Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

High Prevalence of Chronic Diseases

The frequency of chronic diseases is on a rapid rise, leading to a surge in demand for healthcare services. This includes an increase in patient visits, hospital admissions, and surgeries. In 2022, the United States recorded substantial engagement across various healthcare settings. According to CDC data, physician office visits surpassed 900 million, while emergency department (ED) visits totaled approximately 155 million.Additionally, hospitals accounted for around 537 million outpatient visits and performed nearly 45 million outpatient procedures, underscoring the high operational throughput and demand across ambulatory care services. This escalating demand has also resulted in a significant increase in the need for medical imaging equipment, particularly ultrasound systems, which play a crucial role in the diagnosis and treatment of various conditions. Additionally, the growing proportion of geriatric populations worldwide who suffer from chronic diseases has further contributed to the demand for these devices.

Over the past decade, the applications of ultrasound technology have expanded beyond its traditional use in obstetrics, cardiology, obesity, and radiography. It is now widely used in clinical areas such as surgery, gastroenterology, and musculoskeletal. This expansion has been driven by recent innovations and the introduction of numerous products in the point-of-care (POC) sector, including handheld devices. As a result, the deployment of ultrasound systems in primary care, anesthesia, emergency medicine, and critical care applications has significantly increased. All these factors are expected to fuel the growth in sales of medical imaging equipment, particularly ultrasound systems, throughout the forecast period. The continuous advancements in technology and the increasing prevalence of chronic diseases worldwide are driving the need for more comprehensive and advanced healthcare solutions.

Key Market Challenges

Product Recalls

The market is currently experiencing a remarkable surge in growth, driven by groundbreaking advancements in the field of artificial imaging. However, this rapid progress has not been without its challenges. Recent recalls of certain ultrasound equipment have unfortunately tarnished the reputation of major businesses operating in this sector. One such example is the class 2 product recall issued by the U.S. FDA in May 2022 for Koninklijke Philips N.V.'s S83t compact. The recall was prompted by a defect in the transesophageal transducer's auto cool feature, which posed a potential risk of patient harm during ultrasound exams. These recalls highlight the importance of maintaining strict quality control measures and continuously innovating to ensure the safety and reliability of medical imaging technologies.Key Market Trends

Integration of Artificial intelligence

The market is on the cusp of witnessing significant growth as artificial intelligence (AI) continues to seamlessly integrate into healthcare systems. With its remarkable ability to automate time-consuming tasks such as quantification and selecting optimal image slices from vast 3-D collections, AI has emerged as a pivotal component in many cutting-edge ultrasound systems. Looking ahead, experts anticipate AI to become even more prevalent in future ultrasound systems, driving their growth during the forecast period. These advancements in AI technology are truly revolutionizing the field of ultrasound, leading to more efficient and accurate diagnoses, and ultimately enhancing the overall quality of patient care. By harnessing the power of AI, healthcare professionals are empowered to deliver precise and personalized treatment plans, resulting in improved patient outcomes and a brighter future for medical imaging.Key Market Players

- Koninklijke Philips N.V.

- Hitachi Ltd.

- GE Healthcare Inc.

- Neusoft Corporation

- Siemens Healthineers AG

- Chison Medical technologies co. Ltd.

- Canon Medical Systems

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- Shantou Institute of ultrasound instruments Inc.

Report Scope:

In this report, the Global Ultrasound Systems Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Ultrasound Systems Market, By Technology:

- Diagnostic Ultrasound

- Therapeutic Ultrasound

Ultrasound Systems Market, By Display Type:

- Coloured

- Black & White

Ultrasound Systems Market, By Mobility:

- Mobile

- Fixed

Ultrasound Systems Market, By Application:

- Obstetrics/Gynaecology

- General Imaging

- Cardiology

- Urology

Ultrasound Systems Market, By End User:

- Hospital & Clinic

- Diagnostic Centres

- Others

Ultrasound Systems Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Ultrasound Systems Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Koninklijke Philips N.V.

- Hitachi Ltd.

- GE Healthcare Inc.

- Neusoft Corporation

- Siemens Healthineers AG

- Chison Medical technologies co. Ltd.

- Canon Medical Systems

- Mindray Medical International Limited

- Samsung Medison Co., Ltd.

- Shantou Institute of ultrasound instruments Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

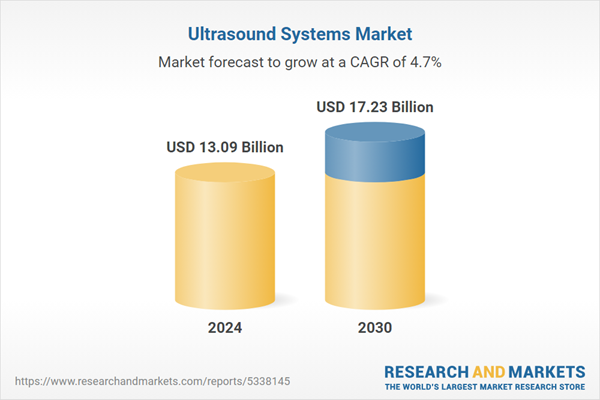

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.09 Billion |

| Forecasted Market Value ( USD | $ 17.23 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |