"Cold chain logistics" is the process of moving things like food and medicine that need to be kept at a certain temperature.Maintaining the quality of the items by keeping them within a specific temperature range is the primary objective of cold chain logistics. Logistics for the cold chain primarily consist of three components: distribution, storage, and refrigerated transportation.

For the supply chain to work best, warehouses still need to be close to places where people live and work.Increased automation in cold storage warehouses is anticipated to boost demand even more. Cloud technology, robotics, conveyor belts, truck loading automation, and energy management are all examples of warehouse automation. Refrigerated storage has grown to be an essential component of supply chain management for moving and storing products that need to be kept at specific temperatures. The demand for cold storage solutions is also anticipated to rise over the coming years as the trade in perishable goods expands.

The COVID-19 epidemic had a big impact on the cold chain logistics industry, and many people in the French cold chain logistics industry are still dealing with problems and worries. With the most industrial and logistics developments, France tops Europe. The "Logistics Plan for 2025" seeks to streamline supply chain administration while enhancing the intramodality of the transportation network through infrastructure improvements.

France Cold Chain Logistics Market Trends

E- Commerce is Driving the Logistics Sector

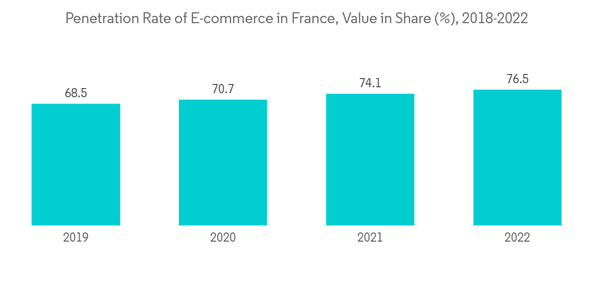

France is a major player in European e-commerce, and its market has grown very quickly in recent years.In 2022, it was predicted that there would be over 50 million e-commerce users in France, placing it third behind Germany and the United Kingdom. The number of active French e-commerce websites has more than doubled just in the last ten years, demonstrating the scope and viability of the nation's expanding digital trade.One of the factors that has fueled the expansion of the logistics industry in recent years is e-commerce. Logistics companies have faced new obstacles as a result of the rapid growth of online retail, forcing them to modify their business practices to satisfy e-commerce clients.

The world's economy and businesses depend on the logistics industry to run smoothly. The expansion of eCommerce has had a significant impact on the logistics sector, forcing businesses to change how they run their operations to satisfy online customers. The need for logistics services has increased as a result of the expansion of eCommerce. This is because orders placed online must be delivered quickly and effectively. Companies have been forced to invest in new infrastructure and technology, such as automated warehouses and distribution facilities, to meet this demand.

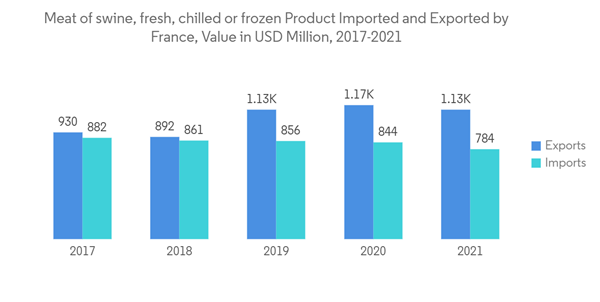

Fresh and Frozen Food Growth Driving the Market

The forces of supply and demand are the market drivers. In recent years, we have come to understand the significance of the retail market. Customers have little alternative but to consume fresh food goods, beverages, and drinks due to the surge in health issues. The demand for cold storage rises as perishable goods, food, and beverages are more in demand.Businesses are refocusing their attention from outdated value chain methods to contemporary supply chains. Maintaining the product's value throughout the cycle is the sole purpose of the value chain process. This is accomplished by effective storage by cold chain businesses and distribution businesses, by adhering to cold chain standards, and by various cold chain associations in various nations. The food industry now feels compelled by the value chain approach to examine its cold chain procedures and monitoring systems. According to WHO standards for "food safety," a cold chain and logistics must be in place.

Business behavior is dominated by consumer behavior. It is essential for cold chain enterprises to play a bigger role in the food sector and address the value chain approach with the emergence of free knowledge and a more intelligent and outspoken generation on social media.

France Cold Chain Logistics Industry Overview

The freight and logistics market is quite competitive, and the cold chain logistics sector is very fragmented. Thanks to the growing e-commerce market and changing plans for infrastructure, the French economy has room to grow and room for new businesses to enter the market. Sofrilog, IRIS Logistics, XPO Logistics, Mutual Logistics, and Kuehne + Nagel are significant players.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Sofrilog

- IRIS Logistics

- XPO Logistics

- Mutual Logistics

- Kuehne + Nagel

- Stef Logistique

- Olano Logistique

- Socopal

- Kloosterboer Harnes

- Seafrigo