COVID-19 impacted the global market for desalination systems due to the halt in operations. However, rising population and increased water consumption have increased demand for desalination systems.

Key Highlights

- The major factor driving the market's growth is the rising gap between water supply and demand in the country. The increasing population also escalated the demand for pure water supplies in India. Hence, this factor is expected to drive the market’s growth.

- But the high cost of water treatment plants and growing environmental concerns about desalination systems are likely to slow the market's growth over the next few years.

- The potential integration of desalination with renewable energy is likely to offer new growth opportunities for the overall industry.

India Desalination Systems Market Trends

Rising Demand from the Municipal Segment

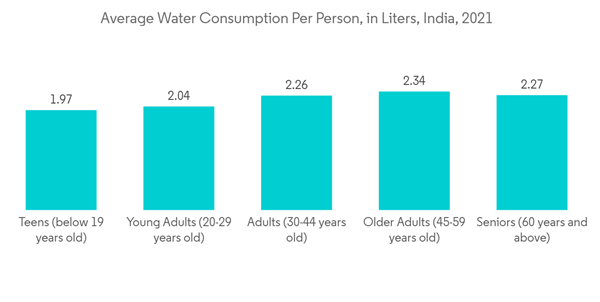

- India is having a hard time getting enough water, especially drinking water, because both surface water and groundwater sources are being used up.The water consumption rate in the country is continuously increasing every year.

- In 2021, the Planning Commission of India released a report saying that the average amount of water per person in the country had dropped to 1,486 cubic meters per year.It may continue to decline to 1,367 cubic meters in 2031.

- Thus, municipalities have taken up the responsibility to treat seawater and generate potable water so that people can get access to clean drinking water.

- In February 2021, the Mumbai Municipal Corporation, also known as the Brihanmumbai Municipal Corporation (BMC), announced its plans to set up a desalination plant with a capacity of 200 MLD per day to overcome the water shortage in the city. The plant is estimated to be operational by 2025.

- The Minister for Municipal Administration says that there are two desalination projects going on in Chennai.The plan with a capacity to treat 150 MLD at Nemmeli will be completed by 2023 and benefit 0.9 million people. Another plant with a capacity of 400 MLD will be completed by 2025, which will provide water to 2.2 million people in the city.

- Also, as part of the Sustainable Development Goal (SDG) for Clean Water and Sanitation, India wants to make sure that everyone can get safe drinking water at a price they can afford by 2030.

- All these factors are expected to drive the Indian desalination systems market during the forecast period.

Membrane Technology to Dominate the Indian Market

- In India, about 30% of the water purifier market in 2021 will be made up of reverse osmosis technology.

- Nanofiltration membranes are used a lot to remove bad smells, colors, and hardness from water systems and separate heavy metal ions.

- All of India's big desalination plants, like the Minjur plant, the Nemmeli seawater desalination plant, and the Mumbai desalination plant, use membrane technology. This shows that India is the market leader in this area.

- In the Union Budget 2022, the Government of India announced a package worth INR 60 lakh crore (USD 805 million) to provide drinkable water to every household, thus boosting the demand for desalination systems.

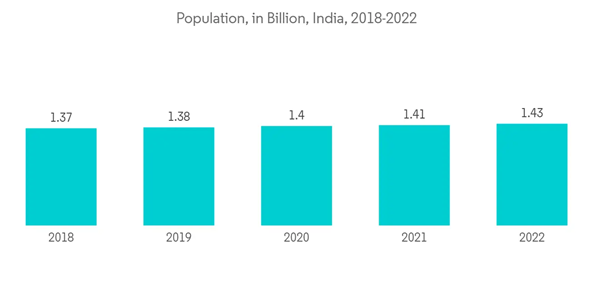

- The rising population in India has propelled the demand for water in various areas. In 2022, India will have a population of around 1.43 billion, and it has been growing rapidly in the last few years.

- In 2022, the bottled water segment’s revenue is expected to be USD 5,764 million, with the average volume per person amounting to 17.4 L.

- In 2025, India is expected to need 73 billion cubic meters of drinking water. It is expected to reach 102 billion cubic meters by 2050, so membrane technology will be needed to get the job done well.

- Therefore, during the next few years, the Indian desalination systems market is likely to be driven by the growing demand for water from different industries and the support of the government.

India Desalination Systems Industry Overview

The Desalination Systems Market in India is partially consolidated. Some of the players (not in any particular order) include Suez SA, Veolia Environnement SA, Aquatech International LLC, IDE Technologies Ltd., and IEI, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Rising Gap Between Water Supply and Demand

4.1.2 Lack of Existence of Water Infrastructure

4.2 Restraints

4.2.1 High Cost Compared to Water Treatment Plant

4.2.2 Other Restraints

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Threat of New Entrants

4.4.2 Bargaining Power of Buyers

4.4.3 Bargaining Power of Suppliers

4.4.4 Threat of Substitute Products

4.4.5 Degree of Competition

4.5 Technological Landscape

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Technology

5.1.1 Thermal Technology

5.1.1.1 Multi-stage Flash Distillation (MSF)

5.1.1.2 Multi-effect Distillation (MED)

5.1.1.3 Vapor Compression Distillation

5.1.2 Membrane Technology

5.1.2.1 Electrodialysis (ED)

5.1.2.2 Electrodialysis Reversal (EDR)

5.1.2.3 Reverse Osmosis (RO)

5.1.2.4 Other Membrane Technologies (Nanofiltration, Ultrafiltration, and Microfiltration)

5.2 Application

5.2.1 Municipal

5.2.2 Industrial

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%) **/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Abengoa

6.4.2 Aquatech International LLC

6.4.3 DuPont

6.4.4 Evoqua Water Technologies

6.4.5 Hitachi Ltd

6.4.6 IDE Technologies Ltd.

6.4.7 IEI

6.4.8 Suez SA

6.4.9 Thermax Limited

6.4.10 VA Tech Wabag Ltd

6.4.11 Veolia Environnement SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Potential Integration of Desalination with Renewable Energy

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abengoa

- Aquatech International LLC

- DuPont

- Evoqua Water Technologies

- Hitachi Ltd

- IDE Technologies Ltd.

- IEI

- Suez SA

- Thermax Limited

- VA Tech Wabag Ltd

- Veolia Environnement SA