In contrast, the market faces limited automation compared to virtualized cloud services, which can impact operational efficiency. The significant upfront and ongoing costs associated with deploying bare metal cloud infrastructure also make adoption challenging for budget-constrained organizations, thus restraining market growth.

Hybrid bare metal cloud to account for the fastest growth rate during the forecast period

Hybrid bare metal cloud presents a significant growth avenue for vendors and solution providers by combining public and private bare metal infrastructure, enabling seamless workload mobility while preserving dedicated server performance. The type addresses the needs of enterprises for flexible capacity scaling, disaster recovery, and cost optimization, ensuring that sensitive workloads are secured in private environments while burst demand is managed through public infrastructure. In July 2024, Rackspace Technology launched its Hybrid Bare Metal as a Service platform, offering unified management and simplified workload migration across public cloud and private bare metal environments.Further advancing hybrid adoption, Google Cloud partnered with Nutanix in April 2025 to enable Nutanix Cloud Clusters (NC2) on Google’s bare metal Z3 instances, supporting seamless orchestration of Kubernetes and AI workloads across hybrid environments. For vendors and solution providers, these advancements highlight the opportunity to deliver integrated platforms that blend cloud elasticity with bare metal’s dedicated performance. Hybrid bare metal is gaining momentum across global operations, gaming, and IoT-driven manufacturing, where low latency, agility, and compliance are critical. By positioning offerings that enable enterprises to run latency-sensitive workloads closer to end users while maintaining operational consistency, providers can capitalize on the growing demand for flexible, high-performance infrastructure that avoids vendor lock-in.

Software & IT Services segment to hold the largest market share during the forecast period

The Software & IT Services sector offers strong potential for vendors and solution providers as it increasingly depends on bare metal cloud to deliver high-performance, secure, and globally distributed applications. SaaS providers such as Salesforce utilize bare metal servers to ensure low latency and high availability for users around the world. This approach eliminates virtualization overhead, which leads to faster data processing and real-time service delivery. In January 2024, Equinix introduced its Equinix Metal bare metal cloud service in Mumbai, India, designed to support SaaS and IT services firms requiring dedicated, low-latency infrastructure. The launch emphasized automated provisioning of bare metal servers integrated with Equinix Fabric, delivering consistent compute power and network reliability for global software delivery.Cybersecurity vendors such as CrowdStrike rely on bare metal environments to process extensive threat intelligence workloads with dedicated compute capacity, enabling rapid detection and incident response. For vendors and solution providers, this sector highlights the opportunity to create customized solutions that meet the increasing demand for data-intensive computing, stringent security, and tailored infrastructure. By addressing the performance and compliance needs of SaaS platforms, IT services, and cybersecurity firms, providers can position bare metal cloud as a fundamental enabler of secure, scalable, and high-performing digital ecosystems.

North America is expected to hold the largest share, while Asia Pacific will be the fastest-growing region during the forecast period

North America is expected to dominate the bare metal cloud market, driven by rising enterprise demand for high-performance computing, dedicated infrastructure, and secure cloud-native environments. For providers and vendors, this presents significant opportunities to deliver scalable platforms that support industries such as BFSI, gaming, healthcare & life sciences, and large-scale analytics. The region’s advanced data center ecosystem and rapid adoption of AI and digital transformation initiatives accelerate the shift from traditional on-premises systems to bare metal deployments, creating strong demand for dedicated, compliant infrastructure.Asia Pacific is expected to hold the highest CAGR during the bare metal cloud market forecast period. The region is rapidly emerging as a core growth region for bare metal cloud driven by accelerated AI adoption, government-backed digitalization, and investments in next-generation computing infrastructure.

Strategic partnerships, including collaborations with hyperscalers and enterprises, highlight how bare metal cloud enhances operational efficiency and workload performance. Capitalizing on these developments enables vendors to meet evolving enterprise requirements, address latency and compliance needs, and establish resilient market positions in an industry marked by rapid adoption and innovation.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the bare metal cloud market.- By Company: Tier I - 38%, Tier II - 42%, and Tier III - 20%

- By Designation: C-Level Executives - 40%, D-Level Executives - 35%, and others - 25%

- By Region: North America - 35%, Europe - 40%, Asia Pacific - 15%, and Rest of the world - 10%

Research Coverage

This research report categorizes the bare metal cloud market based on service model (bare metal servers (dedicated servers, custom-built physical servers, high-performance servers, other bare metal servers), bare metal instances (standard bare metal instances, GPU-accelerated instances, high-memory instances, storage-optimized instances, network-optimized instances, other bare metal instances) and managed services (provisioning & deployment services, monitoring & analytics, support & maintenance, orchestration integration, API & portal-based management and other managed services)), application (high-performance computing (scientific computing, engineering simulations, weather and climate modeling, and others), AI/ML & Data Analytics (real-time data processing, distributed computing frameworks, data warehousing & lakes, and others), gaming & media (cloud gaming platforms, video transcoding & streaming, content delivery optimization, AR/VR applications, and others), general purpose infrastructure (financial modeling (algorithmic trading platforms, risk management simulations, financial forecasting, and others), database applications (in-memory databases, OLTP systems, NoSQL & NewSQL workloads, and others), enterprise applications (virtual desktop infrastructure (VDI), ERP & CRM Platforms, Enterprise Dev/Test Environments, and others))), deployment type (public bare metal, private bare metal, hybrid bare metal), organization size (large enterprises, small & medium sized enterprises), vertical (BFSI, healthcare & life sciences, manufacturing/automotive, software & IT services, media & entertainment, government & public sector, telecommunications, retail & consumer goods, and other verticals (energy & utilities, education, transportation & logistics, and travel & hospitality)), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).The report’s scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the bare metal cloud market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers and acquisitions; and recent developments associated with the bare metal cloud market. This report also covers the competitive analysis of upcoming startups in the bare metal cloud market ecosystem.

Reasons to buy this Report

The report would provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall bare metal cloud market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.The report provides insights on the following pointers:

- Analysis of key drivers (AI workloads increasing demand for low-latency compute, Demand for customizable compute configurations, Need for high-performance computing to support resource-intensive applications, Demand for delivering high-bandwidth connectivity and scalability, Need for enhanced security and compliance to operate in secure environments, Absence of noisy neighbor concerns and hypervisor tax), restraints (Limited Automation versus virtualized cloud services, Cost of implementation of bare metal cloud, Stringent cloud regulations are hindering the market growth), opportunities (Expansion of GPU-backed bare metal offerings, Growing adoption of edge computing infrastructure for real-time data processing, Growing adoption of big data and DevOps applications, Emergence of AI and ML applications), and challenges (Inability to scale infrastructure instantly under variable load, Lack of isolation in multi-tenant environments, Integration with virtualized environments)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the bare metal cloud market

- Market Development: Comprehensive information about lucrative markets - the report analyses the bare metal cloud market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the bare metal cloud market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such Oracle (US), AWS (US), IBM (US), Dell Technologies (US), Microsoft (US), Google (US), Cherry Servers (Lithuania), HostingRaja (India), Red Switches (Singapore), Vultr (US), Zenlayer (US), Gcore (Luxembourg), Oman Data Park (Oman), Bigstep (UK), DartPoints (US), Pure Storage (US), Huawei Cloud (China), Hetzner (Germany), pheonixNAP (US), Limestone Networks (US), OVHcloud (France), HPE (US), Joyent (US), Scaleway (France), Alibaba Cloud (China) and Liquid Web (US). The report also helps stakeholders understand the bare metal cloud market's pulse and provides information on key market drivers, restraints, challenges, and opportunities

Table of Contents

Companies Mentioned

- Oracle

- Aws

- Ibm

- Microsoft

- Dell Technologies

- Alibaba Cloud

- Rackspace Technology

- Lumen Technologies

- Huawei Cloud

- Vultr

- Digitalocean, LLC.

- Ionos Cloud Inc.

- Hivelocity, Inc

- Cherry Servers

- Pure Storage

- Hetzner

- Phoenixnap

- Limestone Networks

- Ovhcloud

- Hpe

- Joyent

- Scaleway

- Hostingraja

- Redswitches

- Zenlayer

- Gcore

- Oman Data Park

- Bigstep

- Dartpoints

- Openmetal.Io

- Cloudone Digital

Table Information

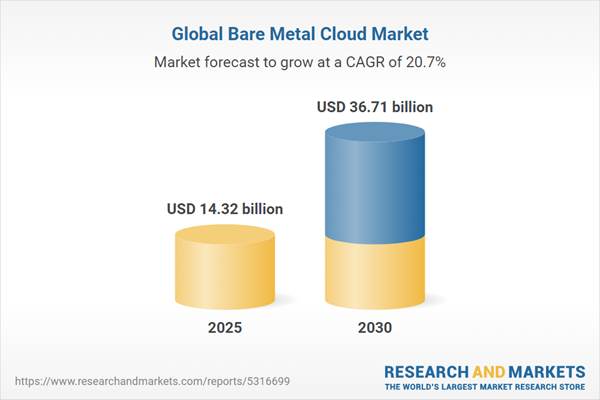

| Report Attribute | Details |

|---|---|

| No. of Pages | 322 |

| Published | September 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 14.32 billion |

| Forecasted Market Value ( USD | $ 36.71 billion |

| Compound Annual Growth Rate | 20.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |