Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Emphasis on Energy Efficiency in Commercial and Residential Buildings

The growing need to reduce energy usage in India’s buildings is a major driver for Building Automation & Control Systems. Escalating power costs and concerns over environmental sustainability have prompted developers and building managers to adopt systems that can intelligently control lighting, HVAC, and other critical utilities. Regulatory policies, such as the Energy Conservation Building Code, are pushing stakeholders toward compliance with energy efficiency benchmarks.In this context, automation technologies that monitor real-time consumption and automate control processes are being adopted in offices, hospitals, shopping complexes, and high-rise residential projects. These systems not only ensure regulatory compliance but also deliver measurable cost savings while enhancing occupant comfort and facility performance. As smart energy management becomes a key feature in urban infrastructure planning, demand for automated systems continues to rise.

Key Market Challenges

High Initial Investment and Long Payback Period

Despite the long-term benefits of automation, the high initial investment continues to be a major obstacle in India’s Building Automation & Control Systems market. Costs associated with purchasing hardware, integrating software, retrofitting infrastructure, and training staff can deter developers, especially in cost-sensitive commercial and residential sectors.Many stakeholders are cautious about the long payback periods, particularly when short-term financial returns are prioritized. Smaller buildings or institutions may not realize energy savings quickly enough to justify the expense, slowing down adoption beyond Tier 1 cities. Furthermore, the absence of standardized ROI benchmarks makes it difficult for buyers to assess economic feasibility during procurement. In the absence of supportive financial models, leasing structures, or government incentives, adoption is expected to remain uneven across the broader Indian building landscape.

Key Market Trends

Integration of Artificial Intelligence and Internet of Things in Building Automation

The India Building Automation & Control Systems market is experiencing a shift towards AI and IoT-enabled systems that offer intelligent, responsive, and personalized building management. These smart systems collect data through a network of sensors and use AI algorithms to detect usage patterns, optimize energy consumption, automate maintenance scheduling, and enhance occupant comfort.Real-time adaptability and predictive capabilities are helping reduce downtime and operational costs. As buildings become increasingly digital and interconnected, demand for cloud-based automation platforms is growing, especially in urban developments. These platforms integrate easily with ERP systems and green certification frameworks, positioning smart buildings as intelligent assets aligned with sustainability goals. The trend reflects a broader move from traditional automation to self-regulating, data-driven infrastructure management across India.

Key Market Players

- Siemens AG

- Schneider Electric SE

- Honeywell International Inc.

- Johnson Controls International plc

- ABB Ltd.

- Larsen & Toubro Limited

- Emerson Electric Co.

- Eaton Corporation plc

Report Scope:

In this report, the India Building Automation & Control Systems Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Building Automation & Control Systems Market, By Product:

- Heating, Ventilation & Air Conditioning

- Electronic Security & Safety

- Lighting Controls & Energy Management Systems

India Building Automation & Control Systems Market, By Communication Protocol:

- Wired

- Wireless

India Building Automation & Control Systems Market, By End User:

- Commercial

- Industrial

- Residential

India Building Automation & Control Systems Market, By Region:

- South India

- North India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Building Automation & Control Systems Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Please note: With the Enterprise license, the PDF product is printable and editable and comes with a market data excel sheet.

Table of Contents

Companies Mentioned

- Siemens AG

- Schneider Electric SE

- Honeywell International Inc.

- Johnson Controls International plc

- ABB Ltd.

- Larsen & Toubro Limited

- Emerson Electric Co.

- Eaton Corporation plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | June 2025 |

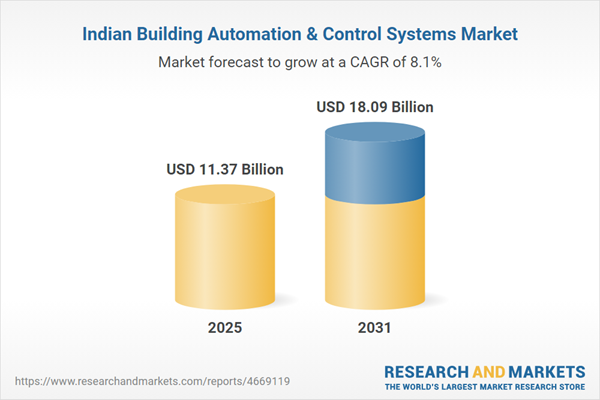

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 11.37 Billion |

| Forecasted Market Value ( USD | $ 18.09 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | India |

| No. of Companies Mentioned | 8 |