Key Highlights

- Spain has some of the best infrastructure in the world. A good infrastructure is required for real estate to increase value and produce higher capital gains. Spain's transportation system is a prime example: world-class airports, vast high-speed rail and metro networks, and miles of roads and highways. The COVID-19 pandemic has promoted e-commerce as a consumer habit, with a total logistics investment volume of EUR 1,400 million (USD 1487 Million) in H1 2021 (led by the sale of the Montepino Portfolio), indicating a 250% year-over-year rise. The economy was already in the 'New Normality' at the end of the first half of 2020. Still, a substantial drop in production and employment is projected as a result of the government's pandemic containment measures. Logistics has continued to be one of the most active real estate sectors, with record levels of activity.

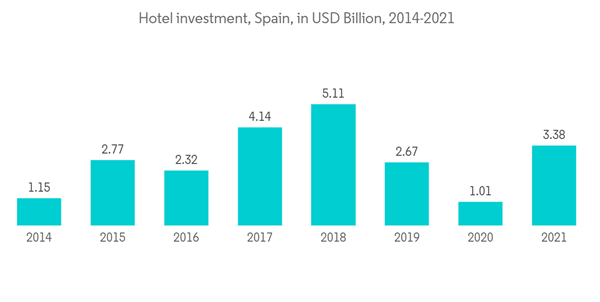

- The hospitality industry was one of the hardest hit by the pandemic in 2020 and the first part of 2021, with a significant drop in liquidity. This circumstance, combined with new asset-light trends, has prompted hotel owners to contemplate selling part of their assets to raise cash and alter their business model. The total amount invested in Hospitality in H1 2021 was EUR 995 million (USD 1056.83 Million), surpassing the total amount invested in FY 2020 and becoming one of the strongest half-year results in the last 15 years. When compared to other countries, Spain has a very favourable return on investment for real estate. There are options with positive profit margins available due to the increasing demand for rentals, the importance of tourism, and the growth of the real estate industry.

- Consumer attitude and footfall grew steadily as the sanitary condition improved thanks to breakthroughs in mass vaccination and a desire to socialize and pent-up demand. On the retailer side, previous trepidation over the pandemic's unclear landscape has translated into increased rental demand for strategic sites at more inexpensive rentals. Retail investors have primarily focused on premium core assets with long-term contracts, with supermarkets being the most in demand. By the end of 2021, Spain returned to pre-pandemic levels of investment. In terms of investment deals in Spain, the year ended with a total of EUR 12.1 billion (USD 12.85 Billion), up 57% from the previous year's figure. In particular, the logistics distribution and office sectors have seen an increase in investment.

- Spain is on the mend, which is great news for one of the countries hardest hit by the pandemic. As a result, annual investment in Spanish real estate is one of the most appealing sources of capital. In Commercial Real Estate, the Q3 2022 logistics transaction value was EUR 610 million (USD 647.91 Million). Between January and September 2022, investment reached a new high of around EUR 2 billion (USD 2.12 billion), a 90% increase over the previous year. Investment funds accounted for 70% of these transactions, with foreign capital accounting for 97%. Many businesses have reopened due to the country's economic recovery, particularly in the restaurant industry and general commerce, resulting in a surge in demand for retail space. Furthermore, many company employees are returning to work in office buildings, which has increased demand for office space.

Spain Commercial Real Estate Market Trends

Increasing demand for logistics property driving the market

During the second half of 2021, e-commerce revenue increased by 13.7% year on year, reaching EUR 13.661 billion (USD 14.51 Billion), despite the relaxation of limitations on the majority of bricks and mortar retail locations. This demonstrates that during the epidemic, customers gained significant experience purchasing things over the Internet, resulting in a portion of buying remaining online. As a result of this e-commerce push, logistics adoption continues to rise. In 2021, the demand for logistics floorspace reached new highs, with over one million square meters transacted in Madrid.Almost all the floor space was taken up along Madrid's major logistics corridors, with 52% along the Henares Corridor (A-2 highway) and 42% along the Southern Corridor (A-4 & A-42 dual carriageways). There were 81 deals in 2021, 22 of which were signed from October to December 2021. The logistics warehouse construction business is still booming, thanks to robust demand and operators focused on high-quality products.

The overall vacancy rate in Madrid stands at around 9.5% at the close of 2021. In spite of the volume of new offerings and vacant grade-A floor area, over the short term, it is anticipated that the current market dynamics will be capable of soaking up logistics floorspace such that there is no downward pressure on rents due to oversupply.

In Barcelona, in the last quarter of 2021, the average floor area per deal amounted to 11,730 sq m, this being 130% of the figure witnessed in Q4 2020 and some 23% above the average for the preceding quarter (9,500 sq m). In terms of size, the most significant deal of the quarter and 2021 was the letting of a 50,000 sq m warehouse in the ZAL (Zona de Actividades Logísticas).

Substantial growth in hospitality sector driving the market

The hospitality market in Spain is experiencing a solid rebound along the summer peak thanks to higher vaccine distribution rates and restrictions lifting in most of the eurozone countries, allowing international visitors to travel. Both ADR and RevPar increased to EUR 102.9 (USD 109.29) and EUR 57.15 (USD 60.70), respectively, at the beginning of 2021. Hotel investment in Spain reached EUR 3.2 billion (USD 3.4 Billion) in 2021 (including hotels in service, properties to be converted into hotels, and land for hotel use).In 2021, a total of 127 hotels and 22,249 rooms were transacted in Spain, versus 68 hotels and 7,228 rooms in 2020. Furthermore, another 18 transactions took place for hotel development land and properties to be converted into hotels. Only in two previous years (2017 and 2018) did the hotel investment figures in Spain exceed EUR 3 billion, which highlights how extraordinary this figure is (26% higher than in 2019).

Unlike prior years, when the holiday segment was the primary participant, investment in 2021 was fairly spread between the holiday and urban segments (50%- 50%). Even though investor interest has shifted to vacation properties, high-profile sales in Madrid and Barcelona have helped to balance the market.

In 2021 Barcelona and Madrid were once again the leading urban destinations with EUR 754 million (USD 800.85 Million) and EUR 468 million (USD 497.08 Million), respectively, accounting for almost 38% of the total EUR 1.2 billion (USD 1.27 Billion) for the second consecutive year. In the holiday segment, the Canary Islands and the Balearic Islands were the main destinations, totalling EUR 633 million (USD 672.33 Million) and EUR 541 million (USD 574.62 Million), respectively, representing 37% of the total investment. The pandemic has clearly shown to be a window of opportunity to acquire assets that would not have been exchanged in a different market situation rather than a chance to get big discounts. Prime assets have demonstrated great liquidity and little susceptibility to market uncertainty in terms of rates.

Spain Commercial Real Estate Market Competitor Analysis

The Spain Commercial Real Estate Market is fragmented, with local, regional, and global players. Some of the major players operating in the commercial real estate sector in the country include Merlin Properties, Via Celere, Kronos Investment Group, and Klapierre. The country is also witnessing an increase in international investors as its economy is rebounding, with some international investors from countries like the United States, France, and Germany.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Developers