Global Immuno-Oncology Market - Key Trends & Drivers Summarized

Why is Immuno-Oncology Revolutionizing Cancer Treatment and Gaining Unprecedented Momentum?

Immuno-oncology (IO) is revolutionizing the field of cancer treatment by leveraging the body's own immune system to detect, target, and eliminate cancer cells. Unlike traditional therapies such as chemotherapy and radiation, which target both cancerous and healthy cells and often lead to significant side effects, immuno-oncology treatments offer a more precise and less toxic approach by selectively enhancing the immune system's ability to fight cancer. This emerging therapeutic modality includes a variety of treatments, such as immune checkpoint inhibitors, CAR-T cell therapies, cancer vaccines, and monoclonal antibodies, each designed to engage the immune system in different ways to recognize and attack tumors. The growing adoption of these therapies is being driven by their ability to achieve long-lasting responses, even in cases of advanced or metastatic cancers where traditional therapies have failed. As a result, immuno-oncology is gaining traction as a first-line and combination therapy across a range of cancer types, including melanoma, lung cancer, breast cancer, and hematological malignancies.The rapid growth of the immuno-oncology market is further fueled by the increasing number of clinical trials, investments in research and development, and regulatory approvals of new IO therapies. Breakthroughs such as the approval of immune checkpoint inhibitors like pembrolizumab (Keytruda) and nivolumab (Opdivo), which target PD-1 and PD-L1 pathways, have set new benchmarks in cancer therapy, demonstrating impressive survival benefits and transforming the treatment landscape for several cancer indications. The success of these therapies has led to a surge in R&D activities focused on exploring new immune targets, combination strategies, and personalized immunotherapies tailored to individual patient profiles. As pharmaceutical companies, research institutions, and biotech firms continue to invest heavily in immuno-oncology research, the market is poised for rapid expansion and further breakthroughs in cancer treatment. The increasing acceptance of IO therapies by oncologists and their integration into standard treatment protocols are solidifying immuno-oncology's role as a cornerstone of modern cancer therapy, driving its market growth and adoption on a global scale.

What Technological Innovations and Clinical Advancements Are Driving the Immuno-Oncology Market?

Technological innovations and clinical advancements are playing a pivotal role in propelling the immuno-oncology market forward, enabling the development of novel therapies and improving patient outcomes. One of the most transformative advancements is the rise of immune checkpoint inhibitors, which work by blocking inhibitory pathways that cancer cells use to evade immune detection. The success of PD-1 and CTLA-4 inhibitors has led to extensive research into other immune checkpoint pathways, such as LAG-3, TIM-3, and TIGIT, with multiple therapies targeting these checkpoints currently in clinical trials. These next-generation checkpoint inhibitors are being explored both as monotherapies and in combination with existing treatments to enhance their efficacy and overcome resistance mechanisms. Combination therapies, such as pairing checkpoint inhibitors with chemotherapy, radiation, or other immunotherapies, are showing promise in expanding the therapeutic benefits of IO treatments to a broader patient population and addressing tumors that are less responsive to single-agent therapies.Another groundbreaking innovation is the development of CAR-T (chimeric antigen receptor T-cell) therapies, which involve genetically engineering a patient's own T-cells to express receptors that specifically target cancer cells. CAR-T therapies have shown remarkable efficacy in treating hematological malignancies such as acute lymphoblastic leukemia (ALL) and non-Hodgkin's lymphoma, offering remission rates that were previously unattainable with conventional therapies. The success of CAR-T therapies is spurring research into CAR-NK (natural killer) and TCR-T (T-cell receptor) therapies, as well as efforts to expand CAR-T applications to solid tumors, which have traditionally been more challenging to treat. Additionally, advancements in biomarker research and diagnostic technologies are enabling more precise patient selection and monitoring of treatment responses. Biomarkers such as tumor mutational burden (TMB) and microsatellite instability (MSI) are helping identify patients who are more likely to respond to specific IO therapies, paving the way for personalized treatment approaches that maximize efficacy and minimize adverse effects.

Further innovations in drug delivery systems, such as nanoparticle-based delivery, are enhancing the bioavailability and targeting capabilities of IO therapies, improving their safety profiles and therapeutic outcomes. The integration of artificial intelligence (AI) and machine learning in drug discovery is accelerating the identification of new immune targets and optimizing clinical trial designs. AI-driven analysis of large-scale genomic, proteomic, and clinical data is uncovering novel insights into the mechanisms of immune evasion and resistance, guiding the development of next-generation immunotherapies. These technological and clinical advancements are not only expanding the range of therapeutic options available to cancer patients but are also driving the rapid growth and evolution of the immuno-oncology market.

How Are Market Dynamics and Regulatory Policies Shaping the Immuno-Oncology Market?

The immuno-oncology market is shaped by a complex interplay of market dynamics, regulatory policies, and competitive strategies that are influencing product development, commercialization, and patient access to innovative therapies. One of the primary market drivers is the increasing prevalence of cancer worldwide, which is fueling the demand for more effective and targeted treatments. According to the World Health Organization (WHO), the global cancer burden is expected to rise significantly in the coming decades, with an estimated 28.4 million new cases by 2040. This growing patient population, coupled with the limitations of conventional therapies, is driving the shift towards immuno-oncology as a promising solution for improving cancer outcomes. In response, pharmaceutical companies and biotech firms are investing heavily in immuno-oncology research, leading to a surge in the number of clinical trials and pipeline candidates. The competitive landscape is characterized by intense R&D activity and strategic collaborations aimed at accelerating the development of novel IO therapies and combination regimens.Regulatory policies and approvals are also playing a critical role in shaping the immuno-oncology market. Regulatory agencies such as the FDA and EMA have implemented expedited approval pathways, such as Breakthrough Therapy Designation, Fast Track, and Priority Review, to facilitate the development and commercialization of promising immunotherapies. These pathways are enabling faster access to innovative treatments for patients with unmet medical needs, particularly in cases of aggressive or advanced cancers. The regulatory landscape is also evolving to accommodate the unique challenges posed by immuno-oncology, such as managing immune-related adverse events (irAEs) and establishing standardized endpoints for clinical trials. Recent regulatory approvals of landmark IO therapies, such as CAR-T cell therapies and bispecific antibodies, have set new precedents and are encouraging further innovation in the field. However, the high cost of IO therapies remains a significant barrier to widespread adoption, prompting regulators, payers, and manufacturers to explore value-based pricing models and reimbursement strategies to ensure patient access while balancing healthcare costs.

Market dynamics such as strategic alliances, mergers and acquisitions, and the rise of biosimilars are also influencing the immuno-oncology market. Strategic collaborations between pharmaceutical giants and biotech firms are enabling the sharing of expertise and resources, accelerating the development of novel immunotherapies. Mergers and acquisitions are consolidating the market and strengthening the pipelines of leading players. For example, recent acquisitions of biotech companies specializing in immune-oncology by larger pharmaceutical firms are expanding the acquirers' portfolios and enhancing their position in the competitive landscape. The emergence of biosimilars and follow-on biologics for established IO therapies, such as monoclonal antibodies, is introducing competition and potentially reducing treatment costs, making these therapies more accessible. As these market dynamics and regulatory policies continue to evolve, they are shaping the trajectory of the immuno-oncology market, influencing innovation, competition, and patient access on a global scale.

What Are the Key Growth Drivers Fueling the Expansion of the Immuno-Oncology Market?

The growth in the global immuno-oncology market is driven by several key factors, including the increasing prevalence of cancer, advancements in immunotherapy research, and the adoption of combination therapies. One of the primary growth drivers is the rising incidence of cancer worldwide, which is creating a significant need for more effective and targeted treatments. Immuno-oncology therapies offer a promising alternative to traditional cancer treatments, with the potential to provide durable responses and even long-term remission in some cases. As awareness of the benefits of immuno-oncology increases among healthcare providers and patients, the demand for these therapies is expected to rise, supporting market expansion. The growing focus on early cancer detection and personalized medicine is also contributing to the adoption of IO therapies, as these approaches enable more tailored and effective treatment strategies.Another significant growth driver is the rapid pace of research and development in immuno-oncology, leading to the discovery of new immune targets and the development of innovative therapies. The success of checkpoint inhibitors, CAR-T therapies, and cancer vaccines has spurred a wave of investment and clinical activity in the field, with hundreds of IO candidates currently in various stages of development. The introduction of novel therapeutic modalities, such as bispecific antibodies and oncolytic viruses, is expanding the range of options available to oncologists and offering new hope for patients with difficult-to-treat cancers. Moreover, the exploration of combination therapies - where immunotherapies are paired with other treatment modalities such as chemotherapy, radiation, or targeted therapies - is enhancing the effectiveness of IO treatments and broadening their applicability across multiple cancer types.

