Alternators are crucial components in modern automotive and industrial applications, primarily responsible for generating alternating current (AC) electricity. They convert mechanical energy, usually from an engine, into electrical energy. Situated in the engine compartment, the alternators is driven by a belt connected to the engine's crankshaft. As the engine runs, it spins the alternators, which activates a magnetic field. This magnetic field interacts with windings to produce AC voltage. The generated electricity powers various electrical systems in a vehicle, such as headlights, air conditioning, and the radio, while also recharging the car's battery for future use. In industrial settings, alternators are often part of standby generators to provide emergency electrical power. Overall, alternators are vital for ensuring a consistent and reliable supply of electricity in both vehicles and various machinery. Their efficiency and robustness make them preferred over direct current (DC) generators for most applications.

One of the most potent market drivers for the alternators industry is the growing demand in the automotive sector. The global automotive market has been experiencing consistent growth, especially in developing nations where rapid urbanization and rising income levels are fueling the need for personal and commercial vehicles. Along with this, the marine industry is becoming a key market driver for alternators. With increasing global trade, the demand for cargo and commercial ships has seen steady growth. These vessels require robust alternators to power navigation systems, lighting, and various other electrical utilities. In addition, the growing trend towards the decentralization of power generation also contributes to the increasing demand for alternators. In remote areas or for specialized installations, such as microgrids, centralized power sources are often impractical. Apart from this, the growth in the agricultural sector, particularly in developing nations, serves as another driver for the alternators industry. Modern agriculture relies on various forms of machinery, such as tractors, harvesters, and irrigation systems that require electrical power. Moreover, small businesses and large enterprises are investing in backup power solutions to avoid the inconveniences and potential financial losses caused by power outages, creating a positive market outlook.

Alternators Market Trends/Drivers

Industrialization and Infrastructure Development

Industrialization plays a significant role in driving the alternators industry. As emerging economies continue to develop, the need for reliable sources of electricity becomes more pronounced. Alternators are an essential component in standby and portable generators, commonly used in industrial applications for uninterrupted power supply. This is crucial in sectors, including manufacturing, construction, and data centers, where even a short period of power outage can result in significant financial loss and operational disruptions. Furthermore, infrastructure projects, such as the construction of airports, highways, and smart cities, also rely on heavy machinery and equipment powered by alternators. Given the scale and growth of industrial activities globally, this is a significant market driver that shows little sign of abating.Renewable Energy Integration

The push for renewable energy is another strong market driver for alternators. As countries move towards more sustainable energy solutions, alternators find applications in systems, including wind turbines and hydroelectric generators. These renewable energy technologies rely on alternators to convert mechanical energy into electrical energy, which is then fed into the grid or used locally. In confluence with this, the global commitment to reduce carbon emissions and shift away from fossil fuels is likely to provide a substantial market for alternators designed to meet the specific needs of renewable energy generation. These alternators often have to meet high standards of efficiency and reliability, making them a specialized and growing segment within the broader alternators market.Continuous Technological Advancements

Innovation and technological advancements are propelling the alternators industry to new heights. Improved materials, more efficient design models, and enhanced manufacturing processes are contributing to the production of alternators that are lighter, more efficient, and more reliable. In addition, smart alternators, capable of varying their output based on the electrical load and battery condition, are gaining traction. These advancements not only serve the traditional markets more effectively but also open doors to new applications. For instance, advanced alternators can be used in electric ships, aerospace, and even in off-grid remote power solutions. As technology continues to evolve, the scope for alternators diversifies, thus enriching the market landscape and driving demand.Alternators Industry Segmentation

This report provides an analysis of the key trends in each segment of the global alternators market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on type, voltage, rated power, application, speed, weight, end-use sector, and fuel used.Breakup by Type

- Electro-Magnet (Induction) Alternators

- Permanent Magnet Alternators

Permanent magnet alternators represent the most widely used type

The report has provided a detailed breakup and analysis of the market based on the type. This includes electro-magnet (induction) alternators, permanent magnet alternators, and other alternators. According to the report, permanent magnet alternators represented the largest segment.Breakup by Voltage

- 220V-440V Alternators

- More than 440V Alternators

- Less than 220V Alternators

A detailed breakup and analysis of the market based on the voltage has also been provided in the report. This includes 220V-440V alternators, more than 440V alternators, and less than 220V alternators. According to the report, 220V-440V alternators voltage accounted for the largest market share.

Breakup by Rated Power

- < 1kW

- 1 kW-5 kW

- 5 kW-50 kW

- < 50KW-500 kW

- 500KW-1500 kW

- 1500KW-5000 kW

- >5000KW

The report has provided a detailed breakup and analysis of the market based on the rated power. This includes < 1kW, 1 kW-5 kW, 5 kW-50 kW, < 50KW-500 kW, 500KW-1500 kW, 1500KW-5000 kW and >5000KW. According to the report, 1500kW-5000 kW accounted for the largest market share.

Breakup by Application

- Industrial Applications

- Automotive and Transportation

- Power Generation

- Standby Power

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes industrial application, automotive and transportation, power generation, standby power and others. According to the report, industrial applications accounted for the largest market share.

Breakup by Speed

- Low Speed Alternators

- Medium Speed Alternators

- High Speed Alternators

- Ultra High-Speed Alternators

The report has provided a detailed breakup and analysis of the market based on the speed. This includes low speed alternators, medium speed alternators, high speed alternators and ultra high-speed alternators. According to the report, high speed alternators accounted for the largest market share.

Breakup by Weight

- Low Weight Alternators

- Medium Weight Alternators

- High Weight Alternators

A detailed breakup and analysis of the market based on the weight has also been provided in the report. This includes low weight alternators, medium weight alternators and high weight alternators. According to the report, low weight alternators accounted for the largest market share.

Breakup by End-Use Sector

- Industrial

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the end-use sector. This includes industrial, commercial and residential. According to the report, the industrial accounted for the largest market share.

Breakup by Fuel Used

- Fossil fuel

- Natural

A detailed breakup and analysis of the market based on the fuel used has also been provided in the report. This includes fossil fuel and natural. According to the report, natural fuel accounted for the largest market share.

Breakup by Region

- Asia-Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, the Middle East and Africa, and Latin America. According to the report, North America represented the largest market share.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Cummins Inc. (Stamford-Avk)

- Mecc Alte SpA

- Leroy-Somer, Inc.

- Valeo Service SAS

- DENSO Europe BV

- Hyundai Electric & Energy Systems Co., Ltd

Key Questions Answered in This Report

1. What are alternators?2. How big is the alternators market?

3. What is the expected growth rate of the global alternators market during 2025-2033?

4. What are the key factors driving the global alternators market?

5. What is the leading segment of the global alternators market based on the type?

6. What is the leading segment of the global alternators market based on voltage?

7. What is the leading segment of the global alternators market based on rated power?

8. What is the leading segment of the global alternators market based on application?

9. What is the leading segment of the global alternators market based on speed?

10. What is the leading segment of the global alternators market based on weight?

11. What is the leading segment of the global alternators market based on end-use sector?

12. What is the leading segment of the global alternators market based on fuel used?

13. What are the key regions in the global alternators market?

14. Who are the key players/companies in the global alternators market?

Table of Contents

Companies Mentioned

- Cummins Inc. (Stamford-Avk)

- Mecc Alte SpA

- Leroy-Somer Inc.

- Valeo Service SAS

- DENSO Europe BV

- Hyundai Electric & Energy Systems Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | February 2025 |

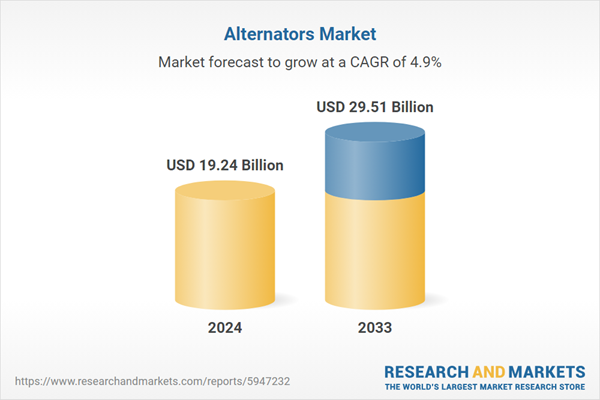

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 19.24 Billion |

| Forecasted Market Value ( USD | $ 29.51 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |