The report entitled “China Infant Formula Market: Size, Trends & Forecasts (2021-2025 Edition)”, provides analysis of the China infant formula market, with detailed analysis of market size and growth of the industry. The analysis includes the market by value, by volume, by segmentation and by products.

Nestle, Danone, Abbott Laboratories and Feihe International Inc. are some of the key players operating in the China infant formula market, whose company profiling has been done in the report. In this segment of the report, business overview, financial overview and business strategies of the companies are provided.

Table of Contents

1. Executive Summary

2. Introduction

3. Global Market Analysis

4. China Market Analysis

5. Market Dynamics

6. Competitive Landscape

7. Company Profile

List of Figures

Samples

LOADING...

Executive Summary

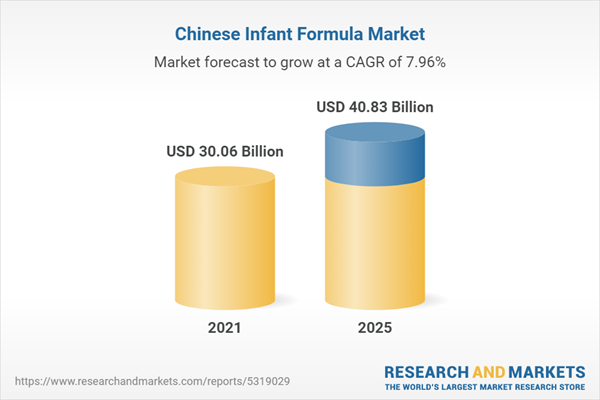

China is a major contributor to the infant formula market at the global level and is supported by increased population in China after withdrawal of one child policy by the Government of China in 2013 and increased income of middle class population.The China infant formula market has increased at a significant CAGR during the years 2016-2020 and projections are made that the market would rise in the next four years i.e. 2021-2025 tremendously. China infant formula market is expected to increase due many growth drivers such as high female workforce share, rising middle class & dual income families, increasing expenditure on premium nutrition, etc. yet the market faces some challenges such as declining new birth in china, foreign brands dominating the market, etc. global hyper converged infrastructure market is expected to observe some new market trends such as gaining popularity by goat milk instant formula, favorable policies for domestic brands, etc.

Companies Mentioned

- Nestle

- Danone

- Abbott Laboratories

- Feihe International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 76 |

| Published | April 2021 |

| Forecast Period | 2021 - 2025 |

| Estimated Market Value ( USD | $ 30.06 Billion |

| Forecasted Market Value ( USD | $ 40.83 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | China |

| No. of Companies Mentioned | 4 |