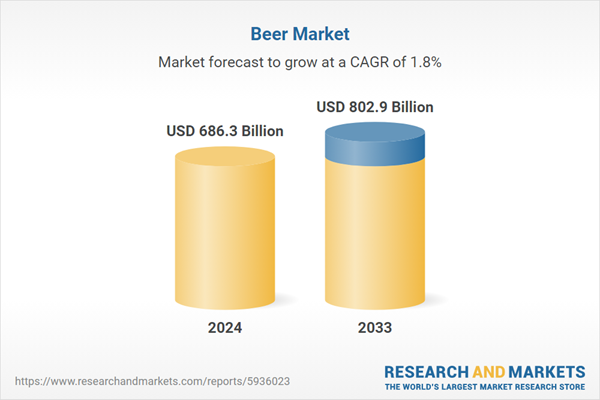

The global beer market size reached USD 686.3 Billion in 2024. Looking forward, the market is forecast to reach USD 802.9 Billion by 2033, exhibiting a growth rate (CAGR) of 1.8% during 2025-2033. The growing e-commerce and online retailing sector, the significant expansion in the tourism and hospitality industry, and the changing consumer preference toward specialty brews, and low-alcohol options are some of the major factors contributing to the market growth.

Beer is a popular alcoholic beverage that is primarily produced from four main ingredients such as water, malted barley (or other grains), hops, and yeast. It involves fermenting sugars from the grains with yeast, which produces alcohol and carbonation. There are several types of products, with lagers and ales being the two broad categories. Lagers are typically fermented at cooler temperatures and tend to have a cleaner, crisper taste, while ales are fermented at warmer temperatures, resulting in several flavors and aromas. Additionally, it is known for its numerous flavors, which can include bitter, sweet, sour, and even fruity tastes.

The market is driven by the evolving consumer preferences. In addition, the increasing product demand for socializing, relaxation, and celebrations is influencing the market growth. Also, it is low in calories, and low in alcohol, and offers non-alcoholic options to consumers seeking healthier alternatives to traditional, thus augmenting the market growth. Moreover, breweries continue to innovate with new ingredients, brewing techniques, and flavors which keeps consumers engaged and excited about trying new products, thus representing another major growth-inducing factor. Besides this, the craft product movement has seen exponential growth, with small, independent breweries gaining market share and drawing consumers to the authenticity and unique offerings of craft breweries, thus accelerating the sales demand. Along with this, the implementation of several government regulations, such as reduced restrictions on alcohol sales and distribution are facilitating the growth of the industry, thus propelling the market growth.

The report has provided a detailed breakup and analysis of the market based on the product type. This includes standard lager, premium lager, specialty beer, and others. According to the report, standard lager accounted for the largest market share.

Standard lager, known for its crisp and refreshing taste, has managed to capture a significant share of the market due to its widespread appeal and adaptability catering to numerous individuals seeking a light and easy-drinking option to desiring a go-to choose for social gatherings drinks which is influencing the market growth. Its approachable taste, characterized by a balanced blend of malt sweetness and a mild hop bitterness, resonates with the audience, making it a preferred choice for many.

Moreover, standard lager has found its place in the ever-evolving craft beer movement. Some craft breweries are recognizing the appeal of producing their own versions of lagers, targeting consumers who seek artisanal quality while maintaining the familiarity of a standard lager is propelling the market growth.

A detailed breakup and analysis of the market based on the packaging has also been provided in the report. This includes glass, PET bottle, metal can, and others. According to the report, glass accounted for the largest market share.

Glass bottles preserve the integrity of the product with their impermeable nature shielding the brew from external elements, such as light and oxygen, which can compromise taste and quality and ensure the product remains fresh and unaltered, contributing to a consistent and enjoyable drinking experience for consumers.

Additionally, glass offers transparency, allowing consumers to see the drinks they're about to enjoy. This visual appeal enhances the drinking experience, as individuals often appreciate the aesthetics of their beverage, from the clarity and color to the effervescence within the bottle. Furthermore, glass is fully recyclable and environmentally friendly which can be melted down and repurposed, reducing its ecological footprint compared to other packaging materials.

The report has provided a detailed breakup and analysis of the market based on the production. This includes macro-brewery, micro-brewery, and others. According to the report, macro-brewery accounted for the largest market share.

Macro-breweries have massive production facilities that allow them to produce alcohol in bulk, resulting in lower production costs per unit which enables them to offer competitive pricing, appealing to budget-conscious consumers. In addition, macro-breweries have expansive distribution networks that span national and international markets which ensures that their products are easily available in numerous retail outlets, bars, and restaurants, making it convenient for consumers to access their products, thus augmenting the market growth.

Furthermore, macro-breweries are investing in marketing campaigns, using their financial resources to create brand awareness and loyalty which attracts new customers and retains existing ones, thus propelling the market growth. These breweries implement quality assurance measures to maintain consistency in taste and product quality which reassures consumers, establishing trust in their brands.

A detailed breakup and analysis of the market based on the alcohol content has also been provided in the report. This includes high, low, and alcohol free. According to the report, high accounted for the largest market share.

High alcohol content often offers a bold and more complex flavor profile, appealing to connoisseurs and individuals seeking a unique drinking experience. Craft breweries are capitalizing on this trend by producing small batches of high alcohol by volume (ABV) beers, often incorporating unconventional ingredients and brewing techniques to create distinct flavors.

Furthermore, breweries are known for their experimentation and innovation, which extends to creating high-alcoholic content, thus driving the culture of exploration and discovery, with consumers seeking out these unique brews propelling the market growth. Along with this, high alcoholic content products are often available in smaller serving sizes, such as 8-ounce or 12-ounce bottles, and command premium prices. Consumers are willing to invest in these products due to their perceived exclusivity and quality resulting in increased profitability for breweries.

A detailed breakup and analysis of the market based on the flavor has also been provided in the report. This includes flavored and unflavored beer. According to the report, flavored beer accounted for the largest market share.

Flavored products are driven by evolving consumer tastes and an increasing desire for unique beverage experiences. In addition, consumers are drawn to several flavors from fruity infusions to exotic spices, catering to various palates, appealing to seasoned enthusiasts and newcomers, thus augmenting the market growth.

Moreover, marketing and branding are essential to promote breweries with flavored products as a refreshing and innovative alternative to conventional brews. Their branding strategies emphasize the quality of ingredients, craftsmanship, and the art of flavor blending, instilling confidence in consumers and establishing trust.

Apart from this, many flavored variants lower alcohol content and reduce calories, appealing to individuals seeking a balanced indulgence, thus accelerating the sales demand. Additionally, some flavors, such as citrus or botanicals, are perceived as healthier choices, further driving the trend.

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, on-trades, specialty stores, convenience stores, and others. According to the report, supermarkets and hypermarkets accounted for the largest market share.

The market is driven by supermarkets and hypermarkets due to its extensive network of outlets spanning urban and rural areas, which ensures that the products are easily available to a vast consumer base. This accessibility caters to the evolving preferences of consumers who seek convenience in their shopping experiences.

Moreover, supermarkets and hypermarket's purchasing power allow them to negotiate favorable deals with manufacturers, resulting in competitive pricing for consumers which further solidifies their growth, thus representing another major growth-inducing factor.

Furthermore, the marketing and promotional strategies employed by supermarkets and hypermarkets showcase an extensive variety of brands and flavors, providing consumers with ample choices. These retailers also engage in strategic placement within their stores, enhancing the visibility of products and thus encouraging impulse purchases.

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific market is driven by the growing population, rising disposable income, and changing consumer preferences. In addition, the increasing product demand in social gatherings and celebrations is further driving its consumption, thus influencing the market growth.

Additionally, the shift toward urbanization and Westernized lifestyle in many parts of Asia are contributing to product consumption. Moreover, the Asia Pacific region is witnessing substantial investments in the brewing industry, thus representing another major growth-inducing factor. Also, domestic and international breweries are recognizing the potential for growth in this market and established a significant presence across the market.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

2. What is the expected growth rate of the global beer market during 2025-2033?

3. What are the key factors driving the global beer market?

4. What has been the impact of COVID-19 on the global beer market?

5. What is the breakup of the global beer market based on the product type?

6. What is the breakup of the global beer market based on the packaging?

7. What is the breakup of the global beer market based on the production?

8. What is the breakup of the global beer market based on the alcohol content?

9. What is the breakup of the global beer market based on the flavor?

10. What is the breakup of the global beer market based on the distribution channel?

11. What are the key regions in the global beer market?

12. Who are the key players/companies in the global beer market?

Beer is a popular alcoholic beverage that is primarily produced from four main ingredients such as water, malted barley (or other grains), hops, and yeast. It involves fermenting sugars from the grains with yeast, which produces alcohol and carbonation. There are several types of products, with lagers and ales being the two broad categories. Lagers are typically fermented at cooler temperatures and tend to have a cleaner, crisper taste, while ales are fermented at warmer temperatures, resulting in several flavors and aromas. Additionally, it is known for its numerous flavors, which can include bitter, sweet, sour, and even fruity tastes.

The market is driven by the evolving consumer preferences. In addition, the increasing product demand for socializing, relaxation, and celebrations is influencing the market growth. Also, it is low in calories, and low in alcohol, and offers non-alcoholic options to consumers seeking healthier alternatives to traditional, thus augmenting the market growth. Moreover, breweries continue to innovate with new ingredients, brewing techniques, and flavors which keeps consumers engaged and excited about trying new products, thus representing another major growth-inducing factor. Besides this, the craft product movement has seen exponential growth, with small, independent breweries gaining market share and drawing consumers to the authenticity and unique offerings of craft breweries, thus accelerating the sales demand. Along with this, the implementation of several government regulations, such as reduced restrictions on alcohol sales and distribution are facilitating the growth of the industry, thus propelling the market growth.

Beer Market Trends/Drivers

The growing e-commerce and online retail sector

The market is driven by the rising e-commerce and online retail sector. Additionally, e-commerce opened up new avenues for producers and retailers to reach a broader customer base. Online stores and delivery services made it easier for consumers to access several product types from the comfort of their homes. Moreover, the online platform offers breweries and craft alcohol producers the opportunity to showcase their products to a global audience representing another major growth-inducing factor. Besides this, the data-driven nature of e-commerce enables personalized recommendations and targeted marketing, allowing companies to customize their product offerings to individual consumer preferences, thus accelerating the sales demand. Furthermore, this data-driven approach enhances customer engagement and provides valuable insights into product development and marketing strategies, thus propelling market growth.The significant expansion in the tourism and hospitality industry

The market is driven by the escalating product demand due to the significant expansion in the tourism and hospitality industry. In addition, the increasing number of tourists exploring various destinations and the escalating demand for alcoholic beverages, with beer being a popular choice among travelers and patrons of hotels, restaurants, and bars, are influencing the market growth. Moreover, many renowned product manufacturers are expanding their reach across international borders, making their products accessible to a more extensive customer base. Furthermore, the introduction of innovative flavors and craft product options is attracting a wider customer base, including those seeking unique and artisanal experiences, thus propelling market growth.The changing consumer preference

The market is driven by evolving consumer preferences due to changing societal trends, health consciousness, and a desire for unique and diverse options. In addition, the growing demand for healthier product options among consumers due to the increasing concerns about their well-being is influencing the market growth. Also, the popularity of low-alcohol and non-alcoholic is augmenting the market growth. Breweries are offering several options, catering to health-conscious consumers enjoying numerous types of flavors without the associated alcohol content. Moreover, the increasing demand for craft products is often produced by smaller, independent breweries and offers unique and artisanal flavors, authenticity, and diversity, while providing an alternative to mass-produced, standardized options, which represents another major growth-inducing factor. Furthermore, the growing environmental concern led to the adoption of environmentally friendly practices, such as recycling, reducing waste, and sourcing locally to meet consumer expectations, thus creating a positive market outlook.Beer Industry Segmentation

This report provides an analysis of the key trends in each segment of the global beer market report, along with forecasts at the global, regional, and country levels for 2025-2033. The report has categorized the market based on product type, packaging, production, alcohol content, flavor, and distribution channel.Breakup by Product Type

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes standard lager, premium lager, specialty beer, and others. According to the report, standard lager accounted for the largest market share.

Standard lager, known for its crisp and refreshing taste, has managed to capture a significant share of the market due to its widespread appeal and adaptability catering to numerous individuals seeking a light and easy-drinking option to desiring a go-to choose for social gatherings drinks which is influencing the market growth. Its approachable taste, characterized by a balanced blend of malt sweetness and a mild hop bitterness, resonates with the audience, making it a preferred choice for many.

Moreover, standard lager has found its place in the ever-evolving craft beer movement. Some craft breweries are recognizing the appeal of producing their own versions of lagers, targeting consumers who seek artisanal quality while maintaining the familiarity of a standard lager is propelling the market growth.

Breakup by Packaging

- Glass

- PET Bottle

- Metal Can

- Others

A detailed breakup and analysis of the market based on the packaging has also been provided in the report. This includes glass, PET bottle, metal can, and others. According to the report, glass accounted for the largest market share.

Glass bottles preserve the integrity of the product with their impermeable nature shielding the brew from external elements, such as light and oxygen, which can compromise taste and quality and ensure the product remains fresh and unaltered, contributing to a consistent and enjoyable drinking experience for consumers.

Additionally, glass offers transparency, allowing consumers to see the drinks they're about to enjoy. This visual appeal enhances the drinking experience, as individuals often appreciate the aesthetics of their beverage, from the clarity and color to the effervescence within the bottle. Furthermore, glass is fully recyclable and environmentally friendly which can be melted down and repurposed, reducing its ecological footprint compared to other packaging materials.

Breakup by Production

- Macro-Brewery

- Micro-Brewery

- Others

The report has provided a detailed breakup and analysis of the market based on the production. This includes macro-brewery, micro-brewery, and others. According to the report, macro-brewery accounted for the largest market share.

Macro-breweries have massive production facilities that allow them to produce alcohol in bulk, resulting in lower production costs per unit which enables them to offer competitive pricing, appealing to budget-conscious consumers. In addition, macro-breweries have expansive distribution networks that span national and international markets which ensures that their products are easily available in numerous retail outlets, bars, and restaurants, making it convenient for consumers to access their products, thus augmenting the market growth.

Furthermore, macro-breweries are investing in marketing campaigns, using their financial resources to create brand awareness and loyalty which attracts new customers and retains existing ones, thus propelling the market growth. These breweries implement quality assurance measures to maintain consistency in taste and product quality which reassures consumers, establishing trust in their brands.

Breakup by Alcohol Content

- High

- Low

- Alcohol-Free

A detailed breakup and analysis of the market based on the alcohol content has also been provided in the report. This includes high, low, and alcohol free. According to the report, high accounted for the largest market share.

High alcohol content often offers a bold and more complex flavor profile, appealing to connoisseurs and individuals seeking a unique drinking experience. Craft breweries are capitalizing on this trend by producing small batches of high alcohol by volume (ABV) beers, often incorporating unconventional ingredients and brewing techniques to create distinct flavors.

Furthermore, breweries are known for their experimentation and innovation, which extends to creating high-alcoholic content, thus driving the culture of exploration and discovery, with consumers seeking out these unique brews propelling the market growth. Along with this, high alcoholic content products are often available in smaller serving sizes, such as 8-ounce or 12-ounce bottles, and command premium prices. Consumers are willing to invest in these products due to their perceived exclusivity and quality resulting in increased profitability for breweries.

Breakup by Flavor

- Flavored

- Unflavored

A detailed breakup and analysis of the market based on the flavor has also been provided in the report. This includes flavored and unflavored beer. According to the report, flavored beer accounted for the largest market share.

Flavored products are driven by evolving consumer tastes and an increasing desire for unique beverage experiences. In addition, consumers are drawn to several flavors from fruity infusions to exotic spices, catering to various palates, appealing to seasoned enthusiasts and newcomers, thus augmenting the market growth.

Moreover, marketing and branding are essential to promote breweries with flavored products as a refreshing and innovative alternative to conventional brews. Their branding strategies emphasize the quality of ingredients, craftsmanship, and the art of flavor blending, instilling confidence in consumers and establishing trust.

Apart from this, many flavored variants lower alcohol content and reduce calories, appealing to individuals seeking a balanced indulgence, thus accelerating the sales demand. Additionally, some flavors, such as citrus or botanicals, are perceived as healthier choices, further driving the trend.

Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, on-trades, specialty stores, convenience stores, and others. According to the report, supermarkets and hypermarkets accounted for the largest market share.

The market is driven by supermarkets and hypermarkets due to its extensive network of outlets spanning urban and rural areas, which ensures that the products are easily available to a vast consumer base. This accessibility caters to the evolving preferences of consumers who seek convenience in their shopping experiences.

Moreover, supermarkets and hypermarket's purchasing power allow them to negotiate favorable deals with manufacturers, resulting in competitive pricing for consumers which further solidifies their growth, thus representing another major growth-inducing factor.

Furthermore, the marketing and promotional strategies employed by supermarkets and hypermarkets showcase an extensive variety of brands and flavors, providing consumers with ample choices. These retailers also engage in strategic placement within their stores, enhancing the visibility of products and thus encouraging impulse purchases.

Breakup by Region

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific market is driven by the growing population, rising disposable income, and changing consumer preferences. In addition, the increasing product demand in social gatherings and celebrations is further driving its consumption, thus influencing the market growth.

Additionally, the shift toward urbanization and Westernized lifestyle in many parts of Asia are contributing to product consumption. Moreover, the Asia Pacific region is witnessing substantial investments in the brewing industry, thus representing another major growth-inducing factor. Also, domestic and international breweries are recognizing the potential for growth in this market and established a significant presence across the market.

Competitive Landscape

At present, key players are implementing various strategies to strengthen their positions and remain competitive. They are introducing new product varieties, flavors, and packaging formats to cater to changing consumer preferences. Additionally, companies are incorporating advanced technology into production and distribution processes to enhance efficiency and quality, ensuring that companies meet consumer demands. They are building a strong connection with consumers through brewery tours, tastings, and loyalty programs fostering brand loyalty and enhancing the market growth. Moreover, key players are focusing on sustainability by implementing eco-friendly practices in production, packaging, and distribution including reducing water usage, using renewable energy, and minimizing carbon emissions. Along with this, companies are investing in creative and effective marketing campaigns to promote their brands and connect with consumers including using social media, sponsorships, and events to build brand loyalty.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Asahi Group Holdings, Ltd.

- ANHEUSER-BUSCH INBEV SA/NV

- Beijing Yanjing Beer Group Corporation

- Carlsberg Group

- Diageo plc

- Dogfish Head Craft Brewery Inc.

- HEINEKEN N.V.

- Sierra Nevada Brewing Co.

- Grupo Modelo

- United Breweries Limited (UBL)

- Oettinger Brauerei GmbH

- Kirin Holdings Company Limited

- Molson Coors Beverage Company

- Tetra Laval Group

Key Questions Answered in This Report

1. What was the size of the global beer market in 2024?2. What is the expected growth rate of the global beer market during 2025-2033?

3. What are the key factors driving the global beer market?

4. What has been the impact of COVID-19 on the global beer market?

5. What is the breakup of the global beer market based on the product type?

6. What is the breakup of the global beer market based on the packaging?

7. What is the breakup of the global beer market based on the production?

8. What is the breakup of the global beer market based on the alcohol content?

9. What is the breakup of the global beer market based on the flavor?

10. What is the breakup of the global beer market based on the distribution channel?

11. What are the key regions in the global beer market?

12. Who are the key players/companies in the global beer market?

Table of Contents

1 Preface3 Executive Summary14 Value Chain Analysis

2 Scope and Methodology

4 Introduction

5 Global Beer Market

6 Market Breakup by Product Type

7 Market Breakup by Packaging

8 Market Breakup by Production

9 Market Breakup by Alcohol Content

10 Market Breakup by Flavor

11 Market Breakup by Distribution Channel

12 Market Breakup by Region

13 SWOT Analysis

15 Porters Five Forces Analysis

16 Price Analysis

17 Competitive Landscape

List of Figures

List of Tables

Companies Mentioned

- Asahi Group Holdings Ltd.

- ANHEUSER-BUSCH INBEV SA/NV

- Beijing Yanjing Beer Group Corporation

- Carlsberg Group

- Diageo plc

- Dogfish Head Craft Brewery Inc.

- HEINEKEN N.V.

- Sierra Nevada Brewing Co.

- Grupo Modelo

- United Breweries Limited (UBL)

- Oettinger Brauerei GmbH

- Kirin Holdings Company Limited

- Molson Coors Beverage Company

- Tetra Laval Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 686.3 Billion |

| Forecasted Market Value ( USD | $ 802.9 Billion |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |