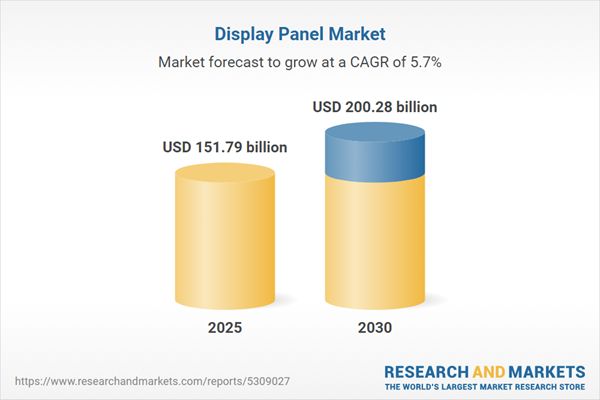

The Display Panel Market is a critical driver of the global electronics industry, powering visual interfaces for televisions, smartphones, digital signage, and automotive applications. Fueled by demand for high-resolution displays, advancements in LED and OLED technologies, and smart device proliferation, the market is experiencing robust growth. Asia-Pacific leads with its manufacturing dominance, followed by North America and Europe. Despite challenges like high production costs and supply chain vulnerabilities, innovations in 4K, OLED, and MicroLED technologies position the market for significant expansion through 2030.

Market Overview

Display panels, encompassing LCD, LED (including OLED and MicroLED), and niche technologies like Quantum Dot and E-Ink, deliver vibrant, energy-efficient visuals for applications such as televisions, smartphones, automotive dashboards, and digital signage. The market is driven by 1.5 billion smartphone shipments and 150 million 4K TV units in 2024 (International Data Corporation, 2024; Consumer Technology Association, 2024). Growth is supported by the rise of digital signage, with $20 billion in global spending, and automotive displays in 80% of new U.S. vehicles (International Sign Association, 2024; U.S. Department of Transportation, 2024). Leading firms like Samsung Display, LG Display, and BOE Technology advance the market with flexible and high-resolution solutions.Growth Drivers

Key factors propelling the market include:High-Resolution Demand: Consumer preference for immersive visuals drives 4K and 8K adoption, with 150 million 4K TVs shipped in 2024 (Consumer Technology Association, 2024).

Technological Advancements: OLED and MicroLED innovations enhance color accuracy and flexibility. Samsung’s 77-inch QD-OLED panel, launched in September 2023, offers 30% brighter output (Samsung Press Release, September 2023).

Smart Device Proliferation: The 1.5 billion smartphones shipped globally in 2024 fuel demand for compact, high-quality displays (International Data Corporation, 2024).

Digital Signage and Automotive Growth: Retail and transportation sectors boost demand, with digital signage spending at $20 billion and automotive displays in 70% of European vehicles in 2024 (International Sign Association, 2024; European Commission, 2024).

Market Restraints

Challenges include:High Manufacturing Costs: OLED and MicroLED production requires significant investment, limiting smaller manufacturers.

Supply Chain Vulnerabilities: Semiconductor shortages impacted 20% of panel output in 2024 (U.S. Department of Commerce, 2024).

Environmental Concerns: Energy-intensive production and e-waste raise sustainability issues under EU regulations (European Commission, 2023).

Geographical Analysis

Asia-Pacific: The region dominates, with China producing 60% of global panels and shipping 90 million TV units in 2024 (China National Bureau of Statistics, 2024; Consumer Electronics Association of China, 2024). India’s 200 million smartphone sales and Samsung’s Noida plant expansion in 2024 drive growth (Ministry of Electronics and Information Technology, 2024; Samsung India Press Release, March 2024). Japan’s Sony launched an 8K MicroLED TV in 2023 (Sony Press Release, October 2023).North America: The U.S. leads with 50 million 4K TVs sold and 80% of new vehicles featuring displays in 2024 (Consumer Technology Association, 2024; U.S. Department of Transportation, 2024). Canada’s $500 million digital signage investment and Mexico’s $100 billion electronics exports bolster demand (Canadian Digital Signage Association, 2024; Mexican Ministry of Economy, 2024).

Europe: Germany’s €3 billion investment in display-equipped vehicles and France’s 10 million 4K TV sales drive growth (German Federal Ministry for Economic Affairs, 2024; French Ministry of Culture, 2024). The EU’s Green Deal promotes energy-efficient panels (European Commission, 2023).

Segment Analysis

LED Technology: OLED and MicroLED dominate premium applications, with 70% of premium smartphones using OLED in 2024 (International Data Corporation, 2024). Samsung’s QD-OLED launch in 2023 enhanced TV brightness by 30% (Samsung Press Release, September 2023).4K Resolution: The largest segment, with 150 million 4K TVs shipped in 2024, supported by LG Display’s 20% production capacity increase (LG Display Press Release, February 2024; Consumer Technology Association, 2024).

Television Applications: Driven by 250 million global TV sales, with 60% featuring 4K or OLED panels, TCL’s 2024 QLED lineup improved color gamut by 30% (Consumer Electronics Association, 2024; TCL Press Release, January 2024).

Key Developments

Samsung QD-OLED: Launched in September 2023, with 30% brighter output (Samsung Press Release, September 2023).LG Display 4K Expansion: Increased OLED capacity by 20% in February 2024 (LG Display Press Release, February 2024).

TCL QLED Lineup: Introduced in January 2024, enhancing color gamut by 30% (TCL Press Release, January 2024).

Sony MicroLED TV: Launched in October 2023 for professional markets (Sony Press Release, October 2023).

Samsung India Expansion: Boosted Noida plant output in March 2024 (Samsung India Press Release, March 2024).

China TV Shipments: 90 million panels in 2024 (Consumer Electronics Association of China, 2024).

The Display Panel Market is thriving, driven by high-resolution demand, smart device growth, and advancements in OLED and 4K technologies. Asia-Pacific leads, with North America and Europe following. Industry experts should focus on innovation, supply chain resilience, and regional trends to capitalize on opportunities through 2030.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Global Display Panel Market Segmentation:

By Technology

- LCD

- LED

- Others

By Resolution

- HD

- Full-HD

- Ultra HD

By Application

- Smartphones & Tablets

- PCs & Laptops

- Television & Digital Signage

- AR/VR Devices

- Automotive Displays

- Others

By End-User

- Consumer Electronics

- Medical & Healthcare

- Automotive

- Media & Entertainment

- Military & Defense

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Japan Display Inc.

- SAMSUNG Electronics Co. Ltd

- Panasonic Corporation

- LG Electronics Inc.

- Sharp Corporation

- AU Optronics Corporation

- BOE Technology Group Co., Ltd

- Innolux Corporation

- Tianma Microelectronics

- HannStar Display Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 151.79 billion |

| Forecasted Market Value ( USD | $ 200.28 billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |