Roofing is an integral component of a residential, commercial, or industrial structure, which can protect the safety of the occupants. According to the roofing market report, the market for roofing is likely to witness an accelerated expansion, owing to the increasing deployment of roofing systems across urban and rural areas to reduce the impact of excessive moisture, restrict water seepage during rainy seasons, and prevent damage caused by pathogens such as structural mildew, mould, and bacteria, among others. Increasing concerns pertaining to the health of children and geriatrics in the residential sector is expected to intensify the roofing industry outlook.

Roofing is the process of applying an external covering on the roof of a building. The external covering can either be self-supporting or be supported by structures underneath it. According to the roofing industry analysis, the market for roofing in the United States contributed to a significant proportion of the market. Due to rapid urbanisation, technological innovations and a rise in construction activities, the roofing market size in the United States is projected to grow at a healthy pace and is expected to drive the demand for roofing globally.

The rapidly growing construction industry in emerging economies like China, India and the Middle East is further expanding the roofing market size. New innovations like green and eco-friendly roofing are also gaining popularity, especially in countries like the United States, the United Kingdom, and Japan. Rising investments in the residential construction sector along with eco-friendly roofing innovations will make the residential sector one of the major application sectors in the industry, thereby, propelling the residential roofing market in the coming years.

Key Trends and Developments

Rising preference for self-cleaning and self-healing roofing; increasing focus on sustainability; the development of smart roofing systems; and rising applications of 3D printing are favouring the roofing market expansion.December 2024

Sika® announced the launch of Sikalastic®-625 BMS, its innovative polyurethane liquid applied membrane (LAM) for flat roofs to emphasise sustainable chemical innovation. The product reduces carbon emissions by more than 35% and supports consumers reduce their roof waterproofing carbon footprint.November 2024

Percheron Capital announced the launch of Alloy Roofing, a residential roofing repair and replacement services platform. The platform is intended to partner with leading roofing businesses across the United States to advanced high-quality roofing repair and replacement solutions to businesses.August 2024

KPG Roofings announced the commencement of its domestic production of ceramic roof tiles in Gujarat, India. By manufacturing ceramic roof tiles indigenously, the company aims to mitigate the challenges posed by the roofing industry amid supply chain disruptions and fluctuating shipping charges.February 2024

Holcim acquired ZinCo, a leading German advanced green roofing system manufacturer, to expand its range of sustainable roofing systems. ZinCo’s roofing expertise aims to complement the company’s existing roofing business while supporting the transition to sustainable building.Rising demand for self-cleaning and self-healing roofing

Self-healing and self-cleaning roofs made from thermoplastics are gaining significant popularity as they can autonomously repair minor damage, hence eliminating the need for frequent maintenance and repair. Benefits such as extended lifespan, availability in diverse styles and colours, and improved durability further boost the appeal of self-cleaning and self-healing roofing.Increasing emphasis on sustainability

With the growing trend of sustainability, there is a rising demand for roofing solutions that are made from recyclable materials, are durable, and reduce energy use for heating and cooling. In the forecast period, recycled and upcycled roofing made from materials such as rubber, metal, and plastic is expected to gain significant popularity.Development of smart roofing systems

The development of smart roofing systems equipped with solar panels, sensors, the Internet of things (IoT), Wi-Fi, and other sophisticated features to provide homeowners control over energy usage and identify potential roofing issues is anticipated to revolutionise the market.Growing applications of 3D printing technology in roofing

3D printing technology is shaping the roofing market trends and dynamics by reducing material waste and facilitating faster production times. The ability of 3D printing technology to develop complex shapes and designs with enhanced precision is enabling the development of customised roofing solutions, driving the market.Roofing Industry Segmentation

Roofing is the process of applying an external covering on the roof of a building. The external covering can either be self-supporting or be supported by structures underneath it.On the basis of type, the roofing market is divided into:

- Asphalt Shingles

- Metal

- Tiles

- Wood Shingles

- Green Roofs

- Others

Market Breakup by Application

- Residential

- Commercial

Market Installation Cost by Roof Type

- Asphalt Shingles

- Metal

- Tiles

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Global Roofing Market Share

Tiles are one of the most popular types of roofing which account for a healthy portion of the roofing market share. This can be attributed to the growing environmental concerns among consumers and developers. Clay and concrete tiles are especially favoured as they are durable and sustainable with a proven positive impact on the environment in the long run. They help in conserving energy by controlling the interior temperature by allowing air to circulate between the loosely arranged tiles leading to a decrease in the usage of air conditioning and conserving electricity. Stringent regulations of various governments aimed towards curbing the emission of greenhouse gases are the crucial roofing industry trends. Metal roofing, on the other hand is expected to propel the roofing market growth in the forecast period, with their low maintenance cost, durability and recyclability.Based on applications, the roofing market is bifurcated into residential and commercial sector. As per the roofing market research, it is expected that roofing will find applications in the residential sector due to the rising number of proposed residential constructions.

The regional markets for roofing include North America, Europe, the Asia-Pacific, Latin America, and the Middle East and Africa.

Roofing Market Analysis

Rapid urbanisation and increasing standards of living in the emerging economies are the key roofing market trends fuelling the market growth. There has been a rising demand for new energy-efficient roofing products like green roofing which reduce electricity waste by decreasing air conditioning usage in the long run as well as improving the air quality and increasing the life span of the roof. These green roofs are especially in high demand in the developed nations of North America and Europe in green building constructions, which are the emerging trends in roofing industry. In addition to this, initiatives focussing on energy-efficient projects, such as renovating old buildings wherein old roofs are replaced by new ones, are also invigorating the roofing market growth. In well-established economies such as the United States, exceptional roofing services to cater to the demand of sporting stadiums and commercial construction projects, which is expected to expand the roofing market size, as well as US commercial roofing market size in the forecast period. Moreover, in the United States, the local demand for roofing to elude from weather disturbances, such as heavy rains, snow, and heat, is likely to contribute to the expansion of roofing market size US, leading to an augmented growth of North America roofing market. Meanwhile, the increasing roofing repair demands in Europe is anticipated to fuel the roofing market Europe in the coming years.Construction of commercial buildings like multiplexes and shopping complexes due to changing lifestyles and increasing urbanisation in the developing countries of Asia-Pacific, Latin America and Africa have aided the market growth. Asia-Pacific is the leading market with growing construction activities in both the residential and commercial sectors, especially in countries like India, China, Indonesia and Vietnam. The Middle East is also a leading roofing market as the governments in the UAE and Qatar have increased their expenditure in commercial and industrial construction projects driving the growth of the roofing market.

Competitive Landscape of Roofing Market

Key roofing market players are increasingly utilising eco-friendly and recycled materials in the manufacturing of roofing systems to enhance their sustainability profile. Roofing companies are also adopting technologies such as artificial intelligence and robotics to streamline their production processes, lower overall costs, and enhance efficiency.Carlisle Companies

Carlisle Companies, founded in 1917 and headquartered in Arizona, United States, is a prominent supplier of innovative building envelope products and solutions for energy-efficient buildings. With a presence in over 180 locations across the world, the company aims to achieve net-zero greenhouse gas emissions by 2050.Owens Corning

Owens Corning, headquartered in Ohio, United States, and founded in 1938, is a leading building and construction materials company. Its integrated businesses, Insulation, Roofing, and Composites, provide sustainable, durable, and energy-efficient solutions to its customers. Boasting 18,000 employees in 30 countries, the company generated sales of USD 9.7 billion in 2023.BMI Group

BMI Group, headquartered in Reading, United Kingdom, is a company that offers innovative roofing and waterproofing systems to roofers, architects, and building and home-owners. The company boasts 8,500 employees and 120 manufacturing facilities across 30 countries across the globe. Some of its prominent brands include Monier, Braas, and Icopal, among others.Atlas Roofing Corporation

Atlas Roofing Corporation, founded in 1982 and headquartered in Georgia, United States, is a prominent manufacturer of residential and commercial building materials. The company has operations across Canada, the United States, and Mexico. It actively partners with companies such as Scotchgard Protector and 3M to provide homeowners with enhanced protection against streaking and staining of roofs.Other key players in the roofing market include Saint Gobain, Wienerberger AG, Beacon Roofing Supply, Inc., Duro-Last, Inc., Sika AG, and GAF Materials LLC, among others.

Table of Contents

Companies Mentioned

The key companies featured in this Roofing market report include:- Carlisle Companies

- Owens Corning

- BMI Group

- Saint Gobain

- Wienerberger AG

- Beacon Roofing Supply, Inc.

- Duro-Last, Inc.

- Atlas Roofing Corporation

- Sika AG

- GAF Materials LLC

Table Information

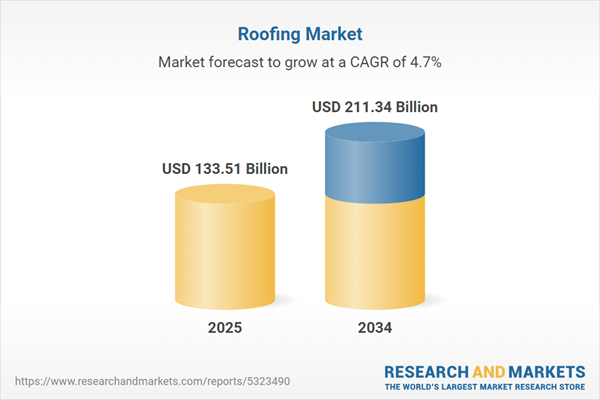

| Report Attribute | Details |

|---|---|

| No. of Pages | 156 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 133.51 Billion |

| Forecasted Market Value ( USD | $ 211.34 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |