Adopting AI-driven threat detection, biometrics, and real-time analytics solutions to enhance security screening accuracy and speed is the key factor driving market growth. With faster and more efficient security processes in greater demand, the market is seeing greater investment in next-generation X-ray machines, millimeter wave machines, and automated lanes. Also, the inclination toward smart infrastructure and government-driven security regulation globally is fueling the deployment of advanced screening solutions across industries.

Biometric systems to capture prominent share of security screening market based on system type

Biometric technology-based security screening systems are expected to hold the largest market share throughout the forecast period, driven by growing demand for contactless, secure, and efficient identification. Face recognition, fingerprint scanning, and iris detection technologies are implemented at a fast pace in airports, border crossing points, and critical infrastructure for increased screening accuracy and operational efficiency. Biometric systems are integrated with AI and surveillance platforms for real-time authentication and automated threat detection. Increasing public and private sector investments, driven by public sentiment on global security and increasingly stringent regulatory standards, drive investments in biometric infrastructure. Their scalability, reliability, and ability to eliminate human error make biometric systems the preferred system in the new security screening paradigm.Pressing need for advanced threat detection to accelerate adoption of security screening solutions for vehicle inspection applications

Vehicle inspection applications are expected to register a significant CAGR during the forecast period, driven by growing security needs at border checkpoints, government facilities, military stations, and commercial transport terminals. Increasing threats from vehicle-borne bombs, illegal smuggling of contraband materials, and unauthorized entry drive the adoption of advanced screening equipment such as under-vehicle scanning systems (UVSS), license plate readers, and X-ray-based scanners. All such equipment ensure non-intrusive, automated, and real-time inspection, enhancing operational efficiency and detection rates. As the world observes rising concerns in critical infrastructure security and more stringent security regulations, the vehicle inspection segment will grow robustly and become a major application area in the overall security screening market.Transportation segment to dominate security screening market, by vertical, throughout forecast period

Transportation is expected to hold the largest market share throughout the forecast period due to growing security requirements in airports, seaports, rail networks, and metro networks. As global passenger and cargo traffic grows, governments seek to implement advanced security screening technologies to ensure security, regulatory adherence, and operational efficiency.Full-body scanners, trace explosive detectors, and biometric access control systems are rapidly installed in transport hubs to detect threats in real time without disturbing operations. Government spendings on upgrading transit infrastructure and implementing global security standards also propel the industry's reliance on high-capacity screening systems. Due to its high throughput requirements and continuous security enhancement, transportation will remain the biggest vertical in the global security screening market.

Growing infrastructure development and rising security concerns to position Asia Pacific as second-largest market for security screening solutions

Asia Pacific is anticipated to hold the second-largest market share throughout the forecast period, led by rapid urbanization, increasing cross-border trade, and increasing security spending among key economies such as China, India, Japan, and Southeast Asian nations. Airports, seaports, and transportation hubs witness high demand for state-of-the-art security screening technologies such as biometric, X-ray, and automatic surveillance systems. Regional governments are adopting demanding safety standards and actively investing in smart infrastructure and digital identification systems to combat increasing security threats. Moreover, growing geopolitical tensions and heightened focus on counterterror efforts further reinforce the demand for complete security solutions. All these factors make Asia Pacific the leading market for security screening solutions.Breakdown of Primaries

Various executives from key organizations operating in the security screening market, including CEOs, marketing directors, and innovation and technology directors, were interviewed in-depth.- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, C-level Executives - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and RoW - 5%

Major players profiled in this report are Smiths Detection Group Ltd. (UK), OSI Systems, Inc. (US), Leidos (US), Thales (France), NEC Corporation (Japan), Teledyne Technologies Incorporated (US), Bruker (US), Analogic Corporation (US), Astrophysics Inc. (US), LINEV Systems (US), NUCTECH COMPANY LIMITED (China), Argus TrueID (Australia), Metrasens (UK), Gilardoni S.p.A. (Italy), Westminster Group Plc (UK), Scanna MSC Ltd (UK), Garrett Metal Detectors (US), Aware, Inc. (US), Autoclear LLC (US), Vidisco (Israel), Neurotechnology (Lithuania), DERMALOG Identification Systems GmbH (Germany), Daon, Inc. (US), C.E.I.A. S.p.A. (Italy), and Precise Biometrics (Sweden). These leading companies possess a broad portfolio of products and establish a prominent presence in established and emerging markets.

The study provides a detailed competitive analysis of these key players in the security screening market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report segments the security screening market based on system type, application, vertical, and region. The system type segment includes X-ray screening systems, electromagnetic metal detectors, biometric systems, spectrometry & spectroscopy systems, and other system types. The application segment comprises people screening, baggage and cargo screening, and vehicle inspection. The vertical segment covers the transportation, government, retail, hospitality, commercial, industrial, education, and other verticals. The market has been segmented into four regions - North America, Asia Pacific, Europe, and Rest of the World (RoW).Reasons to Buy the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the security screening market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.Key Benefits of Buying the Report

- Analysis of key drivers (rising investments in advanced security screening technologies to enhance the travel experience, growing concerns about terrorism and illegal immigration, increasing emphasis on modern security solutions to curb radiological attacks, surging adoption of trace detectors to combat drug trafficking, and rising popularity of biometric security systems), restraints (health and privacy concerns associated with high-frequency scanners, high installation and maintenance costs, and lack of technical knowledge in developing countries), opportunities (rapid advancements in X-ray screening technologies, surging demand for transportation and cargo services, and increasing deployment of automatic explosive detection solutions at airports), and challenges (legal consequences due to false positives in security screening and enforcement of stringent data protection standards) influencing the growth of the security screening market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the security screening market

- Market Development: Comprehensive information about lucrative markets, including the analysis of the security screening market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in security screening solutions

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including Smiths Detection Group Ltd. (UK), OSI Systems, Inc. (US), Leidos (US), Thales (France), and NEC Corporation (Japan)

Table of Contents

Companies Mentioned

- Smiths Detection Group Ltd.

- Osi Systems, Inc.

- Leidos

- Thales

- Nec Corporation

- Teledyne Technologies Incorporated

- Bruker

- Analogic Corporation

- Astrophysics Inc.

- Linev Systems

- Nuctech Company Limited

- Argus Trueid

- Metrasens

- Gilardoni S.P.A.

- Westminster Group PLC

- Garrett Metal Detectors

- Autoclear

- Vidisco

- Neurotechnology

- Dermalog Identification Systems GmbH

- Daon, Inc.

- C.E.I.A. S.P.A.

- Aware, Inc.

- Scanna Msc Ltd

- Precise Biometrics

Table Information

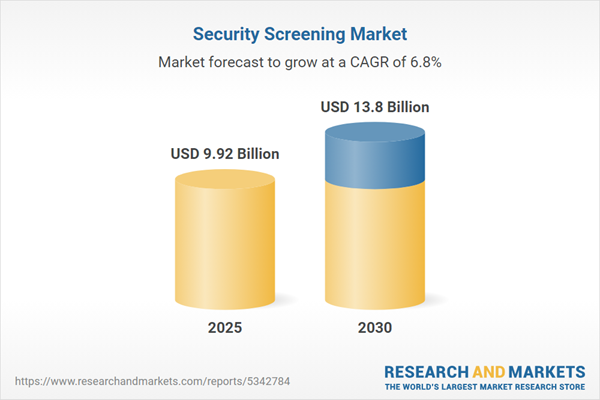

| Report Attribute | Details |

|---|---|

| No. of Pages | 271 |

| Published | June 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 9.92 Billion |

| Forecasted Market Value ( USD | $ 13.8 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |