Trailer Assist System Market

Trailer Assist Systems (TAS) comprise camera- and sensor-based functions that help drivers hitch, reverse, and maneuver with a trailer, spanning features such as trailer angle detection, dynamic steering guidance, automated reversing, hitch view/alignment, and trailer-sway stabilization integrated with ESC. The core customer base includes pickup/SUV and light commercial vehicle (LCV) OEM programs, fleets in delivery/construction/utility, rental and RV operators, and an expanding aftermarket for retrofits. Recent product roadmaps emphasize surround-view camera fusion, ultrasonic/radar augmentation for occlusion handling, ML-based trailer articulation tracking, and tighter integration with parking/auto-park stacks and ADAS domains. Connectivity to trailer ID profiles, load sensing, and diagnostics improves repeatability across trailer sizes and coupler types, while over-the-air (OTA) updates extend capabilities post-sale. Demand is propelled by rising trailer ownership (boats, campers, utility), increased towing capacity across trims, safety expectations for reversing incidents, insurer/fleet loss-prevention priorities, and consumer preference for easier hitching and yard maneuvers. Competitive dynamics feature OEM factory-fit differentiation (trim/package bundling) and Tier-1 modules combining ECUs, cameras, steering actuation, and HMI. Aftermarket players target older towing vehicles and fleets with camera kits, wiring harnesses, and calibration tools. Key challenges include cost/complexity for multi-trailer compatibility, sensor soiling/occlusion, calibration across hitch heights and lengths, standardization of trailer data interfaces, and regulatory clarity for low-speed automated maneuvers. Looking ahead, TAS progressively converges with automated parking and L2+/low-speed autonomy, adds trailer path planning in tighter spaces, and leverages HD cameras and compute advances to make towing more accessible, safer, and a differentiator in truck/LCV buying decisions.Trailer Assist System Market Key Insights

- Feature stack evolution. The market is shifting from basic hitch alignment and camera overlays to automated reversing with path prediction, steering control, and trailer profile libraries - raising perceived value and enabling premium trim monetization and OTA upgrades.

- Sensor fusion becomes mainstream. Camera-only systems face occlusion and low-light limits; adding ultrasonic/radar and refined IMU/ESC signals improves angle estimation and obstacle detection, supporting performance across weather, dust, and tight yards.

- Software defines differentiation. Algorithm accuracy (angle solve, path planning), intuitive HMIs, and auto-calibration drive user trust. Vendors compete on fewer steps to calibrate, faster trailer recognition, and seamless integration with existing park-assist UX.

- Integration with safety domains. Coupling TAS to ESC trailer-sway control, blind-spot monitoring with trailer length extension, and cross-traffic alerts reduces incident rates and strengthens value propositions to insurers and fleets.

- OEM bundling & take-rates. Adoption depends on packaging with tow packages/cameras/parking sensors and dealer education. Clear demonstrations at point-of-sale materially lift take-rates versus standalone options.

- Aftermarket opportunity. Retrofits address the large installed base of tow-capable vehicles lacking factory TAS, especially among RV, marine, landscaping, and light construction users seeking safety and driver training aids.

- Fleet ROI lens. Fleets benchmark reduced reversing claims, quicker yard operations, and lower mirror/corner damage. Simple driver workflows and minimal calibration time are decisive for multi-driver vehicles.

- Calibration and standards. Variability in trailer length/axle/hitch height creates setup friction. Movement toward common trailer profiles, connector pinouts, and data tags will streamline usability and reduce support costs.

- Compute & cost curves. Migration to domain/zonal ECUs and shared perception stacks lowers bill-of-materials per feature, enabling wider mid-trim penetration while preserving premium upsell via advanced automation.

- Regulatory & liability context. Clear guidance for low-speed automated maneuvers and consistent labeling/training content helps adoption; mis-use mitigation (hands-on prompts, speed caps) remains a design focus.

Trailer Assist System Market Reginal Analysis

North America

Strong towing culture anchored in pickups and large SUVs underpins early and deep TAS penetration, especially in tow packages tied to higher trims. Fleets in utilities, construction, and last-mile delivery evaluate TAS for yard maneuvering and incident reduction. Dealer education and live demos boost attachment rates. Aftermarket kits serve the sizeable legacy park camera base. Integration with trailer-sway control and extended blind-spot detection resonates with insurers and safety managers. RV and marine retail channels provide incremental exposure and installation capacity.Europe

Caravan and utility trailer usage, tighter urban spaces, and stringent safety expectations support TAS adoption on SUVs, vans, and LCVs. Procurement emphasizes intuitive HMI, parking-assist integration, and performance in wet/low-light conditions. Fleet duty cycles favor solutions with quick calibration and compatibility across varied trailer fleets. OEMs highlight eco-system interoperability (sensors, ESC, park assist) and compact camera packaging to preserve aesthetics. Aftermarket adoption grows via dealer networks and specialist fitters, aided by regulatory focus on reversing safety.Asia-Pacific

Diverse towing patterns - Australia/NZ pickup culture, ASEAN light commercial usage, and growing recreational segments - create mixed but rising demand. OEMs increasingly localize camera/ECU supply and ruggedize for heat/dust. Urban density and constrained parking make automated reversing compelling. Fleet sales in logistics, utilities, and municipal services adopt TAS for training and incident reduction. Dealer training and multilingual HMIs are pivotal to improve calibration success and repeat use.Middle East & Africa

High pickup/LCV use in construction, oil & gas, and utilities drives interest in yard maneuvering assistance and trailer-sway stabilization. Dust, heat, and off-road scenarios elevate requirements for sensor robustness and cleaning strategies. Premium SUV buyers value factory-fit features; commercial buyers weigh ROI against hardware durability and service availability. Partnerships with regional distributors and upfitters expand retrofit reach.South & Central America

Pickup and small-fleet LCV segments are the primary beachhead, with TAS positioned as a safety and productivity add-on. Economic cyclicality favors scalable bundles and serviceable components. Local installers and dealer accessories programs play an outsized role in awareness and calibration support. Solutions that maintain performance on uneven surfaces and handle diverse trailer geometries gain preference. Growing recreational towing offers incremental consumer demand.Trailer Assist System Market Segmentation

By Component

- Camera/Sensor

- Software Module

By Technology

- Semi-Autonomous

- Autonomous

By Vehicle

- Passenger Cars

- LCV

- Trucks

By User

- OEM Fitted

- Aftermarket

Key Market players

Bosch, Continental, ZF, Valeo, Magna International, Aptiv, Denso, Hyundai Mobis, HELLA (Forvia), Knorr-Bremse, WABCO (ZF), JOST Werke, DexKo Global (Dexter/AL-KO), Volkswagen, Ford Motor CompanyTrailer Assist System Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Trailer Assist System Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Trailer Assist System market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Trailer Assist System market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Trailer Assist System market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Trailer Assist System market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Trailer Assist System market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Trailer Assist System value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Trailer Assist System industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Trailer Assist System Market Report

- Global Trailer Assist System market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Trailer Assist System trade, costs, and supply chains

- Trailer Assist System market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Trailer Assist System market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Trailer Assist System market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Trailer Assist System supply chain analysis

- Trailer Assist System trade analysis, Trailer Assist System market price analysis, and Trailer Assist System supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Trailer Assist System market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bosch

- Continental

- ZF

- Valeo

- Magna International

- Aptiv

- Denso

- Hyundai Mobis

- HELLA (Forvia)

- Knorr-Bremse

- WABCO (ZF)

- JOST Werke

- DexKo Global (Dexter/AL-KO)

- Volkswagen

- Ford Motor Company

Table Information

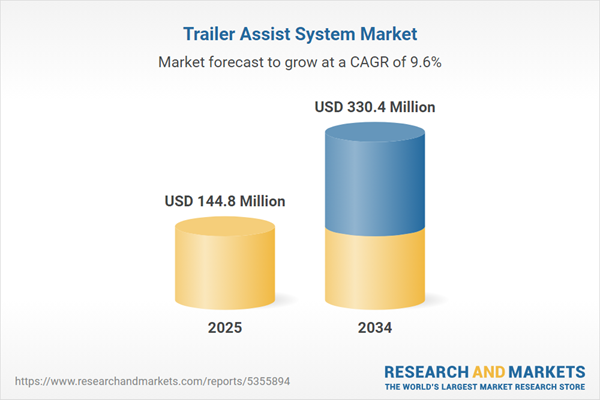

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 144.8 Million |

| Forecasted Market Value ( USD | $ 330.4 Million |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |