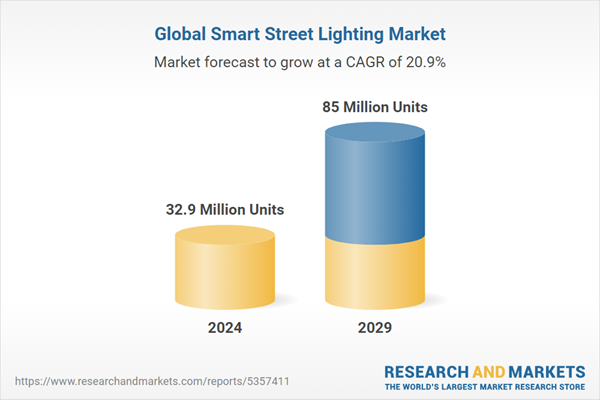

The Installed Base of Individually Controlled Street Lights is to Reach 85.0 Million in 2029

The Global Smart Street Lighting Market analyses the latest developments on this important smart cities application worldwide. This strategic research report provides you with 125 pages of unique business intelligence, including 5-year industry forecasts and expert commentary on which to base your business decisions.

Electrified public street lighting infrastructure has been around since the late 19th century to improve vehicle and pedestrian safety as well as to provide increased comfort to all users of the streets. Today, several hundred million street lights have been installed worldwide and the technology is now close to ubiquitous in all major urban areas of the developed world. The street lighting infrastructure however often constitutes major cost centres in terms of energy consumption and maintenance work, and also accounts for a significant share of the total greenhouse gas emissions that a city generates. In addition, static lighting schemes contribute to unnecessary light pollution, which could have harmful impacts on both humans and environmental ecosystems. Along with the developments in IoT communications and energy-efficient LED technology, smart street lighting systems that enable remote monitoring, control, and management of street lighting networks have emerged to address these issues and allow authorities and utilities to achieve significant cost and energy savings while at the same time improving the societal benefits provided to citizens. In recent years, smart street lighting infrastructure has moreover emerged as a promising platform for the management of a variety of additional smart city devices.

The research team estimates that the global installed base of individually controlled smart street lights amounted to 32.9 million units at the end of 2024. Growing at a CAGR of 20.9 percent, the number will reach 85.0 million in 2029. Europe is the leading adopter and today accounts for around 35 percent of the global installed base. North America is the second largest market and also constitutes the fastest growing market. A variety of proprietary RF networking platforms together account for 57 percent of the individually controlled street lights, while cellular and PLC communications are the second and third most common connectivity technologies, respectively. At the end of 2024, the leading smart street lighting vendor was Signify with an installed base of nearly 5.8 million lighting controls, followed by US-based Itron and the Chinese vendor Fonda Technology.

Highlights From the Report:

- Insights from 20 interviews with market-leading companies.

- 360-degree overview of smart street lighting technology.

- Extensive coverage by region with in-depth market profiles of 27 countries.

- Profiles of 45 key players in the smart street lighting market.

- Reviews of vendor market shares and competitive dynamics.

- Market forecasts by region and technology lasting until 2029.

- Detailed analysis of the latest market and industry developments.

This Report Answers the Following Questions:

- What are the main components of a smart street lighting solution?

- What are the preferred communications technology options?

- How will the adoption of LPWA technologies such as LoRaWAN, NB-IoT and LTE-M evolve?

- Which are the leading companies in the smart street lighting market?

- What is the outlook for smart street lighting vendors in the context of smart cities?

- How will the smart street lighting market evolve over the next five years?

- What trends and developments affect the smart street lighting market?

Who Should Read This Report?

The Global Smart Street Lighting Market is the foremost source of information about the adoption of smart and connected street lighting solutions. Whether you are a device vendor, service provider, telecom operator, utility, investor, consultant, or government agency, you will gain valuable insights from our in-depth research.

Table of Contents

Executive Summary

Electrified public street lighting infrastructure has been around since the late 19th century to improve vehicle and pedestrian safety as well as to provide increased comfort to all users of the streets. Today, several hundred million street lights have been installed worldwide and the technology is now close to ubiquitous in all major urban areas of the developed world. The street lighting infrastructure however often constitute major cost centres in terms of energy consumption and maintenance work, and also account for a significant share of the total greenhouse gas emissions that a city generates.

In addition, static lighting schemes contribute to unnecessary light pollution, which could have harmful impacts on both humans and environmental ecosystems. Along with the developments in IoT communications and energyefficient LED technology, smart street lighting systems that enable remote monitoring, control and management of street lighting networks have emerged to address these issues and allow authorities and utilities to achieve significant cost and energy savings while at the same time improving the societal benefits provided to citizens. In recent years, smart street lighting infrastructure has moreover emerged as a promising platform for the management of a variety of additional smart city devices.

The publisher estimates that the global installed base of individually controlled smart street lights amounted to 32.9 million units at the end of 2024. Growing at a CAGR of 20.9 percent, the number will reach 85.0 million in 2029. Europe is the leading adopter and today accounts for around 35 percent of the global installed base. North America is the second largest market and also constitutes the fastest growing market. A variety of proprietary RF networking platforms together account for 57 percent of the individually controlled street lights while cellular and PLC communications are the second and third most common connectivity technologies respectively. At the end of 2024, the leading smart street lighting vendor was Signify with an installed base of nearly 5.8 million lighting controls, followed by US-based Itron and the Chinese vendor Fonda Technology.

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acuity Brands

- BH Technologies

- C2 SmartLight

- Cisco

- CITiLIGHT

- CityLight.net

- CityLinx

- Citégestion (EDF)

- Current Lighting

- Datek Light Control

- Dhyan

- Dimonoff

- Domestic Chinese Vendors

- eSave

- Flashnet (Lucy Group)

- Fonda Technology

- gridComm

- Itron

- LACROIX

- LED Roadway Lighting

- Lucy Zodion (Lucy Group)

- Luminext

- M2M Telemetria

- MEAZON

- MinebeaMitsumi & Paradox Engineering

- Revetec

- Rongwen Energy Technology Group

- Schréder

- Sensus (Xylem)

- Signify

- Smartmation

- SSE

- ST Engineering Telematics Wireless

- TerraGo

- Trilliant

- TVILIGHT

- Ubicquia

- Umpi

- Urban Control (DW Windsor)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | August 2025 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value in 2024 | 32.9 Million Units |

| Forecasted Market Value by 2029 | 85 Million Units |

| Compound Annual Growth Rate | 20.9% |

| Regions Covered | Global |