Over the short term, the growing demand for Vietnamese fruits and vegetables among countries such as China and Korea and an increase in the number of free trade agreements to boost regional fruits and vegetable exports are some of the factors driving the market growth. More than 50.0% of Vietnam's total fruits and vegetable exports are destined for China. In recent years, exports have been reduced owing to disruptions in China's tightening of the import standards of fruits and vegetables. However, the country's effort to expand exports to markets such as the European Union, the United States, the Republic of Korea, and Japan, opened opportunities for its fruits and vegetables. The revenue from fresh fruits alone was valued at USD 6.49 billion in 2022, a 7.62% increase from 2021.

According to ITC trade data, fruit export from Vietnam increased by almost 8% from 2020 and reached USD 5,504.5 million in 2021. The major importers of fruit from Vietnam are China, the United States, the Netherlands, Thailand, and Germany. Of that, China is the major importer, with a value amounting to USD 2,080.1 million in 2021, which is almost 38% of the total fruit import value of the country. In the case of vegetables, the exports increased by 17.6% from 2020 and reached USD 486.3 million in 2021. Most of the vegetable exports from Vietnam are to the Asia-Pacific region, including China, Korea, Japan, and Singapore.

Vietnam's most important crop is rice, followed by other crops like sugarcane, cassava, sweet potato, corn, nuts, etc. The major fruits produced include banana, orange, mango, coconut, and various citrus fruits.

The impact of climatic changes and the overuse of chemical fertilizers and plant protection products, leading to the production of unsafe food, are affecting the Vietnamese brand of fruits and vegetables in the domestic and export markets.

Vietnam Fruits and Vegetables Market Trends

High Regional Exports of Fruits and Vegetables is Driving the Market

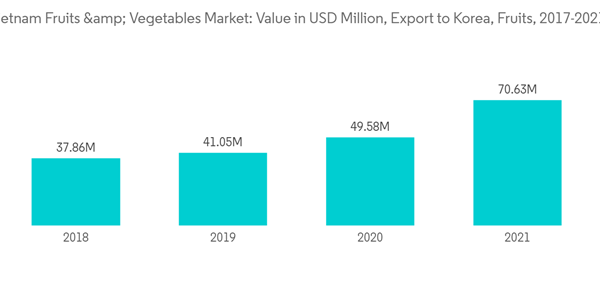

According to the General Department of Customs statistics, Vietnam's fruit and vegetable export in 2021 increased by 8.6% compared to 2020. There is a high demand for agricultural products, including fruits and vegetables, from Vietnam to countries such as the Republic of Korea and Japan, creating opportunities for Vietnam to boost the export of farm produce, especially fruits and vegetables. Though there was a drop in the overall export of fruits, the exports to certain regions increased over the past four years till 2020. The export of fruits and vegetables to Korea increased by 10.1% and to Japan by 20.1% in 2021. The major exports from the country to Korea include coconuts, bananas, mangoes, and dragon fruits.Free trade agreements made by the Ministry of Agricultural and Rural Development (MARD) with Japan and Korea offered an advantage for domestic firms to boost exports. Currently, Vietnam exports to 60 countries, including countries in the European Union, the United States, China, and other Asian countries. With an increase in the number of free trade agreements with the trading countries, the regional exports of fruits and vegetables are expected to increase during the forecast period.

High Demand for Banana is Driving the Market

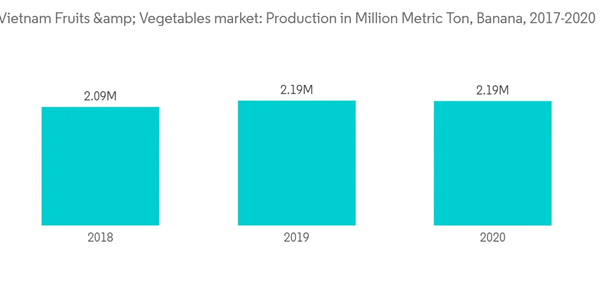

Banana is Vietnam's most important traditional fruit, both in terms of historical and economic significance. It is also an essential fruit for the Vietnamese people, widely known as 'Chuoi.' It is used in the kitchen and for spiritual purposes. In Vietnam, large varieties of bananas are grown, including Chuoi Tieu, Chuoi Qua Tạ, Chuoi Ngu, Chuoi Sap, Chuoi Cau, and Chuoi Su. Although each variety has a different taste and characteristic, all varieties have a natural and sweet taste. Chuoi Tieu and Chuoi Qua Tạ are used in medicine for anti-inflammatory protection and the treatment of high blood pressure. The average revenue per capita in terms of bananas rose by 9.25% from 2021 to 2022 and is expected to surge in the coming years.Fresh banana leaf is commonly used to wrap sticky rice and make many different kinds of Vietnamese cakes like Banh Chung, Banh U, and Banh It. Small banana buds are used as a common ingredient for salads or served in noodle soups, especially clam noodle soup. With a wide range of applications in households and medicine, the demand for bananas is expected to grow during the forecast period.

Vietnam Fruits and Vegetables Industry Overview

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.