The COVID-19 pandemic had a major impact on the high tibial osteotomy plates market. Orthopedic procedures were postponed at the beginning of the pandemic as the hospitals and surgeons were advised to postpone or cancel elective procedures, including osteotomy surgeries. For instance, in January 2021, the Centers for Medicare and Medicaid Services (CMS) and several organizations, such as the American College of Surgeons (ACS) and the American Society of Anesthesiologists (ASA), recommended the interim cancelation of elective surgical procedures in response to the COVID-19 pandemic. Most of the orthopaedic facilities were converted to COVID-19 hospitals and clinics. These factors resulted in a decrease in the number of osteotomy surgeries performed worldwide, thereby affecting the demand for high tibial osteotomy plates. However, the market's growth is stabilizing post-pandemic as the worldwide restrictions have eased down and disease screening services have been resumed.

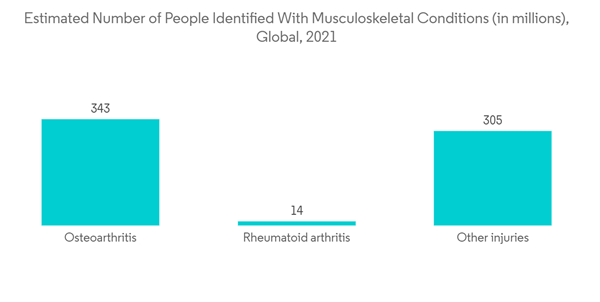

The market's growth can be largely attributed to the increasing incidence rate of musculoskeletal conditions, rising sports-related activities and road injuries, and recent advances in osteotomy plates. For instance, according to the WHO 2021 statistics, an estimated 1.71 billion people suffer from musculoskeletal disorders worldwide. Thus, the increasing musculoskeletal disorders are contributing to the growing adoption of high-tibial osteotomy procedures, driving the demand for high-tibial osteotomy plates.

Moreover, recent advances in osteotomy plates are anticipated to fuel the demand for high-tibial osteotomy plates. For instance, in July 2021, the University of Bath's Centre for Therapeutic Innovation (CTI), United Kingdom, introduced the world's first 3D printed high tibial osteotomy device and procedure given for approval for trials in the United Kingdom. It is a personalized early knee osteoarthritis treatment developed by engineers at the University of Bath's Centre for Therapeutic Innovation (CTI). It uses state-of-the-art 3D metal printing technology to make personalized medical-grade titanium alloy plates. The Tailored Osteotomy for Knee Alignment (TOKA) treatment improves the operative procedure to realign a patient's knee, making them comfortable, stable, and better able to bear weight than existing generic plates. Such advances are anticipated to boost the demand for high tibial osteotomy plates.

Thus, the market studied is anticipated to witness significant growth over the forecast period due to the aforementioned factors. However, complications associated with the procedure, such as blood clots, infection, lack of range of motion (ROM), and the high cost of osteotomy surgery, are some factors impeding the market's growth.

High Tibial Osteotomy Plates Market Trends

Opening Wedge Osteotomy Segment is anticipated to Witness a Significant Growth

The opening wedge osteotomy segment is anticipated to register significant growth. The technique involves an incision on the knee's inside to replace a bone graft into the tibia bone. This graft is made to hold in place with metal plates and screws. It involves an incision inside the knee to place a bone graft into the tibia. It is an established procedure to treat patients suffering from knee osteoarthritis and various deformities. Opening wedge osteotomy is preferred for the treatment of miserable misalignment syndrome. For patients who have arthritis, the procedure aims to slow the degeneration process to relieve pain and correct the lower extremity alignment by reducing the effective load. According to the CDC, in October 2021, about 1 in 4 United States adults (23.7%), or about 58.5 million people, have doctor-diagnosed arthritis. According to the Government of Canada, in September 2021, 374,000 (1.2%) Canadians aged 16 years and older live with diagnosed rheumatoid arthritis. Thus, with the estimated increase in arthritis incidence, the number of people suffering from osteoarthritis is also anticipated to increase, augmenting the demand for opening wedge osteotomy.Older people are prone to suffer from bone-related deformities. According to the World Population Prospects 2022, the share of the global population aged 65 years or above is projected to rise from 10% in the current year to 16% in 27 years. The number of persons aged 65 years or over worldwide is projected to be more than twice the number of children under age five and about the same as that of children under age 12, in 27 years. Therefore, with the anticipated increase in the population, the adoption of the opening wedge osteotomy technique is anticipated to increase. Thus, the market studied is expected to grow significantly over the forecast period due to the aforementioned factors.

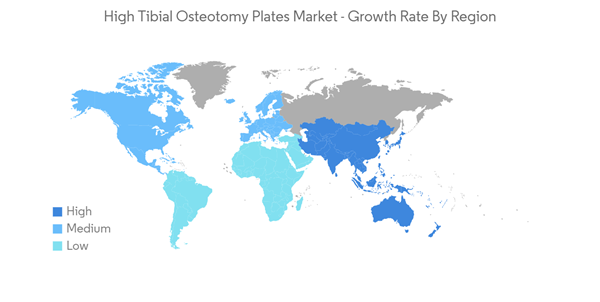

North America is Anticipated to Register a Significant Growth in High Tibial Osteotomy Plates Market

The contribution of the North American segment to the high tibial osteotomy plate market's growth is expected to be significant during the forecast period. The major factors contributing to the growth of the market in the region are increasing incidences of bone-related disorders and developed healthcare infrastructure. For instance, according to the article published by the Frontiers in Physiology in July 2022, musculoskeletal disorders are one of the most commonly reported medical conditions. They are the leading cause of disability in the United States, accounting for more than half of chronic conditions in people over 50. Thus, an increase in bone-related disorders is expected to drive the growth of the market.The increasing incidence of road accidents leading to amputations is also anticipated to propel the market's growth over the forecast period. For instance, according to the data published by the National Highway Traffic Safety Administration in the United States, in May 2022, traffic fatalities increased 10.5% from the previous year. It also reported that fatalities on urban roads rose from 57.0% in the previous year to 62.0% in March 2021, a 5.0% increase. Hence, such factors are expected to increase the demand for high tibial osteotomy, driving the market's growth over the forecast period.

Moreover, in August 2021, Zimmer Biomet Holdings, Inc. and Canary Medical received a U.S. FDA De Novo classification grant and authorization to market the tibial extension for Persona IQ, the world's first and only smart knee cleared by the FDA for total knee replacement surgery.

Hence, the market studied in North America is expected to witness significant growth over the forecast period due to the above-mentioned factors.

High Tibial Osteotomy Plates Industry Overview

The high tibial osteotomy plates market is consolidated in nature due to the presence of a few companies operating globally and regionally. The competitive landscape includes an analysis of a few international and local companies that hold market shares and are well-known, including Johnson & Johnson, Arthrex Inc., Smith & Nephew, B. Braun SE, and Stryker Corporation, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Johnson & Johnson

- Arthrex Inc.

- Zimmer Biomet

- Stryker Corporation

- Smith & Nephew

- AMPLITUDE

- Integra LifeSciences

- B. Braun Melsungen AG

- INTERCUS GmbH

- NEOSTEO

- Acumed

- Novastep Inc.

- NEWCLIP TECHNICS

- SBM France