Countries in Europe, especially the UK, are highly affected due to the COVID-19 pandemic. The region is suffering an economic hit due to a lack of revenue from various industries, as countries such as the UK, Germany, and Italy recorded the highest number of COVID-19 confirmed cases. Additionally, with the outbreak of another variant of COVID-19 in the UK, the battery testing equipment market is hampered. Europe is a significant manufacturing and industrial hub for sectors such as healthcare, aviation, manufacturing, automotive, energy and power, and others. However, due to the outbreak, many businesses in Europe face financial challenges as they had to reduce their activities substantially owing to the lack of human resources, government-imposed restrictions, and decreasing sales. However, the increasing initiatives undertaken by the governments of countries such as the UK, Sweden, and Germany to develop urban air mobility infrastructure in the countries are expected to provide growth opportunities to the market in the coming years.

Based on application, the cell testing segment led the Europe battery testing equipment market in 2019. The cell testing is usually performed on batteries used across smart battery pulse charging, EV drive profiles, and other custom charging/discharging regimes, which have a voltage rating of up to 10V. The cell stress tests are performed to evaluate the response to different stresses such as electrical, environmental, and mechanical. The cell testing is performed to provide a long-term battery life cycle and simulate complex real-world test profiles. Moreover, the cell tester is designed for performing a test on Lithium-ion batteries, electrical double-layer capacitors (EDLC), and Lithium-ion capacitors (LIC). For instance, Chroma Systems Solutions, Inc. designs 17216M 16 channel battery cell tester that consists of Chroma’s powerful battery pro programmable charge/discharge test system software, which allows the full configuration with statistics and reporting capability. Several advantages of cell testing such as more accuracy, programmable testing, and evaluation of different stresses are expected to drive the Europe battery testing equipment market for the cell testing segment during the forecast period.

The overall Europe battery testing equipment market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. The process also serves the purpose of obtaining an overview and forecast for the Europe battery testing equipment market with respect to all the segments pertaining to the region. Also, multiple primary interviews have been conducted with industry participants and commentators to validate the data, as well as to gain more analytical insights into the topic. The participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the Europe battery testing equipment market. Arbin Instruments; CHAUVIN ARNOUX; Chroma Systems Solutions, Inc.; DV POWER; Megger Group Limited; Midtronics, Inc.; and Xiamen Tmax Battery Equipments Limited are among the players operating in the market.

Table of Contents

Companies Mentioned

- Arbin Instruments

- CHAUVIN ARNOUX

- Chroma Systems Solutions, Inc.

- DV POWER

- Megger Group Limited

- Midtronics, Inc.

- Xiamen Tmax Battery Equipments Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | April 2021 |

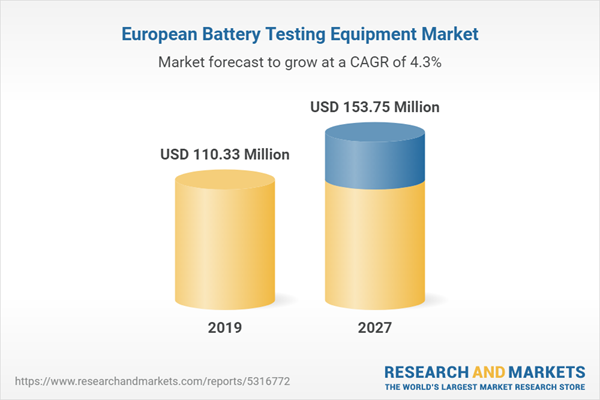

| Forecast Period | 2019 - 2027 |

| Estimated Market Value ( USD | $ 110.33 Million |

| Forecasted Market Value ( USD | $ 153.75 Million |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 7 |