Dairy has always been an integral part of the Indian culinary landscape. From the luscious lassis of Punjab to the fragrant payasams of Kerala, dairy products have found a special place in the heart (and palate) of the Indian consumer. The Indian dairy market primarily thrives on milk and its derivatives like ghee (clarified butter), yoghurt, paneer (cottage cheese), and a plethora of traditional sweets and beverages.

There is a high demand for value-added dairy products, especially among urban consumers. This can be attributed to increasing disposable incomes, urbanisation, and a more global palate, as the Indian middle class becomes increasingly exposed to international dairy products like cheeses, flavoured yoghurts, and probiotics. The Indian dairy market growth is also bolstered by the age-old belief in the nutritional superiority of dairy, as milk is traditionally seen as a source of strength and vitality. A drive towards health and wellness has carved a niche for products that emphasise on the nutritional content.

Based on Indian dairy market analysis, the penetration of technology in the dairy sector plays a pivotal role in the growth of the market. Innovations in cold storage, supply chain optimisation, and digitisation of dairy cooperatives are enabling producers to reach consumers faster, ensuring product freshness. Additionally, the emergence of e-commerce platforms dedicated to dairy and its derivatives has opened a new sales channel, enabling even regional dairy brands to capture a pan-Indian audience.

Meanwhile, rising emphasis on sustainable and organic dairy farming is further boosting the Indian dairy market demand. Conscious consumers are increasingly seeking products sourced from farms that adhere to humane, eco-friendly practices, ensuring the welfare of cattle and minimal environmental impact. As a result, there's a blossoming of premium dairy brands that promise organic, grass-fed, and unadulterated dairy products.

Almond, soy, and oat milk are making their presence felt in urban centres, appealing to the health-conscious and those with lactose intolerance. However, the traditional significance of dairy in the Indian culture ensures that these alternatives complement rather than replace the mainstream dairy products. Fortified dairy products, boasting additional vitamins and minerals, and low-fat, sugar-free, or lactose-free alternatives are gaining traction, thus increasing the Indian dairy market size.

Market Segmentation

The market can be divided based on product, sales channel, and region.Market Breakup by Product

- Liquid Milk

- UHT Milk

- A2 Milk

- Organic Milk

- Flavoured Milk

- Curd

- Lassi

- Butter Milk (Chach)

- Flavoured and Frozen Yoghurts

- Cheese

- Probiotic Dairy Products

- Butter

- Ghee

- Paneer

- Khoya

- Dairy Whitener

- Skimmed Milk Powder

- Ice-Cream

- Dairy Sweets

- Cream

- Milk Shake

- Sweet Condensed Milk

- Others

Market Breakup by Sales Channel

- Direct Selling

- Convenience Stores

- Supermarkets and Hypermarkets

- Online

Market Breakup by Region

- North India

- East and Central India

- West India

- South India

Competitive Landscape

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments, of the leading companies operating in the Indian dairy market. Some of the major players explored in the report are as follows:Dairy Cooperatives

- Gujarat Co-operative Milk Marketing Federation Ltd (GCMMF)

- Karnataka Co-operative Milk Producers Federation Limited (KMF)

- Orissa State Cooperative Milk Producers Federation Ltd (OMFED)

- Maharashtra Rajya Sahakari Dudh Mahasangh Maraydit

- Punjab State Cooperative Milk Producers Federation Limited

- Others

Private Companies

- Mother Dairy Fruits & Vegetables Pvt Limited

- Britannia Industries Ltd.

- Nestle India Limited

- VRS Foods Limited

- Parag Milk Foods Limited

- Sterling Agro Industries Limited

- Kwality Limited

- KSE Limited

- Others

Acquire unparalleled access to critical industry insights with our comprehensive market research reports, meticulously prepared by a team of seasoned experts. These reports are designed to equip decision-makers with an in-depth understanding of prevailing market trends, competitive landscapes, and growth opportunities.

These high-quality, data-driven analysis provide the essential framework for organisations seeking to make informed and strategic decisions in an increasingly complex and rapidly evolving business environment. By investing in our market research reports, you can ensure your organisation remains agile, proactive, and poised for success in today's competitive market.

Don't miss the opportunity to elevate your business intelligence and strengthen your strategic planning. Secure your organisation's future success by acquiring one of our these reports today.

*The publisher always strives to provide you with the latest information. The numbers in the article are only indicative and may be different from the actual report.

Table of Contents

Companies Mentioned

- Gujarat Co-operative Milk Marketing Federation Ltd (GCMMF)

- Karnataka Co-operative Milk Producers Federation Limited (KMF)

- Orissa State Cooperative Milk Producers Federation Ltd (OMFED)

- Maharashtra Rajya Sahakari Dudh Mahasangh Maraydit

- Punjab State Cooperative Milk Producers Federation Limited

- Mother Dairy Fruits & Vegetables Pvt Limited

- Britannia Industries Ltd.

- Nestle India Limited

- VRS Foods Limited

- Parag Milk Foods Limited

- Sterling Agro Industries Limited

- Kwality Limited

- KSE Limited

Table Information

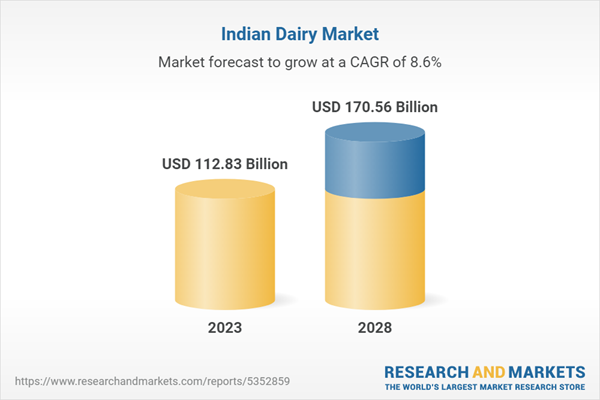

| Report Attribute | Details |

|---|---|

| No. of Pages | 154 |

| Published | September 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 112.83 Billion |

| Forecasted Market Value ( USD | $ 170.56 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | India |

| No. of Companies Mentioned | 13 |