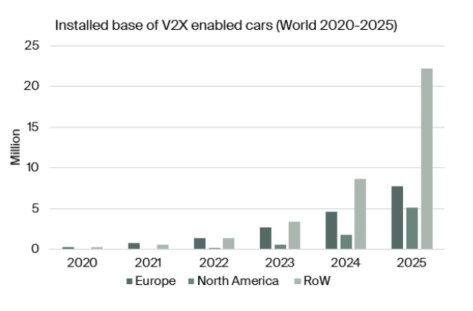

The analyst estimates that there were about 0.7 million cars on the roads equipped with V2X capabilities at the end of 2020. The number is expected to grow to 35.1 million by 2025. The definition of a Vehicle-to-Everything (V2X) system in the following analysis is a technology installed in cars that allow vehicles to communicate with moving parts of the traffic system around them using either IEEE 802.11p or C-V2X protocols. It is believed that both 802.11p-based technologies and C-V2X technologies will co-exist on the market but with varying success in different regions. The attach rate of V2X on new cars sold will grow from 0.6 percent in 2020 to 23.4 percent in 2025. Get up to date with the latest information about vendors, products and markets.The Chinese Market is Expected to Lead the Development of V2X

Highlights from the report:

- Insights from numerous interviews with market-leading companies.

- Comprehensive overview of V2X technologies and key applications.

- Summary of the latest industry trends and developments.

- Case studies of more than 10 car OEM V2X telematics initiatives.

- In-depth profiles of 9 key players in the V2X value chain.

- Extensive global and regional market forecasts lasting until 2025.

According to this research report, there were about 0.7 million cars with V2X capabilities on the roads at the end of 2020. This number is expected to grow to 35.1 million by 2025. Communications between vehicles have been discussed for more than two decades, but with few implementations. One of the main challenges using V2X communications is the lack of industry spanning standards. Two key sets of V2X direct communications exist 802.11p-based technologies such as dedicated short-range communications (DSRC) and Cellular V2X (C-V2X). The first V2X use cases deployed globally are related to traffic efficiency and basic safety. These include for example local hazard warnings and traffic information as well as emergency electronic brake light warnings and left turn assist.

“V2X implementation is starting to gain momentum in key regions after many years of development”, said Martin Svegander, Senior Analyst. DSRC-based V2X has been deployed in Europe and Japan, backed by Volkswagen and Toyota. C-V2X is gaining momentum in other regions and is backed by Ford, BMW, Audi and the telecommunications industry. The market is heavily dependent on regulatory mandates and spectrum allocation. “Policymakers in China favour C-V2X, whereas the US and the EU have been in a regulatory uncertainty”, continued Mr. Svegander. In 2020, the FCC reassigned a portion (30 MHz) of the 5.9 GHz band used for ITS to C-V2X. The analyst believes that C-V2X will account for about 78 percent of all V2X enabled vehicles in 2025, mainly represented by China. About 50 percent of all new cars sold in China will feature C-V2X as standard in 2025. “Examples of automotive OEMs that have launched C-V2X in China include BYD, GAC, FAW, GM/SAIC, Ford, BAIC BJEV, Weltmeister, Great Wall, Human Horizons and NIO”, concluded Mr. Svegander.

This report answers the following questions:

- Which trends and developments are shaping the market?

- Which are the key application areas for this technology?

- What business models are used by the solution vendors?

- What are the market shares for the leading solution vendors?

- How will the introduction of C-V2X affect the market?

- How will the V2X communications market evolve in the future?

Who should buy this report?

The Future of V2X Communications is the foremost source of information about the implementation of this emerging technology. Whether you are a chipset or module vendor, software vendor, vehicle manufacturer, telecom operator, investor, consultant, or government agency, you will gain valuable insights from our in-depth research.

Table of Contents

Executive summary

1 Vehicle-to-Everything (V2X)

1.1 Introduction to V2X

1.1.1 Brief history of V2X communications

1.1.2 The rationale for V2X

1.2 Technology environment

1.2.1 802.11p technologies (DSRC and ITS-G5)

1.2.2 Cellular V2X (C-V2X)

2 The V2X ecosystem

2.1 Automotive OEMs

2.1.1 Audi

2.1.2 BMW

2.1.3 BYD

2.1.4 Daimler

2.1.5 Ford

2.1.6 Geely

2.1.7 General Motors

2.1.8 Honda

2.1.9 Renault

2.1.10 Toyota

2.1.11 Volkswagen

2.2 Semiconductor vendors

2.2.1 Autotalks

2.2.2 Qualcomm

2.2.3 NXP Semiconductors

2.3 Specialised V2X vendors

2.3.1 Askey

2.3.2 Applied Information

2.3.3 Cohda Wireless

2.3.4 Commsignia

2.3.5 Danlaw

2.3.6 HARMAN Savari

3 Market forecast and trends

3.1 Market analysis

3.1.1 Car sales forecast

3.1.2 V2X market sizing and forecast

3.1.3 V2X deployments in Europe

3.1.4 V2X deployments in North America

3.1.5 V2X deployments in Rest of World

3.2 Market trends and industry observations

3.2.1 China is the main market for C-V2X deployments

3.2.2 New car assessment programmes to drive demand for V2X

3.2.3 V2X is a requirement to achieve full automated driving

Glossary

Index

List of Figures

Figure 1.1: Vehicle communication types

Figure 2.1: The MK5 OBU and RSU

Figure 2.2: Commsignia’s OBU and RSU

Figure 3.1: New car sales, by region (World 2019–2025)

Figure 3.2: V2X unit shipments and installed base (World 2020–2025)

Figure 3.3: V2X unit shipments and installed base (EU+UK+EFTA 2020–2025)

Figure 3.4: V2X unit shipments and installed base (North America 2020–2025)

Figure 3.5: V2X unit shipments and installed base (ROW 2020–2025)

Figure 3.6 Car models equipped with C-V2X (China 2020–2021)

Samples

LOADING...

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Applied Information

- Askey

- Audi

- Autotalks

- BMW

- BYD

- Cohda Wireless

- Commsignia

- Daimler

- Danlaw

- Ford

- Geely

- General Motors

- HARMAN Savari

- Honda

- NXP Semiconductors

- Qualcomm

- Renault

- Toyota

- Volkswagen

Methodology

LOADING...