The increasing acceptance of immuno-oncology therapies by healthcare systems and payers is also supporting market growth. As more IO therapies demonstrate clinical efficacy and safety, they are being incorporated into standard treatment guidelines and receiving reimbursement support from healthcare systems. The willingness of payers to cover the high costs associated with immuno-oncology treatments is critical to their adoption, particularly for breakthrough therapies that offer significant benefits over existing options. Additionally, the expansion of clinical trial networks and the adoption of decentralized and adaptive trial designs are accelerating the development and approval of new IO therapies. The growing number of collaborations between academic institutions, research organizations, and pharmaceutical companies is facilitating knowledge exchange and driving innovation in the field. As the global focus on cancer research intensifies and as new therapeutic strategies continue to emerge, the immuno-oncology market is poised for sustained growth, driven by advancements in science, expanding applications, and the need for more effective and personalized cancer treatments.

Report Scope

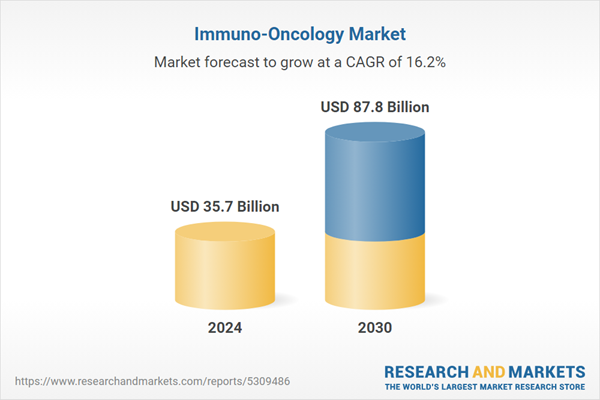

The report analyzes the Immuno-Oncology market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Treatment Type (Immune Checkpoint Inhibitors, Immune System Modulators, Cancer Vaccines, Oncolytic Virus, Other Treatment Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Immune Checkpoint Inhibitors segment, which is expected to reach US$75.1 Billion by 2030 with a CAGR of 16.2%. The Immune System Modulators segment is also set to grow at 15.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.9 Billion in 2024, and China, forecasted to grow at an impressive 15.3% CAGR to reach $13.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Immuno-Oncology Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Immuno-Oncology Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Immuno-Oncology Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie, Inc., Aduro BioTech, Inc., Amgen, Inc., AstraZeneca PLC, Bavarian Nordic A/S and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 102 companies featured in this Immuno-Oncology market report include:

- AbbVie, Inc.

- Aduro BioTech, Inc.

- Amgen, Inc.

- AstraZeneca PLC

- Bavarian Nordic A/S

- Bristol-Myers Squibb Company

- Celgene Corporation

- Celldex Therapeutics, Inc.

- Eli Lilly and Company

- EMD Serono, Inc.

- F. Hoffmann-La Roche AG

- Galena Biopharma, Inc.

- Gilead Sciences, Inc.

- ImmunoCellular Therapeutics Ltd.

- Incyte Corporation

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis International AG

- Pfizer, Inc.

- Prometheus Laboratories, Inc.

- Sanofi SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie, Inc.

- Aduro BioTech, Inc.

- Amgen, Inc.

- AstraZeneca PLC

- Bavarian Nordic A/S

- Bristol-Myers Squibb Company

- Celgene Corporation

- Celldex Therapeutics, Inc.

- Eli Lilly and Company

- EMD Serono, Inc.

- F. Hoffmann-La Roche AG

- Galena Biopharma, Inc.

- Gilead Sciences, Inc.

- ImmunoCellular Therapeutics Ltd.

- Incyte Corporation

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis International AG

- Pfizer, Inc.

- Prometheus Laboratories, Inc.

- Sanofi SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 224 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 35.7 Billion |

| Forecasted Market Value ( USD | $ 87.8 Billion |

| Compound Annual Growth Rate | 16.2% |

| Regions Covered | Global |