Key Highlights

- Aquaculture development is still incipient in Kuwait although the commercial production of gilthead seabream and Sobaity seabream in floating cages in Kuwait bay was started in 1997. Aquaculture activities are expanded in order to supplement local landings from capture fisheries.

- In Kuwait, government support for the sector, the rapid increase in demand from consumers, and the increasing sale of fish via social network platforms are some of the drivers of the market. Through these customers have much greater flexibility in bargaining for fish, along with timely delivery. Also, with changing lifestyles, this trend is expected to augment the sale of seafood. This increasing consumption is resulting in the country being import-dependent to meet domestic demand.

- Through the UK Gulf Marine Environment Partnership (GMEP) Programme, the UK Government's Centre for Environment, Fisheries and Aquaculture Science (Cefas) is collaborating with Gulf region partners to improve sustainable fishing and combat biodiversity loss. Cefas provides the most comprehensive range of applied marine and freshwater science, and its Kuwait office launched in June 2020. This will help to reduce the dependence on imports and tends to increase self-sufficiency of production of the country. The growing production to meet the rising seafood consumption indicates the growth of the market in the country.

Kuwait Fisheries and Aquaculture Market Trends

Growing Consumption of seafood is Driving the market

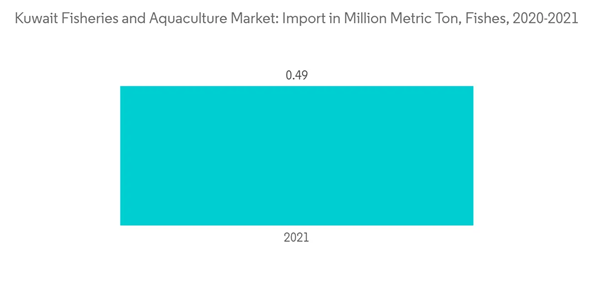

Seafood is an excellent source of lean, high-quality, easily digested protein. Seafood is low in saturated fat and sodium and is a rich source of many essential vitamins and minerals. Seafood also is one of the few foods that contain long-chain omega-3 fatty acids, which have many beneficial health effects and are essential for the development of the nervous system and retina. Seafood includes fish such as catfish, salmon, tuna, trout, and tilapia, and shellfish such as shrimp, crab, clams, and oysters, mostly Nila Tilapia fish becoming popular in the parts of the country. Based on consumer health awareness of seafood and dietary the aquaculture market tends to grow in the coming years.Demand for fresh fish and shrimp in Kuwait is likely to exceed the sustainable potential of its fishery resources. The Public Authority for Agricultural Affairs and Fish Resources (PAAFR) Kuwait has created a development plan to achieve self-sufficiency of locally-consumed fish and narrow down the gap between seafood product supply and demand. According to FAOSTAT, the import of fish in 2021 is 0.49 million metric tons which has declined compared to the previous year due to the pandemic impact on the country.

Additionally, the organization projects that fish farming could fill 50.0% of the fresh fish deficit by the year 2026 if the PAAF completes the implementation of all its planned projects. The increasing demand for fish and seafood despite the higher price is expected to increase consumption in Kuwait during the forecast period which is mainly driven by the government's focus on developing the aquaculture industry to reduce the import dependency.

Decreasing Domestic Production is Increasing Import Potential

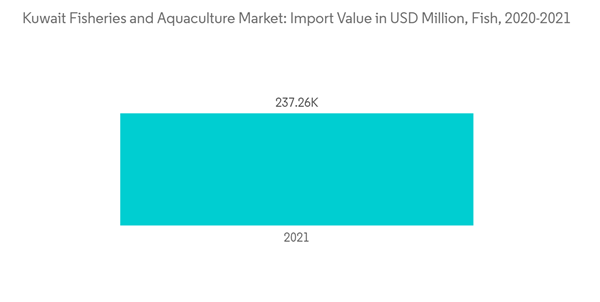

Kuwait's Project "Blue Economy" aims to replace the country's oil revenues (which presently account for 80% of GDP) with marine and maritime projects. Understanding the primary reasons of fish reduction is one of the most important aspects of Kuwait's Blue Economy initiative. According to the Kuwaiti Central Statistical Office and the State Authority of Agriculture Affairs and fish resources (PAAFR), fish stocks in Kuwait waters have been reduced by 30%. thus, making Kuwait import-dependent. Local demand for shrimp has also increased recently, while catches have been low, in contrast to the pre-invasion period, resulting in higher imports and rising prices.According to ITC Trade, in 2021, Kuwait imported 121 million metric ton of fish to meet its domestic demand. The steady increase in imports drives the growth of the market even further during the forecast period. With the increased awareness of the health benefits of fish consumption, demand for fish has increased significantly and even exceeded the local supply. This phenomenon in Kuwait is thus, forcing vendors to import frozen and fresh fish from abroad to meet the increasing demand. According to UNComtrade, India, Pakistan, and Turkey are some of the major exporters of fish to Kuwait in 2021. Two major countries from which Kuwait imports are India with a share of 22% ( USD 51 million), Pakistan with a share of 20% (USD 47 million).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.