The report entitled “The US Snacking Market with Focus on Healthy Snacks: Size, Trends & Forecasts (2021-2025 Edition)”, provides in-depth analysis of the US snacking market, with detailed analysis of market size and growth. The report provides analysis of the US snacking market by value, by volume, by segment, by type and by distribution channel. The report further provides detailed segment analysis of US healthy snack market by value.

Furthermore, the report also assesses the key opportunities in the market and outlines the factors that will be driving the growth of the industry. Growth of the US snacking market has also been forecasted for the years 2021-2025, taking into consideration the previous growth patterns, the growth drivers and the current and future trends.

The US snacking market is dominated by few players like Nestle SA, PepsiCo, Inc., General Mills Inc., and Kellogg’s, who are also profiled with their financial information and respective business strategies.

Company Coverage

Furthermore, the report also assesses the key opportunities in the market and outlines the factors that will be driving the growth of the industry. Growth of the US snacking market has also been forecasted for the years 2021-2025, taking into consideration the previous growth patterns, the growth drivers and the current and future trends.

The US snacking market is dominated by few players like Nestle SA, PepsiCo, Inc., General Mills Inc., and Kellogg’s, who are also profiled with their financial information and respective business strategies.

Company Coverage

- Nestle SA

- PepsiCo Inc.

- General Mills Inc.

- Kellogg’s

Table of Contents

1. Executive Summary

2. Introduction

3. The US Market Analysis

4. Market Dynamics

5. Competitive Landscape

6. Company Profiles

List of Figures

List of Tables

Samples

LOADING...

Executive Summary

Snacking includes the manageable, convenient and small packaged food products that can be solid or liquid, hot or cold and require very less or no additional processing of food and can be directly consumed by the person to satisfy the instant craving for food. The market is bifurcated in different segments which includes, chips (potato chips/snacks), healthy snacks, convenience snacks and other snack foods.The US snacking market has shown progressive growth during the previous years and estimations are made that the market would further propel during the forecasted period i.e., 2021 to 2025. The US snacking market is predicted to augment due to escalating disposable income, rising youth population, growth in fast food demand, increasing urban population, escalating middle class spending, swelling functional food demand, bulging employed population etc.

On the other hand, the growth of The US snacking market would be negatively impacted by numerous challenges. Some of the major challenges faced by the market are, fluctuation in raw material prices, unanticipated business disruption and stringent regulations. Growth in e-commerce food product sale, surging organic snack demand and evolution of personalized and customized snacks are some of the latest trends in the market that would support the growth of the market in the forecasted period.

Companies Mentioned

- Nestle SA

- PepsiCo Inc.

- General Mills Inc.

- Kellogg’s

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 103 |

| Published | April 2021 |

| Forecast Period | 2021 - 2025 |

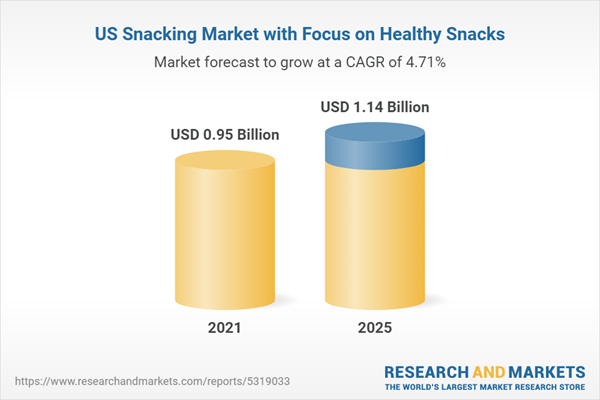

| Estimated Market Value ( USD | $ 0.95 Billion |

| Forecasted Market Value ( USD | $ 1.14 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 4 |