Key Highlights

- Rice cultivation is mostly located in Northern Italy (Piemonte, Lombardia, and Veneto regions) where water is relatively abundant and the rice crop can be raised in flooded fields. Approximately 84.0% of rice varieties grown in Italy are Japonica, while the remaining is Indica.

- A rice variety that is widely cultivated for domestic consumption is the 'Lungo A' grain. This broad category includes Carnaroli, Arborio, Baldo, S. Andrea, and Volano types. In terms of foreign exchange, rice is one of the most commercially important cereal crops in Italy. Since the introduction of the European Community policy, the cultivated rice area in Italy increased mainly owing to favorable market conditions for Italian paddy production.

- An increase in the demand for rice by Italian rice-importing countries and the consumption of rice locally led to demand for rice purchase in the country. As a result, there is a significant increase in rice prices. Average rice production in Italy is 1.3 million metric ton, 53.0% of which is exported to other European countries.

Italy Rice Market Trends

Italy Dominates the Rice Production (Volume) in Europe

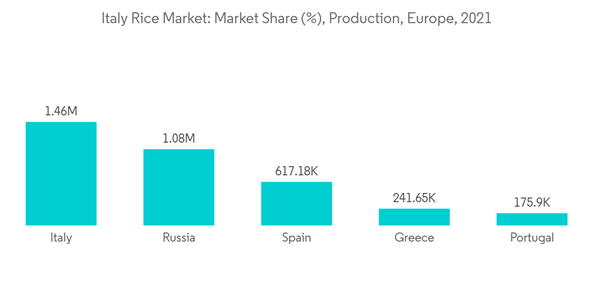

Italy is the leading rice producer in Europe, accounting for 38.6% of total European rice production in 2021, with 1.4 million metric tons. The country's favorable climate for rice cultivation is one of the main factors contributing to its dominance in the industry. Rice production is concentrated in Northern Italian regions, involving around 100 companies, employing as many 1,350 people, and generating an annual turnover of around USD 1.3 billion.About 40% of the processed rice is reserved, which involves the finest varieties of risotto rice, used for preparations such as risotto dishes, new products are also used as substitutes for bread and baked goods in gluten-free diets, and, finally, rice for the preparation of sushi. Such new trends have favored growth in national rice consumption, thus driving rice production in the country.

In addition to being the top producer, Italy is also the leading rice exporter in Europe, exporting 2.9% of its production in 2021. France, Germany, the United Kingdom, and Belgium are the major destinations for Italian rice exports, with France accounting for the largest share at 22% (USD 165 million) of total exports. Germany follows closely behind with a share of 19.9% (USD 143 million), while the United Kingdom and Belgium have smaller shares of 8.27% (USD 59 million) and 4.3% (USD 31 million), respectively.

The volume of Italian rice exports in 2021 reached 5% of the total rice traded in the world, indicating the significant role played by Italy in the global rice market. The increase in demand for rice by Italian rice-importing countries is driving the rice market, making it a significant industry with enormous economic potential.

Growing Imports of the long Grain Rice Varieties

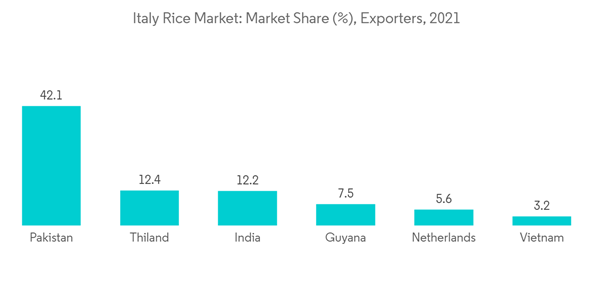

Italy's consumption of rice has been increasing steadily over the past few years. According to a report by the European Rice Federation, Italy's consumption of rice grew by 2.6% in 2019, reaching a total of 1.3 million tonnes. This trend is expected to continue, driven by the growing popularity of ethnic cuisines and the rising health consciousness among consumers. The increasing consumption has also paved way for the import of various rice varieties.Italy's dependence on imports of specialty rice highlights the importance of trade agreements and partnerships with Asian countries. Any disruptions or changes to these trade relationships could have a significant impact on Italy's food industry and the overall economy. Furthermore, the demand for sustainable and organic rice is on the rise, which presents an opportunity for domestic rice producers in Italy to compete with imports.

However, the high costs associated with producing rice in Italy, including labor and land expenses, may make it challenging to compete on price with imports from Asian countries. Italy's reliance on imported specialty rice highlights the importance of international trade partnerships and the challenges of competing with lower-cost producers. As the demand for sustainable and organic rice continues to grow.

Italy Rice Industry Overview

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.