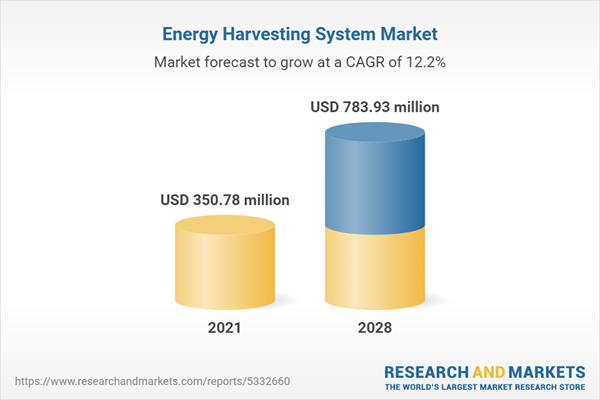

The global energy harvesting market is expected to expand at a CAGR of 12.17%, reaching US$783.93 million in 2028 from US$350.784 million in 2021.

Energy harvesting refers to capturing energy from a system's environment and converting it to electric power for other uses. Various factors influence the energy harvesting system market, like the growing demand for renewable energy, such as solar power, wind power, thermal power, etc., for commercial usage. With population growth, there is an increased demand for energy consumption, which facilitates using energy harvesting systems to fulfill the gap in energy supply and demand.Thus, there is a noticeable renewable energy usage trend in some major global economies, such as the United States, China, and India. For instance, the solar power capacity in India increased by over 600% between 2016 and 2021, from 6.7 GW to 41 GW.

Drivers:

Rising use of wind energy

The rising use of wind energy as a viable alternative energy source is also expected to further propel the market for energy harvesting systems. For instance, as per the Office of Energy Efficiency & Renewable Energy reports of the United States government, wind power capacity in the country has grown over three-fold in the past decade. The country added around 10% of new wind capacity in 2021 to surpass 135 GW as of 2021.Adoption of electric vehicles

The rise in the adoption of electric vehicles is also expected to boost the energy harvesting system market. The emergence of systems, such as tire pressure management systems that use energy harvesting systems in tires to provide power to smaller electric components of vehicles, is also anticipated to help in the growth of the global energy harvesting systems market as the adoption of electric vehicles continues to increase globally.Companies moving toward sustainability.

Major companies are shifting their focus towards renewable energy adoption for powering their operations. For instance, as per the 2021 report of ABB, the share of renewable energy in their total electricity output has increased from 24% in 2019 to 53% in 2021, which indicates the massive shift in company goals for all companies operating in the electricity industry. Moreover, the increasing demand for decentralized power solutions, especially in remote areas or during emergencies, has created opportunities for energy harvesting technologies. For instance, companies like PowerFilm Solar have developed flexible and lightweight solar panels that can be integrated into portable power solutions for camping, outdoor activities, and emergency response situations.Government focus on renewable energy.

Government bodies are also incorporating renewable energy in their electricity policies. The government of India, for instance, has a dedicated Ministry of New and Renewable Energy that focuses on the development of renewable energy in the country and makes plans for its increase and availability. The ministry announced the launch of new initiatives focused on energy efficiency in the buildings sector in 2021 under its Bureau of Energy Efficiency. As the second largest consuming electricity sector, the buildings sector can greatly benefit from using renewable energy in terms of energy efficiency, helping achieve sustainable habitation goals for the ministry.The US government has also implemented initiatives to promote clean energy adoption, such as the Production Tax Credit (PTC). The Inflation Reduction Act of 2022 adds new wage and apprenticeship requirements for projects over 1 MW, where tax credits begin at 0.5 cents/kWh but can increase if labor-related conditions are met. Additionally, the Act includes bonus credits for projects of any size, based on the use of domestic steel/iron materials and project location within an "energy community" with historical reliance on fossil fuel extraction and high unemployment. These incentives encourage investments in renewable energy projects, including those utilizing energy harvesting technologies.

Growing industrial applications

By application, the global energy harvesting system market is segmented as industrial, consumer electronics, home automation, transportation, etc. The industrial application of energy harvesting systems spreads to manufacturing, chemicals, upstream oil & gas, power plants, and refining. The primary source of energy harvesting in industrial applications are photovoltaic, thermal, RF, and mechanical vibration, with each being different in terms of power conversion and intermittent nature.The thermal source of energy harvesting in industrial applications is the most suitable option, as the power density of thermoelectric devices with steep gradients can reach up to 100m/W cm^3. Moreover, thermal energy harvesters are more common in heavy industry than light industry scenarios with a low power load and high efficiency. Moreover, thermoelectric is used for power generation in industries. For example, Cogeneration power plants are used in the industrial sector with high amounts of waste energy, thus being more profitable, and the heat produced during electricity generation is applicable for numerous uses.

Regional Insights

By geography, the global energy harvesting market is segmented as North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The North American market is estimated to grow, driven by increasing demand for sustainable and renewable energy sources, technological advancements, and government initiatives promoting clean energy solutions. The Asia Pacific region is propelled by factors such as rapid industrialization, urbanization, increasing adoption of renewable energy sources, supportive government initiatives, and rising awareness about energy efficiency and sustainability.North America held a significant market share.

The USA holds the largest market share due to a rising focus on energy conservation, advancements in technology enabling efficient energy harvesting solutions, increasing adoption of renewable energy sources, and government support through incentives and policies promoting clean energy initiatives. Canada is another country that holds a significant share of this market after the United States. The market growth in this country is attributed to factors such as increasing investments in renewable energy projects, government initiatives promoting clean energy adoption, favorable policies supporting energy efficiency, and rising awareness about the environmental benefits of energy harvesting technologies among businesses and consumers.Market Developments:

- In January 2023, Global Power Technologies launched a sentinel thermoelectric generator, a reliable energy source for low-power applications. It is certified for HAZLOC applications. Moreover, it enables single-person installation with low maintenance costs.

- In 2020, a government-funded research program was launched to develop energy harvesting systems for use in industrial environments, focusing on improving energy efficiency and reducing carbon emissions. This funding initiative has helped to accelerate the development of energy harvesting systems for industrial applications.

- EnOcean, in 2021, developed energy-harvesting wireless switches and sensors that eliminate the need for batteries in building automation systems, reducing environmental impact and maintenance costs.

Market

Segmentation:

By Technologies

- Photovoltaic

- Electromagnetic

- Thermoelectric

- RF

- Piezoelectric

- Others

By Application

- Industrial

- Consumer Electronics

- Home Automation

- Transportation

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- South Africa

- Others

- Asia Pacific

- Japan

- China

- India

- Australia

- Others

Table of Contents

Companies Mentioned

- ABB

- Honeywell

- Cymbet

- Fujitsu

- Texas Instruments

- Microchip Technology

- STMicroelectronics

- Powercast Corporation

- EnOcean GmbH

- Kinergizer

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | June 2023 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 350.78 million |

| Forecasted Market Value ( USD | $ 783.93 million |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |