Bakery Ingredients Market Analysis:

- Major Market Drivers: The busy lifestyles of individuals are escalating the demand for convenient bakery products, which is acting as a significant growth-inducing factor. Moreover, the increasing interest of people in home baking is also propelling the market.

- Key Market Trends: Key players are introducing packaging solutions that extend shelf life, preserve freshness, and enhance convenience for both consumers and commercial bakers, which is fueling the overall market.

- Competitive Landscape: Some of the prominent companies in the global market include Cargill, Incorporated, Koninklijke DSM N.V., Kerry Group, Südzucker AB, AAK AB, Associated British Foods, Lesaffre ET Compagnie, Tate & Lyle, PLC Archer Daniels Midland Company, Ingredion Incorporated, Corbion N.V., IFFCO Ingredients Solution, Taura Natural Ingredients Limited, Dawn Foods Products, Inc., Muntons Plc, British Bakels Ltd., Lallemand Inc., Novozymes A/S, and Puratos Group, among many others.

- Geographical Trends: The deep-rooted baking traditions and culinary legacies of Europe are augmenting the market across the region. Besides this, the rising number of centers and skilled bakers is further catalyzing the market.

- Challenges and Opportunities: One of the primary challenges hindering the market is the inflating costs of raw materials. However, the development of cost-effective ingredient alternatives will continue to fuel the market over the forecasted period.

Bakery Ingredients Market Trends:

Rising Popularity of Natural Ingredients

The growing consumer health-consciousness is bolstering the demand for organic bakery components. This trend is also driven by the shifting preference for clean labels and minimally processed foods. For instance, in February 2024, GoodMills Innovation launched a new range of clean-label ingredients called Slow Milling, designed to help industrial and retail bakeries make artisan-style baked goods. By enabling the production of traditional goods on an industrial scale, the range aims to enhance cost efficiency while providing fresh, visually appealing bakery products.Increasing Innovations in Vegan Baking

The inflating popularity of plant-based alternatives is stimulating the bakery ingredients market insights. Companies like Just Egg have launched plant-based egg substitutes, while Follow Your Heart offers vegan butter suitable for baking. Furthermore, in March 2024, one of the food tech companies, Incredo, Inc. (U.S.), announced the introduction of Incredo Sugar G2, a concentrated version of its globally recognized sugar-based sugar reduction solution, Incredo Sugar. The solution is the latest addition to its portfolio of innovative offerings for food manufacturers and CPGs. Incredo Sugar G2 is a clean-label, patent-pending concentrated sugar-carrier complex and is now available to companies in Europe and North America for use in chocolates, spreads, baked goods, gummies, etc.Growing Demand for Convenience

The introduction of ready-to-use baking mixes, which offer easy and quick solutions for home baking, is bolstering the market. Furthermore, Pillsbury's launch of pre-mixed batters and doughs exemplifies this trend, thereby providing consumers with hassle-free options for making bread, cookies, and cakes. Similarly, Duncan Hines offers a variety of ready-to-bake mixes that simplify the baking process. These product launches cater to the busy lifestyles of modern consumers, emphasizing convenience without compromising on quality and driving the growth of the ready-to-use segment in the market.Global Bakery Ingredients Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with the bakery ingredients market forecast at the global and regional levels for 2025-2033. Our report has categorized the market based on the product type, application, and end use sector.Breakup by Product Type:

- Emulsifiers

- Leavening Agents

- Enzymes

- Baking Powder and Mixes

- Oils, Fats and Shortenings

- Colors and Flavors

- Starch

- Others

Baking powder and mixes currently exhibit a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes emulsifiers, leavening agents, enzymes, baking powder and mixes, oils, fats and shortenings, colors and flavors, starch, and others. According to the report, baking powder and mixes represented the largest market segmentation.Baking powder and mixes have seen innovative product launches aimed at catering to diverse consumer preferences and dietary needs. For instance, Bob's Red Mill introduced a gluten-free baking powder, appealing to those with gluten sensitivities or celiac disease. Similarly, Pillsbury has expanded its product line with convenient, ready-to-use baking mixes that simplify home baking. This, in turn, is expanding the bakery ingredients industry size across the segmentation.

Breakup by Application:

- Breads

- Cookies and Biscuits

- Rolls and Pies

- Cakes and Pastries

- Others

Currently, breads hold the largest bakery ingredients market demand

The report has provided a detailed breakup and analysis of the market based on the application. This includes breads, cookies and biscuits, rolls and pies, cakes and pastries, and others. According to the report, breads represented the largest market segmentation.Breads represent the largest segmentation in the market due to their fundamental role in diets worldwide and the variety of bread types that cater to different tastes and preferences. The high consumption of staples like sandwich loaves, artisanal breads, and specialty breads such as gluten-free or whole grain options fuels this segment's dominance. For example, the popularity of sourdough has surged, driving demand for specific ingredients like sourdough starters and high-quality flours. Companies like King Arthur Baking Company offer a wide range of flours and bread mixes to meet this demand. Additionally, Bob's Red Mill provides diverse bread-baking ingredients, including whole wheat and organic flour, catering to health-conscious consumers. This, in turn, is bakery ingredients market revenue.

Breakup by End Use Sector:

- Industrial

- Foodservice

- Retail

Allylamines, such as terbinafine, are prominently featured due to their high efficacy and relatively short treatment duration, making them a preferred choice for both patients and healthcare providers. Azoles, including itraconazole and fluconazole, are also thoroughly examined, highlighting their broad-spectrum antifungal activity and flexibility in dosing regimens, which cater to patients requiring alternative treatment options. Griseofulvin, an older antifungal, is analyzed for its continued use in cases where other treatments are contraindicated. The report further explores other emerging drug classes and novel antifungal agents that are being developed to address the limitations of existing therapies, which is propelling the bakery ingredients market share. This analysis not only informs about the market dynamics but also aids in understanding the evolving preferences and trends in antifungal treatments.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Europe currently dominates the market

The bakery ingredients market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Europe accounted for the largest market share.The market is robust, driven by the region's rich baking traditions and growing consumer demand for high-quality and innovative products. Countries like France, Germany, and Italy, renowned for their artisanal breads and pastries, significantly influence market trends. For instance, French baguettes and croissants require specialized flour and butter, while Italian panettone demands unique yeast and candied fruit. Companies like Lesaffre and Puratos are pivotal in supplying these essential ingredients, ensuring authenticity and quality. This, in turn, is bolstering the bakery ingredients market outlook across Europe.

Competitive Landscape:

Companies are investing in research and development (R&D) activities to create innovative ingredient formulations that align with changing consumer preferences. They are focusing on clean-label ingredients, natural alternatives to artificial additives, and functional ingredients that enhance the nutritional profile of baked goods. Additionally, many bakery ingredients manufacturers are prioritizing sustainability by adopting eco-friendly practices throughout their supply chains. They are sourcing raw materials responsibly, using sustainable packaging materials, and implementing energy-efficient manufacturing processes to reduce their environmental footprint. Apart from this, various leading manufacturers are forming strategic partnerships with bakeries and food service chains to provide customized solutions and support their product development efforts.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Cargill Incorporated

- Koninklijke DSM N.V.

- Kerry Group

- Südzucker AB

- AAK AB

- Associated British Foods

- Lesaffre ET Compagnie

- Tate & Lyle

- PLC Archer Daniels Midland Company

- Ingredion Incorporated

- Corbion N.V.

- IFFCO Ingredients Solution

- Taura Natural Ingredients Limited

- Dawn Foods Products Inc.

- Muntons Plc

- British Bakels Ltd.

- Lallemand Inc.

- Novozymes A/S

- Puratos Group

Key Questions Answered in This Report

1. What is the size of the global bakery ingredients market?2. What is the expected growth rate of the global bakery ingredients market?

3. What are the key factors driving the global bakery ingredients market?

4. What has been the impact of COVID-19 on the global bakery ingredients market?

5. What is the breakup of the global bakery ingredients market based on the product type?

6. What is the breakup of the global bakery ingredients market based on the application?

7. What are the key regions in the global bakery ingredients market?

8. Who are the key companies/players in the global bakery ingredients market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Bakery Ingredients Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Product Type

5.5 Market Breakup by Application

5.6 Market Breakup by End Use Sector

5.7 Market Breakup by Region

5.8 Market Forecast

6 Market Breakup by Product Type

6.1 Emulsifiers

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Leavening Agents

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Enzymes

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Baking Powder & Mixes

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Oils, Fats and Shortenings

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Colors & Flavors

6.6.1 Market Trends

6.6.2 Market Forecast

6.7 Starch

6.7.1 Market Trends

6.7.2 Market Forecast

6.8 Others

6.8.1 Market Trends

6.8.2 Market Forecast

7 Market Breakup by Application

7.1 Breads

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Cookies & Biscuits

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Rolls & Pies

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Cakes & Pastries

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by End Use Sector

8.1 Industrial

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Foodservice

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Retail

8.3.1 Market Trends

8.3.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Europe

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Asia Pacific

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Middle East and Africa

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Latin America

9.5.1 Market Trends

9.5.2 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porter’s Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Cargill Incorporated

14.3.2 Koninklijke DSM N.V.

14.3.3 Kerry Group

14.3.4 Südzucker AB

14.3.5 AAK AB

14.3.6 Associated British Foods

14.3.7 Lesaffre ET Compagnie

14.3.8 Tate & Lyle

14.3.9 PLC Archer Daniels Midland Company

14.3.10 Ingredion Incorporated

14.3.11 Corbion N.V.

14.3.12 IFFCO Ingredients Solution

14.3.13 Taura Natural Ingredients Limited

14.3.14 Dawn Foods Products Inc.

14.3.15 Muntons Plc

14.3.16 British Bakels Ltd.

14.3.17 Lallemand Inc.

14.3.18 Novozymes A/S

14.3.19 Puratos Group

List of Figures

Figure 1: Global: Bakery Ingredients Market: Major Drivers and Challenges

Figure 2: Global: Bakery Ingredients Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Bakery Ingredients Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Bakery Ingredients Market: Breakup by Application (in %), 2024

Figure 5: Global: Bakery Ingredients Market: Breakup by End Use Sector (in %), 2024

Figure 6: Global: Bakery Ingredients Market: Breakup by Region (in %), 2024

Figure 7: Global: Bakery Ingredients Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Bakery Ingredients Industry: SWOT Analysis

Figure 9: Global: Bakery Ingredients Industry: Value Chain Analysis

Figure 10: Global: Bakery Ingredients Industry: Porter’s Five Forces Analysis

Figure 11: Global: Bakery Ingredients (Emulsifiers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: Bakery Ingredients (Emulsifiers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: Bakery Ingredients (Leavening Agents) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Bakery Ingredients (Leavening Agents) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Bakery Ingredients (Enzymes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Bakery Ingredients (Enzymes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Bakery Ingredients (Baking Powder & Mixes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Bakery Ingredients (Baking Powder & Mixes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Bakery Ingredients (Oils, Fats and Shortenings) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Bakery Ingredients (Oils, Fats and Shortenings) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Bakery Ingredients (Colors & Flavors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Bakery Ingredients (Colors & Flavors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: Bakery Ingredients (Starch) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: Bakery Ingredients (Starch) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: Bakery Ingredients (Other Product Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: Bakery Ingredients (Other Product Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Bakery Ingredients (Breads) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Bakery Ingredients (Breads) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: Bakery Ingredients (Cookies & Biscuits) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Global: Bakery Ingredients (Cookies & Biscuits) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Global: Bakery Ingredients (Rolls & Pies) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Global: Bakery Ingredients (Rolls & Pies) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Global: Bakery Ingredients (Cakes & Pastries) Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Global: Bakery Ingredients (Cakes & Pastries) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: Global: Bakery Ingredients (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Global: Bakery Ingredients (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Global: Bakery Ingredients (Industrial) Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Global: Bakery Ingredients (Industrial) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Global: Bakery Ingredients (Foodservice) Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Global: Bakery Ingredients (Foodservice) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Global: Bakery Ingredients (Retail) Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Global: Bakery Ingredients (Retail) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: North America: Bakery Ingredients Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: North America: Bakery Ingredients Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Europe: Bakery Ingredients Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Europe: Bakery Ingredients Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Asia Pacific: Bakery Ingredients Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Asia Pacific: Bakery Ingredients Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Middle East and Africa: Bakery Ingredients Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: Middle East and Africa: Bakery Ingredients Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: Latin America: Bakery Ingredients Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: Latin America: Bakery Ingredients Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

Table 1: Global: Bakery Ingredients Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Bakery Ingredients Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 3: Global: Bakery Ingredients Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: Bakery Ingredients Market Forecast: Breakup by End Use Sector (in Million USD), 2025-2033

Table 5: Global: Bakery Ingredients Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Bakery Ingredients Market: Competitive Structure

Table 7: Global: Bakery Ingredients Market: Key Players

Companies Mentioned

- Cargill

- Incorporated

- Koninklijke DSM N.V.

- Kerry Group

- Südzucker AB

- AAK AB

- Associated British Foods

- Lesaffre ET Compagnie

- Tate & Lyle

- PLC Archer Daniels Midland Company

- Ingredion Incorporated

- Corbion N.V.

- IFFCO Ingredients Solution

- Taura Natural Ingredients Limited

- Dawn Foods Products Inc.

- Muntons Plc

- British Bakels Ltd.

- Lallemand Inc.

- Novozymes A/S

- Puratos Group

Table Information

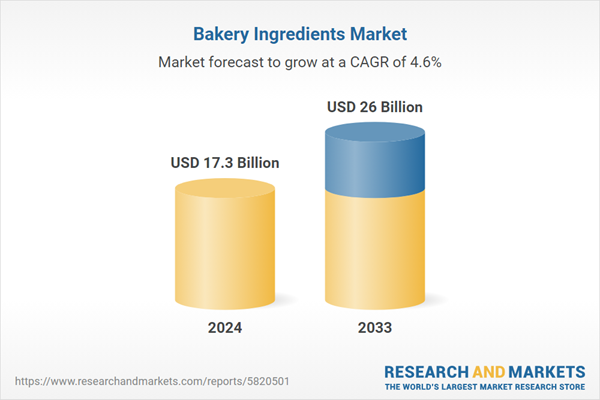

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 17.3 Billion |

| Forecasted Market Value ( USD | $ 26 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |