved worldwide in 2020 and 2021, most of them were approved in the United States before any other country in the world as per FDA. Also, as per clinical trials, 136,276 clinical trials has been registered in the United States up to the current year which contributes 31% of the total registered clinical trials. The high frequency of drug approvals in the region is estimated to boost the market growth in the region during the forecast period.

Furthermore, according to NIH, the President's Budget includes USD 12.1 billion for the FY2023 in mandatory resources to support pandemic preparedness, including research and development of vaccines, diagnostics, and therapeutics against high priority viral families, biosafety and biosecurity, as well as to increase laboratory capacity and clinical trial infrastructure in the United States. These increasing number of clinical trials, number of drug approvals, and major companies' involvement in increased R&D expenditures are expected to boost the demand for pharmaceutical analytical testing market growth in the North American region.

Additionally, the strategic initiatives taken by the key players such as product launches, approvals, partnerships is also fueling the segment growth. For instance, in December 2021, Pace Analytical Services, a division of Pace Science and Technology Company, acquired Special Pathogens Laboratory to strengthen its capabilities in the industry. Such developments are estimated to propel market growth in the region.

Pharmaceutical Analytical Testing Industry Overview

The pharmaceutical analytical testing market is fragmented in nature due to the presence of a number of companies globally. The studied market consists of several international and local companies that hold the majority of the market shares and are well known, including Laboratory Testing Inc., Eurofins Scientific, SGS SA, Toxikon Inc., Pace Analytical Services. Intertek Pharmaceutical Services, Boston Analytical, West Pharmaceutical Services Inc., and Steris.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Laboratory Testing Inc.

- Eurofins Scientific

- SGS SA

- Labcorp (Toxikon Inc)

- Pace Analytical Services

- Intertek Phamaceutical Services

- Boston Analytical

- West Pharmaceutical Services Inc.

- Steris

Methodology

LOADING...