Automotive Powertrain Market

The Automotive Powertrain Market spans internal-combustion (gasoline/diesel), hybrid (micro/mild/full/plug-in), battery-electric (central drive, e-axle), and hydrogen fuel-cell systems - plus transmissions (AT/DCT/CVT/AMT), inverters, e-motors, batteries, engine control, thermal management, aftertreatment, and software for calibration, energy, and torque management. Automakers are re-platforming around modular, multi-energy architectures that share bodies-in-white, EDU packages, and high-voltage components while meeting diverse regulation and consumer price points. ICE efficiency advances (Miller/Atkinson cycles, high EGR, variable compression, lean burn with robust aftertreatment, 48V auxiliaries) coexist with rapid electrification of accessories and propulsion. Hybrids scale as bridge technologies, using high-efficiency Atkinson engines, dedicated hybrid transmissions, and compact e-axles to capture urban efficiency without range anxiety. BEV powertrains prioritize cost, efficiency, and manufacturability via silicon-carbide inverters, hairpin windings, oil-cooled e-motors, integrated e-axles, heat-pump HVAC, and domain/zonal controls; thermal integration (battery, motor, inverter) and software energy management yield major range gains. FCEVs target select heavy duty and long-range niches where refuel time and cold-weather performance matter. Across all, supply chains are localizing critical components (power electronics, battery packs) and standardizing software stacks for OTA, diagnostics, and cybersecurity. Headwinds include raw-material volatility, charging/hydrogen infrastructure gaps, and talent for high-voltage systems; tailwinds include emissions policy, TCO gains in city/last-mile duty cycles, and software-defined vehicles enabling continuous efficiency upgrades.Automotive Powertrain Market Key Insights

- Multi-energy platforms win scale: Flexible architectures supporting ICE, hybrid, and BEV reduce tooling and speed model launches; shared EDU/e-axle modules and common high-voltage components compress costs.

- Efficiency is a system sport: Low-loss driveline bearings, e-oil pumps, thermal valves, high-efficiency power electronics, and intelligent shift/torque strategies stack small gains into meaningful real-world savings.

- Hybrids as profit and compliance backbone: Dedicated hybrid engines, compact DHTs/DHT-e, and smart energy scheduling deliver urban efficiency with minimal customer behavior change - vital where charging is limited.

- BEV cost-down is materials + integration: SiC inverters, high-silicon anodes/LFP chemistries, integrated e-axles, and die-cast housings lower BOM and mass while improving packaging and manufacturability.

- Thermal orchestration is decisive: Unified heat pumps, refrigerant direct cooling, and waste-heat recovery balance cabin comfort with component longevity, unlocking range and towing performance in extreme climates.

- Software defines drivability and durability: Model-predictive energy/torque control, traction/regen blending, and battery health management tune feel and extend life; OTA keeps efficiency and diagnostics current.

- Aftertreatment remains critical for ICE: Close-coupled catalysts, gasoline particulate filters, SCR with twin dosing, and robust sensors maintain compliance under real driving; calibration quality determines warranty risk.

- Supply resilience > spot price: Dual-sourcing chips, local inverter/motor lines, and cell-to-pack assembly protect launch schedules; design-for-substitution eases semiconductor and magnet constraints.

- Right-sizing by segment: Small cars favor LFP and front e-axles; performance and towing adopt dual-motor AWD; trucks/VANs value e-axles with high continuous power and e-PTOs for body functions.

- Circularity gains traction: Reman e-axles, second-life batteries, recyclable magnets, and take-back programs move from pilots to contracts, influencing fleet and public tender decisions.

Automotive Powertrain Market Reginal Analysis

North America

Pickup/SUV mix shapes powertrain choices: efficient turbo ICE and hybrids for towing and range, with growing BEV offerings using high-power e-axles, heat-pump HVAC, and SiC inverters. Fleets adopt BEV vans for depot routes; supply localization of batteries/e-motors accelerates. Calibration for emissions durability and cold-weather range is a procurement focus.Europe

Tight emissions norms and urban policies push hybrids and BEVs, with emphasis on efficiency, lightweighting, and advanced aftertreatment for remaining ICE. Modular e-axles, compact DHTs, and heat-pump thermal stacks dominate new platforms. Software energy optimization, cybersecurity, and recyclability credentials weigh heavily in tenders.Asia-Pacific

Scale leads: broad hybrid penetration, rapid BEV growth in compact/mid segments, and strong local supply bases for batteries, inverters, and motors. Value-engineered e-axles and LFP packs proliferate; kei/mini EVs and city cars prioritize efficient single-motor layouts. Export programs favor multi-energy platforms adaptable to diverse infrastructure.Middle East & Africa

Harsh-climate calibration and durability are paramount; ICE and hybrids remain prevalent, with BEV pilots in fleets and premium segments. Thermal robustness, filtration, and high-temp aftertreatment determine reliability. Developing charging corridors guide BEV adoption in logistics and government fleets.South & Central America

Flex-fuel ICE and hybrids support diverse fuel policies; urban fleets explore BEV vans and buses where depot charging exists. Buyers prioritize robust transmissions, efficient small-displacement engines, and cost-effective e-axles. Serviceability, local assembly, and parts availability influence lifecycle economics across mixed road conditions.Automotive Powertrain Market Segmentation

By Propulsion

- ICE

- Electric Vehicle

By Vehicle

- Passenger Vehicle

- Commercial Vehicle

Key Market players

Aisin Corporation, ZF Friedrichshafen AG, Robert Bosch GmbH, Denso Corporation, Magna International, Hyundai Transys, JATCO Ltd, BorgWarner Inc., Continental AG, Valeo, Marelli, GKN Automotive, Dana Incorporated, Allison Transmission, Cummins Inc.Automotive Powertrain Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Automotive Powertrain Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Automotive Powertrain market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Automotive Powertrain market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Automotive Powertrain market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Automotive Powertrain market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Automotive Powertrain market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Automotive Powertrain value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Automotive Powertrain industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Automotive Powertrain Market Report

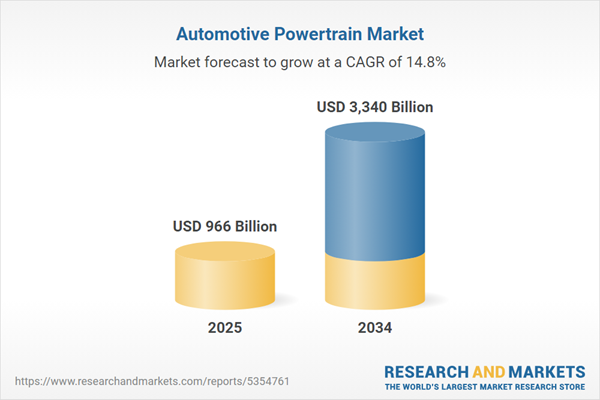

- Global Automotive Powertrain market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Automotive Powertrain trade, costs, and supply chains

- Automotive Powertrain market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Automotive Powertrain market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Automotive Powertrain market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Automotive Powertrain supply chain analysis

- Automotive Powertrain trade analysis, Automotive Powertrain market price analysis, and Automotive Powertrain supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Automotive Powertrain market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Aisin Corporation

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Denso Corporation

- Magna International

- Hyundai Transys

- JATCO Ltd.

- BorgWarner Inc.

- Continental AG

- Valeo

- Marelli

- GKN Automotive

- Dana Incorporated

- Allison Transmission

- Cummins Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 966 Billion |

| Forecasted Market Value ( USD | $ 3340 Billion |

| Compound Annual Growth Rate | 14.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |