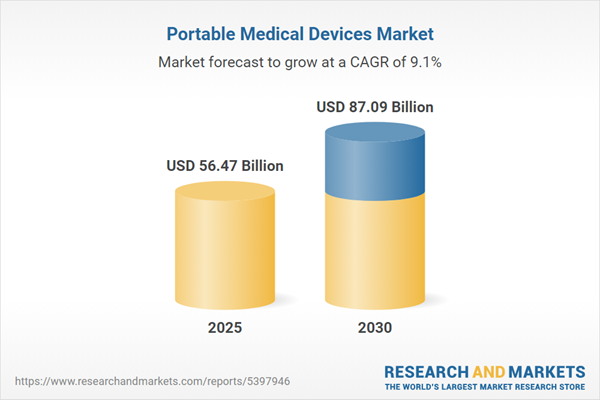

The portable medical devices market is poised for significant growth from 2025 onward, driven by the rising prevalence of chronic diseases, increasing demand for home healthcare, and technological advancements in wearable and wireless devices. These compact, user-friendly devices, including diagnostic imaging, monitoring, and therapeutic tools, enhance patient mobility and accessibility to care, particularly in home and remote settings. This report analyzes key trends, growth drivers, and regional dynamics, providing insights for industry stakeholders navigating this rapidly evolving sector.

Market Trends

The market is experiencing robust expansion due to the growing adoption of smart technologies and wearable electronics. Public awareness of the benefits of portable devices, such as enhanced mobility and real-time health monitoring, is driving their integration into hospitals and home healthcare settings. The proliferation of IoT and AI technologies is further transforming portable medical devices, enabling seamless connectivity, data analysis, and personalized care, which are critical for managing chronic conditions and improving patient outcomes.Growth Drivers

Rising Prevalence of Chronic Diseases

The global increase in chronic conditions, such as cancer and cardiovascular diseases, is a primary driver of market growth. These conditions require continuous monitoring, boosting demand for portable devices like ECG monitors and glucose trackers. The aging population, more susceptible to chronic illnesses, further amplifies the need for accessible, home-based monitoring solutions, reducing hospital visits and enhancing patient independence.Technological Advancements

Innovations in microelectronics, AI, and wireless connectivity are revolutionizing portable medical devices, improving accuracy, portability, and ease of use. For instance, AI-powered devices like SmartCardia’s 7L patch, launched in August 2023, combine remote monitoring with personalized insights, while Wipro GE Healthcare’s Revolution Aspire CT scanner, introduced in April 2023, enhances diagnostic capabilities. These advancements cater to the growing demand for home healthcare and support market expansion in both developed and emerging economies.Geographical Outlook

North America: Market Leader

North America, particularly the U.S., dominates the portable medical devices market due to its advanced healthcare infrastructure, high adoption of cutting-edge technologies, and significant prevalence of chronic diseases. The diagnostic imaging segment, encompassing ultrasound, X-ray, and MRI, is a key contributor, driven by the need for early diagnosis and monitoring. Supportive government policies and robust R&D investments further solidify the region’s leadership, with the U.S. accounting for a substantial market share.Asia Pacific: Rapid Growth

The Asia Pacific region is expected to witness the fastest growth, fueled by improving healthcare infrastructure, rising disposable incomes, and increasing chronic disease burdens in countries like India and China. The adoption of wearable devices and government initiatives promoting remote monitoring are key catalysts, positioning the region as a significant growth hub.Key Developments

Recent innovations underscore the market’s dynamic evolution. In October 2023, Max Ventilator launched advanced portable medical devices to meet healthcare demands, while Biocorp and Novo Nordisk’s partnership introduced the Mallya smart sensor for insulin monitoring in Japan. These developments highlight the industry’s focus on user-centric, technology-driven solutions.Conclusion

The portable medical devices market is set for robust growth from 2025, driven by chronic disease prevalence, technological advancements, and the shift toward home healthcare. North America leads with its advanced infrastructure, while Asia Pacific emerges as a high-growth region. Innovations in AI, IoT, and wearable technologies are reshaping patient care, offering significant opportunities for industry players to address evolving healthcare needs.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Portable Medical Devices Market Segmentation:

By Component

- Sensors

- Microprocessors/Microcontrollers

- IC’s

By Application

- Cardiology

- Orthopedics

- Gynecology

- Urology

- Gastrointestinal

- Neurology

- Others

By Product

- Therapeutics

- Smart Wearable Medical Devices

- Monitoring Devices

- Neuromonitoring

- Cardiac Monitoring

- Respiratory Monitoring

- Neonatal Monitoring

- Fetal Monitoring

- Vital Sign Monitors

- Hemodynamic Monitoring Systems

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Renesas Electronics Corporation

- On Semiconductor Corporation

- Medtronic

- Infineon Technologies

- NXP Semiconductor

- Analog Devices

- GE Healthcare

- Maxim Integrated

- Omron Healthcare

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | July 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 56.47 Billion |

| Forecasted Market Value ( USD | $ 87.086 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |