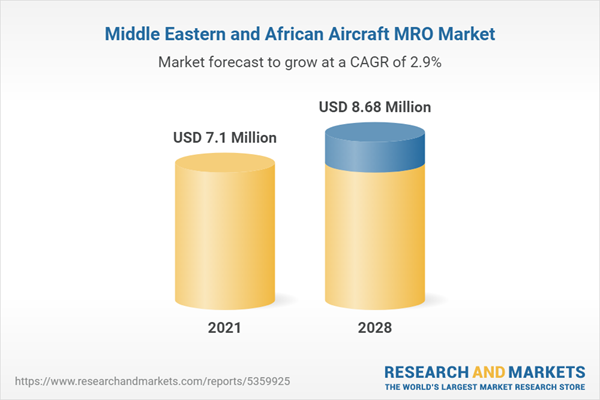

According to this research study titled “MEA Aircraft MRO Market to 2028 - COVID-19 Impact and Regional Analysis and Forecast by Component, Aircraft Type, and End-User,” the market is expected to reach US$ 8.68 billion by 2028 from US$ 7.10 billion in 2021. The market is estimated to grow at a CAGR of 2.9 % from 2021 to 2028. The report provides trends prevailing in the MEA aircraft MRO market along with the drivers and restraints pertaining to the market growth.Rising adoption of blockchain technology and surging deployment of retrofitting technologies for improved aircraft are the major factor driving the growth of the MEA aircraft MRO market. However, burgeoning share of original equipment manufacturers (OEMs) in the aftermarket hinders the growth of MEA aircraft MRO market.

In case of COVID-19, MEA is highly affected especially South Africa. The MEA aircraft MRO market is majorly affected by the disruption in the supply chain. Owing to the closure of borders of countries, the supply chain of several components and parts has been disturbed. The demand for aircraft MRO services has weakened over the past couple of months in the MEA countries. In addition, discontinuation of wide-body jets and narrow-body jets, which were prime customers of aftermarket products and services, has affected the market growth. For instance, in March 2021, Etihad Airways announced the retirement of their 10 Airbus A380 superjumbos under the strategic decision taken due to the COVID-19 crisis. However, there was some positivity in the regional market due to the presence of prominent airline operators such as the Emirates Group and the Etihad Airways. In January 2021, the Emirates Group started providing COVID-19 vaccination to its front-line employees such as pilots and cabin crew. Furthermore, the development of the new airports in the region is also expected to provide growth opportunities to the market in the coming years.

The MEA aircraft MRO market has been segmented on the basis on component, aircraft type, end-user, and country. Based on component, the market has been segmented into engine MRO, avionics MRO, airframe MRO, cabin MRO, landing gear MRO, and others. The engine MRO segment dominated the MEA aircraft MRO market in 2020 and is also expected to be fastest growing during forecast period. The market by aircraft type has been bifurcated into fixed wing aircraft and rotary wing aircraft. The fixed wing aircraft segment dominated the MEA aircraft MRO market in 2020 and rotary wing aircraft segment is expected to be fastest growing during forecast period. Further, based on end-user, it has been categorized into commercial and military. The commercial segment dominated the MEA aircraft MRO market in 2020 and military segment is expected to be fastest growing during forecast period.

AAR, Collins Aerospace, Delta TechOps, GE Aviation, Lufthansa Technik, Rolls-Royce plc., Singapore Technologies Engineering Ltd, and Turkish Technic Inc. are among the leading companies in the MEA aircraft MRO market. The companies are focused on adopting organic growth strategies such as product launches and expansions to sustain their position in the dynamic market. For instance, in 2021, GE Aviation and Etihad Airways have partnered to launch GE’s 360 Foam Wash, a groundbreaking jet engine cleaning system, to optimise performance of Etihad’s GE90 and GEnx-1B engines on its Boeing 777 and 787 fleets.

The report segments the MEA Aircraft MRO Market as follows:

MEA Aircraft MRO Market - By Component

- Engine MRO

- Avionics MRO

- Airframe MRO

- Cabin MRO

- Landing Gear MRO

- Others

MEA Aircraft MRO Market - By Aircraft Type

- Fixed Wing Aircraft

- Rotary Wing Aircraft

MEA Aircraft MRO Market - By End-User

- Commercial

- Military

MEA Aircraft MRO Market - By Country

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Table of Contents

Companies Mentioned

- AAR

- Collins Aerospace

- Delta TechOps

- GE Aviation

- Lufthansa Technik

- Rolls-Royce plc.

- Singapore Technologies Engineering Ltd

- Turkish Technic Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | June 2021 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 7.1 Million |

| Forecasted Market Value ( USD | $ 8.68 Million |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 8 |