Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Urbanization

Urbanization continues to be a major force propelling the Vietnam frozen food market forward. As more individuals migrate to urban centers in pursuit of better career opportunities and improved living conditions, the demand for convenient and efficient meal solutions has grown substantially. In fast-paced cities like Hanoi, Ho Chi Minh City, and Da Nang, residents often have limited time to prepare meals at home, making frozen food a practical and time-saving choice. Additionally, the compact living spaces and smaller kitchens common in city apartments make frozen food products - which are easy to store and require minimal preparation - especially appealing. As a result, the expanding urban demographic is driving consistent demand for ready-to-eat and ready-to-cook frozen meals, aligning with shifting lifestyle patterns.Key Market Challenges

Perception of Frozen Food Quality

A notable challenge in Vietnam’s frozen food market is the lingering perception among consumers that frozen products are inferior to fresh alternatives. Rooted in traditional culinary preferences, many Vietnamese shoppers still view fresh, locally sourced ingredients as healthier and more flavorful. This skepticism toward frozen options - particularly when it comes to fruits, vegetables, seafood, and meat - can impact purchase decisions, as concerns persist about nutritional value and taste retention after freezing. Furthermore, the historical association of frozen products with low-cost, lower-quality items continues to affect consumer confidence, particularly in urban areas where access to fresh food remains high. Overcoming this perception is critical for companies aiming to broaden the appeal of frozen food products among health-conscious and quality-sensitive consumers.Key Market Trends

Increasing Demand for Convenience Foods

A major trend shaping the Vietnam frozen food market is the surging demand for convenience-oriented products. Urban consumers - especially working professionals, students, and dual-income households - are increasingly turning to frozen foods that offer fast and hassle-free meal preparation. The popularity of ready-to-eat meals, pre-cut frozen vegetables, marinated meats, and frozen international dishes such as pizzas and pastas is growing, as these products cater to evolving tastes and time-saving needs. As Vietnam embraces global food trends, the demand for imported and fusion frozen cuisine continues to expand. This trend is driving innovation among manufacturers who are developing diverse, high-quality frozen offerings to cater to modern lifestyles and a more adventurous palate.Key Players Profiled in this Vietnam Frozen Food Market Report

- CP Vietnam Livestock Joint Stock Company

- Sao Ta Foods Joint Stock Company

- Vinh Hoan Corporation

- GreenFeed Vietnam Corp

- Cao Phat Food Trading and Service Company Limited

- Kido Foods Joint Stock Company

- Viet Asia Foods Company Limited

- L&H Food Co., LTD.

- San Ha Co., Ltd.

- Minh Phu Seafood Corp

Report Scope:

In this report, the Vietnam Frozen Food Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Frozen Food Market, by Product Type:

- Frozen Meat, Poultry & Seafood

- Frozen Snacks

- Frozen Fruits & Vegetables

- Others

Vietnam Frozen Food Market, by Sales Channel:

- Supermarkets/Hypermarkets

- Departmental Stores

- Specialty Stores

- Online

- Others

Vietnam Frozen Food Market, by Region:

- Northern Vietnam

- Southern Vietnam

- Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Frozen Food Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Vietnam Frozen Food market report include:- CP Vietnam Livestock Joint Stock Company

- Sao Ta Foods Joint Stock Company

- Vinh Hoan Corporation

- GreenFeed Vietnam Corp

- Cao Phat Food Trading and Service Company Limited

- Kido Foods Joint Stock Company

- Viet Asia Foods Company Limited

- L&H Food Co., LTD.

- San Ha Co., Ltd.

- Minh Phu Seafood Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | May 2025 |

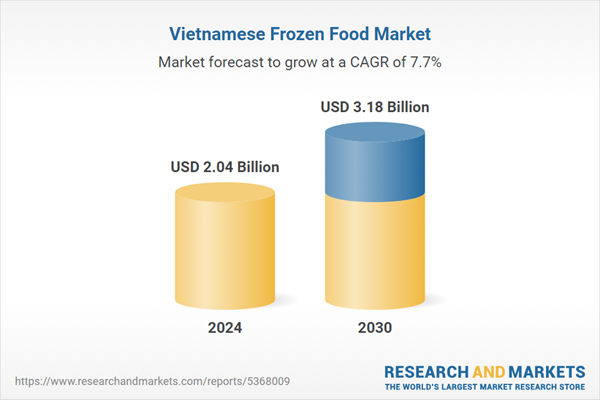

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.04 Billion |

| Forecasted Market Value ( USD | $ 3.18 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 11 |