The methanol market growth is primarily driven by the rising demand for methanol as a feedstock in the production of formaldehyde, acetic acid, and other key chemicals that are being used across multiple industries. Moreover, the growing applications in fuel blending, which improves efficiency and helps to reduce emissions is further propelling the market. In addition, the rising integration of methanol-to-olefins (MTO) technology is giving impetus to the generation of plastics and other derivative products, further expanding the scope of the market. Furthermore, the growing application of methanol as an alternate marine fuel is mitigating issues related to environmental degradation and is driving the market further. In addition, accelerating investments in renewable methanol production based on captured CO₂ are aligning with global sustainability objectives, thereby bolstering methanol market demand. Apart from this, the shift in the attention of people towards cleaner fuels for internal combustion engines of the automobile industry is fostering methanol-based substitutes. Apart from this, integration of methanol in energy storage systems as a hydrogen carrier is gaining momentum and offering new market opportunities.

The United States stands out as a key regional market, driven by the increasing investments in natural gas-based methanol production, leveraging the country's abundant shale gas reserves. The expansion of petrochemical industries is driving demand for methanol as a critical feedstock. Additionally, government incentives and policies promoting low-carbon energy solutions are accelerating the adoption of methanol in clean energy initiatives. The rise in the construction and infrastructure sectors is contributing to the increased use of methanol-derived products, such as adhesives and resins. Furthermore, innovations in methanol production technologies, aimed at reducing costs and improving efficiency, are supporting the methanol market share. For instance, on January 10, 2024, Mitsui & Co. and Celanese Corporation's joint venture, Fairway Methanol LLC, started manufacturing methanol from captured CO₂ emissions, targeting the recycling of 180,000 metric tons of CO₂ annually. This fits within Mitsui's strategic emphasis on the Global Energy Transition and building a sustainable, circular fuel value chain. By using carbon capture and utilization technology, the project represents some of the innovative solutions for reducing fossil fuel dependency while ensuring environmental sustainability.

Methanol Market Trends:

The Widespread Product Adoption in the Chemical Industry

According to an industrial report, in 2023, methanol production worldwide was estimated to have surpassed 111 million metric tons, a slight increase from the previous year. Methanol is widely used in the chemical industry as a versatile raw material to produce various chemicals and chemical intermediates. It is widely used due to its versatility as a chemical feedstock, and its properties, such as its reactivity, solvency, and ease of handling, make it an essential component in various chemical processes. Moreover, methanol serves as a vital feedstock for producing acetic acid, a chemical used to manufacture acetic anhydride, vinyl acetate monomer (VAM), and various esters. In line with this, acetic acid and its derivatives are used to produce fibers, films, paints, solvents, and other industrial products.Significant Growth in the Automotive Industry

According to an industrial report, worldwide car sales in 2023 showed a significant recovery after being steady in 2022, increasing by nearly 10% and exceeding 72 million units as supply chain issues lessened. Methanol is widely used as an alternative fuel for internal combustion engines in passenger vehicles as it can be blended with gasoline in certain proportions. It also reduces emissions and improves fuel efficiency, which in turn is acting as a growth-inducing factor. Additionally, methanol is used as a fuel in professional motorsports such as drag racing and oval track racing as it offers high octane ratings and excellent knock resistance, allowing for increased engine performance. Apart from this, the widespread product utilization as an alternative power source for electric vehicles (EVs), where methanol is converted into electricity through electrochemical reactions, is supporting the market growth.Extensive research and development (R&D) activities

The methanol market is continuously changing due to the extensive R&D activities leading to various innovations. Moreover, the introduction of renewable methanol produced from non-fossil fuel feedstocks, such as biomass, industrial waste gases, or captured carbon dioxide (CO2), is propelling the market growth. For instance, according to an industrial report, global production of renewable methanol from biomass, industrial waste gases, and captured CO2 was less than 0.2 million metric tons in 2023. This is just a minute fraction of total methanol production, which stands at more than 98 million metric tons per annum. However, increasing concern for sustainability and decarbonization has been speeding up developments in the sector. As such, production capacity is likely to increase significantly. Additionally, researchers are continuously working on developing advanced catalysts with improved selectivity, activity, and stability for methanol synthesis, which is positively influencing the market growth. Besides this, ongoing research and development efforts are exploring advanced technologies such as carbon dioxide utilization and biomass conversion to further expand the range of methanol production options and promote sustainability, which is providing a considerable fuel to the market growth.Methanol Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global methanol market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on the application.Analysis by Application:

- Formaldehyde

- Dimethyl ether

- Gasoline

- Chloromethane

- MTBE/TAME

- Acetic acid

- Others

Regional Analysis:

- China

- Asia Pacific (excluding China)

- Europe

- North America

- Latin America

- Middle East and Africa

Key Regional Takeaways:

United States Methanol Market Analysis

Driven primarily by the chemical industry and increasing energy production, besides demanding an alternate type of fuel, the U.S. methanol market keeps experiencing growth. According to the U.S. Energy Information Administration, in the year, 2022, the country reportedly produced around 3.3 million metric tons of methanol. Methanol is being increasingly used in biodiesel production. U.S. biomass-based diesel output has reportedly touched about 4 billion gallons by 2023. As per Clean Fuels Alliance America, the country is also expanding its methanol-to-olefins capacity, which would add to its manufacturing sector. Top players like Methanex and Celanese hold an upper hand in the market. Methanex has even set up the largest methanol plant in the country. Policy support for cleaner fuels and improvements in methanol production technology continue to spur market growth. The United States is also an important exporter, with increased demand for methanol in Asian markets, making it a critical player in the global methanol industry.Europe Methanol Market Analysis

The growth in Europe's methanol market is driven by growing demand for both the chemical and automotive sectors and greater consumption for green fuel technologies. According to the European Methanol Producers' Association, Europe produced around 8,540,000 tons in 2023, with countries like Germany and the Netherlands driving industrial demand. The European Union's pressure for reduction of carbon emissions is propelling investment in renewable methanol. For instance, various projects of methanol production from waste and biomass have been initiated. For example, a Netherlands-based company Carbon Clean Solutions aims to capture CO2 and convert it into methanol for use by chemical and energy sectors. Several automakers have already commenced testing of vehicles using methanol as fuel that may replace gasoline for the environment. Europe's tough environmental regulations also encourage innovation in methanol production, making it a leader in sustainable chemical manufacturing.Asia Pacific Methanol Market Analysis

Increasing rapid industry demand, growing economic trend, and increasing energy necessities are driving the Asia Pacific methanol market. According to the International Methanol Institute, China is not only the world's biggest methanol producer, but its capacity exceeds 40 million tons by 2023. Notably, it is also the biggest importer of methanol with an import figure of 18 million tons in 2022. The most important one amongst them is India with the annual growth rate of methanol consumption pegged at 7%. This is because it promotes methanol-based fuels. It forms part of the National Policy on Biofuels, so demand within manufacturing processes for methanol is fairly high, as is often in the production of plastics and other chemicals. Investment is significant in methanol-to-olefins plants. There is also interest for the region in using methanol as a marine fuel, with Japan and South Korea leading the way with ships that run on methanol. The growth of the market is further supported by government-backed initiatives in both China and India, thus making Asia Pacific a crucial hub for both methanol production and consumption.Latin America Methanol Market Analysis

Latin America's methanol market is growing steadily, mostly due to the demand from industrial chemicals and alternative fuels. According to an industry report, Trinidad and Tobago had a production capacity of more than 6 million metric tonnes of methanol per annum. Methanol Holdings (Trinidad) Limited alone boasts of producing over 4 million metric tonnes annually. Methanex Corporation's Atlas plant in Trinidad during the third quarter of 2023 produced 287,000 tonnes of methanol. Brazil has increased its production capacity in methanol while focusing on methanol usage for biodiesel and energy generation purposes. The middle class of countries like Argentina and Mexico are also showing a growing rate due to more industrialization and further pushing the demand for methanol. In addition, the growing demand of the region's petrochemical industry and clean fuel movement is opening doors to more opportunities for methanol in transportation. Export capabilities of Latin America are improving; countries such as Trinidad and Tobago will benefit from good demand coming from the United States and Asia Pacific. Latin America will continue to play an important role as one of the world's significant suppliers of methanol.Middle East and Africa Methanol Market Analysis

This industry is growing steadily in the Middle East and Africa due to the vast natural gas reserves in the region and due to its importance in world energy markets. According to the industry reports, Iran and Saudi Arabia were among the top producers of methanol, with the ability to produce more than 10 million tons annually. Because the Middle East is strategically situated along global methanol trade lanes, it facilitates exports directly into Asia and Europe. Methanol is primarily consumed in Africa within South Africa, with continuous growth demands in industrial consumers such as plastics and chemicals. Expansion of methanol production sites by major companies in the Middle East is also supporting the region in terms of market share - SABIC and Qatar Fuel are major players in that region. Increased attention to using methanol as a substitute to the traditional fuel sources drives demand for alternative energy supply sources and fuels diversification. The region remains instrumental in the supply of methanol at the international level.Competitive Landscape:

According to the emerging methanol market trends, several key players are significantly investing in research and development (R&D) projects to explore innovative methods to improve methanol production processes. Additionally, the development of advanced catalysts, novel reactor designs, and optimization of process conditions to improve methanol yield and energy efficiency and reduce environmental impacts is supporting the market growth. Furthermore, growing strategic partnerships between top companies, industry players, academic institutions, and research organizations to advance methanol-related technologies are further driving the market growth. Besides this, the leading market players and various manufacturers are investing in R&D activities to develop advanced production methods, such as the BASF and ICI processes. Several companies are also expanding their production capacities by establishing new plants to serve the growing markets and gain a competitive advantage.The report provides a comprehensive analysis of the competitive landscape in the methanol market with detailed profiles of all major companies.

Key Questions Answered in This Report

1. How large is the methanol market?2. What is the future outlook of the methanol market?

3. What are the key factors driving the methanol market?

4. Which region accounts for the largest methanol market share?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Physical and Chemical Properties

4.3 Key Industry Trends

5 Global Methanol Industry

5.1 Market Overview

5.2 Market Performance

5.2.1 Volume Trends

5.2.2 Value Trends

5.3 Impact of COVID-19

5.4 Price Trends

5.4.1 Key Price Indicators

5.4.2 Price Structure

5.4.3 Price Trends

5.5 Market Forecast

5.6 SWOT Analysis

5.6.1 Overview

5.6.2 Strengths

5.6.3 Weaknesses

5.6.4 Opportunities

5.6.5 Threats

5.7 Value Chain Analysis

5.7.1 Overview

5.7.2 Raw Material Mining and Extraction

5.7.3 Manufacturing

5.7.4 Marketing

5.7.5 Distribution

5.7.6 Export

5.7.7 End Use

5.8 Margin Analysis

5.9 Porter’s Five Forces Analysis

5.9.1 Overview

5.9.2 Bargaining Power of Buyers

5.9.3 Bargaining Power of Suppliers

5.9.4 Degree of Competition

5.9.5 Threat of New Entrants

5.9.6 Threat of Substitutes

5.10 Trade Data

5.10.1 Imports

5.10.2 Exports

5.11 Key Market Drivers and Success Factors

6 Performance of Key Regions

6.1 China

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Asia Pacific (Excluding China)

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Europe

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 North America

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Latin America

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Middle East and Africa

6.6.1 Market Trends

6.6.2 Market Forecast

7 Market Breakup by Application

7.1 Formaldehyde

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Dimethyl Ether

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Gasoline

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Chloromethane

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 MTBE/TAME

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 Acetic Acid

7.6.1 Market Trends

7.6.2 Market Forecast

7.7 Others

7.7.1 Market Trends

7.7.2 Market Forecast

8 Competitive Landscape

8.1 Market Structure

8.2 Market Breakup by Key Players

8.3 Key Player Profiles

9 Methanol Manufacturing Process

9.1 Product Overview

9.2 Chemical Reactions Involved

9.3 Detailed Process Flow

9.4 Raw Material Requirements

9.5 Mass Balance and Feedstock Conversion Rates

10 Methanol: Feedstock Analysis

10.1 Coal

10.1.1 Market Performance

10.1.1.1 Volume Trends

10.1.1.2 Value Trends

10.1.2 Price Trends

10.1.3 Market Breakup by Region

10.1.4 Market Breakup by Application

10.2 Natural Gas

10.2.1 Market Performance

10.2.1.1 Volume Trends

10.2.1.2 Value Trends

10.2.2 Price Trends

10.2.3 Market Breakup by Region

10.2.4 Market Breakup by Application

List of Figures

Figure 1: Global: Methanol Market: Major Drivers and Challenges

Figure 2: Global: Methanol Market: Volume Trends (in Million Tons), 2019-2024

Figure 3: Global: Methanol Market: Value Trends (in Billion USD), 2019-2024

Figure 4: Global: Methanol Market: Average Prices (in USD/Ton), 2019-2024

Figure 5: Global: Methanol Market Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 6: Global: Methanol Market Forecast: Value Trends (in Billion USD), 2025-2033

Figure 7: Global: Methanol Market Forecast: Average Prices (in USD/Ton), 2025-2033

Figure 8: Global: Methanol Market: Price Structure

Figure 9: Global: Methanol Industry: SWOT Analysis

Figure 10: Global: Methanol Industry: Value Chain Analysis

Figure 11: Global: Methanol Industry: Profit Margin at Various Level of Supply Chain

Figure 12: Global: Methanol Industry: Porter’s Five Forces Analysis

Figure 13: Global: Methanol Market: Breakup by Region (in %), 2024

Figure 14: China: Methanol Market (in ‘000 Tons), 2019 & 2024

Figure 15: China: Methanol Market Forecast (in ‘000 Tons), 2025-2033

Figure 16: Asia Pacific (Excluding China): Methanol Market (in ‘000 Tons), 2019 & 2024

Figure 17: Asia Pacific (Excluding China): Methanol Market Forecast (in ‘000 Tons), 2025-2033

Figure 18: Europe: Methanol Market (in ‘000 Tons), 2019 & 2024

Figure 19: Europe: Methanol Market Forecast (in ‘000 Tons), 2025-2033

Figure 20: North America: Methanol Market (in ‘000 Tons), 2019 & 2024

Figure 21: North America: Methanol Market Forecast (in ‘000 Tons), 2025-2033

Figure 22: Latin America: Methanol Market (in ‘000 Tons), 2019 & 2024

Figure 23: Latin America: Methanol Market Forecast (in ‘000 Tons), 2025-2033

Figure 24: Middle East and Africa: Methanol Market (in ‘000 Tons), 2019 & 2024

Figure 25: Middle East and Africa: Methanol Market Forecast (in ‘000 Tons), 2025-2033

Figure 26: Global: Methanol Market: Breakup by Application (in %), 2024

Figure 27: Global: Methanol Market: Formaldehyde (in ‘000 Tons), 2019 & 2024

Figure 28: Global: Methanol Market Forecast: Formaldehyde (in ‘000 Tons), 2025-2033

Figure 29: Global: Methanol Market: Dimethyl Ether (in ‘000 Tons), 2019 & 2024

Figure 30: Global: Methanol Market Forecast: Dimethyl Ether (in ‘000 Tons), 2025-2033

Figure 31: Global: Methanol Market: Gasoline (in ‘000 Tons), 2019 & 2024

Figure 32: Global: Methanol Market Forecast: Gasoline (in ‘000 Tons), 2025-2033

Figure 33: Global: Methanol Market: Chloromethane (in ‘000 Tons), 2019 & 2024

Figure 34: Global: Methanol Market Forecast: Chloromethane (in ‘000 Tons), 2025-2033

Figure 35: Global: Methanol Market: MTBE/TAME (in ‘000 Tons), 2019 & 2024

Figure 36: Global: Methanol Market Forecast: MTBE/TAME (in ‘000 Tons), 2025-2033

Figure 37: Global: Methanol Market: Acetic Acid (in ‘000 Tons), 2019 & 2024

Figure 38: Global: Methanol Market Forecast: Acetic Acid (in ‘000 Tons), 2025-2033

Figure 39: Global: Methanol Market: Other Applications (in ‘000 Tons), 2019 & 2024

Figure 40: Global: Methanol Market Forecast: Other Applications (in ‘000 Tons), 2025-2033

Figure 41: Global: Methanol Market: Share of Key Players (in %), 2024

Figure 42: Methanol Manufacturing: Detailed Process Flow

Figure 43: Methanol Manufacturing: Conversion Rate of Feedstocks

Figure 44: Global: Coal Market: Production Volume Trends (in Million Tons), 2019-2024

Figure 45: Global: Coal Market: Value Trends (in ’000 USD), 2019-2024

Figure 46: Global: Coal Market: Average Prices (in USD/Ton), 2019-2024

Figure 47: Global: Coal Market: Breakup by Region (in %), 2024

Figure 48: Global: Coal Market: Breakup by Application (in %), 2024

Figure 49: Global: Natural Gas Market: Production Volume Trends (in Million Tons), 2019-2024

Figure 50: Global: Natural Gas Market: Value Trends (in ’000 USD), 2019-2024

Figure 51: Global: Natural Gas Market: Average Prices (in USD/Ton), 2019-2024

Figure 52: Global: Natural Gas Market: Breakup by Region (in %), 2024

Figure 53: Global: Natural Gas Market: Breakup by Application (in %), 2024

List of Tables

Table 1: Methanol: Physical Properties

Table 2: Methanol: Chemical Properties

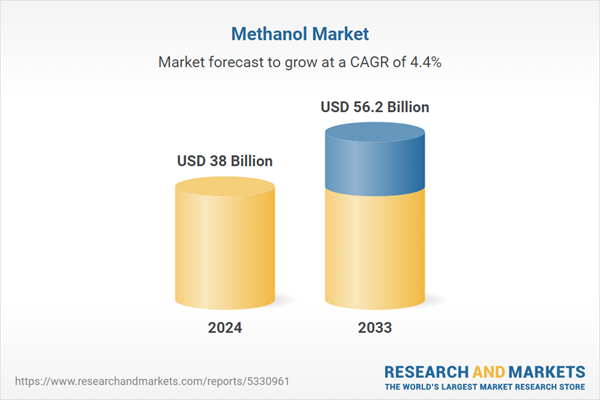

Table 3: Global: Methanol Market: Key Industry Highlights, 2024 and 2033

Table 4: Global: Methanol Market Forecast: Breakup by Region (in ‘000 Tons), 2025-2033

Table 5: Global: Methanol Market Forecast: Breakup by Application (in ‘000 Tons), 2025-2033

Table 6: Global: Methanol Market: Imports by Major Countries

Table 7: Global: Methanol Market: Exports by Major Countries

Table 8: Methanol Manufacturing: Raw Materials Required

Table 9: Methanol Manufacturing: Chemical Reactions Involved in Syngas Formation

Table 10: Methanol Manufacturing: Chemical Reactions Involved in Methanol Formation

Table 11: Global: Methanol Market: Competitive Structure

Table 12: Global: Methanol Market: Key Players

Table 13: Global: Coal Market: Key Suppliers

Table 14: Global: Natural Gas Market: Key Suppliers

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 38 Billion |

| Forecasted Market Value ( USD | $ 56.2 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |