1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Inclusions & Exclusions

1.4 Study Scope

1.4.1 Markets Covered

1.4.2 Regions Covered

1.4.3 Years Considered

1.4.4 Currency Considered

1.5 Research Limitations

1.6 Stakeholders

1.7 Summary of Changes

2 Research Methodology

2.1 Research Data

2.2 Research Approach

Figure 1 Research Design Methodology

2.2.1 Secondary Data

2.2.1.1 Key Data from Secondary Sources

2.2.2 Primary Data

Figure 2 Primary Sources

2.2.2.1 Key Data from Primary Sources

2.2.3 Key Industry Insights

2.2.3.1 Breakdown of Primary Interviews

Figure 3 Breakdown of Primary Interviews: Supply-Side and Demand-Side Participants

Figure 4 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Company Revenue Estimation Approach

Figure 5 Company Revenue Estimation Approach: Infectious Disease Diagnostics Market

2.3.3 Presentations of Companies and Primary Interviews

2.3.4 Growth Forecast

2.3.5 CAGR Projections

Figure 6 CAGR Projections: Supply-Side Analysis

2.3.6 Top-Down Approach

Figure 7 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

Figure 8 Data Triangulation Methodology

2.5 Market Share Assessment

2.6 Study Assumptions

2.6.1 Growth Rate Assumptions

2.7 Risk Assessment

Table 1 Risk Assessment: Infectious Disease Diagnostics Market

2.8 Impact of Recession on Infectious Disease Diagnostics Market

3 Executive Summary

Figure 9 Infectious Disease Diagnostics Market, by Product & Service, 2023 vs. 2028 (USD Million)

Figure 10 Infectious Disease Diagnostics Market, by Type of Testing, 2023 vs. 2028 (USD Million)

Figure 11 Infectious Disease Diagnostics Market, by Sample Type, 2023 vs. 2028 (USD Million)

Figure 12 Infectious Disease Diagnostics Market, by Technology, 2023 vs. 2028 (USD Million)

Figure 13 Infectious Disease Diagnostics Market, by Disease Type, 2023 vs. 2028 (USD Million)

Figure 14 Infectious Disease Diagnostics Market, by End-user, 2023 vs. 2028 (USD Million)

Figure 15 Infectious Disease Diagnostics Market, by Region, 2023 vs. 2028 (USD Million)

4 Premium Insights

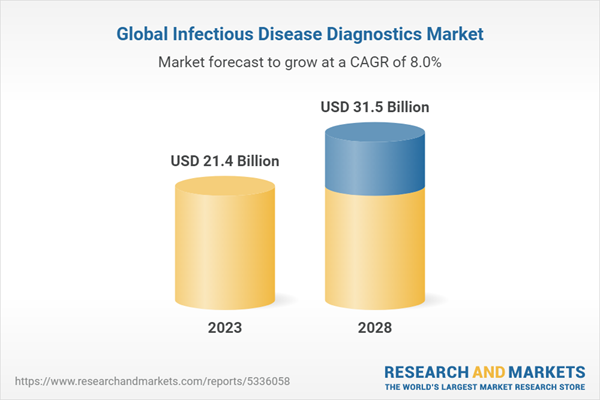

4.1 Infectious Disease Diagnostics Market Overview

Figure 16 Growing Prevalence of Infectious Disease and Increasing Investment in R&D to Drive Market

4.2 Infectious Disease Diagnostics Market, by Product & Service, 2023 vs. 2028 (USD Million)

Figure 17 Reagents, Kits, and Consumables Segment to Dominate Market During Forecast Period

4.3 Infectious Disease Diagnostics Market, by Type of Testing, 2023 vs. 2028 (USD Million)

Figure 18 Laboratory Testing to Dominate Market During Study Period

4.4 Infectious Disease Diagnostics Market, by Sample Type, 2023 vs. 2028 (USD Million)

Figure 19 Blood, Serum, and Plasma to Command Largest Market Share During Forecast Period

4.5 Infectious Disease Diagnostics Market, by Technology, 2023 vs. 2028 (USD Million)

Figure 20 Immunodiagnostics to Dominate Market During Forecast Period

4.6 Infectious Disease Diagnostics Market, by Disease Type, 2023 vs. 2028 (USD Million)

Figure 21 Hepatitis to Command Largest Market Share During Study Period

4.7 Infectious Disease Diagnostics Market, by End-user, 2023 vs. 2028 (USD Million)

Figure 22 Diagnostic Laboratories to Dominate Market During Study Period

4.8 Regional Growth Opportunities

Figure 23 Asia-Pacific to Register Highest Growth Rate During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 24 Drivers, Restraints, Opportunities, and Challenges: Infectious Disease Diagnostics Market

5.2.1 Drivers

5.2.1.1 Rising Prevalence of Infectious Diseases

5.2.1.2 Rising Focus on R&D and Funding for Infectious Disease Diagnostic Products

5.2.1.3 Growing Awareness for Early Disease Diagnosis in Emerging Economies

5.2.1.4 Adoption of New and Advanced Technologies for Infectious Disease Diagnosis

5.2.1.5 Shift in Focus from Centralized Laboratories to Decentralized Poc Testing Centers

5.2.2 Restraints

5.2.2.1 Unfavorable Reimbursement Scenario

5.2.3 Opportunities

5.2.3.1 Increased Growth Opportunities in Emerging Economies

5.2.4 Challenges

5.2.4.1 Changing Regulatory Landscape

5.2.4.2 Operational Barriers and Shortage of Skilled Laboratory Technicians

5.3 Pricing Analysis

Table 2 Indicative Pricing for Infectious Disease Diagnostic Products

Table 3 Average Selling Price of Infectious Disease Diagnostic Products, by Region

5.4 Patent Analysis

Figure 25 Patent Analysis for Isothermal Nucleic Acid Amplification Technologies (January 2013-December 2022)

Table 4 List of Major Patents, January 2021-December 2022

5.5 Value Chain Analysis

Figure 26 Value Chain Analysis: Major Value Added During Manufacturing and Assembly Phases

5.6 Supply Chain Analysis

Figure 27 Supply Chain Analysis: Infectious Disease Diagnostics Market

5.7 Ecosystem Market Map

Figure 28 Ecosystem Market Map: Infectious Disease Diagnostics Market

Table 5 Role in Ecosystem

5.8 Porter's Five Forces Analysis

Table 6 Porter's Five Forces Analysis

5.8.1 Threat of New Entrants

5.8.2 Threat of Substitutes

5.8.3 Bargaining Power of Buyers

5.8.4 Bargaining Power of Suppliers

5.8.5 Intensity of Competitive Rivalry

5.9 Regulatory Landscape

5.9.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 7 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 8 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 9 Latin America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 10 Rest of the World: List of Regulatory Bodies, Government Agencies, and Other Organizations

5.9.2 North America

5.9.2.1 US

5.9.2.2 Canada

5.9.3 Europe

Table 11 Europe: Classification of Devices

5.9.4 Asia-Pacific

5.9.4.1 China

5.9.4.2 Japan

Table 12 Japan: Time, Cost, and Complexity of Registration Process

5.9.4.3 India

5.9.5 Latin America

5.9.5.1 Brazil

5.9.5.2 Mexico

5.9.6 Middle East

5.9.6.1 Africa

5.10 Trade Analysis

Table 13 Import Data for Diagnostic and Laboratory Reagents, by Country, 2018-2022 (USD Million)

Table 14 Export Data for Diagnostic and Laboratory Reagents, by Country, 2018-2022 (USD Million)

5.11 Technology Analysis

5.12 Key Conferences & Events

Table 15 Detailed List of Key Conferences & Events in 2O22-2023

5.13 Trends/Disruptions Impacting Customers’ Businesses

Figure 29 Revenue Shift in Infectious Disease Diagnostics Market

5.14 Key Stakeholders & Buying Criteria

5.14.1 Key Stakeholders in Buying Process

Figure 30 Influence of Stakeholders on Buying Process of Infectious Disease Diagnostic Products

Table 16 Influence of Stakeholders on Buying Process of Infectious Disease Diagnostic Products (%)

5.14.2 Buying Criteria

Figure 31 Key Buying Criteria for Infectious Disease Diagnostic Products

Table 17 Key Buying Criteria for Infectious Disease Diagnostic Products

5.15 Case Study Analysis

Figure 32 Case Study: Market Assessment and Consumer Buying Behaviour in India

6 Infectious Disease Diagnostics Market, by Product & Service

6.1 Introduction

Table 18 Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 19 Prices of Infectious Disease Diagnostic Products, 2022

6.2 Reagents, Kits, and Consumables

6.2.1 Recurrent Purchases of Reagents, Kits, and Consumables to Drive Market

Table 20 Infectious Disease Diagnostics Market for Reagents, Kits, and Consumables, by Region, 2021-2028 (USD Million)

6.3 Instruments

6.3.1 Increasing Need for Faster and More Accurate Test Results with Minimum Human Intervention to Drive Market

Table 21 Key Instruments Available in Market

Table 22 Infectious Disease Diagnostics Market for Instruments, by Region, 2021-2028 (USD Million)

6.4 Software & Services

6.4.1 Growing Uptake of Advanced Instruments and Increasing Competitiveness for Value-Added Services to Drive Market

Table 23 Infectious Disease Diagnostics Market for Software & Services, by Region, 2021-2028 (USD Million)

7 Infectious Disease Diagnostics Market, by Type of Testing

7.1 Introduction

Table 24 Infectious Disease Diagnostics Market, by Type of Testing, 2021-2028 (USD Million)

7.1.1 Primary Notes

Figure 33 Key Industry Insights: Infectious Disease Diagnostics Market, by Type of Testing

7.2 Laboratory Testing

7.2.1 Advancements in Diagnostic Technologies and Increased Focus on Early Disease Detection to Drive Market

Table 25 Infectious Disease Diagnostics Market for Laboratory Testing, by Region, 2021-2028 (USD Million)

7.3 Poc Testing

7.3.1 Faster Turnaround Time and More Efficient Treatment Options to Drive Market

Table 26 Infectious Disease Diagnostics Market for Poc Testing, by Region, 2021-2028 (USD Million)

8 Infectious Disease Diagnostics Market, by Sample Type

8.1 Introduction

Table 27 Infectious Disease Diagnostics Market, by Sample Type, 2021-2028 (USD Million)

8.1.1 Primary Notes

Figure 34 Key Industry Insights: Infectious Disease Diagnostics Market, by Sample Type

8.2 Blood, Serum, and Plasma

8.2.1 Higher Versatility, Greater Clinical Efficacy, and Better Reimbursement Policies to Drive Market

Table 28 Infectious Disease Diagnostics Market for Blood, Serum, and Plasma, by Region, 2021-2028 (USD Million)

8.3 Urine

8.3.1 Non-Invasive Nature of Urine Samples to Drive Market

Table 29 Infectious Disease Diagnostics Market for Urine, by Region, 2021-2028 (USD Million)

8.4 Other Sample Types

Table 30 Infectious Disease Diagnostics Market for Other Sample Types, by Region, 2021-2028 (USD Million)

9 Infectious Disease Diagnostics Market, by Disease Type

9.1 Introduction

Table 31 Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

9.2 Hepatitis

Table 32 Infectious Disease Diagnostics Market for Hepatitis, by Region, 2021-2028 (USD Million)

Table 33 Infectious Disease Diagnostics Market for Hepatitis, by Region, 2021-2028 (Million Tests)

Table 34 Infectious Disease Diagnostics Market for Hepatitis, by Method, 2021-2028 (USD Million)

Table 35 Infectious Disease Diagnostics Market for Hepatitis, by Type, 2021-2028 (USD Million)

9.2.1 Hepatitis B

9.2.1.1 Increasing Global Prevalence of Hepatitis B to Drive Segment

Table 36 Hepatitis B Market, by Region, 2021-2028 (USD Million)

9.2.2 Hepatitis C

9.2.2.1 Rising Number of Government Initiatives for Hepatitis C Diagnosis to Drive Segment

Table 37 Hepatitis C Market, by Region, 2021-2028 (USD Million)

9.2.3 Other Hepatitis Diseases

Table 38 Other Hepatitis Diseases Market, by Region, 2021-2028 (USD Million)

9.3 HIV

9.3.1 Growing Prevalence of Aids and Increasing Availability of HIV Poc Testing to Drive Market

Table 39 Infectious Disease Diagnostics Market for HIV, by Region, 2021-2028 (USD Million)

Table 40 Infectious Disease Diagnostics Market for HIV, by Region, 2021-2028 (Million Tests)

9.4 Hospital-Acquired Infections

9.4.1 Rising Burden of Infections and Increasing Adoption of Advanced Diagnostic Tests to Drive Market

Table 41 Infectious Disease Diagnostics Market for Hospital-Acquired Infections, by Region, 2021-2028 (USD Million)

Table 42 Infectious Disease Diagnostics Market for Hospital-Acquired Infections, by Region, 2021-2028 (Million Tests)

9.5 Mosquito-Borne Diseases

9.5.1 Rising Incidence of Dengue and Malaria and Increasing Number of Awareness Programs to Drive Market

Table 43 Major Products for Dengue Testing Available in Market

Table 44 Infectious Disease Diagnostics Market for Mosquito-Borne Diseases, by Region, 2021-2028 (USD Million)

9.6 Hpv

9.6.1 Technological Advancements for Preventing Hpv Infections to Drive Market

Table 45 Infectious Disease Diagnostics Market for Hpv, by Region, 2021-2028 (USD Million)

Table 46 Infectious Disease Diagnostics Market for Hpv, by Region, 2021-2028 (Million Tests)

9.7 Chlamydia Trachomatis

9.7.1 Growing Incidence of Chlamydia and Rising Awareness Among Patients to Drive Market

Table 47 Infectious Disease Diagnostics Market for Chlamydia Trachomatis, by Region, 2021-2028 (USD Million)

Table 48 Infectious Disease Diagnostics Market for Chlamydia Trachomatis, by Region, 2021-2028 (Million Tests)

9.8 Neisseria Gonorrhea

9.8.1 Rising Incidence of Gonorrhea and Growing Funding for R&D to Drive Market

Table 49 Infectious Disease Diagnostics Market for Neisseria Gonorrhea, by Region, 2021-2028 (USD Million)

9.9 Tuberculosis

9.9.1 Increasing Burden of Tuberculosis in Underdeveloped Nations to Drive Market

Table 50 Infectious Disease Diagnostics Market for Tuberculosis, by Region, 2021-2028 (USD Million)

Table 51 Infectious Disease Diagnostics Market for Tuberculosis, by Region, 2021-2028 (Million Tests)

Table 52 Infectious Disease Diagnostics Market for Tuberculosis, by Method, 2021-2028 (USD Million)

9.10 Influenza

9.10.1 Rising Focus on Faster Diagnosis and Control to Drive Market

Table 53 Infectious Disease Diagnostics Market for Influenza, by Region, 2021-2028 (USD Million)

Table 54 Infectious Disease Diagnostics Market for Influenza, by Region, 2021-2028 (Million Tests)

Table 55 Infectious Disease Diagnostics Market for Influenza, by Method, 2021-2028 (USD Million)

9.11 Syphilis

9.11.1 Growing Adoption of Novel Technologies for Improved Screening to Drive Market

Table 56 Infectious Disease Diagnostics Market for Syphilis, by Region, 2021-2028 (USD Million)

9.12 Other Infectious Diseases

Table 57 Infectious Disease Diagnostics Market for Other Infectious Diseases, by Region, 2021-2028 (USD Million)

9.13 COVID-19

9.13.1 Declining Cases of COVID-19 to Limit Market

Table 58 Infectious Disease Diagnostics Market for COVID-19, by Region, 2021-2028 (USD Million)

10 Infectious Disease Diagnostics Market, by Technology

10.1 Introduction

10.2 Primary Notes

Figure 35 Key Industry Insights: Infectious Disease Diagnostics Market, by Technology

Table 59 Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

10.3 Immunodiagnostics

10.3.1 Rising Prevalence of Infectious Diseases and Demand for Rapid Diagnostic Kits to Drive Market

Table 60 Infectious Disease Diagnostics Market for Immunodiagnostics, by Region, 2021-2028 (USD Million)

10.4 Clinical Microbiology

10.4.1 Quicker Turnaround Time for Results with Higher Sensitivity and Reliability to Drive Market

Table 61 Infectious Disease Diagnostics Market for Clinical Microbiology, by Region, 2021-2028 (USD Million)

10.5 Polymerase Chain Reaction

10.5.1 Ease of Use, Cost-Effectiveness, and High Specificity to Drive Market

Table 62 Infectious Disease Diagnostics Market for Polymerase Chain Reaction, by Region, 2021-2028 (USD Million)

10.6 Isothermal Nucleic Acid Amplification Technology

10.6.1 Lower Cost and Better Suitability for Point-Of-Care Testing to Drive Market

Table 63 Infectious Disease Diagnostics Market for Isothermal Nucleic Acid Amplification Technology, by Region, 2021-2028 (USD Million)

10.7 DNA Sequencing & Next-Generation Sequencing

10.7.1 Advancements in Sequencing Technologies and Increased Focus on Molecular Targeted Drugs to Drive Market

Table 64 Infectious Disease Diagnostics Market for DNA Sequencing & Next-Generation Sequencing, by Region, 2021-2028 (USD Million)

10.8 DNA Microarray

10.8.1 High Instrument Costs and Need for Expert Technicians to Limit Market

Table 65 Infectious Disease Diagnostics Market for DNA Microarray, by Region, 2021-2028 (USD Million)

10.9 Other Technologies

Table 66 Infectious Disease Diagnostics Market for Other Technologies, by Region, 2021-2028 (USD Million)

11 Infectious Disease Diagnostics Market, by End-user

11.1 Introduction

Table 67 Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

11.2 Diagnostic Laboratories

11.2.1 Development of Low-Cost and Highly Specialized Screening Tests to Drive Market

Table 68 Infectious Disease Diagnostics Market for Diagnostic Laboratories, by Region, 2021-2028 (USD Million)

11.3 Hospitals & Clinics

11.3.1 Increasing Adoption of Diagnostic Tools and Better Reimbursement Facilities to Drive Market

Table 69 Infectious Disease Diagnostics Market for Hospitals & Clinics, by Region, 2021-2028 (USD Million)

11.4 Academic Research Institutes

11.4.1 Increasing Focus on R&D for Developing Innovative Tests to Drive Market

Table 70 Infectious Disease Diagnostics Market for Academic Research Institutes, by Region, 2021-2028 (USD Million)

11.5 Other End-users

Table 71 Infectious Disease Diagnostics Market for Other End-users, by Region, 2021-2028 (USD Million)

12 Infectious Disease Diagnostics Market, by Region

12.1 Introduction

Table 72 Infectious Disease Diagnostics Market, by Region, 2021-2028 (USD Million)

12.2 North America

Figure 36 North America: Infectious Disease Diagnostics Market Snapshot

Table 73 North America: Infectious Disease Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 74 North America: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 75 North America: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 76 North America: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 77 North America: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.2.1 North America: Recession Impact

12.2.2 US

12.2.2.1 Increasing Prevalence of Infectious Diseases to Drive Market

Table 78 US: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 79 US: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 80 US: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 81 US: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.2.3 Canada

12.2.3.1 Focus on Affordable Tests and Use of Personalized Medicine to Drive Market

Table 82 Canada: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 83 Canada: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 84 Canada: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 85 Canada: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.3 Europe

Table 86 Europe: Infectious Disease Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 87 Europe: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 88 Europe: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 89 Europe: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 90 Europe: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.3.1 Europe: Recession Impact

12.3.2 Germany

12.3.2.1 Increasing Healthcare Expenditure and Rising Per Capita Disposable Income to Drive Market

Table 91 Germany: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 92 Germany: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 93 Germany: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 94 Germany: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.3.3 UK

12.3.3.1 Growing Number of Accredited Diagnostic and Hospital Laboratories to Drive Market

Table 95 UK: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 96 UK: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 97 UK: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 98 UK: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.3.4 France

12.3.4.1 Rising R&D Expenditure and Increasing Demand for Early Diagnosis to Drive Market

Table 99 France: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 100 France: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 101 France: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 102 France: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.3.5 Italy

12.3.5.1 Increased Adoption of Advanced Diagnostic Technologies and Growing Government Healthcare Investment to Drive Market

Table 103 Italy: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 104 Italy: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 105 Italy: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 106 Italy: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.3.6 Spain

12.3.6.1 Rising Geriatric Population and Improving Healthcare Infrastructure to Drive Market

Table 107 Spain: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 108 Spain: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 109 Spain: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 110 Spain: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.3.7 Rest of Europe

Table 111 GDP Expenditure on Healthcare, by Country (%)

Table 112 Rest of Europe: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 113 Rest of Europe: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 114 Rest of Europe: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 115 Rest of Europe: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.4 Asia-Pacific

Figure 37 Asia-Pacific: Infectious Disease Diagnostics Market Snapshot

Table 116 Asia-Pacific: Infectious Disease Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 117 Asia-Pacific: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 118 Asia-Pacific: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 119 Asia-Pacific: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 120 Asia-Pacific: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.4.1 Asia-Pacific: Recession Impact

12.4.2 China

12.4.2.1 Increased Public Access to Modern Healthcare and Favorable Government Policies to Drive Market

Table 121 China: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 122 China: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 123 China: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 124 China: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.4.3 Japan

12.4.3.1 Presence of Well-Developed Healthcare System and Universal Reimbursement Policies to Drive Market

Table 125 Japan: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 126 Japan: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 127 Japan: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 128 Japan: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.4.4 India

12.4.4.1 Increasing Private and Public Investments in Healthcare System to Drive Market

Table 129 India: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 130 India: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 131 India: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 132 India: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.4.5 Rest of Asia-Pacific

Table 133 Rest of Asia-Pacific: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 134 Rest of Asia-Pacific: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 135 Rest of Asia-Pacific: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 136 Rest of Asia-Pacific: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.5 Latin America

12.5.1 Rising Prevalence of Infectious Diseases and Increasing Healthcare Expenditure to Drive Market

Table 137 Latin America: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 138 Latin America: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 139 Latin America: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 140 Latin America: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.5.2 Latin America: Recession Impact

12.6 Middle East & Africa

Table 141 Middle East & Africa: Infectious Disease Diagnostics Market, by Country, 2021-2028 (USD Million)

Table 142 Middle East & Africa: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 143 Middle East & Africa: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 144 Middle East & Africa: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 145 Middle East & Africa: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.6.1 Middle East & Africa: Recession Impact

12.6.2 GCC Countries

12.6.2.1 Rising Focus on Advanced Health Infrastructure to Drive Market

Table 146 GCC Countries: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 147 GCC Countries: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 148 GCC Countries: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 149 GCC Countries: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

12.6.3 Rest of Middle East & Africa

Table 150 Rest of Middle East & Africa: Infectious Disease Diagnostics Market, by Product & Service, 2021-2028 (USD Million)

Table 151 Rest of Middle East & Africa: Infectious Disease Diagnostics Market, by Technology, 2021-2028 (USD Million)

Table 152 Rest of Middle East & Africa: Infectious Disease Diagnostics Market, by Disease Type, 2021-2028 (USD Million)

Table 153 Rest of Middle East & Africa: Infectious Disease Diagnostics Market, by End-user, 2021-2028 (USD Million)

13 Competitive Landscape

13.1 Overview

13.2 Key Strategies/Right to Win

13.2.1 Overview of Strategies Adopted by Key Players

Table 154 Overview of Strategies Adopted by Key Players in Infectious Disease Diagnostics Market

13.3 Revenue Share Analysis

Figure 38 Revenue Share Analysis of Top Players

13.4 Market Share Analysis

Figure 39 Infectious Disease Diagnostics Market Share, by Key Player (2022)

Table 155 Degree of Competition: Infectious Disease Diagnostics Market

13.5 Company Evaluation Matrix

13.5.1 Stars

13.5.2 Emerging Leaders

13.5.3 Pervasive Players

13.5.4 Participants

Figure 40 Company Evaluation Matrix, 2022

13.5.5 Company Footprint

Figure 41 Product and Regional Footprint of Key Players

Table 156 Company Footprint

Table 157 Product & Service Footprint

Table 158 Regional Footprint

13.6 Start-Up/SME Evaluation Matrix

13.6.1 Progressive Companies

13.6.2 Responsive Companies

13.6.3 Dynamic Companies

13.6.4 Starting Blocks

Figure 42 Start-Up/SME Evaluation Matrix, 2022

13.6.5 Competitive Benchmarking

Table 159 Detailed List of Key Start-Ups/SMEs

13.7 Competitive Scenarios and Trends

13.7.1 Key Product Launches & Regulatory Approvals

Table 160 Key Product Launches & Regulatory Approvals, 2020-2023

13.7.2 Key Deals

Table 161 Key Deals, 2020-2023

14 Company Profiles

14.1 Key Players

(Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1.1 F. Hoffmann-La Roche Ltd.

Table 162 F. Hoffmann-La Roche Ltd.: Company Overview

Figure 43 F. Hoffmann-La Roche Ltd.: Company Snapshot (2022)

14.1.2 Abbott

Table 163 Abbott: Company Overview

Figure 44 Abbott: Company Snapshot (2022)

14.1.3 Biomérieux

Table 164 Biomérieux: Company Overview

Figure 45 Biomérieux: Company Snapshot (2022)

14.1.4 Siemens Healthineers AG

Table 165 Siemens Healthineers AG: Company Overview

Figure 46 Siemens Healthineers AG: Company Snapshot (2022)

14.1.5 Danaher

Table 166 Danaher: Company Overview

Figure 47 Danaher: Company Snapshot (2022)

14.1.6 Thermo Fisher Scientific Inc.

Table 167 Thermo Fisher Scientific Inc.: Company Overview

Figure 48 Thermo Fisher Scientific Inc.: Company Snapshot (2022)

14.1.7 Hologic, Inc.

Table 168 Hologic, Inc.: Company Overview

Figure 49 Hologic, Inc.: Company Snapshot (2022)

14.1.8 Becton, Dickinson and Company

Table 169 Becton, Dickinson and Company: Company Overview

Figure 50 Becton, Dickinson and Company: Company Snapshot (2022)

14.1.9 Revvity

Table 170 Revvity: Company Overview

Figure 51 Revvity: Company Snapshot (2022)

14.1.10 Qiagen

Table 171 Qiagen: Company Overview

Figure 52 Qiagen: Company Snapshot (2022)

14.1.11 Seegene Inc.

Table 172 Seegene Inc.: Company Overview

Figure 53 Seegene Inc.: Company Snapshot (2022)

14.2 Other Players

14.2.1 Quidelortho Corporation

14.2.2 Grifols, SA

14.2.3 Diasorin S.P.A.

14.2.4 Bio-Rad Laboratories, Inc.

14.2.5 Sysmex Corporation

14.2.6 Orasure Technologies

14.2.7 Co-Diagnostics, Inc.

14.2.8 Meridian Bioscience

14.2.9 Chembio Diagnostics, Inc.

14.2.10 Trinity Biotech

14.2.11 Genetic Signatures Ltd.

14.2.12 Epitope Diagnostics, Inc.

14.2.13 Trivitron Healthcare

14.2.14 Elitech Group

14.2.15 Meril Life Sciences Pvt. Ltd.

14.2.16 Inbios International, Inc.

14.2.17 Uniogen Oy

14.2.18 Vela Diagnostics

*Details on Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies

15 Appendix

15.1 Discussion Guide

15.2 Knowledgestore: The Subscription Portal

15.3 Customization Options