Plant-based meat, also known as vegan or vegetarian meat, is a type of food product designed to replicate the taste, texture, and appearance of traditional animal-derived meats, such as beef, chicken, and pork, using plant-based ingredients. These products are crafted by combining various plant sources, such as soy, peas, mushrooms, and grains, to create a product that mimics the sensory experience of consuming animal meat. In recent years, plant-based meats have gained significant popularity due to their potential health and environmental benefits. These products often boast lower saturated fat content and reduced cholesterol levels compared to their animal-based counterparts. Additionally, they contribute to a decreased environmental footprint by requiring less water, land, and emitting fewer greenhouse gases during production.

A growing awareness of the potential health benefits associated with plant-based diets has led to a surge in demand for plant-based meat. Consumers are seeking alternatives that offer lower saturated fat, reduced cholesterol, and improved nutritional profiles compared to traditional animal meats. Additionally, increasing concerns about environmental degradation and climate change have prompted consumers to explore more sustainable food options. Plant-based meats require fewer natural resources, such as water and land, and emit fewer greenhouse gases during production, aligning with the sustainability goals of environmentally conscious individuals. Other than this, the ethical treatment of animals has driven a shift towards plant-based diets. Individuals concerned about animal welfare are opting for plant-based meats to avoid contributing to the livestock industry's practices that raise ethical concerns. Besides this, the development of diverse plant-based meat products, ranging from burgers and sausages to meatballs and nuggets, has expanded culinary options for consumers. This innovation has contributed to the popularity of plant-based diets by offering familiar comfort foods in a sustainable and ethical manner. In line with this, increasing availability of plant-based meat products in mainstream grocery stores, restaurants, and fast-food chains has made these alternatives more accessible to a wider audience. Partnerships between plant-based meat producers and foodservice establishments have played a pivotal role in driving market growth.

Plant-Based Meat Market Trends/Drivers:

Increasing Health-Conscious Consumer Base

With increasing access to information about the potential health benefits of plant-based diets, individuals are making informed choices to reduce their consumption of traditional animal meats. Plant-based meat products are inherently lower in saturated fat and cholesterol compared to their animal-based counterparts. This characteristic aligns with the preferences of health-conscious consumers who aim to lower their risk of chronic diseases, including cardiovascular issues. Furthermore, the rich presence of fiber, vitamins, and minerals in plant-based meats adds to their appeal, offering a nutritious protein source while minimizing health concerns associated with excessive meat consumption. The emphasis on wellness has driven plant-based meat beyond niche markets, making it an attractive option for individuals actively seeking to adopt healthier dietary patterns.Growing Awareness About Environmental Sustainability

A growing global awareness of environmental issues and the role of food production in contributing to climate change has fueled the adoption of plant-based diets and, consequently, the demand for plant-based meat. The livestock industry is a notable contributor to greenhouse gas emissions, deforestation, and water consumption. In contrast, plant-based meat production requires fewer resources, including water and land, and generates fewer carbon emissions. Environmentally conscious consumers are drawn to plant-based meat as a sustainable solution to mitigate their ecological footprint. The alignment of personal dietary choices with broader environmental goals resonates with those seeking ways to make environmentally friendly lifestyle changes. As consumers become more informed about the environmental impact of their food choices, the popularity of plant-based meat products continues to rise as a tangible way to contribute to a more sustainable future.Ethical and Animal Welfare Considerations

Consumers are increasingly concerned about the living conditions and treatment of animals in industrial farming systems. The inherent cruelty and ethical concerns associated with traditional animal farming have prompted individuals to seek alternatives that do not contribute to such practices. Plant-based meat serves as an ethical choice, allowing consumers to enjoy meat-like products without participating in the consumption of animal-derived meats. This aligns with the values of those who prioritize animal welfare and advocate for more humane practices in food production. The growing discourse on animal rights and the moral implications of food consumption has fueled the growth of the plant-based meat market, offering consumers a way to satisfy their culinary preferences while respecting their ethical convictions.Global Plant-Based Meat Market Segmentation

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, source, meat type, and distribution channel.Breakup by Product Type:

- Burger Patties

- Sausages

- Nuggets and Strips

- Ground Meat

- Meatballs

- Others

Burger patties dominate the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes burger patties, sausages, nuggets and strips, ground meat, meatballs, and others. According to the report, burger patties represented the largest segment.Burger patties are a cornerstone of the plant-based meat market, mimicking the taste and texture of traditional beef patties while offering a sustainable and healthier alternative. These plant-based options are typically made from a blend of ingredients like soy, pea protein, and mushrooms, providing a satisfying and flavorful burger experience. The popularity of plant-based burger patties has soared due to their versatility, allowing consumers to enjoy classic fast-food favorites while reducing their meat consumption. They are commonly found in both home kitchens and restaurant menus, catering to a wide range of dietary preferences, including vegetarians, flexitarians, and those looking for meat-free options.

Breakup by Source:

- Soy

- Wheat

- Peas

- Others

Soy holds the largest share in the market

A detailed breakup and analysis of the market based on the source has also been provided in the report. This includes soy, wheat, peas, and others. According to the report, soy accounted for the largest market share.Soy-based plant-based meat products are a prominent player in the market, renowned for their ability to replicate the texture and taste of animal-derived meats. Derived from soybeans, these products are rich in protein and offer a complete amino acid profile. Soy-based plant-based meats often exhibit a meat-like texture that appeals to consumers seeking a convincing alternative. The versatility of soy-based ingredients allows for the creation of various products such as burger patties, sausages, nuggets, and ground meat. Soy's nutritional content, combined with its well-established presence in plant-based diets, has positioned it as a staple source for plant-based meat products.

Breakup by Meat Type:

- Chicken

- Beef

- Pork

- Others

Beef dominates the market

The report has provided a detailed breakup and analysis of the market based on the meat type. This includes chicken, beef, pork, and others. According to the report, beef represented the largest segment.Beef alternatives, typically crafted from soy, pea protein, or a combination of sources, closely mimic the taste, texture, and appearance of beef. From burger patties to ground meat, plant-based beef products cater to consumers who enjoy classic meat-centric dishes but opt for a more sustainable and ethical choice. The surge in interest for plant-based beef signifies a shift in dietary preferences and a growing awareness of the environmental impact of livestock farming. As plant-based options become more advanced and accessible, plant-based beef has emerged as a leader in transforming the way individuals perceive and consume meat.

Breakup by Distribution Channel:

- Restaurants and Catering Industry

- Supermarkets and Hypermarkets

- Convenience and Specialty Stores

- Online Retail

Supermarkets and hypermarkets hold the majority of the share in the market

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes restaurants and catering industry, supermarkets and hypermarkets, convenience and specialty stores, and online retail. According to the report, supermarkets and hypermarkets accounted for the largest market share.Supermarkets and hypermarkets play a pivotal role in introducing plant-based options to a wider audience, including those who are curious about reducing meat consumption but may not necessarily seek out specialized stores. The availability of plant-based meat in these retail settings facilitates the mainstream adoption of sustainable and ethical dietary choices. Moreover, the convenience of purchasing plant-based alternatives in these outlets has expanded their accessibility, allowing consumers to seamlessly integrate these products into their shopping routines.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- United Kingdom

- Germany

- Italy

- France

- Netherlands

- Sweden

- Others

- Asia Pacific

- China

- Australia

- South Korea

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- UAE

- Others

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (United States and Canada), Europe (United Kingdom, Germany, Italy, France, Netherlands, Sweden, and others), Asia Pacific (China, Australia, South Korea, and others), Latin America (Brazil, Mexico, and others), Middle East and Africa (Turkey, Saudi Arabia, UAE, and others). According to the report, North America accounted for the largest market share.North America stands as a key stronghold for the plant-based meat market, with a dynamic consumer base driving demand for sustainable and ethical dietary choices. The region's growing awareness of health and environmental concerns has spurred the popularity of plant-based options, appealing to a diverse range of individuals, from vegans to flexitarians. Plant-based meat products are well-integrated into the diets of consumers seeking alternatives to traditional animal products. The presence of numerous innovative plant-based brands, coupled with partnerships with restaurants and retailers, has solidified North America's status as a major player in the global market. As dietary preferences continue to shift, North America remains a hub of innovation and consumption, showcasing the market's ability to thrive in response to evolving consumer demands.

Competitive Landscape:

Leading companies in the plant-based meat sector invest heavily in research and development to enhance the taste, texture, and nutritional profile of their products. They leverage food science and technology to create products that closely resemble the sensory experience of consuming traditional animal meats. Additionally, collaborations between plant-based meat producers and well-established foodservice chains have accelerated market growth. Partnerships enable these companies to offer plant-based options on menus, making them accessible to a wider audience and mainstream consumers. Other than this, key players focus on building strong brand identities that resonate with health-conscious, environmentally aware, and ethical consumers. Effective marketing campaigns highlight the benefits of plant-based meats, positioning them as appealing alternatives for diverse dietary preferences. Besides this, industry leaders continually expand their product portfolios, introducing an array of options such as burger patties, sausages, nuggets, ground meat, and more. This diversity caters to different culinary applications and preferences, ensuring a broader market appeal.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Amy's Kitchen, Inc.

- Beyond Meat

- Boca Foods Company (Kraft Foods, Inc.)

- Garden Protein International (Conagra Brands, Inc.)

- Impossible Foods, Inc.

- Maple Leaf Foods

- MorningStar Farms (Kellogg Na Co.)

- Quorn Foods

- The Vegetarian Butcher

- Vbites Food Limited

Key Questions Answered in This Report

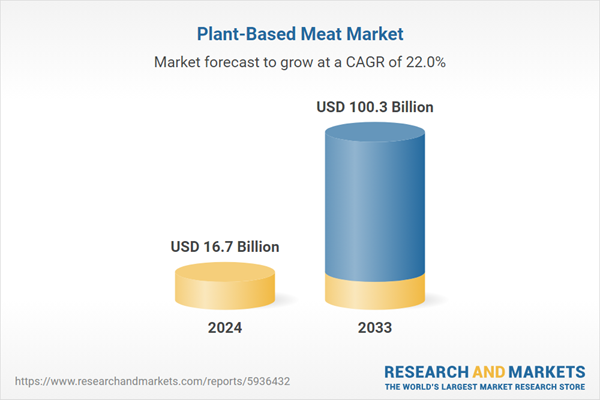

1. What was the size of the global plant-based meat market in 2024?2. What is the expected growth rate of the global plant-based meat market during 2025-2033?

3. What has been the impact of COVID-19 on the global plant-based meat market?

4. What are the key factors driving the global plant-based meat market?

5. What is the breakup of the global plant-based meat market based on the product type?

6. What is the breakup of the global plant-based meat market based on the source?

7. What is the breakup of the global plant-based meat market based on the meat type?

8. What is the breakup of the global plant-based meat market based on the distribution channel?

9. What are the key regions in the global plant-based meat market?

10. Who are the key players/companies in the global plant-based meat market?

Table of Contents

Companies Mentioned

- Amy's Kitchen Inc.

- Beyond Meat

- Boca Foods Company (Kraft Foods Inc.)

- Garden Protein International (Conagra Brands Inc.)

- Impossible Foods Inc.

- Maple Leaf Foods

- MorningStar Farms (Kellogg Na Co.)

- Quorn Foods

- The Vegetarian Butcher

- Vbites Food Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 16.7 Billion |

| Forecasted Market Value ( USD | $ 100.3 Billion |

| Compound Annual Growth Rate | 22.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |