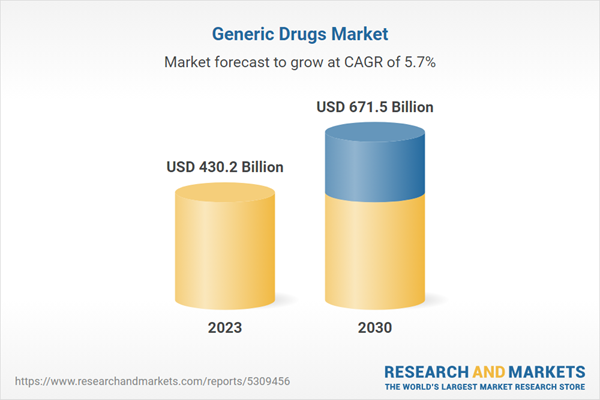

Global Generic Drugs Market to Reach $671.5 Billion by 2030

The global market for Generic Drugs estimated at US$430.2 Billion in the year 2023, is projected to reach a revised size of US$671.5 Billion by 2030, growing at a CAGR of 5.7% over the analysis period 2023-2030.Small-Molecule Generics, one of the segments analyzed in the report, is projected to record 4.2% CAGR and reach US$538.8 Billion by the end of the analysis period. Growth in the Biosimilars segment is estimated at 15.3% CAGR for the next 8-year period.

The U.S. Market is Estimated at $130.2 Billion, While China is Forecast to Grow at 7.1% CAGR

The Generic Drugs market in the U.S. is estimated at US$130.2 Billion in the year 2023. China, the world's second largest economy, is forecast to reach a projected market size of US$126.8 Billion by the year 2030 trailing a CAGR of 7.1% over the analysis period 2023 to 2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 4.2% and 5% respectively over the 2023-2030 period. Within Europe, Germany is forecast to grow at approximately 4.9% CAGR.Exciting New Report Features

- Full access to influencer engagement stats

- Free access to digital archives & research platform. The proprietary platform is fully enabled to unlock creativity and market knowledge of domain experts worldwide in a cohesive and collaborative manner. The state-of-art tools bring world class market perspectives while protecting participants` privacy and identity. Numbers, statistics and market narrative in the report are based on fully curated insights shared by domain experts and influencers in this space.

- Opportunity to engage with interactive questionnaires that come with real-time data simulator tools & bespoke report generation capabilities

- Full client access to peer collaborative and interactive platform for cross-enterprise smart exchange of ideas

- Complimentary report updates for one year

- Competitor coverage with global market shares of major players

- Player market presence analysis (Strong/Active/Niche/Trivial) across multiple geographies

- Access to curated YouTube video transcripts of domain experts/influencer interviews, podcasts, press statements and event keynotes

What to Expect from the Global Economy in 2024

Edgy geopolitics, and economic instability caused by monetary policy tightening and ensuing higher interest rates will create a tumultuous landscape for 2024. Several factors will continue to exert pressure on the path to recovery including hostilities in the Middle East and increasingly common climate disasters. Among the risks, several positives are also taking shape such as growing signs of disinflation and easing of anxiety over stubborn inflation, supply chain normalization and price moderation despite volatility in energy costs. Elections across several G21 jurisdictions, notably in India and the United States, will have potential ramifications for capital flows and investment strategies. While India emerges as a compelling destination in the global investment landscape, U.S, based tech firms will continue to dominate, fueled by a dynamic ecosystem of talent and capital. Tech opportunities in Silicon Valley and beyond remain attractive for investors seeking high-growth prospects supported largely by a resilient albeit slowing domestic economy and conducive regulatory environment. Europe will continue to battle tight monetary policy and recession risks with U.K. having the most challenging outlook and running the greatest risk of recession in 2024. China remains a wild card with hope for growth in the country underpinned by government spending and improvements in consumer spending. The volatile environment will offer both opportunities and challenges for investors and businesses alike. Embracing volatility as a catalyst for growth together with agility and strategic foresight in navigating investment decisions will remain important for survival.Select Competitors (Total 255 Featured)

- Abbott Laboratories

- Apotex Inc.

- ASKA Pharmaceutical Co., Ltd.

- Aspen Pharmacare Holdings Limited

- AstraZeneca Plc

- Baxter International Inc.

- Dr. Reddy’s Laboratories Limited`

- Eli Lilly and Company

- Endo International plc

- F. Hoffmann-La Roche AG

- Fresenius Kabi AG

- GSK plc

- H. Lundbeck A/S

- Incepta Pharmaceuticals Ltd.

- Lupin Ltd.

- Novo Nordisk A/S

- Sandoz International GmbH

- Sanofi-Aventis U.S. LLC

- STADA Arzneimittel AG

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Table of Contents

I. METHODOLOGYII. EXECUTIVE SUMMARY2. FOCUS ON SELECT PLAYERSIII. MARKET ANALYSISITALYSPAINRUSSIAREST OF EUROPESOUTH KOREAREST OF ASIA-PACIFICARGENTINABRAZILMEXICOREST OF LATIN AMERICAIRANISRAELSAUDI ARABIAUNITED ARAB EMIRATESREST OF MIDDLE EASTIV. COMPETITION

1. MARKET OVERVIEW

3. MARKET TRENDS & DRIVERS

4. GLOBAL MARKET PERSPECTIVE

UNITED STATES

CANADA

JAPAN

CHINA

EUROPE

FRANCE

GERMANY

UNITED KINGDOM

ASIA-PACIFIC

AUSTRALIA

INDIA

LATIN AMERICA

MIDDLE EAST

AFRICA

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Apotex Inc.

- ASKA Pharmaceutical Co., Ltd.

- Aspen Pharmacare Holdings Limited

- AstraZeneca Plc

- Baxter International Inc.

- Dr. Reddy’s Laboratories Limited`

- Eli Lilly and Company

- Endo International plc

- F. Hoffmann-La Roche AG

- Fresenius Kabi AG

- GSK plc

- H. Lundbeck A/S

- Incepta Pharmaceuticals Ltd.

- Lupin Ltd.

- Novo Nordisk A/S

- Sandoz International GmbH

- Sanofi-Aventis U.S. LLC

- STADA Arzneimittel AG

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 711 |

| Published | April 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 430.2 Billion |

| Forecasted Market Value ( USD | $ 671.5 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |