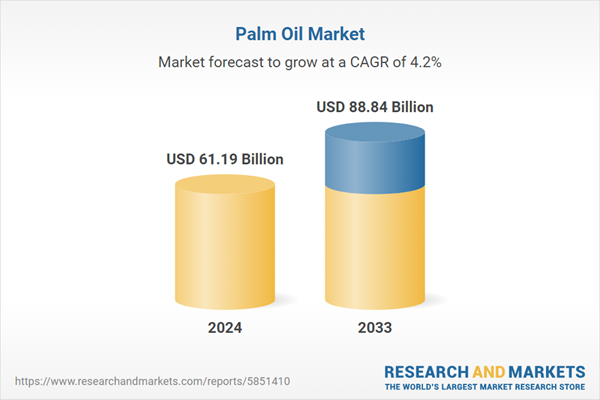

Palm Oil Global Market Report by Application (Household Cooking, Food & Beverages, Oleo Chemicals, Personal Care, Animal Feed, Bio-fuel) Countries and Company Analysis, 2025-2033.

Global Palm Oil Industry Overview

One of the biggest and most important segments of the edible oils market is the worldwide palm oil business. The fruit of the oil palm tree yields palm oil, a flexible and incredibly affordable substance utilized in a wide range of items, such as industrial goods, food, cosmetics, and biofuels. The majority of the world's production and use of vegetable oil occurs in Southeast Asia, where Indonesia and Malaysia are the main providers. Palm oil is preferred for its effectiveness in satisfying worldwide demand because of its high output per hectare when compared to other vegetable oils. Millions of people are employed by the sector, which is also essential to the economies of these producing nations.However, because of its effects on the environment and society, the palm oil business has come under heavy fire. Significant greenhouse gas emissions, biodiversity loss, and deforestation have resulted from the growth of oil palm plantations. Concerns have also been made about the industry's connection to worker exploitation and land rights issues. In response, initiatives have been made to adopt more sustainable techniques. For example, the Roundtable on Sustainable Palm Oil (RSPO) was established to certify palm oil that is produced with the least amount of negative impact on the environment and society. Notwithstanding these initiatives, there are still difficulties in implementing sustainability guidelines throughout the whole supply chain. A crucial challenge for the sector going forward will be striking a balance between economic expansion and ethical and environmental concerns as the demand for palm oil rises worldwide.

Leading geospatial intelligence AI technology company Dabeeo started its most recent AI monitoring project of Indonesian palm oil crops in May 2024. For the 765 square kilometer project, the business signed an agreement with Tunas Sawa Erma Group, one of Indonesia's largest producers of palm oil.

In May 2024, 3F Oil Palm's first integrated oil palm processing unit in India began conducting business. A state-of-the-art oil palm factory (Palm Oil Processing and Refinery), a zero-discharge effluent plant, a power plant based on palm waste, and other buildings and go-downs for support are all part of this integrated oil palm project. This plant is the first oil palm factory under NMEO-OP in India and the first in Arunachal Pradesh.

Furthermore, in January 2024: M11 Industries and edible oil and food business MK Agrotech, located in Karnataka, announced the start of an oil palm plantation operation in Odisha. The National Mission on Edible Oils-Oil Palm (NMEO-OP) of the Government of Odisha and the firm signed a memorandum of understanding (MoU).

Growth Drivers for the Palm Oil Market

Increasing Interest in Fortified Palm Oil

Vitamins like vitamin A and vitamin D, which are vital for general health and wellbeing, are included in fortified palm oil. Additionally, there is a growing need for fortified palm oil as consumer preferences change toward healthier food options. Cooking oils that have been fortified can help people consume 25% to 30% more vitamin D and A than they need. As consumer health awareness has grown, several countries have launched extensive programs to encourage the fortification of staple foods, particularly oils. Furthermore, the market share of palm oil is increasing as concerned government officials recognize the value of food fortification and its potential to help meet international nutrition standards.For instance, in order to boost immunity and fight malnutrition, especially deficiencies in micronutrients, the Food Safety and Standards Authority of India (FSSAI) released a proposal in 2021 mandating the fortification of cooking and edible oil with vitamins A and D. A growing number of palm oil producers are also investing in the creation of more nutritious palm oils and adhering to sustainable methods. In October 2023, for example, KTC Edibles, the biggest edible oil supplier in the UK, introduced Planet Palm, a new line of certified sustainable, traceable, and ethically sourced palm oil products for UK food producers. Similarly, BASF West Africa and EDCEL Limited introduced the Vitamin A premix for edible oils in September 2021.

Increasing Production of Biofuel

One important feedstock for the production of biofuels, especially biodiesel, is palm oil. Biodiesel made from palm oil is a renewable energy source that contributes to energy security and energy source diversity by lowering reliance on fossil fuels. Demand for palm oil is increasing as a result of government officials in many countries encouraging the use of biofuels as fossil fuel substitutes, especially in areas where biofuel regulations and incentives are in place. For example, the "National Policy on Biofuels" was released by India's Ministry of Petroleum and Natural Gas in 2018 and underwent additional revisions in June 2022. By encouraging indigenous biofuel generation, the program seeks to decrease the import of petroleum products.A favorable prognosis for the market as a whole is being created by the numerous biofuel producers who are investing more in growing their businesses in response to these measures. For example, Eni Kenya B.V. began producing the first vegetable oil for bio-refineries in July 2022 after finishing the construction of the oilseed collecting and pressing plant (agri-hub) in Makueni, Kenya. With a projected output of 2,500 tons in 2022, the corporation claims that the first agri-hub had a capacity of 15,000 tons. The palm oil industry is expected to grow in the upcoming years as a result of the many initiatives put in place by national governments to promote bio-based products like palm oils.

Versatility in Industrial Applications

The broad demand for palm oil is a result of its adaptability, which goes well beyond the food business. Because of its moisturizing and emulsifying qualities, it is a crucial component of soaps, shampoos, lotions, and makeup products. Derivatives of palm oil are utilized in detergents and surface cleansers because they effectively remove grease. Because of its stability and capacity to serve as a carrier for active substances, palm oil is also used by the pharmaceutical sector in the manufacturing of pills, ointments, and medications. Additionally, palm oil is used to make candles, lubricants, and biodiesel. Its cost-effectiveness and versatility in such a wide range of industries greatly support its market expansion and worldwide demand.Challenges in the Palm Oil Market

Environmental Impact

One of the industry's biggest challenges is the effect that palm oil production has on the environment. Rapid oil palm plantation growth, especially in nations like Malaysia and Indonesia, has resulted in extensive deforestation, which has harmed important ecosystems and reduced biodiversity. Endangered animals like tigers and orangutans frequently reside in forests that are removed for agriculture. Furthermore, massive volumes of carbon dioxide are released when forests are burned to make way for new land, which contributes to climate change. Global concerns have been raised by these environmental problems, leading to demands for more sustainable methods of producing palm oil. Although initiatives like the Roundtable on Sustainable Palm Oil (RSPO) seek to address these issues, implementing meaningful change is still a difficult task.Price Volatility

Due to a number of reasons, including shifting production levels, geopolitical tensions, and unexpected weather, price volatility is a major problem in the palm oil industry. Diseases, floods, and droughts are examples of natural occurrences that can interrupt the supply of palm oil, influencing yields and pricing. Price instability can also be exacerbated by geopolitical concerns in key producing nations, such as export limits or trade regulations. Because it can result in abrupt price increases or decreases, this volatility causes uncertainty for both producers and consumers. While consumers may have to pay more for products made from palm oil, manufacturers find it challenging to make long-term plans and investment decisions due to price fluctuations. The palm oil industry is made more complex by this volatility, which makes steady expansion and market predictability more difficult.United States Palm Oil Market

The demand from a variety of industries, including as food, cosmetics, and biofuels, is propelling the steady growth of the US palm oil industry. Because it is inexpensive and has a long shelf life, palm oil is frequently used in food products including margarine, baked goods, and snacks. With the Roundtable on Sustainable Palm Oil certification gaining acceptance, the demand for certified sustainable palm oil has increased due to growing interest in sustainable sourcing. Derivatives of palm oil are utilized not just in food but also in cleaning supplies, biodiesel, and personal care items. Nonetheless, calls for more sustainable techniques have arisen as a result of worries about social and environmental problems associated with the production of palm oil. Because of its affordability and adaptability, the industry is anticipated to keep growing in the United States despite these obstacles.United Kingdom Palm Oil Market

The usage of palm oil in many other industries, such as food, cosmetics, and biofuels, is what propels the market in the United Kingdom. Because palm oil is inexpensive and has a longer shelf life, it is frequently used in baked products, snacks, and processed meals. However, worries about the effects on the environment, such as deforestation and biodiversity loss connected to the production of palm oil, are putting more and more pressure on the sector to embrace sustainable practices. The Roundtable on Sustainable Palm Oil (RSPO) accreditation is growing more significant, and the UK market is increasingly focused on sourcing certified sustainable palm oil. The demand for products sourced ethically is increasing as customer awareness increases. Despite issues with sustainability, palm oil is nevertheless a necessary component of many UK industries.India Palm Oil Market

India's palm oil market is expanding significantly due to rising demand from the food, cosmetics, and biofuel industries. India is one of the world's biggest users of edible oils, and it uses a lot of palm oil, especially for cooking oils, processed foods, and snack items. Indian consumers favor palm oil because of its affordability and adaptability. Sustainable sourcing is becoming more popular, nevertheless, as a result of worries about its effects on the environment, including deforestation and biodiversity loss in major producing nations like Malaysia and Indonesia. India is increasingly implementing more sustainable methods to meet the demand for palm oil obtained ethically, and initiatives such as the Roundtable on Sustainable Palm Oil (RSPO) accreditation are gaining support.Saudi Arabia Palm Oil Market

The market for palm oil in Saudi Arabia is expanding as a result of rising demand for edible oils for cooking, snacking, and food processing. Palm oil is a popular and reasonably priced oil in Saudi Arabia, where it is a crucial component of many packaged and processed foods. Derivatives of palm oil are also found in the market in goods like biodiesel, detergents, and cosmetics. Saudi Arabia is one of the biggest importers of palm oil, mainly from Southeast Asia, while not being a significant producer. However, the demand for palm oil sourced ethically has increased due to sustainability concerns about deforestation and biodiversity loss. As consumers and regulators push for more environmentally friendly sourcing methods, the use of certified sustainable palm oil, such as RSPO-certified goods, is steadily growing.Palm Oil Market Segments

Application -Market breakup in 6 viewpoints:

1. Household Cooking2. Food & Beverages

3. Oleo Chemicals

4. Personal Care

5. Animal Feed

6. Bio-fuel

Country -Market breakup in 25 viewpoints:

North America

1. United States2. Canada

Europe

1. France2. Germany

3.Italy

4. Spain

5. United Kingdom

6. Belgium

7. Netherlands

8. Turkey

Asia Pacific

1. China2. Japan

3. India

4. Australia

5. South Korea

6. Thailand

7. Malaysia

8. Indonesia

9. New Zealand

Latin America

1. Brazil2. Mexico

3. Argentina

Middle East & Africa

1. South Africa2. Saudi Arabia

3. United Arab Emirates

All the Key players have been covered from 4 Viewpoints:

1. Overview2. Key Persons

3. Recent Development & Strategies

4. Financial Insights

Company Analysis:

1. Archer-Daniels-Midland Company2. Boustead Holdings Berhad

3. IJM Corporation Berhad

4. IOI Corporation Berhad

5. Kulim Malaysia Berhad (Johor Corporation)

6. Sime Darby Plantation Berhad

7. United Plantations Berhad

8. Univanich Palm Oil Public Company Ltd.

9. Wilmar International Ltd.

Table of Contents

Companies Mentioned

- Archer-Daniels-Midland Company

- Boustead Holdings Berhad

- IJM Corporation Berhad

- IOI Corporation Berhad

- Kulim Malaysia Berhad (Johor Corporation)

- Sime Darby Plantation Berhad

- United Plantations Berhad

- Univanich Palm Oil Public Company Ltd.

- Wilmar International Ltd.

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 61.19 Billion |

| Forecasted Market Value ( USD | $ 88.84 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |