The HD maps for autonomous driving market is growing with the rise of semantic mapping, where maps show roads and interpret objects, such as traffic lights, crosswalks, and lane markings for contextual awareness. Another emerging trend is the use of blockchain and secure data-sharing frameworks to ensure reliability and trust in map updates across fleets.

In addition, energy-efficient mapping techniques are gaining attention to reduce the computational load on autonomous vehicles while maintaining accuracy. Data for HD maps is typically collected through fleets of sensor-equipped vehicles using LiDAR, cameras, GPS, and radar, which continuously capture and update detailed road and environment information. This crowdsourced and sensor-fusion approach ensures maps remain precise and up to date for autonomous driving. All these factors are boosting the growth of the HD maps for autonomous driving market.

The embedded segment is projected to account for a significant share during the forecast period.

By solution type, the embedded segment is projected to account for a significant share during the forecast period. Embedded solutions offer real-time, high-precision localization and navigation directly within a vehicle’s onboard systems, processing mapping data locally to reduce latency and enable faster response times critical for safety in dynamic driving environments. These systems operate independently of cloud connectivity, providing enhanced reliability and resilience, especially in areas with limited or no network coverage.By seamlessly integrating real-time data from sensors and vehicle-to-everything (V2X) communication, embedded solutions ensure that HD maps remain current and accurate, supporting the continuous updates required by autonomous vehicles. The growing complexity of urban infrastructure and the need for detailed environmental understanding further drive the demand for sophisticated embedded mapping systems capable of handling intricate road geometries and traffic scenarios. With advancements in semiconductor technology and sensor fusion algorithms, these systems are becoming increasingly cost-effective and efficient.

Companies such as HERE (Netherlands), Baidu Inc. (China), Hyundai Autoever Corporation (South Korea), and Mapbox (US) offer embedded HD Map solutions. The Volvo EX90 and Polestar 3 were among the first to feature Google’s embedded HD maps to improve driver assistance. NIO also provides an offline mode for its HD maps in the Navigation on Pilot system of the NIO ET7, allowing use in areas with weak or no internet connection. Similarly, BMW’s Personal Pilot Level 2+ system uses HERE Technologies’ embedded HD maps to enable on-map driving.

The autonomous vehicles segment is projected to grow at a significant rate during the forecast period.

By level of automation, the autonomous vehicles segment is projected to grow at a significant rate during the forecast period. The growth of HD maps in autonomous vehicles, including Level 4 and Level 5 autonomy, is driven by major advancements in AI, HD mapping, LiDAR, and sensor fusion, making fully autonomous driving possible without human input. Increasing investments in robotaxis, autonomous shuttles, and logistics fleets, supported by government smart mobility programs, are speeding up large-scale adoption. The launch of commercial robotaxi services by companies such as Waymo, Uber, and Baidu Apollo in selected urban areas further boosts the market. These players use HD maps to provide centimeter-level localization, detailed road understanding, and real-time navigation for safe autonomous driving. This helps them improve ride reliability, enhance passenger safety, and ensure smooth operation in complex urban environments.In September 2025, Uber Technologies (China) and Momenta (China) plan to begin testing Level 4 autonomous robotaxi services in Munich, Germany. Similarly, in August 2025, Kia partnered with Autonomous A2Z to develop Level 4 self-driving cars using Kia’s PBV (Platform Beyond Vehicle) system, with plans to showcase these vehicles at the 2025 Asia Pacific Economic Cooperation summit in Gyeongju, South Korea. In addition, the use of autonomous driving in freight and delivery operations helps lower costs and tackle driver shortages, creating more opportunities for HD maps.

Europe is projected to grow at the highest rate during the forecast period.

Europe is projected to grow at the highest rate in the HD maps for autonomous driving market during the forecast period. The demand for HD maps in Europe will be driven by stringent EU safety regulations, the expansion of Level 2+ and Level 3 semi-autonomous driving features in premium vehicles, and strong government backing for smart mobility and connected infrastructure. Growing autonomous trials in urban mobility further accelerate adoption.Companies such as HERE (Netherlands), TomTom International BV (Netherlands), and Navmii (UK) provide HD maps for autonomous driving vehicles in Europe. In August 2025, HERE partnered with DAF Trucks N.V. in the EU co-funded MODI Project to advance and test Level 4 automated freight transport across Europe. In this project, DAF contributes its expertise in commercial vehicles. At the same time, HERE provides its High-Definition Live Map (HDLM), which functions as an external sensor, with data collected from DAF’s sensor-equipped automated trucks feeding into HERE’s platform to keep the maps continuously updated for safe and reliable operations.

Likewise, in April 2025, HERE signed an MoU with Lotus Robotics, the intelligent driving division of Lotus Technology, to develop an advanced Highway Navigation Pilot that delivers Level 2+ (L2+) automated driving functions. The partnership combined Lotus’s sensor perception stack with HERE’s high-precision maps to enable safer, more advanced driving features, including hands-off driving in certain conditions. The solution, planned for European approval in 2025, will be used in future Lotus vehicles and offered to other automakers.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEM - 8%, Tier I - 74%, and Tier 2/3 - 8%

- By Designation: CXOs - 36%, Managers - 51%, and Executives - 13%

- By Region: North America - 24%, Europe - 30%, Asia Pacific - 38%, and ROW - 8%

Research Coverage

The report covers the HD maps for autonomous driving market by service type (mapping & localization, update & maintenance, and advertisement), vehicle type (passenger car and commercial vehicle), solution type (embedded and cloud-based), usage type, level of automation, and region. It covers the major HD maps’ competitive landscape and company profiles for autonomous driving market ecosystem players.The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall HD maps for autonomous driving market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The Report Provides Insight into the Following Pointers:

- Analysis of key drivers (Rising penetration of autonomous vehicles in the global mobility ecosystem, focus on leveraging next-gen mapping and data collection for enhanced navigation, emergence of autonomous urban mobility applications, increasing adoption of L2 and L3 ADAS-equipped vehicles), restraints (lack of global standardization, less reliability in untested environments), opportunities (integration with traffic and infrastructure systems for optimized urban navigation, map-as-a-service enabling scalable and flexible adoption, adoption in emerging markets with 5G expansion), and challenges (high cost of development and maintenance, complex real-time merging of multi-sensor data, dependence on high-bandwidth networks and advanced edge computing infrastructure).

- Product Development/Innovation: Detailed insights into upcoming technologies and research & development activities in the HD maps for autonomous driving market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the HD maps for autonomous driving market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players, such as HERE (Netherlands), Baidu, Inc. (China), TomTom International BV (Netherlands), NVIDIA Corporation (US), and Mobileye (Israel) in the HD maps for autonomous driving market

Table of Contents

Companies Mentioned

- Here

- Baidu Inc.

- Tomtom International Bv

- Nvidia Corporation

- Mobileye

- Waymo LLC

- Dynamic Map Platform Co. Ltd.

- Navinfo Co. Ltd.

- Luminar Technologies, Inc.

- the Sanborn Map Company, Inc.

- Momenta

- Mapbox

- CE Info Systems Ltd.

- Navmii

- RMSI

- Zenrin Co. Ltd.

- Woven by Toyota, Inc.

- Swift Navigation, Inc.

- Imerit

- Voxelmaps

- Hyundai Autoever Corp.

- Genesys International Corporation Ltd

- Geomate

- Intellias

- Morai Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 260 |

| Published | September 2025 |

| Forecast Period | 2025 - 2032 |

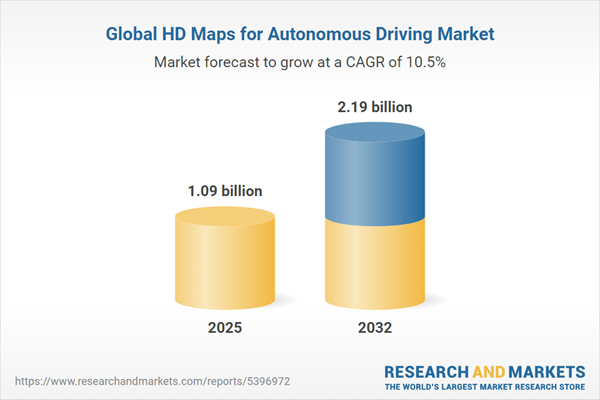

| Estimated Market Value in 2025 | 1.09 billion |

| Forecasted Market Value by 2032 | 2.19 billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |