Caustic soda, also known as sodium hydroxide (NaOH), refers to an inorganic compound which comprises sodium cations Na+ and hydroxide anions OH-. It is industrially prepared through the electrolytic chlor-alkali process in which electrolysis of aqueous sodium chloride solution produces chlorine gas and sodium hydroxide. It is an odorless and non-flammable white solid which is commercially available in the form of flakes, pellets, granules and aqueous solutions of different concentrations.

Major factor driving the market of sodium hydroxide in Oman region is increasing use of NaOH in number of industries including chemical, automotive, water treatment, and food and beverage. Oman being one of the Gulf region’s fastest growing economies has growing industries in this region therefore accelerated the demand of caustic soda in this region. Moreover, on account of its easy availability and affordability over its substitutes, it is regarded as one of the preferred chemical compounds employed to control acidity and remove heavy metals from water. Moreover, NaOH costs less than its alternative available which is potassium hydroxide. Therefore, it is economical to use sodium hydroxide than its alternative. It is available commercially in various forms such as liquid, solid, flakes, or particles. Wide accessibility and availability of the product in Oman region has further driven the market of NaOH. Caustic soda is also used in the production of paper wherein it helps in dissolving unwanted compounds present in the wood pulp. Omani government is facilitating tax incentives and credit approvals, and also making amendments in policies in order to attract foreign direct investments.

Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the Oman sodium hydroxide market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on end use, form and application.Breakup by End Use:

- Aluminium Processing

- Pulp and Paper

- Textile

- Soaps and Detergents

- Petroleum

- Chemical Processing

- Others

Breakup by Form:

- Liquid

- Solid

Breakup by Application:

- Cleaning Agent

- Catalysts

- Additives

Competitive Landscape:

The report has also examined the competitive landscape of the Oman sodium hydroxide market.Key Questions Answered in This Report:

- How has the Oman sodium hydroxide market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Oman sodium hydroxide market?

- Which are the key forms in the Oman sodium hydroxide market?

- What are the major application segments of Oman sodium hydroxide market?

- What are the major end-use industries in the sodium hydroxide market in Oman?

- What has been the prices of sodium hydroxide in Oman and how will the prices change in the coming years?

- What is the structure of the Oman sodium hydroxide industry and who are the key players?

- What are the key driving factors and challenges in the Oman sodium hydroxide industry?

- What is the degree of competition in the Oman sodium hydroxide industry?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Oman Sodium Hydroxide Market

5.1 Market Overview

5.1.1 Volume Trends

5.1.2 Value Trends

5.2 Market Performance

5.2.1 Volume Trends

5.2.2 Value Trends

5.3 Impact of COVID-19

5.4 Consumption by End-Use

5.5 Consumption by Form

5.6 Consumption by Application

5.7 Market Forecast

5.7.1 Volume Trends

5.7.2 Value Trends

6 Consumption Breakup by End-Use

6.1 Aluminium Processing

6.2 Soaps and Detergents

6.3 Petroleum

6.4 Chemical Processing

6.5 Pulp and Paper

6.6 Textile

6.7 Others

7 Consumption Breakup by Form

7.1 Liquid

7.2 Solid

8 Consumption Breakup by Application

8.1 Cleaning Agent

8.2 Catalysts

8.3 Additives

9 Price Analysis

9.1 Price Dynamics

9.2 Key Price Indicators

9.3 Price Structure

9.4 Average Prices by End-Use Industry

9.5 Prices Variation by Country

9.6 Price Forecast

9.7 Key Assumptions

10 Key Buyers & Purchasing Criteria Analysis by Industry

10.1 Key Buyers Analysis

10.2 Purchasing Criteria

11 Competitive Landscape

11.1 Market Structure

11.2 Key Players

11.3 Key Market Opportunities for New Entrants

11.4 Possibility for Capturing Market Share by a New Entrant

12 Key Industry Dynamics

12.1 Technological Factors and their Impact on the Industry: Current Trends & Future Prospects

12.2 Economic Factors and their Impact on the Industry: Current Trends & Future Prospects

12.3 Social Factors and their Impact on the Industry: Current Trends & Future Prospects

12.4 Other Factors and their Impact on the Industry: Current Trends & Future Prospects

13 Profiles of Key Players

List of Figures

Figure 1: Oman: Sodium Hydroxide Market: Major Drivers and Challenges

Figure 2: Oman: Sodium Hydroxide Market: Volume Trends (in ‘000 Metric Tons), 2019-2024

Figure 3: Oman: Sodium Hydroxide Market: Value Trends (in Million USD), 2019-2024

Figure 4: Oman: Sodium Hydroxide Market: Breakup by End-Use (in %), 2024

Figure 5: Oman: Sodium Hydroxide Market: Breakup by Form (in %), 2024

Figure 6: Oman: Sodium Hydroxide Market: Breakup by Application (in %), 2024

Figure 7: Oman: Sodium Hydroxide Market Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 8: Oman: Sodium Hydroxide Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 9: Oman: Sodium Hydroxide Market (Aluminium Processing): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 10: Oman: Sodium Hydroxide Market (Aluminium Processing) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 11: Oman: Sodium Hydroxide Market (Soaps and Detergents): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 12: Oman: Sodium Hydroxide Market (Soaps and Detergents) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 13: Oman: Sodium Hydroxide Market (Petroleum Product): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 14: Oman: Sodium Hydroxide Market (Petroleum Product) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 15: Oman: Sodium Hydroxide Market (Chemical Processing): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 16: Oman: Sodium Hydroxide Market (Chemical Processing) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 17: Oman: Sodium Hydroxide Market (Pulp and Paper): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 18: Oman: Sodium Hydroxide Market (Pulp and Paper) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 19: Oman: Sodium Hydroxide Market (Textile): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 20: Oman: Sodium Hydroxide Market (Textile) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 21: Oman: Sodium Hydroxide Market (Others): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 22: Oman: Sodium Hydroxide Market (Others) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 23: Oman: Sodium Hydroxide Market (Liquid): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 24: Oman: Sodium Hydroxide Market (Liquid) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 25: Oman: Sodium Hydroxide Market (Solid): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 26: Oman: Sodium Hydroxide Market (Solid) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 27: Oman: Sodium Hydroxide Market (Cleaning Agent): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 28: Oman: Sodium Hydroxide Market (Cleaning Agent) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 29: Oman: Sodium Hydroxide Market (Catalysts): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 30: Oman: Sodium Hydroxide Market (Catalysts) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 31: Oman: Sodium Hydroxide Market (Additives): Volume Trends (in ‘000 Metric Tons), 2019 & 2024

Figure 32: Oman: Sodium Hydroxide Market (Additives) Forecast: Volume Trends (in ‘000 Metric Tons), 2025-2033

Figure 33: Oman: Sodium Hydroxide Market: Breakup of manufacturing cost (in%)

Figure 34: Oman: Caustic Soda Market: Price Structure

Figure 35: Oman: Sodium Hydroxide Market: Average Prices by End-Use Industry (in USD/Metric Tons), 2024

Figure 36: Oman: Caustic Soda Market: Average Export Price Trends Country Wise (2019-2021)

Figure 37: Oman: Caustic Soda Market: Average Price Trends & Forecast (in USD/Metric Tons), 2019-2033

List of Tables

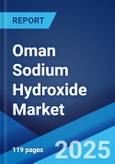

Table 1: Oman: Sodium Hydroxide Market: Key Industry Highlights, 2024 and 2033

Table 2: Oman: Sodium Hydroxide Market Forecast: Breakup by End-Use (in ‘000 Metric Tons), 2025-2033

Table 3: Oman: Sodium Hydroxide Market Forecast: Breakup by Form (in ‘000 Metric Tons), 2025-2033

Table 4: Oman: Sodium Hydroxide Market Forecast: Breakup by Application (in ‘000 Metric Tons), 2025-2033

Table 5: Oman: Caustic Soda Industry: Key Price Indicators

Table 6: Oman: Sodium Hydroxide Market Structure

Table 7: Oman: Sodium Hydroxide Market: Key Players

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 181860 Tons |

| Forecasted Market Value by 2033 | 249570 Tons |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Oman |